Are sports bets taxed

The proceeds from a successful sports bet are taxable income, just like your paycheck or investment gains. If you've won money placing bets, the tax rate can be are sports bets taxed from 10% to 37% based on your income tax bracket. For federal taxes, there are two types of withholdings on gambling winnings: a regular gambling withholding (24% or % for certain non cash. According to the IRS, winnings from sports betting—or any form of gambling, including horse racing and lotteries—must be listed as “other income.

Are Sports Bets Taxed?

As the excitement of sports betting continues to grow, some fans might be wondering whether their winnings are subject to taxes. In the world of sports gambling, understanding the tax implications is crucial for every bettor out there.

How are sports bets taxed?

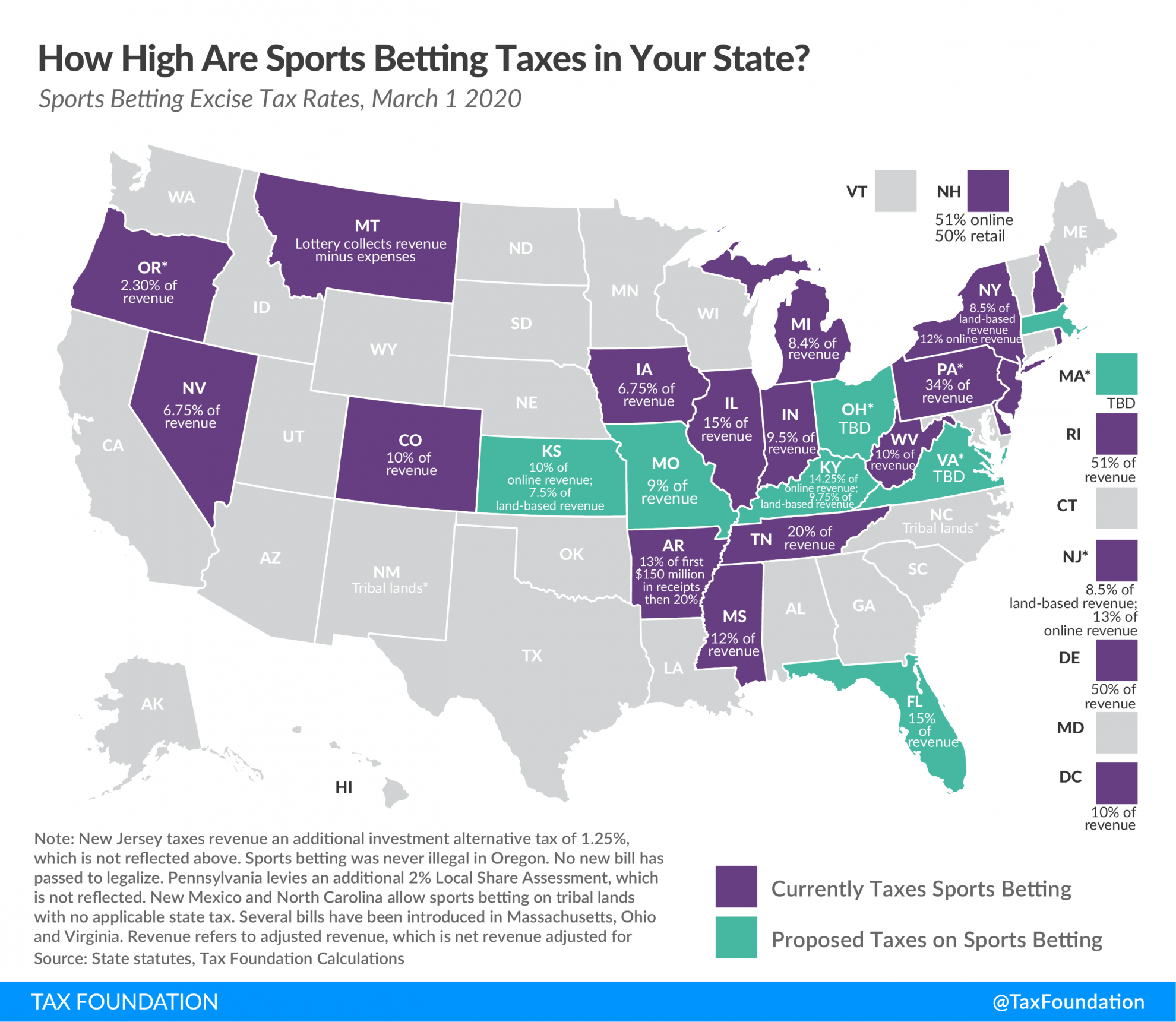

When it comes to taxing sports bets, the rules can vary depending on where you reside. In the United States, for example, any winnings from sports betting are considered taxable income. This means that if you hit a big win on your favorite team, you'll likely need to report those earnings when tax season rolls around. The tax rate on gambling winnings can also vary depending on your total annual income.

In some countries, however, sports betting winnings might be tax-free for the average bettor. This is not a universal rule, and it's essential to check your local regulations to determine whether you need to report your winnings to the tax authorities.

Understanding the regulations

It's crucial for sports bettors to be aware of the tax laws in their area to prevent any potential legal issues down the line. Ignoring the tax implications of your sports bets could lead to penalties and fines, so it's always best to stay informed and compliant.

Data on sports betting taxes in select countries

| Country | Tax on Sports Betting Winnings |

|---|---|

| United States | Varies; generally taxed as regular income |

| United Kingdom | No tax on sports betting winnings for the average bettor |

| Australia | No tax on sports betting winnings for the average bettor |

Conclusion

While the topic of sports betting taxes can be complex and varies from country to country, it's crucial for bettors to understand the regulations in their area. By staying informed and proactive about reporting your winnings, you can enjoy the thrill of sports betting without any tax-related worries.

Did You Bet on the Super Bowl? Don’t Forget About Taxes

Does DraftKings report all winnings to IRS? If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC.

Do sportsbooks report winnings to IRS? Do sportsbooks and casinos report gambling winnings to the IRS? If you win at a sportsbook or casino, they are legally obligated to report your winnings to the IRS and to you if you win up to a certain amount ($600 on sports, $1,200 on slots, and $5,000 on poker).

Bet on the big game? Here's what you need to know about paying taxes on sports bets

The same is true of up-front money that you stake. Guidances issued by the IRS state that you can deduct up-front stakes on Schedule A, which is not available to people who take the standard deduction. Money that you do not stake up front, but merely wager as a potential loss, is not deductible unless you lose. There is a lack of clarity on the issue of whether up-front stakes reduce your taxable winnings by the amount that you initially wagered.

This ambiguity only applies to wagers with up-front stakes. It goes poorly and you lose your bet. There are two possible outcomes:. While a W-2G or a Form from your payer should indicate taxable income, be sure to check with a tax professional if you are unsure how to proceed. Like all forms of gambling winnings, money you get from sports betting counts as income.

You must pay federal income taxes on all winnings regardless of amount and may owe state taxes as well. The rules of state taxes are highly jurisdiction-specific, however, so be sure to research the specific laws of your own state. Helpful Guides Tax Guide.

What Is Conservatorship. Family Trusts CFA vs. Financial Advisors Financial Advisor Cost. Helpful Guides Investing Guide. Compare Accounts Brokerage Accounts. Learn More What is a Fiduciary. Are sports bets taxed Types of Investments Tax Free Investments. Helpful Guides Credit Cards Guide.

Compare Quotes Life Insurance Quotes. Helpful Guides Life Insurance Guide. Calculators Refinance Calculator. Compare Rates Compare Refinance Rates. Helpful Guides Refinance Guide. Gambling losses can be deducted up to the amount of gambling winnings. Whereas your winnings are reported by the payer on a Form W2-G, your losses may not be reported.

You will have to produce other documentation to validate the deduction. This can include:. It may also be possible to establish your losses by keeping some type of detailed log.  This log should include information such as the:. No matter what moves you made last year, TurboTax will make them count on your taxes. More from TurboTaxBlogTeam. Hi Bob, Unfortunately you can only deduct losses up to your winnings and you have to be able to itemize your tax deductions.

This log should include information such as the:. No matter what moves you made last year, TurboTax will make them count on your taxes. More from TurboTaxBlogTeam. Hi Bob, Unfortunately you can only deduct losses up to your winnings and you have to be able to itemize your tax deductions.

Table of Contents What types of gambling winnings are considered taxable income. How are gambling winnings taxed. Do sportsbooks and casinos report gambling winnings to the IRS. Are gambling winnings taxed on both the federal and state level. How to report your gambling winnings on your taxes Are the rules different for professional gamblers. Can you deduct gambling losses?

If you are one of the millions who placed a bet this year, you need to know that the IRS considers sports betting to be gambling. And income from gambling winnings is taxable. The IRS expects you to report your winnings on your federal income tax return. Gambling losses are generally deductible on your federal income tax return, but only to the extent of your winnings and if you itemize deductions.

In any case, keep good records. If you itemize, you should be able to show the IRS the amounts of your gambling winnings, your losses, dates, places, and payers associated with that gambling. Remember that, like the federal government, most states tax income including gambling winnings , although some states don't allow deductions for gambling losses.

If you're unsure how to report gambling winnings and losses from the state you reside in, or from a different state, check with a tax professional when it's time to file your taxes. As the senior tax editor at Kiplinger. Taylor simplifies federal and state tax information, news, and developments to help empower readers.

Kelley has over two decades of experience advising on and covering education, law, finance, and tax as a corporate attorney and business journalist. Here's what you need to know. By Joey Solitro Published 17 April EV Credits Claiming federal electric vehicle tax credits at the point of sale is a new and popular option in

Popular Pages

- Why is sports betting bad

- Where is sports betting legal in the world

- Where to bet on sports in nyc

- How to use a vpn to bet on sports

- Can you be prosecuted for sports betting

- What sports betting apps give you free money

- Can nba players sports bet

- Can you get rich off sports betting

- Is sport betting legal in illinois

- What atlantic city casinos have sports betting