How much does sport betting withhold for taxes

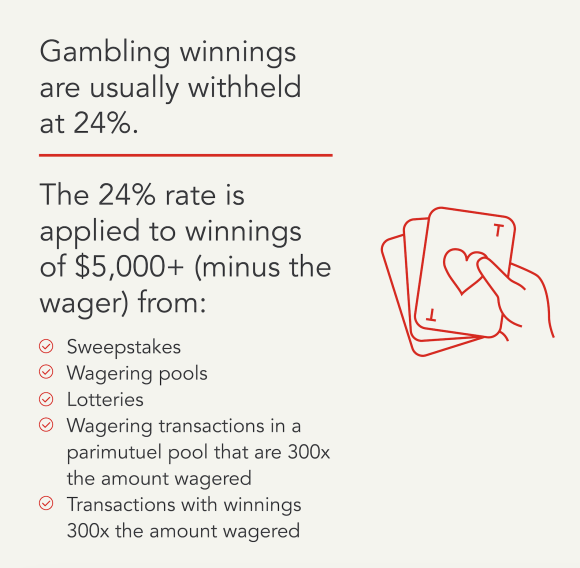

Go Online to westcoasteaglesfans.com.au This publication provides general information and is not meant to be a substitute for tax laws or regulations. Withholding. Gambling. Lotteries – 24% withholding on winnings greater than $5, · Sweepstakes – 24% withholding on winnings greater than $5, · Wagering Pools – 24% withholding on. Gambling winnings are fully taxable and you must report the income on your how much does sport betting withhold for taxes return. Gambling income includes but isn't limited to winnings. However, many online gamers may not be aware of the tax implications of their winnings. According to the Income Tax Act, any game winnings are.

The Impact of Taxes on Sports Betting Winnings

When it comes to sports betting, the thrill of placing a wager and winning can be exhilarating. However, what many bettors may not consider is the impact of taxes on those winnings. Understanding how much of your sports betting earnings are withheld for taxes is crucial for managing your finances effectively.

Tax withholdings on sports betting

Depending on where you live and the amount you win, a portion of your sports betting winnings may be subject to taxes. In the United States, for example, the IRS requires individuals to report all gambling winnings on their tax returns, including those from sports betting.

How much is withheld?

The amount withheld for taxes on sports betting winnings varies depending on the country and region. In the United States, if your sports betting winnings exceed a certain threshold, typically $600, the sportsbook may be required to withhold 24% of your winnings for federal taxes. This withholding is done at the time of payout.

Managing tax implications

It is important for sports bettors to keep accurate records of their winnings and losses to ensure they are properly reporting and paying taxes on their earnings. Consulting with a tax professional can help navigate the complexities of tax laws related to sports betting.

Conclusion

While the excitement of winning a sports bet is undeniable, bettors must be aware of the tax implications that come with those winnings. By understanding how much is withheld for taxes and staying informed about tax laws, bettors can manage their finances responsibly and avoid any potential issues with the tax authorities.

Taxes on Gambling Winnings and Losses: 8 Tips to Remember

Does DraftKings withhold taxes? Winnings that meet certain state or federal thresholds must be reported by DraftKings to the IRS for tax purposes. There may be tax withheld from your winnings, depending on how much you've won, and what game you were playing.

Does Fanduel withhold taxes? Yes, your winnings from Fanduel and other fantasy sports platforms, such as Draft Kings are taxable. Fanduel will issue a W-2G or 1099 for your winnings. Once your winnings reach $5,000 they will withhold 25% for you for federal tax purposes. Fanduel is not the only gambling platform whose winnings are taxable income.

Should I have taxes withheld from gambling winnings? If you didn't give the payer your tax ID number, the withholding rate is also 24%. Withholding is required when the winnings, minus the bet, are: More than $5,000 from sweepstakes, wagering pools, lotteries, At least 300 times the amount of the bet.

Do sportsbooks withhold taxes? If you have winnings of $5,000 or more, the business may withhold up to 24% of the proceeds for federal income tax. If this is the case, it will be shown on Box 4 of your W-2G. To complete your tax return, you'll report your winnings as “gambling income” on Form 1040, Schedule 1.

How are Fanduel winnings taxed? There are two withholdings, regular and backup. If the wins are subject to regular withholding, they will not be subject to backup withholding. If your winnings are $5,000 or greater, the gambling entity can withhold up to 24% for federal taxes, which will be indicated on Box 4 of the W-2G.

What is the tax withholding on sports betting? For federal taxes, there are two types of withholdings on gambling winnings: a regular gambling withholding (24% or 31.58% for certain non cash payments) and back withholding also at 24%. If your winning is already subject to regular gambling with holding you won't also be subject to backup withholding.

Gambling Winnings Taxes: An Intro Guide

If you look carefully at Form W-2G you'll notice that there are boxes for reporting state and local winnings and withholding. That's because you may owe state or local taxes on your gambling winnings, too. The state where you live generally taxes all your income — including gambling winnings.

However, if you travel to another state to place a bet, you might be surprised to learn that the other state wants to tax your winnings, too. And they could withhold the tax from your payout to make sure they get what they're owed. You won't be taxed twice, though. The state where you live should give you a tax credit for the taxes you pay to the other state.

You may or may not be able to deduct gambling losses on your state tax return. Check with your state tax department for the rules where you live. Rocky Mengle was a Senior Tax Editor for Kiplinger from October to January with more than 20 years of experience covering federal and state tax developments. Rocky holds a law degree from the University of Connecticut and a B. The main indexes temporarily tumbled after Fed Chair Powell said interest rates could stay higher for longer.

By Karee Venema Published 16 April By John M. Goralka Published 16 April Fraud A new report sheds light on how older adult scam victims end up with big tax bills and lost retirement savings. By Kelley R. Taylor Last updated 16 April Tax Filing Tax Day means some people need to mail their federal income tax returns. Taylor Published 15 April By Katelyn Washington Last updated 14 April By Katelyn Washington Last updated 15 April Scams Tax season is a time to look out for email and text message scams.

Taylor Last updated 3 April Property Taxes High property tax bills make the places on this list the most expensive states for homeowners to live in. By Katelyn Washington Last updated 3 April Tax Deductions Do you qualify for the student loan interest deduction this year?

By Katelyn Washington Last updated 29 March By Katelyn Washington Last updated 14 March Kiplinger is part of Future plc, an international media group and leading digital publisher. How much does sport betting withhold for taxes Table of Contents Expand. Table of Contents. How Gambling Winnings Are Taxed. Reporting Gambling Winnings. Taxes for Professional Gamblers.

Tax Requirements for Nonresidents. The Bottom Line. Trending Videos. You'll report your winnings and your tax payments when you file your annual tax return. You may then have to pay more in taxes or you may get a refund, depending on your tax bracket. You can deduct gambling losses up to the amount of winnings that you report so keep good records.

Are Gambling Losses Deductible.  Do States Tax Gambling Winnings. Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Do States Tax Gambling Winnings. Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear.

Investopedia does not include all offers available in the marketplace. Part Of. Related Articles. Partner Links. This can include:. It may also be possible to establish your losses by keeping some type of detailed log. This log should include information such as the:. No matter what moves you made last year, TurboTax will make them count on your taxes.

More from TurboTaxBlogTeam. Hi Bob, Unfortunately you can only deduct losses up to your winnings and you have to be able to itemize your tax deductions. Table of Contents What types of gambling winnings are considered taxable income. How are gambling winnings taxed. Do sportsbooks and casinos report gambling winnings to the IRS?

Are gambling winnings taxed on both the federal and state level. How to report your gambling winnings on your taxes Are the rules different for professional gamblers. Can you deduct gambling losses. Get started now. Best, Lisa Greene-Lewis Reply. Leave a Reply Cancel reply.

Popular Pages

- Is sports betting a game of skill or chance

- What does potential payout mean in sports betting

- Will iowa have online sports betting

- How to bet on sports in tennessee

- What is robin sports bet nfl

- What is a push in sports betting

- How does baseball sports betting work

- Is sports betting against the bible

- What is the key to successful sports betting

- What are the safest sports bets