How is sports betting taxes in nj

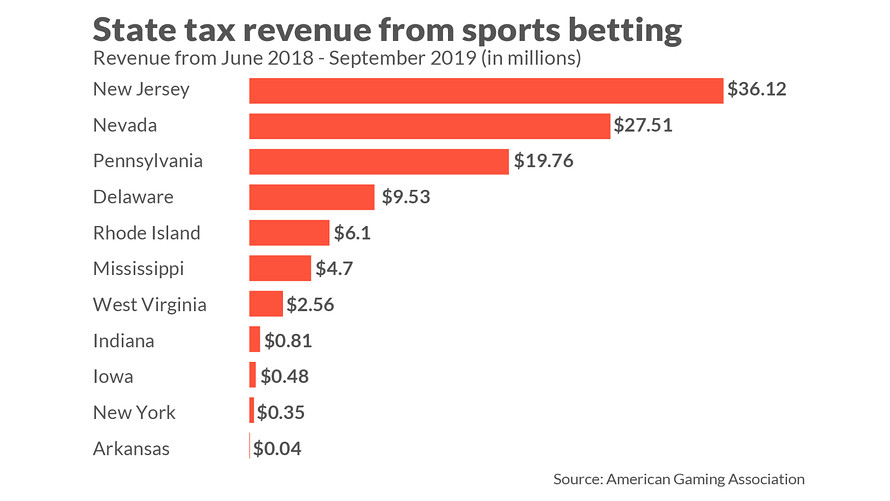

Governing Body: The regulatory oversight of casino gambling and sports how is sports betting taxes in nj in the state is conducted Tax Allocation: Taxes from gaming in New Jersey. John McKeon's Bill S suggests raising the New Jersey tax rate on online sports betting and gaming to 30%. A tax on retail sports betting revenue at % and gain from mobile and online gambling taxed at % amounts to a lot of tax dollars. Online. According to the IRS, gambling winnings in any state, including New Jersey, “are fully taxable and you must report the income on your tax return.

The Exciting World of Sports Betting Taxes in New Jersey

Greetings, dear readers! Today, we delve deep into the thrilling realm of sports betting taxes in New Jersey. This state has been a pioneer in legalizing sports betting, making it a hotspot for enthusiasts and punters alike. But what about the taxes involved in this exciting pastime?

Understanding the Taxation Landscape

New Jersey, known for its vibrant sports culture, has a tax rate of X% on sports betting revenue. This rate is considered relatively competitive compared to other states with legalized sports betting. The taxes collected from sports betting activities have contributed significantly to the state's revenue stream.

Impact on Sports Betting Operators

The tax structure in New Jersey has both positive and challenging aspects for sports betting operators. On one hand, the tax rate is favorable, allowing businesses to thrive in a flourishing market. On the other hand, the tax obligations require careful consideration and financial planning to ensure profitability amidst competition.

| Year | Total Betting Revenue | Tax Collected |

|---|---|---|

| 2020 | $XXX million | $YY million |

| 2021 | $ZZZ million | $PPP million |

The Future Outlook

As the sports betting industry continues to evolve in New Jersey, the taxation framework is likely to undergo adjustments to cater to the changing landscape. It is essential for stakeholders to stay informed about tax policies and regulations to adapt and thrive in this dynamic environment.

With adrenaline-pumping sports moments and tax implications to consider, the world of sports betting in New Jersey is a captivating arena for both fans and industry players alike.

New Jersey Sports Betting Revenue, Handle and Taxes

Do I pay back taxes for money won gambling? Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos. It includes cash winnings and the fair market value of prizes, such as cars and trips.

Withholding Tax on Gambling Winnings: Yes. Gambling winnings are treated as taxable income in New Jersey and withheld at a rate of 3 percent of the payout. Self-exclusion: New Jersey allows players to self-exclude themselves from casino gaming activities and/or Internet gaming activities.Do you have to pay taxes on gambling winnings in NJ? The New Jersey gambling winnings tax for casinos is just the standard 24% federal tax + the 3% income tax. You'll receive a W-2G form for wins of over $1,200 on slots and over $5,000 on poker tournaments (minus the buy-in costs).

How much is online gaming taxed in New Jersey? Pennsylvania allows up to 13 online vendors at a tax rate of 36% gross gaming revenue. New Jersey allows up to 39 with a tax rate of 14.25%.

Can you write off gambling losses in NJ? You may use your gambling losses to offset gambling winnings from the same year as long as they do not exceed your total winnings. If your losses were greater than your winnings, you cannot report the negative figure on your New Jersey tax return. You must claim zero income for net gambling winnings.

What percentage of taxes do you pay on sports betting? Sports betting winnings are taxable income, which means they are taxed like other ordinary income on your tax return. The tax rate that you pay on your sports betting winnings may vary from 0% to 37% depending on the amount of other income that you have, your filing status, and several other factors on your tax return.

How much is NJ gambling tax? 3 percent

How are taxes calculated on sports betting? If you've won money placing bets, the tax rate can be anywhere from 10% to 37% based on your income tax bracket. If you've lost money, you won't owe any taxes, but you may be able to deduct your losses if you itemize your deductions on your return. Take note: You can't deduct more than your winnings.

Your Guide to Paying Taxes on Your Casino Winnings

Local and state governments consider sports betting and gambling one and the same which means — yes, you must pay taxes on winnings earned from sportsbooks. You would include these gambling winnings on the same federal and New Jersey state tax forms based on your residency status. The tax withholding rates for states can vary by location and game.

For taxes on lottery winnings, the state has tax brackets based on the total prize amount. We know that money won by gambling is taxable income, but the IRS also taxes non-cash prizes won while gambling at their fair market value. Follow these steps for paying taxes on your gambling winnings and understanding the gambling income tax requirements.

The casino may hold winnings of a certain amount until you are able to provide this information. They add information like your full name, address, SSN, and other information to a W-9 that they keep on file to accurately withhold federal and state if applicable taxes and issue you tax forms that you will use to file your taxes for the year. You have to keep a record of that amount, on what casino game you played, and what the odds were if applicable.

You should also keep an eye on your digital records through your casino loyalty account for brick-and-mortar casinos or online casino accounts, too. Both online casinos and land-based casinos provide you with a tax form at the end of the year that outlines how much money you won at their establishment. Every payer casino, sportsbook , or other gaming facility is required to issue a W-2G so you can easily fill out your and report your winnings.

Cash poker games and other table games like craps, roulette , and blackjack never trigger a casino to issue you a W-2G. That means you must keep really good track of all your wins and losses for playing these games. These records may include:. If you are 65 years or older, you would list this income on the SR — Schedule 1.

If you won while visiting the U. E-file tax software, like TaxAct or TurboTax, make this part pretty easy. You just need to input your information from your records based on the questions and prompts, and the software will fill out these individual forms for you. If you won at a brick-and-mortar or online casino in New Jersey, you must complete the NJ form based on your residency status in the state.

New Jersey residents must report winnings with an NJ form , while non-residents aka visitors to the state must fill out a NJNR. How is sports betting taxes in nj E-file tax software should also fill out these forms for you based on your answers to the prompts. You can only apply losses against your winnings if you itemize all your deductions, which means keeping an even more detailed record of all your casino losses to make sure you really lost more than that amount and have the records to prove it.

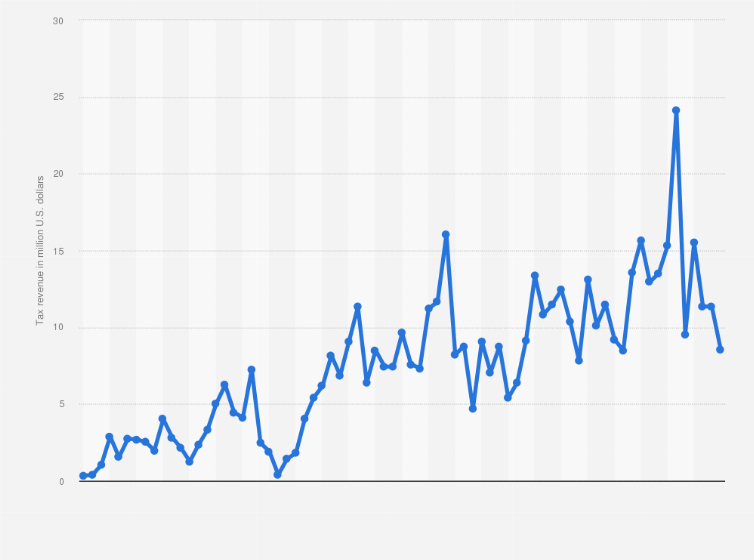

This number can vary based on the odds of a given sporting event and the type of bet. New Jersey sports betting hold started out at 9. After September, the New Jersey sports betting hold started to drop again and held steady between 4. It did not surpass 9. Following that, the New Jersey sports betting hold hovered around 3.

It followed the same trend until just recently when the New Jersey sports betting hold was The New Jersey sporting betting hold was That was the second consecutive month with a double-digit sports betting hold. The average New Jersey sports betting hold for is 8. Sports Betting. State Promos. Legal States.  Top Sportsbooks. Betting Guides. New Jersey Gambling Date Trends.

Top Sportsbooks. Betting Guides. New Jersey Gambling Date Trends.

Popular Pages

- Can you get in trouble for online sports betting

- How to activate sports bet account

- How to use sports bet card

- Why is sports betting bad

- How big is sports betting industry

- How do odds in sports betting work

- Where to place sports bets in tunica ms

- Is sports betting profitable reddit

- How to sports betting companies detect matched bettors

- Is sports betting legal in all states