Is sports betting taxed

When you win, the entity paying you will issue you a Form W2-G, Certain Gambling Winnings, if the win is large enough. This form is similar to. Key Takeaways · The payer will deduct 24% from your winnings on the spot if you win above a certain amount. · You'll report your winnings and your tax payments. The wagering and betting tax applies at a rate of 10% of net wagering revenue, including GST, from customers located in Victoria in excess of the tax-free. However, it is important to note that winnings from online betting are fully taxable per is sports betting taxed Income Tax Department. Online Betting Income Tax.

Is Sports Betting Taxed?

Amidst the thrill of sports betting, there lies a question that often sneaks into the minds of enthusiasts: Is sports betting taxed? This inquiry delves into the financial nuances of wagering on sports events and the possible implications that taxes may have on your winnings.

The truth is that sports betting winnings are indeed subject to taxation in many countries around the world. Whether you are participating in online betting platforms or placing bets at physical bookmakers, your profits may be liable for taxation depending on the regulations of your jurisdiction.

From a legal standpoint, it is essential to comprehend the local laws and regulations governing sports betting in your region. Some countries require individuals to declare their gambling earnings as part of their annual income, subjecting them to income tax rates. These tax rates can vary significantly, impacting the overall profits derived from successful sports bets.

Furthermore, the nature of your betting activities can influence the tax treatment of your winnings. For instance, professional gamblers who earn a substantial portion of their income through sports betting may face different tax obligations compared to occasional bettors.

It is crucial for sports bettors to keep accurate records of their betting transactions and receipts, as having a clear audit trail can facilitate compliance with tax regulations and aid in accurately reporting earnings to the relevant authorities.

While the thrill of sports betting remains a captivating pastime for many, it is imperative to recognize the potential tax implications that come along with it. By understanding the taxation laws related to sports betting in your jurisdiction, you can navigate the financial landscape of this exciting activity more effectively.

Bet on the big game? Here's what you need to know about paying taxes on sports bets

Do I have to pay taxes on Fanduel winnings? Yes, your winnings from Fanduel and other fantasy sports platforms, such as Draft Kings are taxable. Fanduel will issue a W-2G or 1099 for your winnings. Once your winnings reach $5,000 they will withhold 25% for you for federal tax purposes. Fanduel is not the only gambling platform whose winnings are taxable income.

What states do not tax gambling winnings? All states except the following eleven, along with Puerto Rico and the U.S. Virgin Islands, do not tax national lottery winnings: Alaska, California, Delaware, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

If you win $600 or above, the gambling facility should ask for your social security number so they can report your winnings to the IRS, but remember, even if you don't receive a form reporting your income, you still have to claim your winnings on your taxes.At what point do you have to pay taxes on DraftKings? $600 or

How do sports bettors pay taxes? Typically, the betting organization or platform will send you and the IRS Form W-2G when you win $600 or more. If you have winnings of $5,000 or more, the business may withhold up to 24% of the proceeds for federal income tax. If this is the case, it will be shown on Box 4 of your W-2G.

Will DraftKings send me a tax form? If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. If you receive your winnings through PayPal, the reporting form may be a 1099-K.

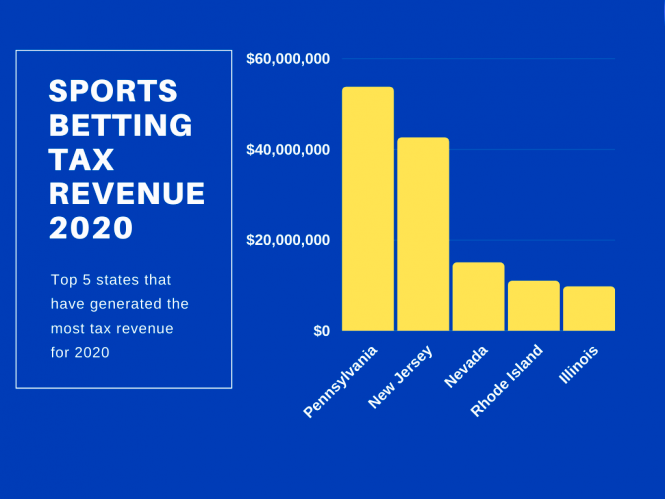

How much tax revenue from sports betting? Land-based gambling alone brought in $50.02 billion, a commanding 75.3% of all revenue. AGA also touts that gambling taxes generated $14.4 billion for state and local governments in 2023.

Do people pay taxes on sports betting? Sports betting winnings are taxable income, which means they are taxed like other ordinary income on your tax return. The tax rate that you pay on your sports betting winnings may vary from 0% to 37% depending on the amount of other income that you have, your filing status, and several other factors on your tax return.

Gambling Winnings Taxes: An Intro Guide

However, you still must report your winnings on your IRS tax return even if the winnings did not result in a tax form, so keep accurate records of all your buy-ins and winnings at casinos. Keep accurate records of your wager or buy-in amounts, as this can be used to offset your reported winnings. The tax rate on gambling winnings will typically vary from state to state.

The majority of states have income taxes, which means that gambling winnings are likely subject to both federal and state taxation. The rules and rates of your gambling wins and taxes can vary significantly depending on your state. Some states take your gambling winnings tax at a flat rate, while other states tie it to your overall income tax rate. Form W-2G details your gambling winnings and any taxes withheld.

Even if your gambling winnings are not substantial and you were not issued Form W-2G, you are still required to report your winnings as part of your total income. Whether you won the lottery or a sweepstakes or simply enjoyed a bit of friendly competition, keeping track and reporting your gambling income is important to stay on the right side of tax regulations.

If you engage in gambling activities as a means of livelihood and pursue it regularly as a professional gambler, then some rules can vary. However, deductions from losses that exceed the income of your winnings are still not allowed. While casual gamblers only need to report their winnings as part of their overall income on their tax forms, professional gamblers may file a Schedule C as self-employed individuals.

They may be able to deduct their gambling-related expenses, such as travel or casino entry fees, to determine their net income. In regards to losses, deductions for gambling losses must be less than or equal to gambling winnings. You can deduct losses from your gambling, but only if you itemize your deductions and keep an accurate record of your winnings and losses. Taxpayers who itemize their taxes can deduct their losses on Schedule A.

However gambling losses can only offset gambling winnings. They cannot be used to reduce your taxable income from other sources. As with all deductions , you must keep records and receipts of all claimed losses. The manner in which you make the bet does not matter when paying federal income taxes.

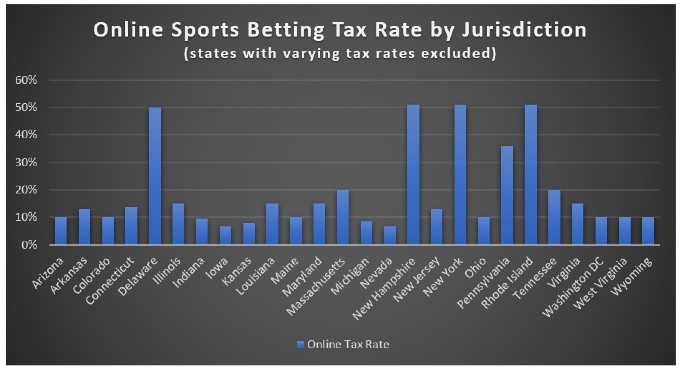

For example, the tax implications for the IRS are the same regardless of whether you make the bet in person or via an app. Is sports betting taxed States have set rules on betting, including rules on taxing bets, in a variety of ways. Depending on your state, legal sports betting may be a combination of in person, online, retail at specifically licensed physical properties. At time of writing 17 states continue to ban sports betting entirely.

Every state has its own laws when it comes to gambling taxes. Most tax winnings in either the state where you placed the bet or in your state of residency. The explosion of online and app-based sportsbooks. A sportsbook is the institution where you can place bets on sporting events, otherwise known as your bookie.

The legal issues around online sportsbooks have not yet been fully resolved. These institutions argue that all bets occur either where the company is registered or where it keeps its servers. At time of writing this was not fully resolved. The following table is based on Tax Foundation information.

This does not absolve you of responsibility to report that income yourself, in the same way that you still have to file your taxes even though the IRS has your W It does mean, however, that you should be scrupulous when you file your taxes. Many people underreport gambling winnings.  There are many reasons not to do this, including the fact that the IRS may already know all about your income.

There are many reasons not to do this, including the fact that the IRS may already know all about your income.

Depending on the nature of your bet, you may receive a Form W-2G from whoever pays out your winnings. This is particularly true if they use some form of third party institution to make your payment. You can only deduct losses if you itemize your taxes. The same is true of up-front money that you stake.

If you do decide to itemize your deductions, your gambling losses can't be greater than the sum of your winnings. How much of your winnings you owe Uncle Sam depends on your tax bracket. Because gambling facilities are required to withhold a flat percentage of your winnings if they're large enough, there may be a difference between the tax withheld and what you owe on your tax return.

In addition, depending on where you live and where you gambled, you may also owe state and local taxes. Check your state's guidelines to find out. If you had any gambling wins in , you should report the full winnings on your tax return in , claiming it as "gambling income" on line 8 of Form , Schedule 1.

Itemized deductions can be reported on Schedule A of Form The tax-filing season kicked off on Jan. TurboTax offers step-by-step guidance for filers and can access prior returns to get you started, even if they were filed with a different service. If you're going to write off your gambling losses, you should opt for TurboTax Deluxe — the basic edition is only available for simple returns with standard deductions.

TurboTax Free Edition. Click here for TurboTax offer details and disclosures. Terms apply. Users can also upload previous returns from other providers and they'll get an estimate of their tax refund in real time. Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here.

Any winnings from a sports bet must be reported as income on your tax return. You can deduct gambling losses, but only if you itemize your deductions and they don't add up to more than your winnings. At CNBC Select , our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Popular Pages

- Can you bet on sports at sugarhouse

- Whats the best app to bet on sports

- How to know the favorite in sports betting

- How to track sports bets on excel

- What betting sites let you watch sports

- What is a straight bet in sports betting

- Can you sports bet in south dakota

- How people win big on sports betting

- What is an exotic bet sports

- What is hedging in sports betting