Why are sports betting stocks down

For sports and online betting fans, here are three stocks to consider. Caesars Entertainment (CZR): CZR has significantly outpaced this. For ASX sports betting stocks, the post-COVID rollercoaster has been steep in both directions. There was the upslope, when money poured. Sports betting broke records inwhy are sports betting stocks down to new data released by the American Gaming Association (AGA). In practice, a lot of investors are gamblers, making wild bets on cheap stocks for a quick buck, and the result is often the same as gambling.

Unraveling the Mystery: Why Sports Betting Stocks are Down

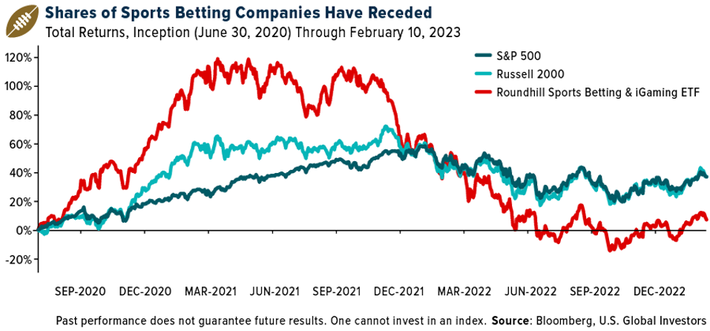

In recent times, a puzzling trend has emerged in the world of sports betting stocks—an unanticipated downward spiral that has left many market analysts scratching their heads. As a fervent follower of these financial ins and outs, it has become apparent to me that there are several underlying factors contributing to this unexpected slump.

The Impact of Regulatory Changes: One key element in this decline is the looming specter of regulatory changes within the industry. Tightening regulations and increased scrutiny on the legality and ethical implications of sports betting have created a sense of uncertainty among investors, causing a palpable unease in the markets.

Fluctuating Revenue Streams: Another significant factor that cannot be ignored is the fluctuating nature of revenue streams in the sports betting sector. With the ebb and flow of sporting events impacted by the global pandemic, revenue projections have been anything but stable, leading to a cautious approach from investors.

Competition and Market Saturation: The fierce competition and market saturation in the sports betting industry have also played a role in the dwindling stock prices. As more players enter the market, vying for a share of the pie, the pressure on existing companies to deliver consistent growth has intensified.

While these factors are undoubtedly influencing the current state of sports betting stocks, it is crucial to note that the landscape remains dynamic and subject to change. The interplay of regulatory frameworks, revenue models, and market dynamics is a delicate dance that continues to shape the fortunes of companies in this arena. As we navigate these uncertain waters, only time will tell how the tide will turn for sports betting stocks.

Sports betting boom: Gross revenue hit $7.5 billion in 2022, shattering record

Never fear, for the long-term oriented investor, there are still diamonds in the rough. One of those stocks is DraftKings (DKNG 4.03%). This is a company that is hard to ignore. It lies within an industry that carries a long history of consumer interest, while also being something new and fledgling.Will DraftKings stock ever recover? DraftKings is undeniably making bottom-line progress, and at its current trajectory should indeed swing to the anticipated profit in 2025. A firm figure is elusive, though. The few analysts that care to make a guess about its earnings that far out suggest the company will earn on the order of $2.07 per share in 2026.

Has anyone got rich from DraftKings? In Week 7 of the 2019 NFL season, DFS legend Michael Cohen, also known as TwoGun, made history by notching his THIRD $1,000,000 win on DraftKings.

Is DraftKings losing money? The sports betting company saw a 44% increase in revenue year-over-year. For the last three months of 2023, DraftKings reported a net loss of $44.6 million compared with $242.7 million in the same period a year earlier.

Is DraftKings a long-term buy? Never fear, for the long-term oriented investor, there are still diamonds in the rough. One of those stocks is DraftKings (DKNG 4.03%). This is a company that is hard to ignore. It lies within an industry that carries a long history of consumer interest, while also being something new and fledgling.

Is DraftKings in debt? Total debt on the balance sheet as of December 2023 : $1.34 B. According to DraftKings's latest financial reports the company's total debt is $1.34 B. A company's total debt is the sum of all current and non-current debts.

Should I buy DraftKings stock? Is DKNG a Buy, Sell or Hold? DraftKings has a conensus rating of Strong Buy which is based on 25 buy ratings, 2 hold ratings and 1 sell ratings. What is DraftKings's price target? The average price target for DraftKings is $50.92.

How much will DraftKings stock be worth in 5 years? According to the latest long-term forecast, DraftKings price will hit $60 by the end of 2024 and then $80 by the end of 2025. DraftKings will rise to $100 within the year of 2026, $125 in 2027, $150 in 2028 and $200 in 2032.

Why is DraftKings stock down so much? DraftKings Inc. shares dropped more than 3% in the extended session Thursday after the sports-betting platform surprised Wall Street with a quarterly loss and revenue that was merely in line with expectations.

Who is the largest shareholder of DraftKings? Largest shareholders include Vanguard Group Inc, BlackRock Inc., VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, ARK Investment Management LLC, Wellington Management Group Llp, NAESX - Vanguard Small-Cap Index Fund Investor Shares, State Street Corp, Sumitomo Mitsui Trust Holdings, Inc., Whale Rock ...

How much will DraftKings make in 2024? “Based on continued strong underlying fundamentals through the first six weeks of 2024 on top of excellent customer acquisition in the fourth quarter, we are raising the midpoint of our fiscal year 2024 revenue guidance range to $4.775 billion from $4.65 billion and the midpoint of our fiscal year 2024 Adjusted EBITDA ...

What happens if I win $1 million on DraftKings? What happens if you win a lot of money on DraftKings? - Quora. If you win a lot of money on DraftKings, the platform will credit your account with the winnings. You can choose to withdraw your funds or use them to play more games on the platform.

Is DraftKings a good long-term investment? NASDAQ: DKNG

Is DraftKings stock expected to go up? DraftKings stock prediction for 1 year from now: $ 64.81 (44.22%) DraftKings stock forecast for 2025: $ 77.71 (72.91%) DraftKings stock prediction for 2030: $ 1,201.20 (2,572.90%)

Are Sports Betting Stocks Played Out?

Read More Sports Betting. Morning Update. Lunch Update. Market Close Update. Weekend Update. You might be interested in. Featured Articles Mining. Strickland Metals acquires 5. New Age Exploration hits the ground running at Wagyu in its quest for gold in the Pilbara. Don't be the last to know Get the latest stock news and insights straight to your inbox.

Unsubscribe whenever your want. This field is for validation purposes and should be left unchanged. Editor's Picks. Get the latest Stockhead news delivered free to your inbox For investors, getting access to the right information is critical. Still, its ownership of the ESPN television network means the House of Mouse has long held a prominent leadership role in sports.

It took some time, but the company partnered with Penn Entertainment to roll out ESPN Bet, its online sports betting platform aimed at competing with DraftKings, FanDuel, and the other legacy casinos that have also jumped into the online betting scene. Investors are also getting a diversified media business in Disney, so the stock isn't a pure play on the betting industry.

Disney's sports business is part of a broader media empire that includes multiple streaming services, theme parks and cruise lines, and movie studios that continue pumping out new intellectual assets. Why are sports betting stocks down Disney's stock has struggled a bit since the pandemic. But the pendulum is now swinging the other way.

Disney has begun raising prices to make money on streaming, and profits are rolling in. CEO Bob Iger recently updated investors on the company's performance, noting that Disney is currently trending ahead of cash-flow guidance for this year. That's a solid setup for long-term investors willing to own the stock for years and let improving profitability in Disney's streaming business carry earnings higher and create shareholder value.

The 10 stocks that made the cut could produce monster returns in the coming years. Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. See the 10 stocks.

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Walt Disney. The Motley Fool has a disclosure policy. Now, with sports betting nearing critical mass, has that contrarian potential been wrung out. It hit a post pandemic low in mid and now sits relatively high.

That former glory is really far off.  The same can be said for DraftKings and PENN, which are trading well off their all-time high levels of , per the chart below. Per Morningstar, U. And this is all without Florida and Texas — two massive untapped revenue streams -- legalizing sports betting. For the third quarter of , in the most recent version of the U.

The same can be said for DraftKings and PENN, which are trading well off their all-time high levels of , per the chart below. Per Morningstar, U. And this is all without Florida and Texas — two massive untapped revenue streams -- legalizing sports betting. For the third quarter of , in the most recent version of the U.

You can bet — no pun intended — that those numbers will rise in coming quarters with the NFL playoffs and Super Bowl getting factored in. The recent string of lackluster earnings and sentiment trends are facing off with indicators of massive revenue flows in the macro sense. So are sports betting stocks a has-been investing trend, a former flavor of the week gone the same way of pot stocks and video game headsets?

Or are we still in the nascent stages of a potentially very lucrative inflection point for the sports betting industry. It depends on what you bet on. Toggle navigation. Schaeffer's Volatility Scorecard. Featured Publication. Trading Analysis. Stock Options. Trading Education. Market News. Daily Market Newsletters.

All Trading Services.

Popular Pages

- What does ev mean in sports betting

- What app is better tab app or.sports bet

- What is the takeout in fanduel sports betting

- What is teasing in sports betting

- What a sports bet juice means probability to win

- When can i bet on sports in louisiana

- What is a whale in sports betting

- Is sports betting legal in europe

- How to program sports betting robots

- Is sports betting legal in south africa