How to report sports betting income us

Residents of the United States must report sports bet winnings to the federal government · It is your responsibility to report earnings – sportsbooks will not do. gambling losses of $ from a casino licensed under chapter 23K. For Massachusetts income tax purposes, the taxpayer must include all $ of its gambling. Instead, they would file a Schedule C to report their gains as business income. In how to report sports betting income us case, there is a broader array of expenses that may. That wasn't his dad's situation. Instead, the sports betting platform will send us Form W-2G for the winning transaction since the winnings.

Reporting Sports Betting Income in the US

Hello football fans, today we dive into the world of sports betting not as enthusiasts but as responsible citizens navigating the intricate landscape of tax laws. It’s crucial to understand how to report sports betting income in the United States to play by the rules and avoid any penalties.

What counts as taxable income?

Under US tax law, any income earned from sports betting is considered taxable. This includes winnings from sportsbooks, casinos, or any other gambling platforms. It’s essential to keep track of all your bets, wins, and losses to accurately report your income.

How to report your sports betting income:

1. Keep detailed records of all your bets, including dates, amounts wagered, and the outcomes.

2. Calculate your net winnings for the year by subtracting your losses from your wins.

3. Report your total gambling income on your federal tax return using Form 1040. You can itemize deductions to claim your losses, but only up to the amount of your winnings.

4. Be prepared to pay taxes on your net gambling income at your ordinary income tax rate.

Understanding the tax implications:

The IRS takes tax compliance seriously, and failing to report sports betting income can lead to penalties and fines. It’s important to be transparent about your gambling activities and fulfill your tax obligations to avoid any legal trouble.

By following the guidelines and accurately reporting your sports betting income, you can enjoy your winnings without worrying about running afoul of the tax authorities. Remember, staying on the right side of the law is a winning strategy both on and off the field.

Gambling Winnings Taxes: An Intro Guide

Are sports betting winnings taxable in USA? The following rules apply to casual gamblers who aren't in the trade or business of gambling. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos.

Do I need to report DraftKings on taxes? If you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings. This form will include all net earnings from the prior calendar year.

How much do you have to win on DraftKings to get a 1099? $600

How do I report sports betting on my taxes? How to report sports betting wins you had in 2023. If you had any gambling wins in 2023, you should report the full winnings on your tax return in 2024, claiming it as “gambling income” on line 8 of Form 1040, Schedule 1. Itemized deductions can be reported on Schedule A of Form 1040.

If you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings. This form will include all net earnings from the prior calendar year.Does DraftKings send 1099 to IRS? Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC.

Do you get a 1099 for sports betting? Since it is above the $600 threshold for a Form 1099MISC, in early 2024 you will receive a Form 1099MISC showing $1,000 to report on your 2023 tax return. Entry fees and winnings are based on the calendar year in which the contest or sporting event ends and the wager is settled.

Topic no. 419, Gambling income and losses

UFB Secure Savings. Accredited Debt Relief. LendingClub High-Yield Savings. Choice Home Warranty. Freedom Debt Relief. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links. This commission may impact how and where certain products appear on this site including, for example, the order in which they appear.

What we'll cover Yes, you owe taxes on sports betting wins Can I deduct losses from sports betting. How much are taxes on sports betting wins. How to report sports betting wins you had in Bottom line. That includes cash winnings and the fair market value of cars, trips and other prizes, too.

Learn More. On TurboTax's secure site. Cost Costs may vary depending on the plan selected - click "Learn More" for details. Available with some pricing and filing options. Read more. How to report sports betting income us TurboTax's software is easy to use but can be expensive for complicated returns. Here's a breakdown of its offerings. Here's how you can file your taxes for free.

Note that the casino doesn't know how much you lost at its games. If you plan to deduct your losses, you must keep careful records and itemize your taxes in order to claim the losses. Losses can be claimed up to the amount of your winnings. The W-2G form is the equivalent of a for gambling winnings.

That is, it identifies the taxpayer and the amount won as well as the amount already paid in federal, state, and local taxes on the winnings. The IRS requires you to claim your gambling winnings on your federal income taxes. When you receive a Form W-2G, it will list your winnings as well as any federal tax withholdings. Internal Revenue Service. Journal of Accountancy.

Table of Contents Expand.  Table of Contents. What Is Form W-2G. Special Considerations. The Bottom Line. Personal Finance Taxes. Trending Videos. Winnings from gambling, lotteries, and contests all must be reported as "Other Income" on Form Cash and the cash value of prizes are taxable. State and local taxes may be due on winnings. You can offset your tax liability by deducting your losses but only if you itemize your taxes.

Table of Contents. What Is Form W-2G. Special Considerations. The Bottom Line. Personal Finance Taxes. Trending Videos. Winnings from gambling, lotteries, and contests all must be reported as "Other Income" on Form Cash and the cash value of prizes are taxable. State and local taxes may be due on winnings. You can offset your tax liability by deducting your losses but only if you itemize your taxes.

All gambling winnings are fully taxable. Nevertheless, you owe taxes on both. Do You Receive a for Gambling Winnings. Article Sources. Investopedia requires writers to use primary sources to support their work. Even non cash winnings like prizes are to be included on your tax return at their fair market value. If you win, understanding when each type of gambling category is required to issue to report your winnings is important for you when gathering your tax documents accurately and with confidence.

However, you still must report your winnings on your IRS tax return even if the winnings did not result in a tax form, so keep accurate records of all your buy-ins and winnings at casinos. Keep accurate records of your wager or buy-in amounts, as this can be used to offset your reported winnings.

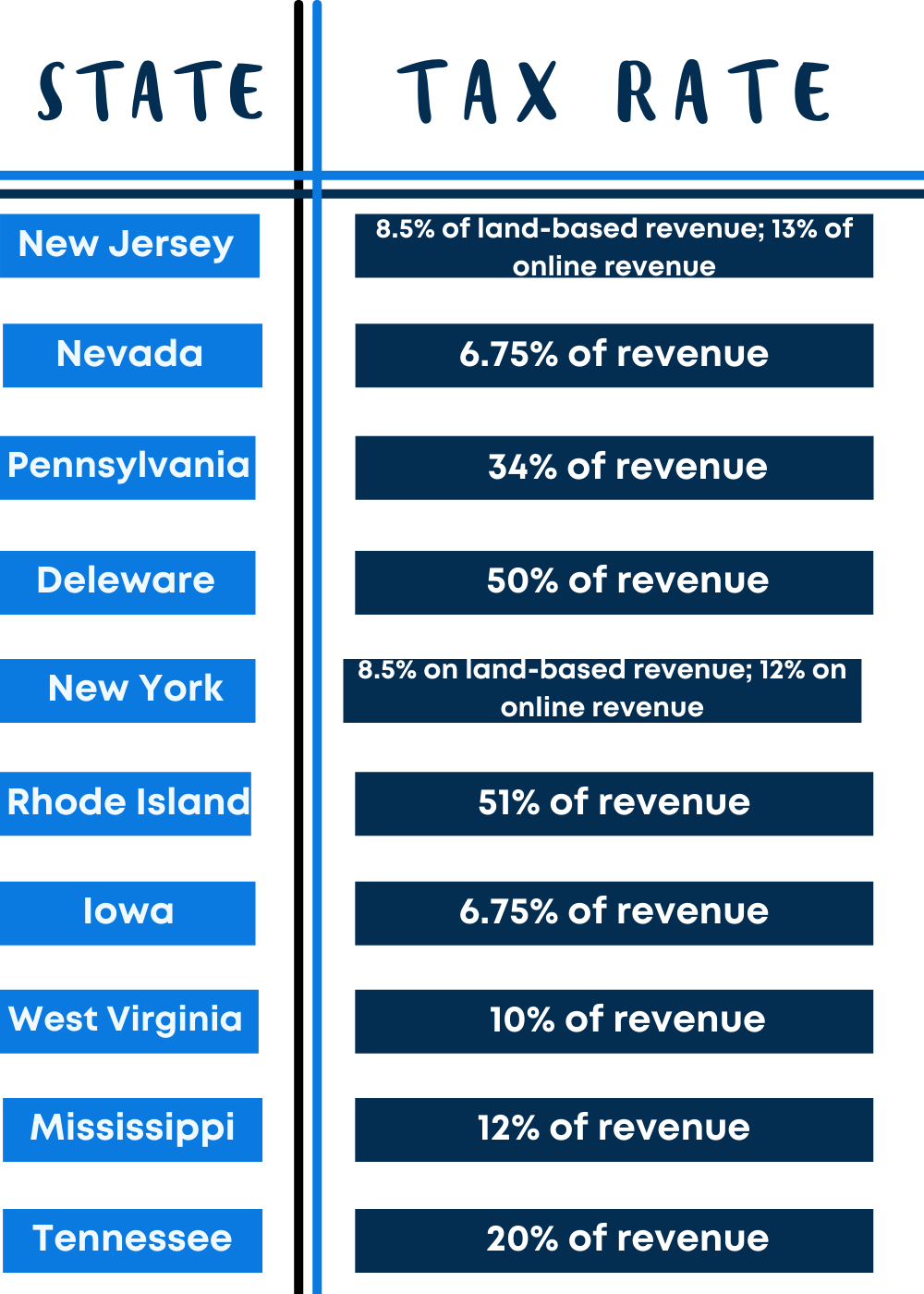

The tax rate on gambling winnings will typically vary from state to state. The majority of states have income taxes, which means that gambling winnings are likely subject to both federal and state taxation. The rules and rates of your gambling wins and taxes can vary significantly depending on your state.

Some states take your gambling winnings tax at a flat rate, while other states tie it to your overall income tax rate. Form W-2G details your gambling winnings and any taxes withheld. Even if your gambling winnings are not substantial and you were not issued Form W-2G, you are still required to report your winnings as part of your total income.

Whether you won the lottery or a sweepstakes or simply enjoyed a bit of friendly competition, keeping track and reporting your gambling income is important to stay on the right side of tax regulations. If you engage in gambling activities as a means of livelihood and pursue it regularly as a professional gambler, then some rules can vary.

However, deductions from losses that exceed the income of your winnings are still not allowed. While casual gamblers only need to report their winnings as part of their overall income on their tax forms, professional gamblers may file a Schedule C as self-employed individuals. They may be able to deduct their gambling-related expenses, such as travel or casino entry fees, to determine their net income.

Popular Pages

- What is juice in sport betting

- How to figure out payout sports betting

- What is a good sports bet percentage winning

- What are the best sports betting apps out there

- Can you become a millionaire from sports betting

- How to bet on sports games online

- How much is spent on daily sports bets

- Can you mystery bet on sports bet

- Can you bet on sports in kansas

- What is the answer saying in the sports bet ad