Do you need to pay taxes on sports betting

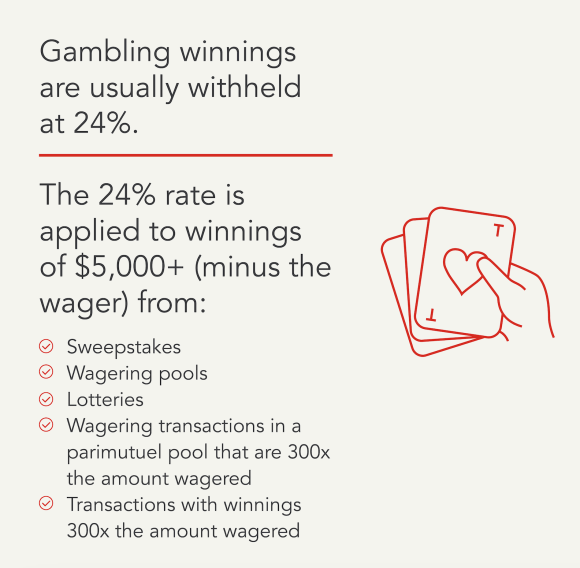

Whether it's $5 or $5, from the track, an office pool, a casino or a gambling website, all gambling winnings must be reported on your tax return as "other. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income do you need to pay taxes on sports betting but isn't limited to winnings. Most states tax all income earned in their state, regardless of your residency. Your resident state will also require you to report the winnings but will offer. If your gambling winnings are over $5, or more than times your wager, the IRS requires that the casino/sportsbook withhold at least 24%.

The Taxing Dilemma in Sports Betting

As the thrill of sports betting continues to capture the hearts and minds of enthusiasts worldwide, a pertinent question often arises regarding the financial implications of this exciting pastime - taxes. Are sports bettors obliged to pay taxes on their winnings? Let's delve into this complex scenario and shed light on the taxing dilemma that plagues many punters.

The Legal Landscape

Under the law, taxation on sports betting may vary depending on the jurisdiction you reside in. Some countries view gambling winnings as taxable income, subjecting bettors to pay a percentage of their profits to the government. In contrast, others do not impose taxes on these earnings, thereby allowing individuals to keep the full extent of their winnings.

United States: The Taxing Truth

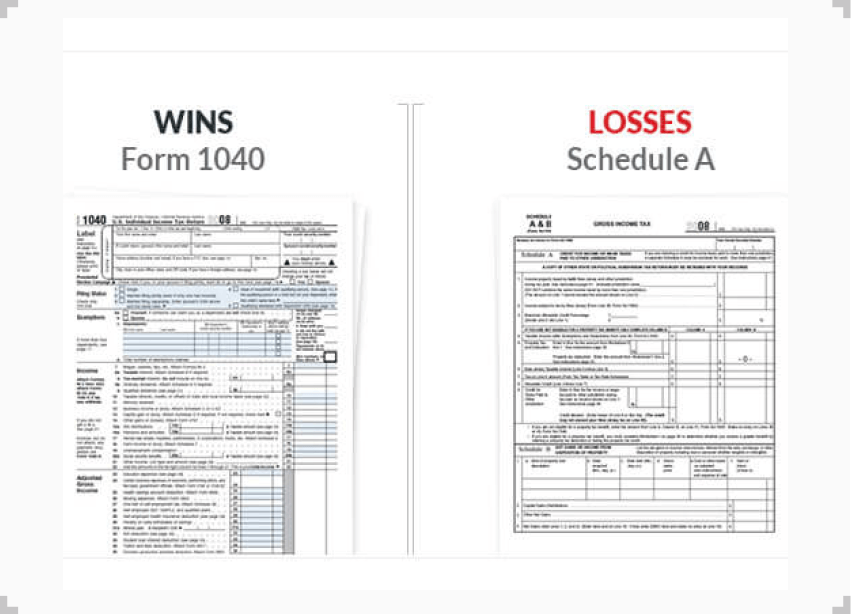

In the United States, the scenario is multifaceted. According to the IRS, gambling winnings are considered taxable income. For instance, if you win a significant amount through sports betting, you are required to report these earnings on your tax return. However, the deductibility of gambling losses can also come into play, providing some relief to bettors facing taxation.

Tables Turned: Understanding the Numbers

| Scenario | Tax Treatment |

|---|---|

| Country A | Tax on all gambling winnings |

| Country B | No taxation on sports betting winnings |

Conclusion

Ultimately, it is essential for sports bettors to acquaint themselves with the tax laws governing their respective regions to avoid any unpleasant surprises. While the thrill of winning big in sports betting is undeniably enticing, being aware of the taxation implications is crucial for maintaining financial integrity. Remember, accuracy and compliance are key when it comes to navigating the taxed world of sports betting.

Taxes on Gambling Winnings and Losses: 8 Tips to Remember

Income tax payable on winnings from online, offline games of chance

He stresses this is a gray area of the law and evaluations should be case by case. The bottom line is that millions of online sports bettors are in a triple jam. Campagna strongly advises gamblers to keep detailed logs, as such records can persuade revenue agents to back off in audits and are essential in court cases. For more requirements, see IRS Publication Gamblers who qualify as professionals can net losses against winnings without itemizing and even use them to reduce other taxable income.

But this status is hard to attain; Feuerstein says he often advises against claiming it. Filers with taxable gambling winnings should consider adjusting paycheck withholding or paying quarterly estimated taxes to avoid charges based on underpayments. If the bettor is your dependent—such as a college student—consider the tax consequences.

Looks like you have exceeded the limit to bookmark the image. Remove some to bookmark this image. You are now subscribed to our newsletters. Hello User. Sign in. Sign Out. My Account. CryptoCurrencies View Less -. Elections Mint Premium View Less -. Tools and Calculators.

Podcasts View Less -. Do you need to pay taxes on sports betting Summary With the explosion of betting apps in recent years, millions of gamblers have racked up taxable winnings. Their losses, on the other hand, may not be doing them any favors. If you win a non-cash prize, such as a car or a trip, report its fair market value as income. And be sure you report all your gambling winnings. The IRS isn't typically hunting down small-time winners, but you should file an accurate income tax return.

The payout doesn't have to be times the wager for these types of winnings. Your reportable winnings will be listed in Box 1 of the W-2G form. If a W-2G is required, the payer sports betting parlor, casino, racetrack, lottery, etc. In some cases, you'll get the W-2G on the spot. Otherwise, for winnings, the payer must send the form to you by Jan. In any event, if your bet was with a casino, we're fairly certain you'll get the W-2G.

But if your bet was just a friendly wager with a friend or you won an office pool … well, don't count on it.  Special withholding rules apply for winnings from bingo, keno, slot machines and poker tournaments. The amount withheld will be listed in Box 4 of the W-2G form you'll receive. You will also have to sign the W-2G stating under penalty of perjury, that the information listed on the form is correct.

Special withholding rules apply for winnings from bingo, keno, slot machines and poker tournaments. The amount withheld will be listed in Box 4 of the W-2G form you'll receive. You will also have to sign the W-2G stating under penalty of perjury, that the information listed on the form is correct.

When you file your for the tax year, include the amount withheld by the payer, as federal income tax withheld. It will be subtracted from the tax you owe. You'll also have to attach the W-2G form to your return. Again, this is what to expect when you place a bet at a casino, racetrack, sports betting parlor, or with some other legally operated gaming business.

Don't expect your friend who is running an office pool, for example, to withhold taxes although, technically, they should. Did you have a bad night at the blackjack table or pick the wrong horse to win. There's a possible silver lining if you lose a bet or two — your gambling losses might be deductible. Gambling losses include the actual cost of wagers plus related expenses, such as travel to and from a casino or other gambling establishment.

There are a couple of important catches, though. First, unless you're a professional gambler more on that later , you have to itemize in order to deduct gambling losses itemized deductions are claimed on Schedule A. Unfortunately, most people don't itemize. So, if you claim the standard deduction , you're out of luck twice — once for losing your bet and once for not being able to deduct your gambling losses.

Second, you can't deduct gambling losses that are more than the winnings you report on your return. If you were totally down on your luck and had absolutely no gambling winnings for the year, you can't deduct any of your losses. Also, according to the IRS, "to deduct your [gambling] losses, you must be able to provide receipts, tickets, statements or other records that show the amount of both your winnings and losses.

If you are a professional gambler , you can deduct your losses as business expenses on Schedule C without having to itemize. However, a note of caution: An activity only qualifies as a business if your primary purpose is to make a profit and you're continually and regularly involved in it. Sporadic activities or hobbies don't qualify as a business.

To help you keep track of how much you've won or lost over the course of a year, the IRS suggests keeping a diary or similar record of your gambling activities. You should also keep other items as proof of gambling winnings and losses. For example, hold on to all W-2G forms, wagering tickets, canceled checks, credit records, bank withdrawals, and statements of actual winnings or payment slips provided by casinos, sports betting parlors, racetracks, or other gambling establishments.

If you receive a W-2G form along with your gambling winnings, don't forget that the IRS is getting a copy of the form, too. So, the IRS is expecting you to claim those winnings on your tax return. Deducting large gambling losses can also raise red flags at the IRS. Remember, casual gamblers can only claim losses as itemized deductions on Schedule A up to the amount of their winnings.

Be careful if you're deducting losses on Schedule C , too. The IRS is always looking for supposed "business" activities that are just hobbies. If you look carefully at Form W-2G you'll notice that there are boxes for reporting state and local winnings and withholding. That's because you may owe state or local taxes on your gambling winnings, too.

The state where you live generally taxes all your income — including gambling winnings. However, if you travel to another state to place a bet, you might be surprised to learn that the other state wants to tax your winnings, too. And they could withhold the tax from your payout to make sure they get what they're owed.

Popular Pages

- Is sport betting taxable in belgium

- What is a 3 way in sports betting

- Where can you sports bet online reddit

- How to use math in sports betting

- Whats the biggest sports bet win

- Who is the chalk in sports betting

- Why do people bet on sports

- Where to bet on sports in nyc

- Can you sports bet at wheeling island casino

- How does betting odds work in sports