When do i have to pay taxes on sports betting

Sports gambling winnings are subject to income tax and you must report them on your tax return, even if you don't receive tax documentation for the gambling. Effective August ofwhen do i have to pay taxes on sports betting required rate for gambling winnings in Maine became %, the highest personal income tax rate. This means that. Gambling income is fully taxable and must be reported on your federal tax return as gambling income. Key Takeaways. Gambling income is any money that you earn. Sports betting winnings are taxed and should be reported on your tax return. Professional gamblers can deduct gambling-related expenses.

When Do I Have to Pay Taxes on Sports Betting?

As I delve into the world of sports betting, it's essential to understand the financial implications that follow a successful wager. The thrill of predicting outcomes and the adrenaline rush that comes with it may cloud our judgment, but taxes are a reality in this domain that we cannot afford to overlook.

So, when do we have to pay taxes on sports betting?

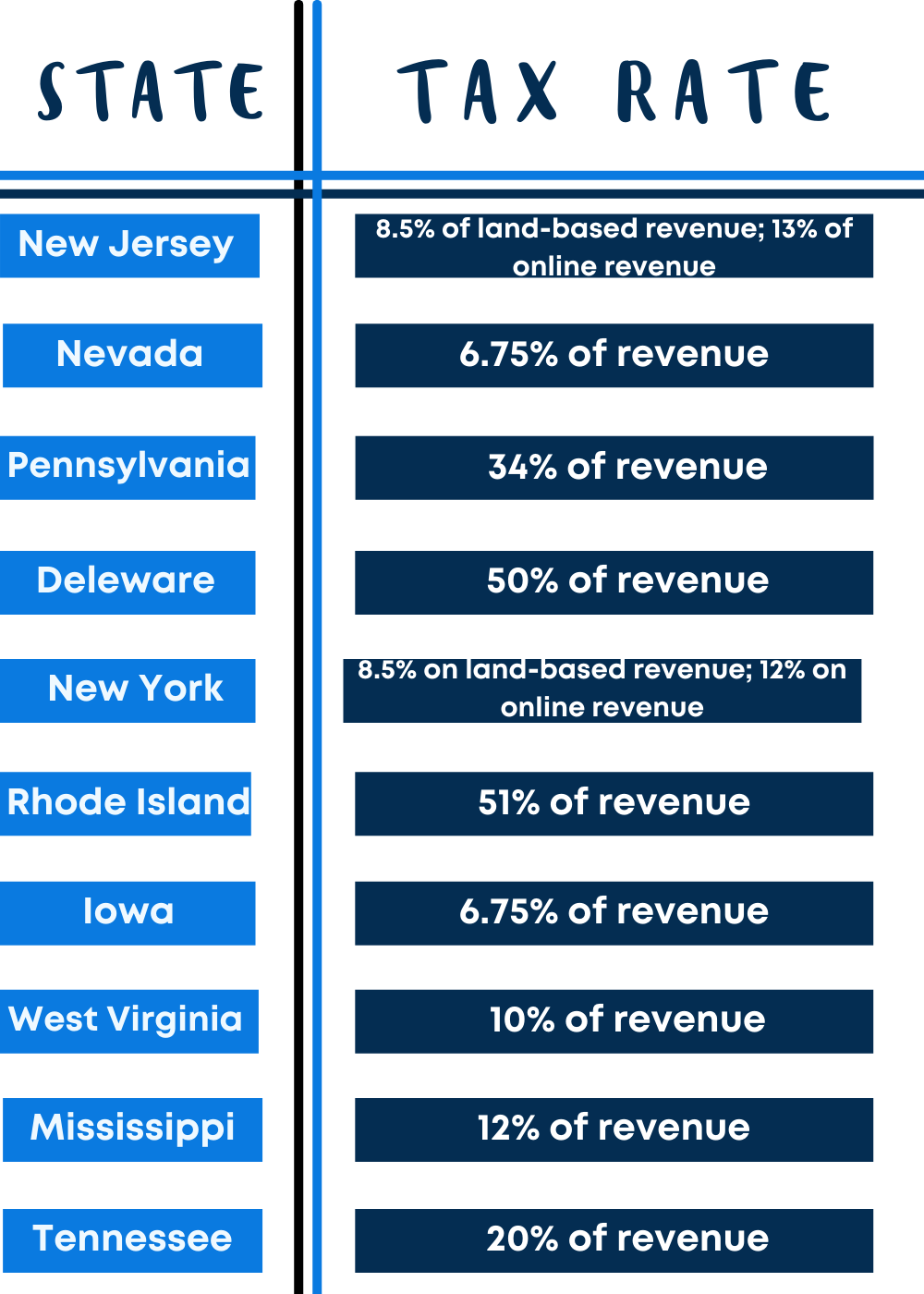

First and foremost, it's crucial to note that tax laws vary depending on the country or state where you reside. In some regions, such as the United States, sports betting winnings are considered taxable income and must be reported to the IRS. On the other hand, in countries like the United Kingdom, gambling winnings are not taxed.

For instance, in the US, if your sports betting winnings exceed a certain threshold, usually set by the IRS, you are obligated to report them as income on your tax return. Failure to do so can lead to penalties and legal consequences down the line. It's essential to keep detailed records of your bets, wins, and losses to ensure accurate reporting.

On the flip side, not all bets are subject to taxation. In cases where your losses exceed your winnings, you may be able to offset those losses against your taxable income, thereby reducing your overall tax liability. Understanding the nuances of tax laws related to sports betting can help you navigate this aspect of the activity more effectively.

When pondering the tax implications of sports betting, seeking guidance from a financial advisor or tax professional can prove invaluable. They can provide tailored advice based on your specific circumstances and ensure that you comply with the applicable tax laws.

In conclusion, while the excitement of sports betting can be exhilarating, it's essential to be mindful of the tax obligations that accompany any winnings. By staying informed and seeking expert advice, we can ensure that our foray into sports betting remains financially sound and enjoyable.

Do You Have to Pay Sports Betting Taxes?

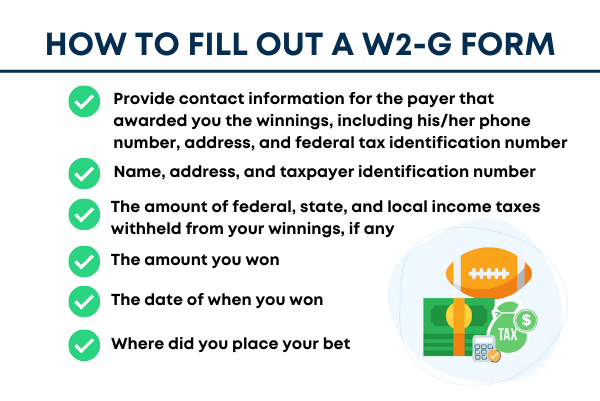

SSNs are used to verify the identity of players for regulatory purposes. In addition, customers will be asked to complete an IRS Forms W-9 or W-8BEN after a Big Win. This information will be used by DraftKings to prepare informational reporting tax forms (i.e. IRS Form W-2G).How do taxes work on sports betting? In short, the proceeds from a successful sports wager are taxable income, just like your paycheck or capital gains from investment income. While you can write off some gambling losses if you itemize, that deduction can't exceed the amount of your winnings.

Do I need to fill out a W 9 for DraftKings? For Sportsbook and Casino

How much money can I win before paying taxes? Do sportsbooks and casinos report gambling winnings to the IRS? If you win at a sportsbook or casino, they are legally obligated to report your winnings to the IRS and to you if you win up to a certain amount ($600 on sports, $1,200 on slots, and $5,000 on poker).

Gambling Winnings Taxes: An Intro Guide

Your resident state will also require you to report the winnings but will offer a credit or deduction for taxes already paid to a non-resident state. Yes, but certain thresholds must be eclipsed to trigger such reporting. Gambling winnings are fully taxable according to IRS regulations but gambling losses can be deductible up to the amount of your winnings if you choose to itemize deductions on your tax return.

Be sure to maintain detailed records of your wins and losses to support your tax deduction claims. If you or someone you know has a gambling problem, you can call the National Problem Gambling Helpline at or visit ncpgambling. American Gaming Association. Map: Sports Betting. Nonresident Alien Income Tax Return. Table of Contents Expand. Table of Contents.

How Gambling Winnings Are Taxed. Reporting Gambling Winnings. Taxes for Professional Gamblers. Tax Requirements for Nonresidents. The Bottom Line. Trending Videos. You'll report your winnings and your tax payments when you file your annual tax return. When do i have to pay taxes on sports betting You may then have to pay more in taxes or you may get a refund, depending on your tax bracket.

You can deduct gambling losses up to the amount of winnings that you report so keep good records. Are Gambling Losses Deductible. Do States Tax Gambling Winnings. Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.  Part Of. Related Articles. Partner Links. Related Terms. Gambling Income: What It Is, How It Works, and Advantages Gambling income refers to any money that is generated from games of chance or wagers on events with uncertain outcomes.

Part Of. Related Articles. Partner Links. Related Terms. Gambling Income: What It Is, How It Works, and Advantages Gambling income refers to any money that is generated from games of chance or wagers on events with uncertain outcomes.

Learn how gambling income is taxed. Gambling Loss: What It Means and How It Works A gambling loss is a loss resulting from risking money or other stakes on games of chance or wagering events with uncertain outcomes. If you do decide to itemize your deductions, your gambling losses can't be greater than the sum of your winnings.

How much of your winnings you owe Uncle Sam depends on your tax bracket. Because gambling facilities are required to withhold a flat percentage of your winnings if they're large enough, there may be a difference between the tax withheld and what you owe on your tax return. In addition, depending on where you live and where you gambled, you may also owe state and local taxes.

Check your state's guidelines to find out. If you had any gambling wins in , you should report the full winnings on your tax return in , claiming it as "gambling income" on line 8 of Form , Schedule 1. Itemized deductions can be reported on Schedule A of Form The tax-filing season kicked off on Jan.

TurboTax offers step-by-step guidance for filers and can access prior returns to get you started, even if they were filed with a different service. If you're going to write off your gambling losses, you should opt for TurboTax Deluxe — the basic edition is only available for simple returns with standard deductions. TurboTax Free Edition. Click here for TurboTax offer details and disclosures.

Terms apply. Users can also upload previous returns from other providers and they'll get an estimate of their tax refund in real time. Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox.

Sign up here. Any winnings from a sports bet must be reported as income on your tax return. You can deduct gambling losses, but only if you itemize your deductions and they don't add up to more than your winnings. At CNBC Select , our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every tax article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of tax products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. UFB Secure Savings. Accredited Debt Relief. LendingClub High-Yield Savings. Whats a good roi for sports betting Choice Home Warranty.

Popular Pages

- How much is sports betting generating in ghana

- How to make a sports betting app

- Can i bet on sports online in new york

- Is bet on sports app real money

- How many states allow online sports betting

- What is a unit in sports betting

- How to mail in vegas sports bet

- Where to find sports betting tipsters

- How to read sports bet odds

- Does your possible winnings include your bet in sports betting