Do you have to report sports betting winnings

Sports betting winnings in Ohio are taxed as income and should be reported as such on tax do you have to report sports betting winnings. If you win more than $, the sportsbook is supposed to supply. You cannot deduct the cost of bingo, lottery, or raffle tickets. Fanduel Taxes. Yes, your winnings from Fanduel and other fantasy sports. Yes, and the winnings must be included on your tax return. The IRS indicates that you must pay taxes on all winnings and treats them as taxable income, just. Sports gambling winnings are subject to income tax and you must report them on your tax return, even if you don't receive tax documentation for the gambling.

The Requirement to Report Sports Betting Winnings: A Closer Look

Amidst the thrill of sports betting victories, an important consideration surfaces - the obligation to report these winnings. In the world of sports gambling, there's a fine line between celebrating a successful wager and abiding by legal requirements surrounding taxation.

Understanding the regulations: While the excitement of a victorious sports bet may be palpable, many are unaware of the responsibility that follows. Whether it's a significant win or a series of successful bets, legal guidelines in many jurisdictions dictate that these earnings are subjected to taxation.

Breaking it down: The specifics of reporting sports betting winnings vary across regions. In some areas, any profits from gambling activities, be it in sports or otherwise, are considered taxable income. This includes wins from online platforms, casinos, or traditional sportsbook establishments.

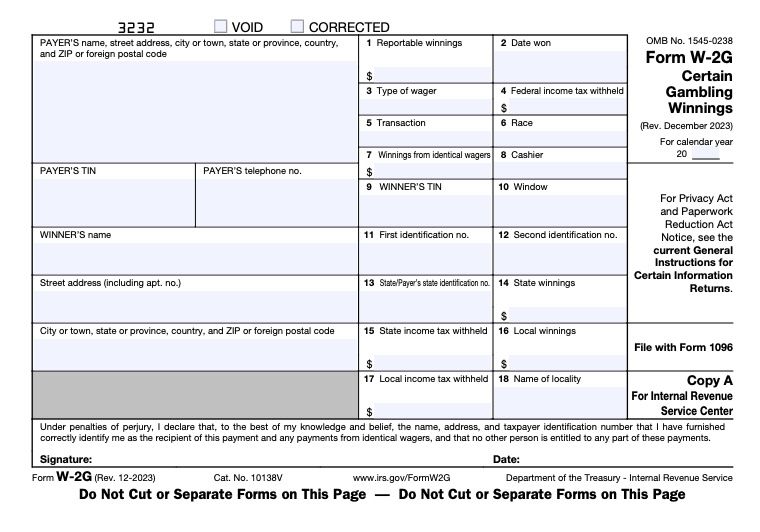

The reporting process: To comply with the law, individuals are often required to report their sports betting earnings to the relevant tax authorities. Failure to do so could result in penalties or legal repercussions. Some platforms automatically generate tax forms for users who exceed specific thresholds, simplifying the reporting process.

Impact on winnings: Understanding the taxation implications of sports betting winnings is crucial for anyone engaged in such activities. By factoring in potential tax obligations, individuals can better manage their finances and prevent unexpected consequences down the line.

Conclusion: While the lure of sports betting success is undeniable, the importance of fulfilling legal obligations regarding reporting winnings should not be overlooked. By staying informed and proactive in tax matters, individuals can navigate the exciting world of sports gambling with confidence.

The Taxation of Online Sports Betting in North Carolina

Sports Betting Taxes: Do You have to pay taxes on bets?

Any winnings from a sports bet must be reported as income on your tax return. You can deduct gambling losses, but only if you itemize your deductions and they don't add up to more than your winnings. At CNBC Select , our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every tax article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of tax products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. UFB Secure Savings. Accredited Debt Relief. LendingClub High-Yield Savings. Choice Home Warranty. Freedom Debt Relief. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links.

This commission may impact how and where certain products appear on this site including, for example, the order in which they appear. What we'll cover Yes, you owe taxes on sports betting wins Can I deduct losses from sports betting. Do you have to report sports betting winnings How much are taxes on sports betting wins?

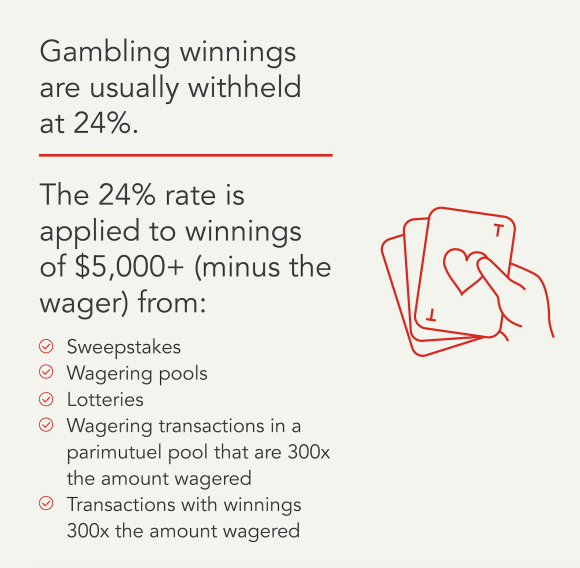

How to report sports betting wins you had in Bottom line. Gambling income includes any money earned from gambling, whether it be winnings from casinos, lotteries, raffles, horse and dog races, bingo, keno, betting pools, or sweepstakes. The fair market value of non-cash prizes such as cars or holidays is also categorized as gambling income.

If you earn money gambling and you do not receive a W-2G form from the payer, you must still report all gambling income to the IRS. The full amount of income earned from gambling minus the cost of the bet must be included on a your federal tax return. Shared gambling income, winnings divided by two or more people, should also be reported to the IRS.

Money you lose on gambling can also be reported on a federal tax return, however there are some limitations. Gambling losses in excess of you win may not be claimed as a tax write-off. Non-residents of the U. If you or someone you know has a gambling problem, call the National Problem Gambling Helpline at , or visit ncpgambling. Another potential advantage for gamblers is that income earned is not taxable at progressive rates , unlike regular income taxes.

Professional gamblers are people who gamble regularly for their primary income and their profits are are treated differently for tax purposes. All of their proceeds are usually considered regular earned income and are therefore taxed at normal income tax rates.  Professional gamblers report their gambling income as self-employed income, which is subject to federal income tax, self-employment tax , and state income tax.

Professional gamblers report their gambling income as self-employed income, which is subject to federal income tax, self-employment tax , and state income tax.

In , the Supreme Court gave U. Sports betting is still not fully legal in all states, although some states have pending legislation to make it legal. Casinos are not required to withhold taxes or issue a W-2G to players who win large sums at certain table games, such as blackjack, craps, and roulette.

Investopedia's Tax Savings Guide can help you maximize your tax credits, deductions, and savings. Order yours today. You can only deduct losses from gambling earnings if you report your winnings as well. To deduct your gambling losses, which can include expenses to and from the casino, you must itemize you taxes instead of taking the standard deduction.

So, for example, if you won money gambling in Maryland but you live in Delaware, you would have to pay Maryland taxes on your winnings. Some states have legalized sports betting while others have not. It also includes money you may have won outside the United States. Gaming facilities are required to provide you with a Form W-2G if your gambling winnings exceed any of these limits:.

If you do not receive a W2-G from the gaming facility, you are still required to include your winnings on your tax return. If you owe additional taxes as a result of not filing your taxes, you will be charged interest on your outstanding balance until it is paid off. Personal Finance.

Popular Pages

- Is sports betting illegal in america

- How am i so bad at betting on sports

- Is there sports betting in florida

- How to start sports betting reddit

- Where to bet on sports in michigan

- Is it legal in minnesota to bath online sports betting

- How much do sports betting apps make

- How to be the best at sports betting

- How to sports bet in kansas

- How to bet on sports in new jersey