Is sports betting taxable

Yes, and the winnings must be included on your tax return. The IRS indicates that you must pay taxes on all winnings and treats them as taxable income, just. If you're a normal, ordinary gambler, your winnings are taxed as ordinary income at ordinary income rates, like wages. However, when it goes on. The legalization of sports gambling is is sports betting taxable controversial subject. Supporters argue that legalization will produce revenue for the. States and. Do you have to pay taxes on gambling winnings? Yes. Just like income from your wages or investments, earnings from sports gambling are.

Is Sports Betting Taxable?

As sports enthusiasts, we all love the rush of excitement that comes with placing a bet on our favorite teams or players. However, have you ever stopped to consider the tax implications of your sports betting activities? Let's take a closer look at whether sports betting is taxable or not.

Taxation of Sports Betting Winnings

Sports betting winnings are generally considered taxable income by the tax authorities in most countries. Whether you're wagering on football, basketball, horse racing, or any other sport, any profits you make are subject to taxation. The exact rules and rates can vary depending on your jurisdiction, so it's essential to be aware of the laws in your area.

Reporting Requirements

When it comes to reporting your sports betting winnings, honesty is the best policy. In many places, the onus is on the individual bettor to report their profits accurately and pay any applicable taxes. Failure to do so could result in penalties or fines down the line.

Professional Bettors and Taxes

For those who engage in sports betting as a profession, the tax implications can be more complex. Professional bettors may be subject to different rules and regulations compared to casual bettors. Some jurisdictions may even consider professional gambling as a legitimate business, with income taxes and deductions similar to other self-employed individuals.

Understanding Deductions and Losses

It's important to note that in many countries, you can deduct your gambling losses from your winnings when calculating your taxable income. This means that if you have had a net loss from your sports betting activities over the year, you may be able to reduce your overall tax liability.

Conclusion

While the thrill of sports betting can be exhilarating, it's crucial to be aware of the tax implications of your betting activities. Make sure to stay informed about the rules and regulations in your area, report your winnings accurately, and consider seeking professional advice if you have any questions about the taxation of sports betting.

Do You Have to Pay Sports Betting Taxes?

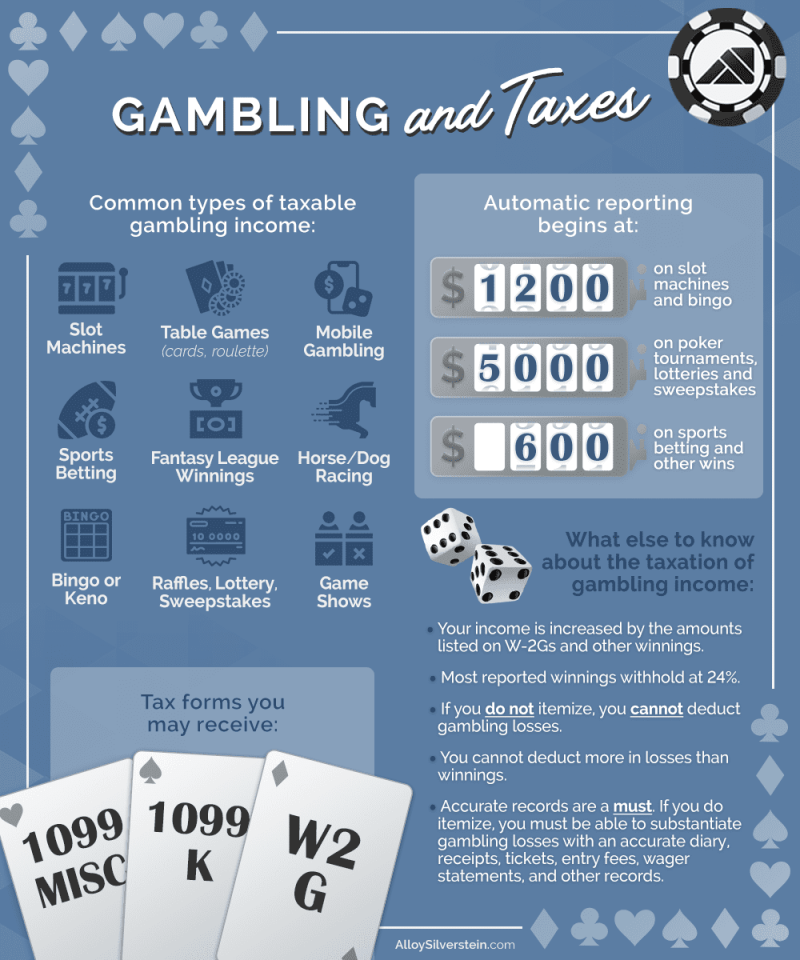

Does DraftKings automatically take out taxes? Winnings that meet certain state or federal thresholds must be reported by DraftKings to the IRS for tax purposes. There may be tax withheld from your winnings, depending on how much you've won, and what game you were playing.

Do I have to pay taxes on FanDuel winnings? Yes, your winnings from Fanduel and other fantasy sports platforms, such as Draft Kings are taxable. Fanduel will issue a W-2G or 1099 for your winnings. Once your winnings reach $5,000 they will withhold 25% for you for federal tax purposes. Fanduel is not the only gambling platform whose winnings are taxable income.

What happens if I don't report FanDuel winnings? In the US only large winnings are reported to the IRS, and taxes are generally withheld at the time. If you don't report those, you will get a letter from the IRS telling you to report them. If you ignore the letter, the IRS will probably add them in—plus interest and penalties—and send you a bill.

What are the 1099-Misc reporting thresholds for DraftKings Daily Fantasy Sports, Reignmakers, and Pick6 winnings? (US) If you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings.Do I pay taxes on DraftKings? Yes. Just like any other form of income, gambling winnings are taxable. This applies to all types of gambling, whether you placed your bet in person, on an app, or on your computer. One bright spot: You do have to win money in order to owe taxes on your gambling income.

Does the IRS tax sports betting? More In File Sports wagering, like wagering in general, is subject to federal excise taxes, regardless of whether the activity is allowed by the state. The following federal excise tax returns are due if you are in the business of accepting sports wagers: Form 730, Monthly Tax Return for Wagers.

How much can you win gambling without reporting to IRS? Generally, if you receive $600 or more in gambling winnings, the payer is required to issue you a Form W-2G. If you have won more than $5,000, the payer may be required to withhold 28% of the proceeds for Federal income tax.

How much taxes do you pay on DraftKings winnings? DraftKings customers in the United States aren't taxed on their withdrawals.

How much can I win on FanDuel before taxes? If you've won in your fantasy football league, $600 or above must be reported. For poker tournaments, it's anything over $5,000. Bingo or slot machines are $1,200, and Keno is $1,500. Gambling winnings are considered taxable income.

Do I pay taxes on DraftKings winnings? Yes. Just like any other form of income, gambling winnings are taxable. This applies to all types of gambling, whether you placed your bet in person, on an app, or on your computer. One bright spot: You do have to win money in order to owe taxes on your gambling income.

Do I have to report DraftKings winnings to IRS? DraftKings is required to report winnings of $600 or more to the IRS on Form 1099-MISC. You will receive a copy of this form and will need to report your winnings on your tax return. The amount of tax you owe will depend on your total income for the year and other factor such as deductions and credits.

How much can you win on DraftKings without paying taxes? $600

Bet on the big game? Here's what you need to know about paying taxes on sports bets

If you were totally down on your luck and had absolutely no gambling winnings for the year, you can't deduct any of your losses. Also, according to the IRS, "to deduct your [gambling] losses, you must be able to provide receipts, tickets, statements or other records that show the amount of both your winnings and losses.

If you are a professional gambler , you can deduct your losses as business expenses on Schedule C without having to itemize. However, a note of caution: An activity only qualifies as a business if your primary purpose is to make a profit and you're continually and regularly involved in it.

Sporadic activities or hobbies don't qualify as a business. To help you keep track of how much you've won or lost over the course of a year, the IRS suggests keeping a diary or similar record of your gambling activities. You should also keep other items as proof of gambling winnings and losses.

For example, hold on to all W-2G forms, wagering tickets, canceled checks, credit records, bank withdrawals, and statements of actual winnings or payment slips provided by casinos, sports betting parlors, racetracks, or other gambling establishments. If you receive a W-2G form along with your gambling winnings, don't forget that the IRS is getting a copy of the form, too.

So, the IRS is expecting you to claim those winnings on your tax return. Deducting large gambling losses can also raise red flags at the IRS. Remember, casual gamblers can only claim losses as itemized deductions on Schedule A up to the amount of their winnings. Be careful if you're deducting losses on Schedule C , too. The IRS is always looking for supposed "business" activities that are just hobbies.

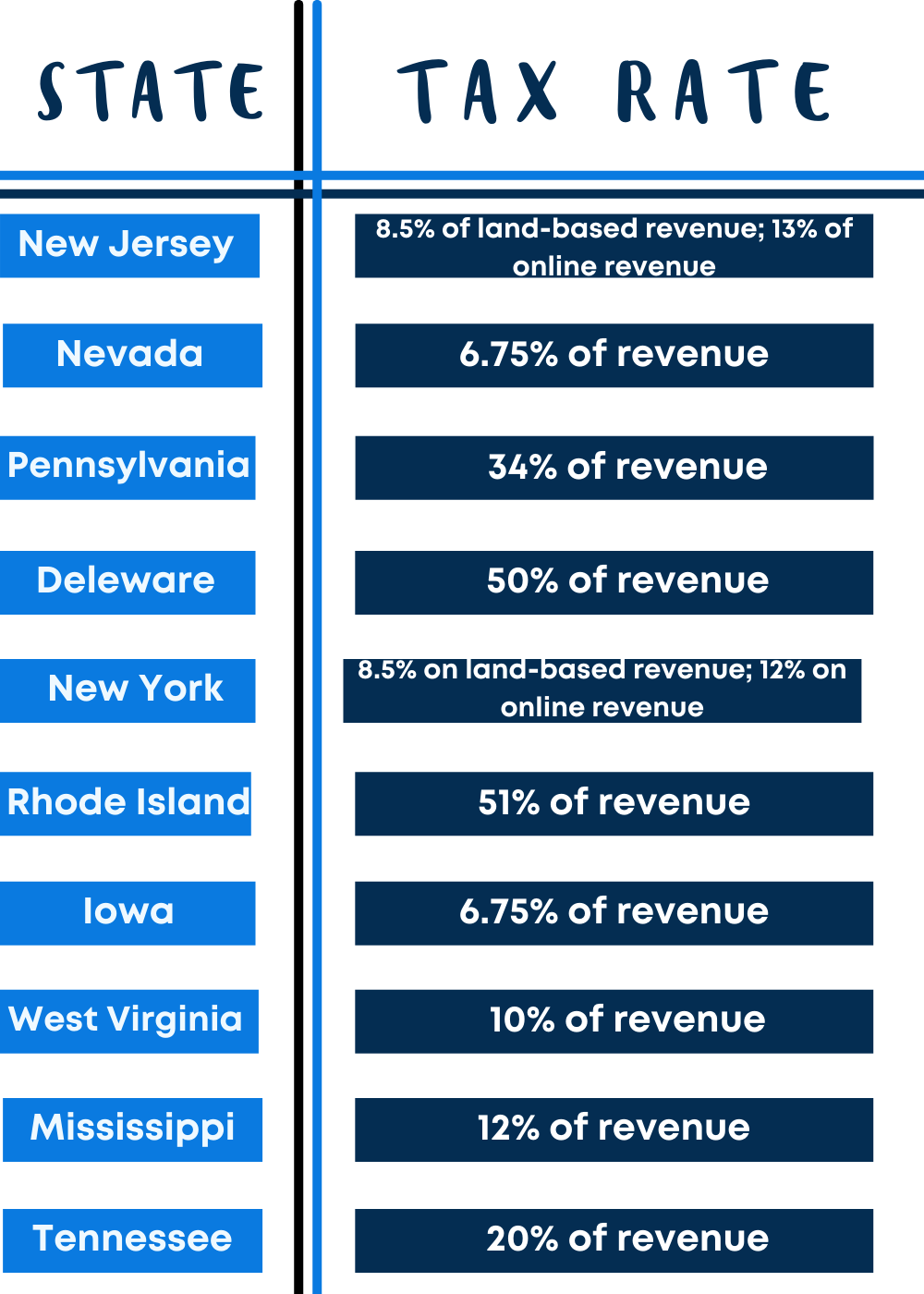

If you look carefully at Form W-2G you'll notice that there are boxes for reporting state and local winnings and withholding. That's because you may owe state or local taxes on your gambling winnings, too. The state where you live generally taxes all your income — including gambling winnings.

However, if you travel to another state to place a bet, you might be surprised to learn that the other state wants to tax your winnings, too. And they could withhold the tax from your payout to make sure they get what they're owed. You won't be taxed twice, though. The state where you live should give you a tax credit for the taxes you pay to the other state. Is sports betting taxable You may or may not be able to deduct gambling losses on your state tax return.

Check with your state tax department for the rules where you live. Rocky Mengle was a Senior Tax Editor for Kiplinger from October to January with more than 20 years of experience covering federal and state tax developments. Rocky holds a law degree from the University of Connecticut and a B.

The main indexes temporarily tumbled after Fed Chair Powell said interest rates could stay higher for longer. By Karee Venema Published 16 April By John M. Goralka Published 16 April Fraud A new report sheds light on how older adult scam victims end up with big tax bills and lost retirement savings. By Kelley R. Taylor Last updated 16 April Tax Filing Tax Day means some people need to mail their federal income tax returns.

Taylor Published 15 April By Katelyn Washington Last updated 14 April By Katelyn Washington Last updated 15 April Scams Tax season is a time to look out for email and text message scams. Taylor Last updated 3 April Property Taxes High property tax bills make the places on this list the most expensive states for homeowners to live in.

By Katelyn Washington Last updated 3 April Tax Deductions Do you qualify for the student loan interest deduction this year. By Katelyn Washington Last updated 29 March By Katelyn Washington Last updated 14 March Kiplinger is part of Future plc, an international media group and leading digital publisher.

Visit our corporate site. Many people underreport gambling winnings.  There are many reasons not to do this, including the fact that the IRS may already know all about your income. Depending on the nature of your bet, you may receive a Form W-2G from whoever pays out your winnings. This is particularly true if they use some form of third party institution to make your payment.

There are many reasons not to do this, including the fact that the IRS may already know all about your income. Depending on the nature of your bet, you may receive a Form W-2G from whoever pays out your winnings. This is particularly true if they use some form of third party institution to make your payment.

You can only deduct losses if you itemize your taxes. The same is true of up-front money that you stake. Guidances issued by the IRS state that you can deduct up-front stakes on Schedule A, which is not available to people who take the standard deduction. Money that you do not stake up front, but merely wager as a potential loss, is not deductible unless you lose.

There is a lack of clarity on the issue of whether up-front stakes reduce your taxable winnings by the amount that you initially wagered. This ambiguity only applies to wagers with up-front stakes. It goes poorly and you lose your bet. There are two possible outcomes:. While a W-2G or a Form from your payer should indicate taxable income, be sure to check with a tax professional if you are unsure how to proceed.

Like all forms of gambling winnings, money you get from sports betting counts as income. You must pay federal income taxes on all winnings regardless of amount and may owe state taxes as well. The rules of state taxes are highly jurisdiction-specific, however, so be sure to research the specific laws of your own state. Helpful Guides Tax Guide. What Is Conservatorship. Family Trusts CFA vs.

Financial Advisors Financial Advisor Cost. Helpful Guides Investing Guide. Compare Accounts Brokerage Accounts. Learn More What is a Fiduciary. Types of Investments Tax Free Investments. Helpful Guides Credit Cards Guide. Compare Quotes Life Insurance Quotes.

Helpful Guides Life Insurance Guide. Calculators Refinance Calculator. Compare Rates Compare Refinance Rates. Helpful Guides Refinance Guide. Calculators Personal Loan Calculator. Compare Rates Personal Loan Rates. Helpful Guides Personal Loan Guide.

Calculators Student Loan Calculator. How to be the best at sports betting Helpful Guides Student Loan Guide. Helpful Guides Personal Loans Guide. Helpful Guides Student Loans Guide. I'm an Advisor Find an Advisor.

Popular Pages

- What are good sports betting sites

- Where can i place a sports bet near me

- Can you place sports bets in casinos

- When can i bet on sports in illinois

- How to read sports bet form guide

- How much do australians lose on sports betting each year

- How to find arbitrage opportunities in sports betting

- Can you bet sports online in delaware

- Can you bet on sports in new jersey

- What does buying points mean in sports betting