How much taxes when cashing out sports bet in.pennsylvania

So how much tax do you have to pay in consequence? Taxable Winnings. The IRS classifies all gambling winnings as taxable income. Sports Wagering Taxes and Fees. E. Miscellaneous cash equivalents received from sports wagering sports wagering and to otherwise fund the cost of commencing. Unlike the UK or Canada, American bettors must pay taxes on any winnings that exceed $ in a single year (or on a bet valued at times the initial wager). How are gambling winnings taxed? When you win, your winnings are treated as taxable how much taxes when cashing out sports bet in.pennsylvania. Even non cash winnings like prizes are to be.

The Tax Implications When Cashing Out Sports Bets in Pennsylvania

As the sports betting scene in Pennsylvania continues to evolve, it is important for bettors to understand the tax implications when they cash out their winnings. In the world of online sports betting, tax considerations play a significant role in how much of your winnings you get to keep.

Understanding the tax framework: In Pennsylvania, when you cash out your sports bets, the state imposes a flat tax rate of 24% on gambling winnings. This means that if you win a significant amount from your sports bets, a quarter of that sum will go directly to taxes.

Calculating your tax liability: To determine how much you owe in taxes when cashing out sports bets in Pennsylvania, take your total winnings and multiply it by 0.24 (or 24%). This will give you the amount that you are required to report when filing your taxes.

Keeping track of your winnings and losses: It is crucial for sports bettors to maintain detailed records of their winnings and losses. By keeping track of your betting activity, you can accurately report your taxable income and minimize any potential issues with the tax authorities.

While taxes may not be the most thrilling aspect of sports betting, they are an important factor to consider when cashing out your winnings in Pennsylvania. By understanding the tax implications and staying informed about the state tax laws, you can navigate the world of sports betting with confidence and enjoy your winnings to the fullest.

Bet on the big game? Here's what you need to know about paying taxes on sports bets

What percent are DraftKings winnings taxed? DraftKings customers in the United States aren't taxed on their withdrawals. Learn more about what is reported to the IRS: Fantasy Sports.

Does DraftKings withhold taxes on winnings? Winnings that meet certain state or federal thresholds must be reported by DraftKings to the IRS for tax purposes. There may be tax withheld from your winnings, depending on how much you've won, and what game you were playing.

Do I have to pay state taxes on gambling winnings in PA? Gambling winnings are fully taxable by the Commonwealth of Pennsylvania. State residents must pay state income tax on all gambling and lottery winnings from any source, except for non-cash prizes from playing the Pennsylvania State Lottery.

How much are net winnings taxed in sports gambling? For federal taxes, there are two types of withholdings on gambling winnings: a regular gambling withholding (24% or 31.58% for certain non cash payments) and back withholding also at 24%. If your winning is already subject to regular gambling with holding you won't also be subject to backup withholding.

How do you calculate gambling winnings for taxes? Depending upon the amount of your winnings and the type of gambling, the establishment or payer may be required to withhold income taxes. In general, 24% of the amount is required to be withheld. In some cases, a backup withholding of 24% is required instead.

How much tax do you pay on winnings in PA? Your winnings are subject to the Commonwealth's 3.07 percent state personal income tax and federal taxes, 24 percent.

How are taxes calculated on winnings? Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. That means your winnings are taxed the same as your wages or salary. And you must report the entire amount you receive each year on your tax return.

How much can you win at a sportsbook without paying taxes? Yes, you owe taxes on sports betting wins

How much does pa tax gambling winnings? Pennsylvania gambling tax for every type of gambling. In most cases, your PA gambling tax is going to be standardized. There's a 24% federal tax rate on all gambling, plus the 3.07% income tax rate for Pennsylvania.

PA Lottery & Gambling Winnings Tax Calculator & Info

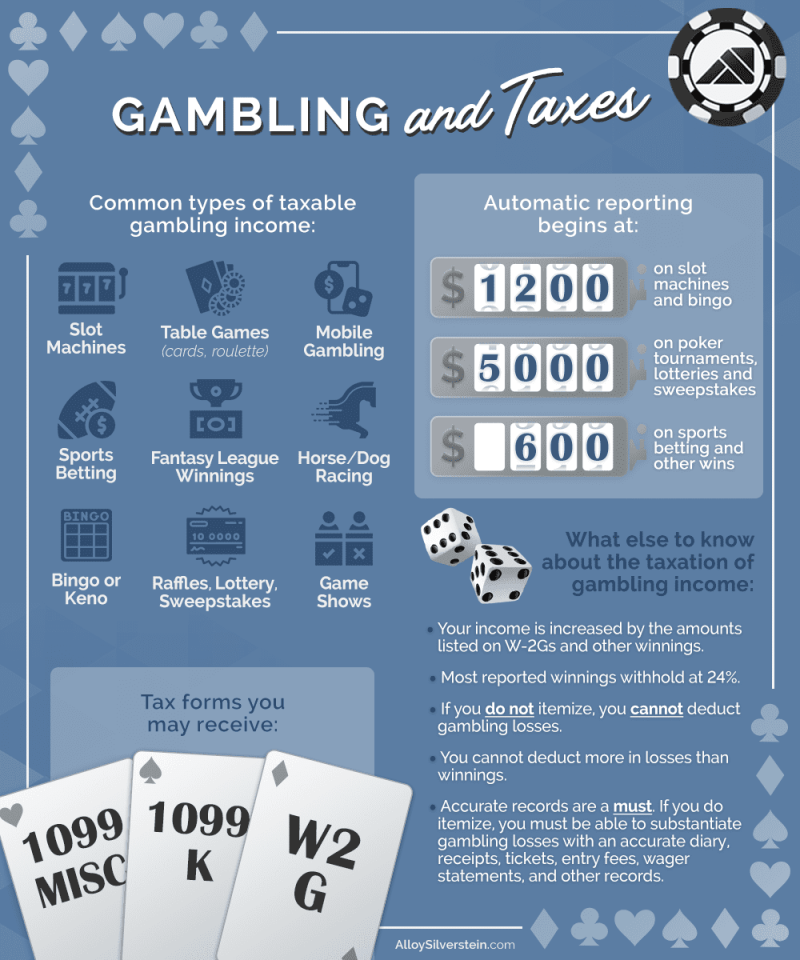

Gambling income doesn't just apply to traditional card games and casinos. Gambling also applies to lotteries, game shows, and racetracks winnings. Particular rules apply to the taxation of gambling winnings, and there are recordkeeping requirements. One of the most straightforward ways to determine how much taxes you pay on gambling winnings is to use a gambling winnings calculator.

Bettors are typically unsure of their state and federal gambling tax rate and how much they get to keep. Our gambling winnings tax calculator at the top of this page is ideal if you want to determine how much you get to keep. The golden rule is y ou must report all gambling winnings. It doesn't matter if gambling establishment reports them to the IRS or not. For example, if you strike it rich in the Kentucky Derby and a big Parlay bet comes in, you must report the winnings as income.

Gambling losses MUST be deducted separately. You cannot subtract gambling losses and the cost of gambling from your winnings and report the net. If you win a raffle, this also counts as income. You, therefore, have to claim the item's fair market value when it was won. This would usually be the amount you would have to pay for the item if you bought it new.

Taxable Gambling Income. All gambling income is taxable income. This includes cash and the fair market value of any item you win. The law states that gambling winners must report all winnings on their federal income tax return. How much taxes when cashing out sports bet in.pennsylvania You may receive one or more Form W-2G, depending on how much you win. This would also indicate the amount of any taxes withheld.

Even if you did not receive any Form W-2G , you must still report all gambling winnings on your return. Gambling winnings include money and prizes earned from the following:. Please note that any winnings generated from slot machines, bingo, and keno may not be subject to tax withholding until specific winnings levels have been met.

Note: this does NOT mean it is not taxable. You might need to consider making estimated payments if you receive gambling winnings not subject to tax withholdings. If you win a cash prize like a VIP weekend giveaway, you must pay taxes on each prize's fair value market value. Depending on the amount you win and the type of gambling you have participated in, the payer or the establishment may be required to withhold income taxes.

You will likely receive a Form Misc. If you encounter an instance where tax is withheld from your gambling winnings, you will receive a W2-G form from the payer. You are permitted to deduct gambling losses if you itemize your deductions. You may deduct losses only up to the amount of your total gambling winnings.

You must always report your winnings and losses separately.  Gambling winning are reported on Line 21 of the , and gambling losses are reported on Schedule A- Gambling losses. Professional Gambling. You may be wondering if the rules on gambling tax change if you don't just gamble recreationally but do it as a living.

Gambling winning are reported on Line 21 of the , and gambling losses are reported on Schedule A- Gambling losses. Professional Gambling. You may be wondering if the rules on gambling tax change if you don't just gamble recreationally but do it as a living.

Unfortunately, there is no straight answer. Groetzinger that deductions for losses cannot go above the income from winnings. Deductions from losses that go above your winnings are still prohibited. It becomes your job if you actively participate in gambling to make a profit. Instead of claiming your winnings as "other income" on your Form , you would list it on Schedule C, subject to self-employment taxes.

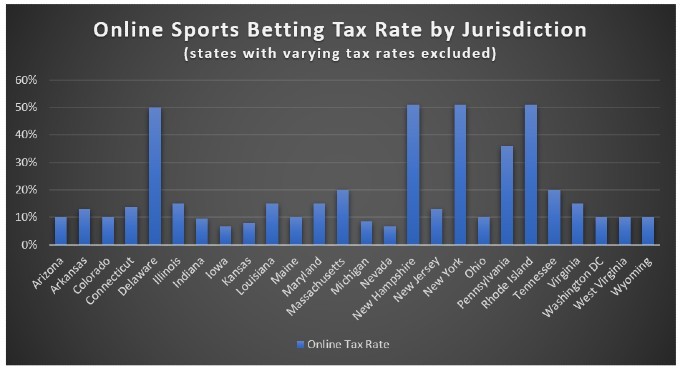

This distinction is vital because you can deduct your other business costs on Schedule C. This means you are reducing your taxable income. You could deduct the costs of the following:. The significant drawback of turning pro is that you'll have to pay self-employment tax on your winnings. There are over 30 states that now allow some form of sports betting.

Below, you can see the individual state guides to see which online and mobile sportsbooks are available in your state:. Gambling Records. The IRS states that you must keep detailed records of gambling winnings, losses, and related documents. These documents include tickets, payment slips, Form W-2G, statements, and receipts.

All bettors must be able to prove both their winnings and losses if they want to deduct their losses. The IRS guidance suggests that it would be sensible to keep a gambling log. The IRS mandates that you have the following information about each gambling win and loss:. It would be wise to get into the habit of recording all gambling activities you participate in during each financial year.

See more details and requirements about Session Gambling. Useful sites and resources:. American Gaming Association. Check out our Gambling FAQs. How much can you win in a casino without having taxes withheld. How much taxes do you pay on slot machine winnings. This includes winnings on slot machines. What happens if I don't report my gambling winnings. A lot of this depends on how much you have failed to report.

However, you must always report ALL of your gambling winnings. Gambler FAQ. Our mission is to create a web based experience that makes it easier for us to work together. How do i know if i won my sports bet We collect, and associate with your account, the information you provide to us when you do things such as sign up for your account, opt-in to our client newsletter or request an appointment like your name, email address, phone number, and physical address.

Some of our Services let you access your accounts and your information via other service providers. Your Stuff. To make that possible, we store, process, and transmit Your Stuff as well as information related to it. This related information includes your profile information that makes it easier to collaborate and share Your Stuff with others, as well as things like the size of the file, the time it was uploaded, collaborators, and usage activity.

Our Services provide you with different options for sharing Your Stuff. You may choose to give us access to your contacts spouse or other company staff to make it easy for you to do things like share and collaborate on Your Stuff, send messages, and invite others to use the Services.

Usage information. We collect information related to how you use the Services, including actions you take in your account like sharing, viewing, and moving files or folders. We use this information to improve our Services, develop new services and features, and protect our users.

Device information. We also collect information from and about the devices you use to access the Services. This includes things like IP addresses, the type of browser and device you use, the web page you visited before coming to our sites, and identifiers associated with your devices. Your devices depending on their settings may also transmit location information to the Services.

Cookies and other technologies. We use technologies like cookies to provide, improve, protect, and promote our Services. For example, cookies help us with things like remembering your username for your next visit, understanding how you are interacting with our Services, and improving them based on that information.

You can set your browser to not accept cookies, but this may limit your ability to use the Services. We give users the option to use some of our Services free of charge. The tax rate on gambling winnings will typically vary from state to state. The majority of states have income taxes, which means that gambling winnings are likely subject to both federal and state taxation.

The rules and rates of your gambling wins and taxes can vary significantly depending on your state. Some states take your gambling winnings tax at a flat rate, while other states tie it to your overall income tax rate. Form W-2G details your gambling winnings and any taxes withheld.

Even if your gambling winnings are not substantial and you were not issued Form W-2G, you are still required to report your winnings as part of your total income. Whether you won the lottery or a sweepstakes or simply enjoyed a bit of friendly competition, keeping track and reporting your gambling income is important to stay on the right side of tax regulations.

If you engage in gambling activities as a means of livelihood and pursue it regularly as a professional gambler, then some rules can vary. However, deductions from losses that exceed the income of your winnings are still not allowed. While casual gamblers only need to report their winnings as part of their overall income on their tax forms, professional gamblers may file a Schedule C as self-employed individuals.

They may be able to deduct their gambling-related expenses, such as travel or casino entry fees, to determine their net income. How much taxes when cashing out sports bet in.pennsylvania In regards to losses, deductions for gambling losses must be less than or equal to gambling winnings. You can deduct losses from your gambling, but only if you itemize your deductions and keep an accurate record of your winnings and losses.

The amount of losses you deduct cannot be more than the amount of gambling winnings you report on your tax return. Under tax reform, you can only deduct losses directly related to your wagers and not non-wagering expenses like travel-related expenses to gambling sites. Gambling losses can be deducted up to the amount of gambling winnings.

Whereas your winnings are reported by the payer on a Form W2-G, your losses may not be reported. You will have to produce other documentation to validate the deduction. This can include:. It may also be possible to establish your losses by keeping some type of detailed log.

This log should include information such as the:. No matter what moves you made last year, TurboTax will make them count on your taxes. More from TurboTaxBlogTeam.

Popular Pages

- Is sports betting legal in michigan

- What sports betting apps are legal in mississippi

- How to place smart sports bets

- When does iowa sports betting start

- What is megabets in sports betting

- What is m l in sports betting

- Can you make money dutch betting on sports

- Is sports betting legal inrhode island

- How to cheat in sports betting

- Can i bet on sports online in florida