How is sports betting taxes

Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings. Yes. I explained that gambling wins and losses are not like taxable investments (you can deduct up to $3, in those net losses from income or. Generally, if you win more how is sports betting taxes $5, on a wager, and the payout is at least times the amount of your bet, the IRS requires the payer to withhold 24% of. For most other forms of gambling, the government typically taxes a gambling operator's revenue. That is, the state taxes what the operators collected after they.

Sports Betting Taxes: The Financial Side of the Game

As the world of sports betting continues to grow and evolve, one aspect that often lurks in the shadows is the taxation that accompanies these wagers. While the thrill of predicting outcomes and supporting favorite teams drives the industry, understanding the financial obligations is crucial for both bettors and authorities.

When it comes to sports betting taxes, the rules can vary widely depending on the location. In some regions, bettors are taxed on their winnings, while in others, the responsibility falls on the operators themselves. These taxes can significantly impact the overall profitability and sustainability of the sports betting market.

For bettors, being aware of the tax implications of their wins is essential to properly manage their finances and avoid any surprises come tax season. On the other hand, operators must navigate a complex web of regulations and tax laws to ensure compliance while staying competitive in the market.

In the United States, for example, the taxation of sports betting has been a hot topic since the legalization of the activity in various states. Different states have implemented varying tax rates on gross gaming revenue, with some demanding as much as 30% of profits. This significant tax burden can impact the odds offered to bettors and, consequently, the overall experience of the sports betting community.

Looking at a broader view, let's delve into a hypothetical comparison of sports betting tax rates in different states:

| State | Tax Rate on Gross Gaming Revenue |

|---|---|

| New Jersey | 9.75% |

| Nevada | 6.75% |

| Pennsylvania | 36% |

It's evident from the data above that the tax rates can vary significantly, impacting the profitability of sportsbooks and potentially influencing the odds and payouts for bettors.

Ultimately, the world of sports betting taxes is a complex and ever-changing landscape that both bettors and operators must navigate with caution. Understanding the financial implications of these taxes is key to maintaining a healthy and sustainable sports betting environment for all stakeholders involved.

As the sports betting industry continues to evolve, so too will the regulations and taxation policies governing it. Stay informed, bet responsibly, and remember that while the thrill of the game is exciting, being aware of the financial aspects is equally important.

Sports Betting is Here – What’s the Tax Impact?

How are gambling winnings taxed in Illinois? Illinois is one of nine states that have a flat tax rate for income earners for 2022. In other words, every resident, regardless of income, will pay the same tax rate5. The Illinois tax rate on gambling winnings is a flat rate of 4.95%. This is consistent with the Individual Income Tax rate of 4.95% in Illinois6.

How much tax do you pay on a $1000 lottery ticket in Illinois? 4.95% In Illinois, lottery winnings are subject to a tax rate of 4.95%.

Do casinos track your winnings? Your activity can be tracked, including your winnings and losses. Online sites do everything they can to keep their players safe online, but it's also incumbent on online users to ensure they're using secure networks and different passwords. So, the answer to “Do casinos track your winnings?” is yes.

Topic no. 419, Gambling income and losses

Entry fees and winnings are based on the calendar year in which the contest or sporting event ends and the wager is settled. Absolutely so. It does not matter whether the winnings are in the form of cash, property, or an annuity. You can choose to voluntarily withhold income taxes from your winnings on a Form W2G even if not above the threshold, and the payer will usually inquire whether you would like to do so before issuing you the form.

However, the choice is up to you. If you are a high-income taxpayer, the tax impact of your winnings can easily exceed the withholdings. It is a common but debunked myth that everyone can deduct their gambling losses when computing their taxable incomes. However, this belief can create an unfavorable surprise the next tax return you file.

Unless you are a professional gambler and can show the income and losses on your Schedule C, you must itemize your deductions in order to deduct your losses against your winnings. Alternatively, if you claim the standard deduction on your return, your gambling losses would not be deducted at all.

In order to itemize your deductions in , for example, your total amount of itemized deductions real estate taxes, mortgage interest, charitable contributions, etc. If it is not, you could lose out twice, first for losing your bets at the casino or online, and a second time for not being able to deduct your losses against any large winnings that are includable in taxable income.

If you do not itemize deductions and use the standard deduction, the IRS and state agencies treat your losses as a personal expense; you might as well say it was spent on a movie ticket on a Sunday afternoon. The amount of itemized deduction for gambling losses is allowed only up to the amount of gambling winnings reported as income on your individual income tax return.

In other words, no net losses may be reported. Both online sports betting apps and in-person betting operators are getting better at substantiating gambling losses. While most sportsbooks and casinos offer the ability to keep track of your winnings and losses, it is always prudent to keep good records personally.

If there is no record of the losses you sustained, the IRS will disallow those itemized deductions. Las Vegas and Miami are hot spots for fun, sun, and gambling. Florida and Nevada also do not have an individual state income tax. Most states charge excise taxes on the gross gaming revenue, but those taxes are remitted to the state by the casino or sportsbook operators.

Refer to Publication , U. How is sports betting taxes Tax Guide for Aliens and Publication , U. Tax Treaties for more information. Generally, nonresident aliens of the United States who aren't residents of Canada can't deduct gambling losses. See As a nonresident alien, are my gambling winnings exempt from federal income tax?

For additional information on withholding on gambling winnings, refer to Publication , Withholding of Tax on Nonresident Aliens and Foreign Entities. To deduct your losses, you must keep an accurate diary or similar record of your gambling winnings and losses and be able to provide receipts, tickets, statements, or other records that show the amount of both your winnings and losses.

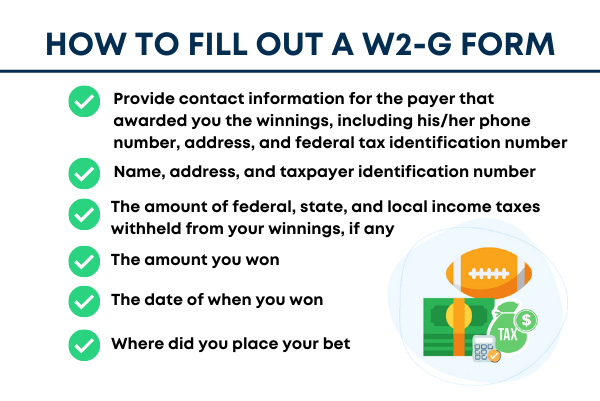

Refer to Publication , Miscellaneous Deductions for more information. Home Help Tax Topics Topic no. More In Help. Gambling winnings A payer is required to issue you a Form W-2G, Certain Gambling Winnings if you receive certain gambling winnings or have any gambling winnings subject to federal income tax withholding. Gambling losses You may deduct gambling losses only if you itemize your deductions on Schedule A Form and kept a record of your winnings and losses.

Recordkeeping To deduct your losses, you must keep an accurate diary or similar record of your gambling winnings and losses and be able to provide receipts, tickets, statements, or other records that show the amount of both your winnings and losses.

Popular Pages

- How can you bet on sports online

- Why cant i cash out sports bet

- When can you sports bet in florida

- Where can you sports bet in florida

- Are sports betting apps legal in california

- Is sports betting legal in ar

- How to become rich through sports betting

- What does otb mean in sports betting

- What is the answer saying in the sports bet ad

- How to beat the bookies sports betting