Are sports betting winnings taxable in canada

There are two principal statutory bases for subjecting gambling are sports betting winnings taxable in canada to taxation under the current text of the Income Tax Act.4 The first, and by far the more. Private sportsbooks, on the other hand, are required to pay a standard 20% effective tax rate, which is an average rate across Canada. New. So long as you should not be expected to profit, gamblers in Canada are deemed, for tax purposes, amateurs, and therefore their Ontario mobile. 3. While there is no debate as to whether paragraph 40(2)(f) of the Act applies to the casual gambler, there are occasions where the Minister of National.

Sports Betting Winnings Taxation in Canada: Clearing Up the Score

Dear fans of the sports betting world, let's dive into an aspect as crucial as a last-minute goal—taxation on sports betting winnings in Canada. There's a mix of excitement and confusion among punters when it comes to whether the revenue from their bets is taxable or not. Let's separate the facts from the myths and make things crystal clear.

Understanding the GameIn Canada, the tax laws regarding sports betting winnings can cause some head-scratching moments. The thrilling part is that according to the Canada Revenue Agency (CRA), the taxman sees these winnings as not mere luck, but rather as profit earned, making them generally taxable. This applies to a wide range of gaming activities, including sports betting and lottery winnings.

Exemption CallsHowever, punters placing legal bets through platforms regulated by provinces face a silver lining. The good news is that if you're making straight bets via provincial-run sportsbooks, there's often an exemption in place. This exemption spares you from reporting and paying taxes on those winnings to the CRA. The thrill of victory comes with a sense of relief!

Going ParlayFor those partial to broader accumulators such as parlay bets or trying their luck on international platforms, be prepared for a different game plan. In such cases, winnings exceeding a certain threshold warrant reporting as additional income in your annual tax return. Brush up on your record-keeping skills, as those big wins might just get the taxman's attention.

Shifting ScoresIt's important to note that the tax laws in Canada are dynamic, akin to a game with changing strategies and rules. Thus, it's prudent for punters to stay updated on any amendments or revisions that might impact the taxation of sports betting winnings.

Remember, like a game-winning goal, accurate knowledge can be your true victory. So, play smart, stay informed, and ensure your betting escapades remain both thrilling and tax-savvy. Now, let's gear up for the next kick-off with a clear understanding of the taxation game in the sports betting arena!

Strategic Wins: Navigating Taxes for Canadian Gamblers

What to do if you win a million dollars in Canada? What to do if you win the lottery?

- Stop. ...

- Resist the almost insurmountable urge to call anybody to share the news. ...

- Sign the ticket and put it in a secure place. ...

- Call your financial planner, attorney and accountant to decide on a plan to protect, preserve and invest your money.

What is the max you can win in Vegas without paying taxes? You can choose to have taxes withheld if you win less than $5,000 and a W2-G is issued. The gambling establishment is required to withhold taxes if you win $5,000 or more and it triggers a W2-G. The standard withholding amount is 24% from gambling winnings.

What money is not taxable in Canada? Lottery Winnings, Gifts, and Inheritances

Do Canadians pay tax on DraftKings winnings? You would report your gross income and expenses (such as entry fees, etc). If the income is considered gambling winnings, it would not be taxable in Canada.

Do you have to pay taxes on sports gambling winnings in Canada? As stated at the top of this page, gambling winnings are not taxable in Canada unless the player is deemed professional, or the player is earning income on the winnings. This applies to both [online gambling](/online-gambling/) and offline gambling.

Can Canadians recover taxes on US gambling winnings? Can Canadians recover taxes on US gambling winnings? Yes, they can. American casinos withhold 30% of your winnings but Canadian residents can file for a potential gambling tax refund.

Do Canadians get taxed on winnings? You do not have to report certain non-taxable amounts as income, including the following: lottery winnings of any amount, unless the prize can be considered income from employment, a business or property, or a prize for achievement.

What happens if a Canadian wins money in Vegas? Did you know that Canadians can recover taxes on U.S. gambling winnings? The IRS can tax all gambling winnings such as Keno, slot machines, bingo, lotteries, etc. As a Canadian who is not residing in the U.S., the tax rate is 30%.

Are Gambling Winnings Taxable in Canada?

Thanks to the advancements in technology and the evolution of software developers, players now have more exciting ways to gamble and more opportunities to win. The big question is — what happens with taxes on these gambling winnings. If betting on sports or online poker or anything casino gaming related is deemed to be your profession, then yes, you have to pay tax on that, as you would a salary.

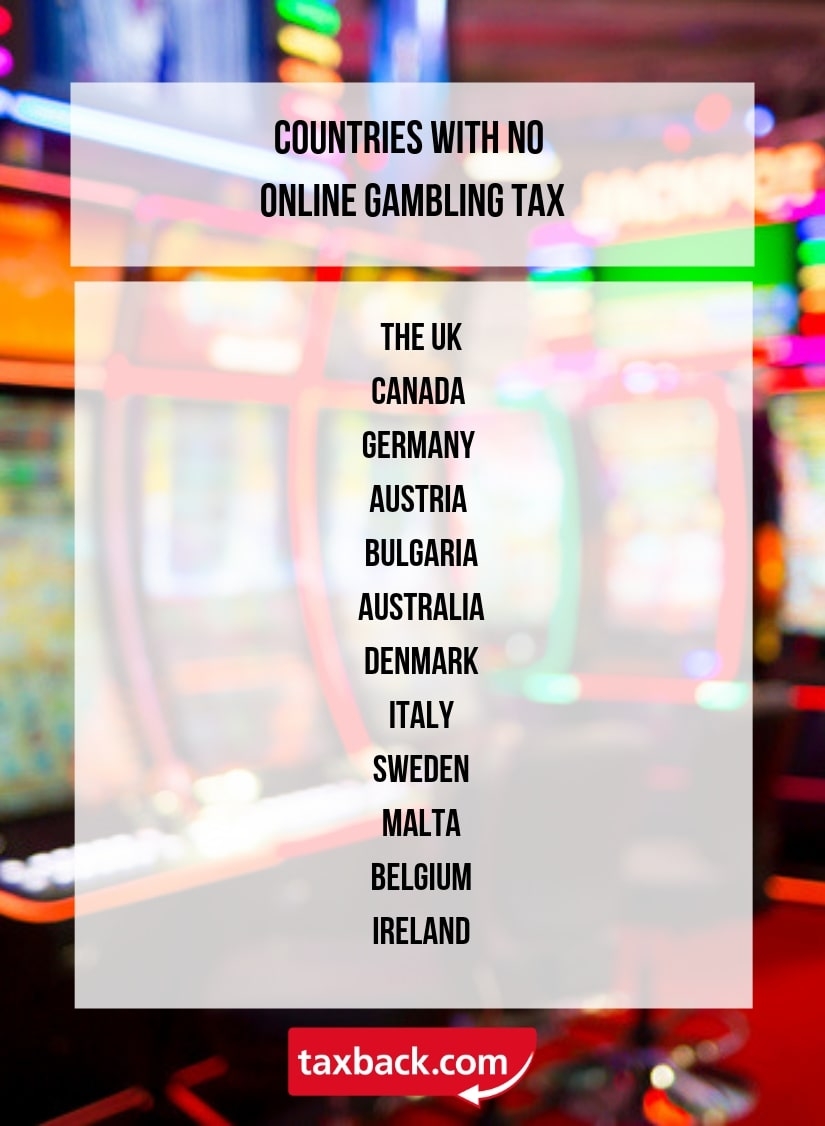

Canadian gambling tax varies and it depends on the scenario. In general, gambling winnings in Canada are not taxable. Many people view this as a fair system, after all, playing and winning in casino games or sports is challenging and does require some skill. In other countries, like the United States, the government does tax gambling winnings.

In some cases, players lose more than they win but the government will still tax these players regardless. In Canada, the government does not always get involved in taxation, it depends on the case. Since gambling winnings are not taxed by the provincial or federal government, there is no need to track gambling losses.

Losses would only be useful to write off from winnings if there was tax on the winnings as in the United States. Just keep in mind when spending your money, that there may be certain things that you do or buy that could be taxed. That is standard though, whether your money comes from gambling winnings or anything else. For people who gamble for a living, the tax rules may be a real pain in the neck.

If your money comes straight from running online casinos, that is business income. Casino wins or losses will be treated as income or loss from a business, and the taxpayer will be assumed to want to make money. If you treat gambling like a business, the CRA says that the main reason you do it must be to make money.

People who play games of skill for a living have to pay taxes on their casino winnings in Canada, just like the rest of us. To be more precise, many individuals who work for the government have the opinion that gamblers only care about the amount of money they can earn for themselves.

The possibility of gaining financial gain from these activities is a significant motivating factor for a lot of individuals to engage in them. If, on the other hand, you gamble just infrequently for entertainment purposes, you may retain all of the money you win without being required to pay taxes on it. Are sports betting winnings taxable in canada So, what should be done about taxes on betting on the internet?

The brothers consistently won during the taxation years in question to Accordingly, the Court concluded the gambling activities were of a personal nature and not business income subject to taxation. Physical, rather than technical, skills appear to be an obvious tipping point for the Courts in finding for gambling activities being business income. For example, both a seasoned pool player challenging inexperienced and inebriated bar patrons Luprypa v.

The Queen , 96 DTC TCC have been situations where the Court decided against the taxpayer, by including such amounts in income and thus recognizing the presence of a business. Presumably, it is against this analysis and categorization of gambling activities that Chief Justice Bowman as he then was saw all four of the cases engage in a detailed but largely irrelevant discussion of whether poker is a game of skill.

Hundreds of paragraphs of these four cases were dedicated to determining the level of skill present in poker and whether skill determined success. The cases all concluded that some element of skill was involved in poker but made no direct conclusion as to whether each individual relied solely on skill to consistently earn income.

Both Mr. Duhamel and Mr. Duhamel includes extensive facts, detailed use of expert testimony and evidence across a variety of topics, such as winnings, business structures, sponsorship agreements and analysis under the Tax Act. At first glance, Mr. The evidence was that Mr. Duhamel used mitigation strategies, published a book, analyzed opponents, received sponsorship income, played in charitable poker tournaments and hired an agent to manage profit-sharing agreements.

By all accounts, it appeared that this venture was more than just mere hobby or entertainment, especially considering Mr.  Testimony revealed a significantly more carefree approach that disclosed little training and little theory of advanced poker strategies or other advantages used that would lean in favour of a finding of commerciality. While Mr. Duhamel occasionally watched YouTube videos and browsed poker news sites, this was not sufficient to constitute training.

Testimony revealed a significantly more carefree approach that disclosed little training and little theory of advanced poker strategies or other advantages used that would lean in favour of a finding of commerciality. While Mr. Duhamel occasionally watched YouTube videos and browsed poker news sites, this was not sufficient to constitute training.

Furthermore, he did not seek a profit by providing any courses to the public. The Court noted that table placements at tournaments are determined at random, making it obvious that players cannot study games in advance. In addition, the mathematical knowledge necessary to play poker does not require advanced training. The agents hired to manage interviews and media were not involved in the management of poker activities, as Mr.

Duhamel registered and organized his trips personally. Duhamel had other sources of income, including dividend payments from his subcompany, income from investment portfolios, sponsorship income and speaking engagements. Even though most this income can be said to have originated from his success as a poker player, the Court was not convinced that his sole or main occupation was related to gambling activities.

The Court refused to find this factor relevant, noting that the activities of the subcompany and the activities of Mr. Duhamel were distinct. The subcompany was a clear separate legal entity that paid corporate tax and included sponsorship income, poker winnings and appearance fees. Other evidence in favour of finding no commerciality included the fact that no separate banking account or credit card was opened for a gambling business, there was no business plan, no records of winnings and losses and no serious preparation for tournaments with high entry fees.

The Duhamel decision, on its own, fits neatly with the jurisprudence and it is surprising that the matter reached the trial stage. In Duhamel, the Minister simply had bad facts, particularly when looking at the arguments that conflate separate activities of the individual taxpayer and his related corporate entities.

The result is that Mr. Whereas Duhamel focused on the details of how specific income was made sponsorship, poker winnings, appearance fees, etc. This was likely due, in part, to the fact that Mr. The single largest factor in deciding the case appears to have been the ability for Mr. This approach strongly favours a results-based analysis, rather than income being a by-product of either training, or the presence of a business plan, or careful considerations of profit and loss.

All three cases were written by Justice Favreau and contain similar themes and trends in how various pieces of evidence are weighted. Analysis of other commercial factors or detailing the presence of a system received only passing analysis. In answering the legal test posed in Stewart v. In contrast, Duhamel sees Justice Lafleur primarily tie her analysis to Stewart and specifically focus on the commerciality of the evidence throughout the decision.

Despite his extraordinary lifestyle and his propensity to always want to play at the very high stakes tables, the Appellant behaved like a serious businessman. He played poker to win. He avoided playing against certain opponents and he adapted his game according to his "bankroll" to avoid situations that were too perilous. The Appellant adopted objective standards for risk management and minimization.

When he participated in face-to-face tournaments, he shared and sold shares to other players based on tournament entry costs. Despite his extraordinary lifestyle and his propensity to always want to ridicule his opponents, the Appellant behaved like serious businessmen. He didn't need accounting records or business plans. He played to win and he knew how to achieve his goal.

Popular Pages

- Can you sports bet in alaska

- How does virtual sports betting work

- What percent of americans bet on sports

- What does off mean in sports betting

- How to bet odds on sports

- Can you sports bet in south dakota

- How profitable is sports betting business in nigeria

- How to bet on sports in colorado

- How do you place a sports bet

- What is the line in sports betting