How to keep track of sports betting wins and losses

Join the ultimate social betting community with Pikkit's sports betting tracker. Sync your sportsbook accounts in one place, stay up-to-date on your. Spreadsheets are great for keeping a record of your betting progress. You can use formulas to calculate betting numbers, ROI, and expected value. The most basic way to keep track of your bets, however, is by hand writing them down in a notebook. Here is a quick list at how your records. This will help you to become a how to keep track of sports betting wins and losses punter and it will enable you to track exactly how much you are winning and losing. Relying on memory alone can be.

**Mastering the Art of Tracking Sports Betting Results

**Sports betting enthusiasts often find themselves caught up in the thrill of wagering on their favorite teams and events. Amid the highs and lows, it becomes crucial to maintain a systematic record of wins and losses to stay on top of one's betting game.

Setting Up a Winning Strategy

Tracking your sports betting wins and losses is not just about keeping score—it's a strategic move to analyze performance and refine your betting approach. Establishing a structured method for recording results is essential to maximize your profitability in the long run.

Utilizing Digital Tools

In the digital age, numerous apps and online platforms are available to assist in monitoring your betting outcomes. Explore options that offer customizable features to input data, categorize bets based on sports or bet types, and generate comprehensive reports for insightful analysis.

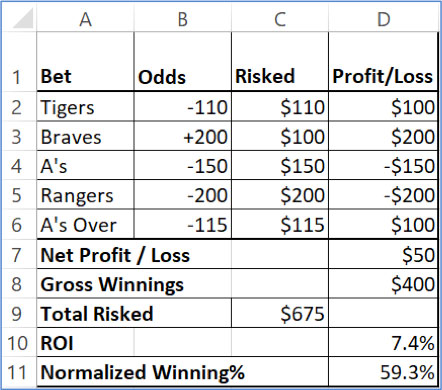

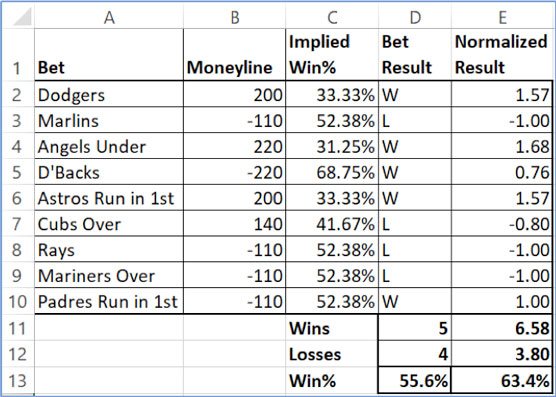

Creating a Personal Spreadsheet

For those inclined towards a hands-on approach, building a personalized spreadsheet can be a game-changer. Organize columns for date, event, bet type, odds, stake, outcome, and profit/loss to track each wager methodically. Regularly update your spreadsheet to have a clear overview of your betting progress.

Learning from Past Results

Reviewing your betting history enables you to identify patterns, trends, and areas for improvement. By analyzing your wins and losses over time, you can pinpoint successful strategies and adjust tactics that may be leading to undesirable outcomes.

Staying Disciplined and Responsible

Remember, tracking your sports betting wins and losses is not just about celebrating victories but also acknowledging setbacks. Practicing responsible betting habits, adhering to a budget, and recognizing the importance of bankroll management are fundamental principles to uphold throughout your betting journey.

**In Summary

**By meticulously monitoring your sports betting results, you equip yourself with valuable insights to enhance your betting skills and decision-making. Whether through digital platforms, personalized spreadsheets, or manual record-keeping, maintaining a record of your wins and losses elevates your betting experience to a professional level.

Maximize Your Betting Success with a Free Bet Tracker Spreadsheet!

How do online casinos track you? The IP address is your online address. It gives the casino a location they can use to track and monitor you. Casinos need to track IP addresses for multiple reasons. They are required by law to track them for audit purposes.

How do I keep track of my gambling? Recordkeeping. To deduct your losses, you must keep an accurate diary or similar record of your gambling winnings and losses and be able to provide receipts, tickets, statements, or other records that show the amount of both your winnings and losses.

Why do casinos track you? However, there is no malicious reason behind it. Casinos keep track of this information for their own records in terms of the casino's gains and losses, as well as for players' safety. It can help to combat problem gambling by keeping an eye on players displaying potentially concerning behaviour.

How do you keep betting records? Some suggested things that you record are:

- Date and time of bet.

- Bookmaker or betting exchange where bet was placed.

- Stake size.

- Market type.

- Sport, competition and venue.

- Sport-specific information. ...

- Profit and loss.

- Return on investment.

What is the best app to track sports gambling? Juice Reel is the #1 sports betting tracker & it's designed to help you bet smarter. More than just a bet tracker, Juice Reel shares AI picks & betting predictions! Connect to over 300+ sportsbooks & DFS sites, allowing you to analyze your data & connect with the market.

What is the best app for tracking prop bets? You Might Also Like

- Outlier: Smart Sports Betting. Sports.

- Props.Cash | Player Props Data. Sports.

- Pickswise Sports Betting. Sports.

- Optimal: +EV Picks & Analysis. Sports.

- Pikkit: Sports Betting Tracker. Sports.

- ParlayPlay Fantasy Sports Game. Sports.

Is there an app to track all your bets? HEATR is the leading sports bet tracking app, designed for real-time bet monitoring. Track all your bets for all your favorite sports. Pull down to refresh and stay up to date during games. Keep track of your bets with a real-time results dashboard.

Which is the best bet Analyser app? BetAnalyser is the best free app for football. It covers more than 850 leagues from 90+ countries and major competitions. Now you can easily study and predict the outcome of the upcoming matches in a unique way with a high probability using stats, teams attack strength, defence weakness and recent form analysis!

What is a good betting record? For the record, we do believe there are good handicappers out there that are able to achieve 55% over the long-term, which is a very good win rate.

What makes betting addictive? Gambling can stimulate the brain's reward system much like drugs or alcohol can, leading to addiction. If you have a problem with compulsive gambling, you may continually chase bets that lead to losses, use up savings and create debt. You may hide your behavior and even turn to theft or fraud to support your addiction.

3 Best Google Sheets templates to track your sports betting progress & bets

The Linemaker Sports Bet Tracker provides an intuitive dashboard that offers various graphs and charts to visualize your betting performance. The dashboard displays bar graphs that illustrate your total wins, unit gain, and win-loss statistics, making it easy to track your progress month by month.

Additionally, pie graphs provide a breakdown of your wins and losses by sport, giving you a clear picture of where your strengths lie. Is the Linemaker Sports Bet Tracker free to use. There are no hidden charges or subscriptions required. Can I track bets from multiple sportsbooks in the Bet Tracker?

The Bet Tracker allows you to record and manage bets from multiple sportsbooks in one convenient place. Simply input the relevant details for each bet, including the sportsbook name. How often should I update the Bet Tracker with new bets. Ideally, you should update the Bet Tracker immediately after placing a bet to ensure accurate and real-time data.

Consistency is crucial for gaining valuable insights into your betting performance. Can I export the data from the Bet Tracker for further analysis. At the moment, the Bet Tracker does not have an export function. However, you can manually copy and paste the data into a spreadsheet program for in-depth analysis and customization.

In conclusion, the Linemaker Sports Bet Tracker is an invaluable tool for all sports bettors looking to improve their game. By properly tracking and analyzing your bets, you'll have a clearer understanding of your strengths, weaknesses, and overall profitability. So why not give it a try. Head to the provided link, download the Bet Tracker, and start taking control of your sports betting Journey today!

Success With Sam. Xtream UTD. How to keep track of sports betting wins and losses Udio AI. Create unique AI-generated MP3 songs instantly. AI Music Generator. Chaindesk AI. Create custom AI chatbots with Chaindesk for streamlined customer support. AI Chatbot. Find AI Tools No difficulty. No complicated process. Find ai tools. Updated on Nov 27, Downloading and Setting Up the Bet Tracker 4.  Inputting Data into the Bet Tracker 4.

Inputting Data into the Bet Tracker 4.

Article Introduction In the world of sports betting, keeping track of your bets is crucial for success. The Importance of Tracking Bets Before diving into the details of the Linemaker Sports Bet Tracker, let's first discuss why tracking bets is essential.

Introducing the Linemaker Sports Bet Tracker The Linemaker Sports Bet Tracker is a comprehensive tool designed to assist all types of bettors in managing and analyzing their bets. Inputting Data into the Bet Tracker Upon opening the tracker, You 'll be greeted with a clean and organized data entry form. Analyzing and Filtering Data in the Bet Tracker The Bet Tracker not only allows you to track your bets but also provides options for analyzing and filtering your data.

Here are a few key advantages that all bettors can enjoy: Better visibility of betting patterns and trends Enhanced decision-making Based on data-driven insights Identification of profitable betting strategies Awareness of strengths and weaknesses in specific sports Ability to track and manage multiple sportsbooks in one place Tracking Performance and Analyzing Results One of the main advantages of the Linemaker Sports Bet Tracker is the ability to track your performance and analyze your results.

Exploring the Dashboard and Graphs The Linemaker Sports Bet Tracker provides an intuitive dashboard that offers various graphs and charts to visualize your betting performance. Tips and Tricks for Effective Bet Tracking To make the most of your bet tracking experience, consider the following tips and tricks: Consistency is key: Make it a habit to input your bets into the tracker immediately after placing them to ensure accurate and up-to-date data.

Review and analyze: Take the time to regularly review and analyze your betting history in the Bet Tracker. Look for patterns, identify successful strategies, and learn from past mistakes. Set goals: Use the Bet Tracker to set realistic goals for yourself, whether it's improving your win percentage or increasing your overall profitability.

Tracking your progress towards these goals will keep you motivated and accountable. Highlights Introducing the Linemaker Sports Bet Tracker, a free tool for tracking and analyzing bets Step-by-step guide on using the Bet Tracker to input and analyze betting data Benefits of tracking bets, including improved decision-making and identification of profitable strategies Exploring the dashboard and graphs in the Bet Tracker for visualizing performance Tips and tricks for effective bet tracking, including consistency and goal-setting FAQs addressing common questions about the Bet Tracker's features and usage.

Most people like. Exactly AI. Advanced AI artwork creation platform for artists. However, if you're lucky enough to win from a bet or smart gamble, don't forget that the federal government wants its cut through gambling taxes. So, here are 8 things to know about how gambling winnings are taxed. If you win a non-cash prize, such as a car or a trip, report its fair market value as income.

And be sure you report all your gambling winnings. The IRS isn't typically hunting down small-time winners, but you should file an accurate income tax return. The payout doesn't have to be times the wager for these types of winnings. Your reportable winnings will be listed in Box 1 of the W-2G form. If a W-2G is required, the payer sports betting parlor, casino, racetrack, lottery, etc.

In some cases, you'll get the W-2G on the spot. Otherwise, for winnings, the payer must send the form to you by Jan. In any event, if your bet was with a casino, we're fairly certain you'll get the W-2G. But if your bet was just a friendly wager with a friend or you won an office pool … well, don't count on it. Special withholding rules apply for winnings from bingo, keno, slot machines and poker tournaments.

The amount withheld will be listed in Box 4 of the W-2G form you'll receive. You will also have to sign the W-2G stating under penalty of perjury, that the information listed on the form is correct. When you file your for the tax year, include the amount withheld by the payer, as federal income tax withheld.

It will be subtracted from the tax you owe. You'll also have to attach the W-2G form to your return. Again, this is what to expect when you place a bet at a casino, racetrack, sports betting parlor, or with some other legally operated gaming business. Don't expect your friend who is running an office pool, for example, to withhold taxes although, technically, they should.

Did you have a bad night at the blackjack table or pick the wrong horse to win. There's a possible silver lining if you lose a bet or two — your gambling losses might be deductible. How to calculate roi sports betting Gambling losses include the actual cost of wagers plus related expenses, such as travel to and from a casino or other gambling establishment.

There are a couple of important catches, though. First, unless you're a professional gambler more on that later , you have to itemize in order to deduct gambling losses itemized deductions are claimed on Schedule A. Unfortunately, most people don't itemize. So, if you claim the standard deduction , you're out of luck twice — once for losing your bet and once for not being able to deduct your gambling losses.

Second, you can't deduct gambling losses that are more than the winnings you report on your return. If you were totally down on your luck and had absolutely no gambling winnings for the year, you can't deduct any of your losses. Also, according to the IRS, "to deduct your [gambling] losses, you must be able to provide receipts, tickets, statements or other records that show the amount of both your winnings and losses.

If you are a professional gambler , you can deduct your losses as business expenses on Schedule C without having to itemize. However, a note of caution: An activity only qualifies as a business if your primary purpose is to make a profit and you're continually and regularly involved in it.

Sporadic activities or hobbies don't qualify as a business. To help you keep track of how much you've won or lost over the course of a year, the IRS suggests keeping a diary or similar record of your gambling activities. You should also keep other items as proof of gambling winnings and losses. For example, hold on to all W-2G forms, wagering tickets, canceled checks, credit records, bank withdrawals, and statements of actual winnings or payment slips provided by casinos, sports betting parlors, racetracks, or other gambling establishments.

If you receive a W-2G form along with your gambling winnings, don't forget that the IRS is getting a copy of the form, too. So, the IRS is expecting you to claim those winnings on your tax return. Deducting large gambling losses can also raise red flags at the IRS. Remember, casual gamblers can only claim losses as itemized deductions on Schedule A up to the amount of their winnings.

Be careful if you're deducting losses on Schedule C , too. The IRS is always looking for supposed "business" activities that are just hobbies. If you look carefully at Form W-2G you'll notice that there are boxes for reporting state and local winnings and withholding. That's because you may owe state or local taxes on your gambling winnings, too.

The state where you live generally taxes all your income — including gambling winnings.

Popular Pages

- Is sports betting illegal in virginia

- Is bovada safe for sports betting

- How to use excel for sports betting

- Can you sports bet in vegas

- Can you be rich by sports betting

- Which states is sports betting legal

- How to use statistics in sports betting

- Which visa for sports betting in canada

- Is sports betting legal in minnesota

- Is it legal to bet on sports virginia