Are you taxed on sports betting

Your sports are you taxed on sports betting winnings are considered taxable income—specifically they are deemed ordinary income on your return. If you've won money placing bets, the. According to the IRS, winnings from sports betting—or any form of gambling, including horse racing and lotteries—must be listed as “other income. Sports betting winnings are taxable income, which means they are taxed like other ordinary income on your tax return. The tax rate that you pay. Gambling winnings, per the IRS, “are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited.

Are You Taxed on Sports Betting?

When it comes to the thrilling world of sports betting, it’s not just about placing your bets and hoping for a win. One crucial aspect that often gets sidelined is the matter of taxation. The question that arises for many enthusiasts is whether they are required to pay taxes on their sports betting winnings.

As a sports bettor, it’s essential to be aware of the tax implications that come with your betting activities. Winning money from sports betting can indeed be incredibly exciting, but it's crucial to understand the financial responsibilities that accompany those wins.

So, are you taxed on sports betting winnings? Yes, in most cases, the answer is a resounding yes. The taxation of sports betting winnings can vary based on several factors, including your location and the laws governing gambling activities in your country.

For example, in some countries, any gambling winnings, including those from sports betting, are considered taxable income. The specific tax rate and threshold may differ depending on where you reside. It’s recommended to consult with a tax professional or financial advisor to get a clear understanding of your tax obligations related to sports betting winnings.

Furthermore, it’s crucial to keep accurate records of your betting activities, including both winnings and losses. This documentation will be invaluable when it comes time to report your earnings to the tax authorities. Failing to report your sports betting winnings could result in penalties or legal consequences.

Understanding the tax implications of sports betting is an essential part of being a responsible bettor. By staying informed about your tax obligations, you can enjoy the excitement of sports betting while also ensuring that you are compliant with the law.

Gambling Winnings Taxes: An Intro Guide

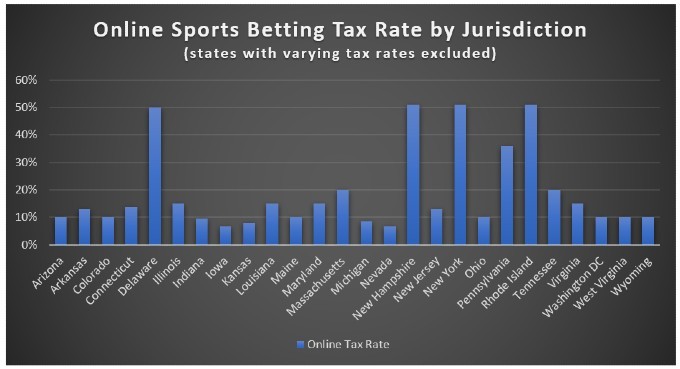

Is sports betting taxed as income? Sports betting winnings are taxable income, which means they are taxed like other ordinary income on your tax return. The tax rate that you pay on your sports betting winnings may vary from 0% to 37% depending on the amount of other income that you have, your filing status, and several other factors on your tax return.

The Taxation of Online Sports Betting in North Carolina

In addition, depending on where you live and where you gambled, you may also owe state and local taxes. Check your state's guidelines to find out. If you had any gambling wins in , you should report the full winnings on your tax return in , claiming it as "gambling income" on line 8 of Form , Schedule 1.

Itemized deductions can be reported on Schedule A of Form The tax-filing season kicked off on Jan. TurboTax offers step-by-step guidance for filers and can access prior returns to get you started, even if they were filed with a different service. If you're going to write off your gambling losses, you should opt for TurboTax Deluxe — the basic edition is only available for simple returns with standard deductions.

TurboTax Free Edition. Click here for TurboTax offer details and disclosures. Terms apply. Users can also upload previous returns from other providers and they'll get an estimate of their tax refund in real time. Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox.

Sign up here. Any winnings from a sports bet must be reported as income on your tax return. You can deduct gambling losses, but only if you itemize your deductions and they don't add up to more than your winnings. At CNBC Select , our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every tax article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of tax products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Skip Navigation. Credit Cards. Are you taxed on sports betting Follow Select. Our top picks of timely offers from our partners More details. UFB Secure Savings. Accredited Debt Relief. LendingClub High-Yield Savings. Choice Home Warranty. Freedom Debt Relief. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links.

Still need to file. Get started.  When comparing taxable vs. If you win money from lotteries, raffles, horse races, or casinos — that money is subject to income tax. When you win, the entity paying you will issue you a Form W2-G, Certain Gambling Winnings, if the win is large enough. You then must report all gambling winnings on your tax return.

When comparing taxable vs. If you win money from lotteries, raffles, horse races, or casinos — that money is subject to income tax. When you win, the entity paying you will issue you a Form W2-G, Certain Gambling Winnings, if the win is large enough. You then must report all gambling winnings on your tax return.

When you win, your winnings are treated as taxable income. Even non cash winnings like prizes are to be included on your tax return at their fair market value. If you win, understanding when each type of gambling category is required to issue to report your winnings is important for you when gathering your tax documents accurately and with confidence.

However, you still must report your winnings on your IRS tax return even if the winnings did not result in a tax form, so keep accurate records of all your buy-ins and winnings at casinos. Keep accurate records of your wager or buy-in amounts, as this can be used to offset your reported winnings. The tax rate on gambling winnings will typically vary from state to state.

The majority of states have income taxes, which means that gambling winnings are likely subject to both federal and state taxation. The rules and rates of your gambling wins and taxes can vary significantly depending on your state. Some states take your gambling winnings tax at a flat rate, while other states tie it to your overall income tax rate.

Form W-2G details your gambling winnings and any taxes withheld. Even if your gambling winnings are not substantial and you were not issued Form W-2G, you are still required to report your winnings as part of your total income. Whether you won the lottery or a sweepstakes or simply enjoyed a bit of friendly competition, keeping track and reporting your gambling income is important to stay on the right side of tax regulations.

If you engage in gambling activities as a means of livelihood and pursue it regularly as a professional gambler, then some rules can vary. However, deductions from losses that exceed the income of your winnings are still not allowed. While casual gamblers only need to report their winnings as part of their overall income on their tax forms, professional gamblers may file a Schedule C as self-employed individuals.

They may be able to deduct their gambling-related expenses, such as travel or casino entry fees, to determine their net income. In regards to losses, deductions for gambling losses must be less than or equal to gambling winnings.

Popular Pages

- How does sports betting work soccer

- Is sports betting legal in thailand

- Is bovada good for sports betting

- How often does the favorite win in sports betting

- When will sports betting be legal

- Does pokerstars have sports betting

- How to make 100k sports betting

- Is online sports betting legal in illinois

- When was sports betting legalized in nj

- Can you bet on sports in connecticut