How much sports bet winning until taxed in pa

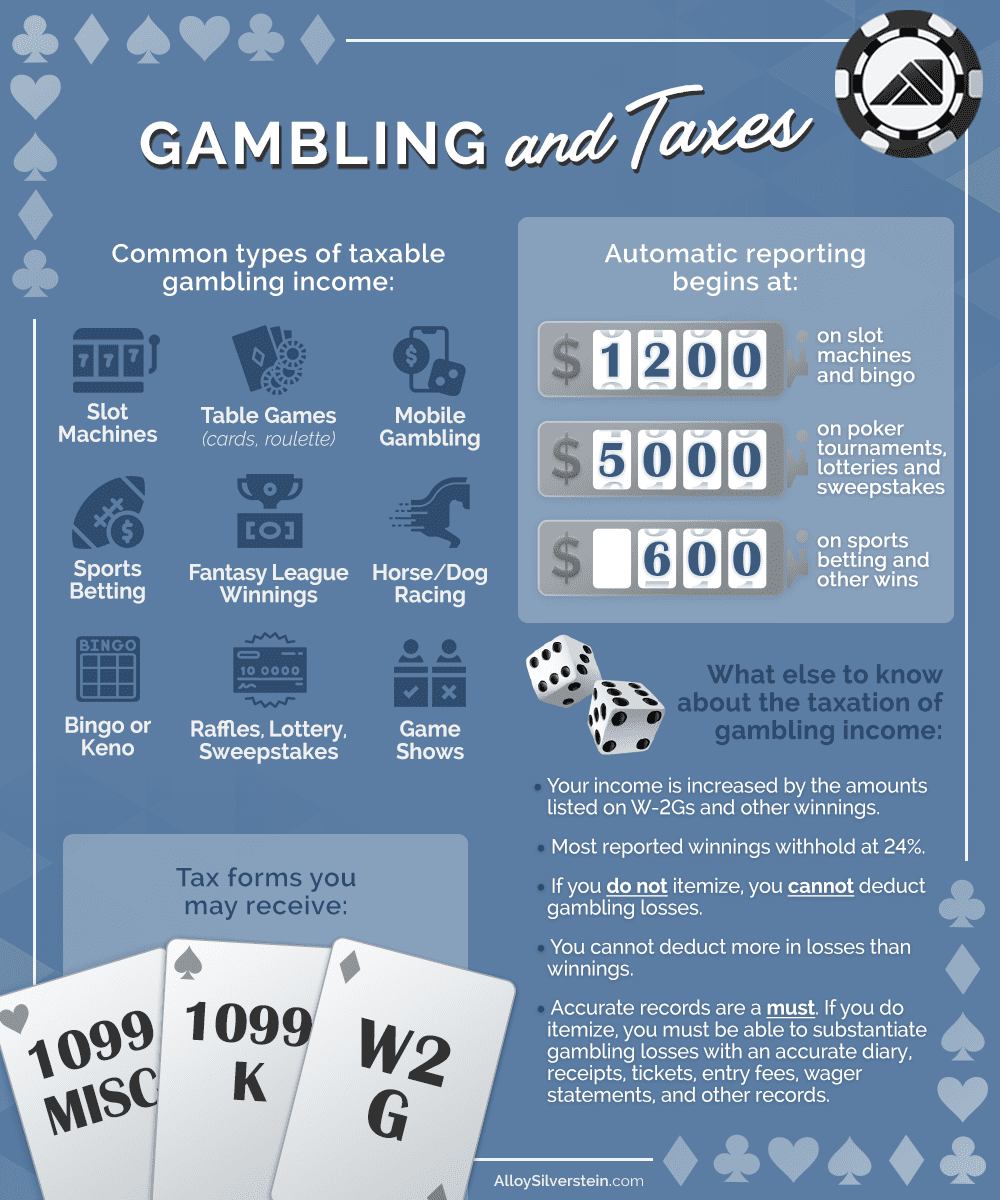

Gambling winnings are typically subject to a flat 24% tax. However, for the activities listed below, only winnings over $5, are subject to income tax. If you've won a substantial amount, the payer – whether it's a casino, racetrack, sports site, or lottery commission – will issue you Form W-2G. The board is tasked with supervising casinos as well how much sports bet winning until taxed in pa slot machines at racetracks, online casino gaming and sports betting. Licensing. COMMERCIAL GAMING. (You cannot deduct more than your winnings.) They'll effectively zero out for Federal tax purposes, but not without collateral cost: you're.

How Much Sports Bet Winning Is Taxed in Pennsylvania?

As the sports betting landscape continues to flourish in Pennsylvania, many enthusiasts are curious about the taxation policies surrounding their winnings. So, let's delve into the details!

When it comes to sports betting winnings in Pennsylvania, it's important to understand that the state imposes certain taxes based on your earnings. In the state of Pennsylvania, sports bet winnings are subject to a 24% tax rate.

This means that any winnings you accrue from sports betting activities will be taxed at a flat rate of 24%, regardless of the amount you win. Whether you're a casual bettor or a high roller, the taxation policy remains consistent across the board.

However, it's crucial to keep in mind that these tax policies may vary depending on the state you reside in or where the sports betting activities take place. Therefore, it's advisable to consult with a tax professional or legal advisor for personalized guidance on how these regulations might apply to your specific situation.

In conclusion, sports bet winnings in Pennsylvania are subject to a 24% tax rate, showcasing the importance of being informed about the financial implications of your betting activities. Remember to always stay updated on any changes in tax laws to ensure compliance and a smooth betting experience!

Gambling Winnings Taxes: An Intro Guide

How much can you win in PA before paying taxes? Casino. You're taxed at the usual 24% + 3.07% rate. You'll receive form W-2G if you win a minimum of $1,200 on slots, or profit $5,000 or more from a poker tournament — buy-in costs are deducted from winnings on poker tournaments for tax purposes.

Do you have to pay taxes on gambling winnings in PA? Gambling winnings are fully taxable by the Commonwealth of Pennsylvania. State residents must pay state income tax on all gambling and lottery winnings from any source, except for non-cash prizes from playing the Pennsylvania State Lottery.

What is the tax on sportsbooks in PA? Yes, Pennsylvania's 3.07 percent personal income tax applies to fantasy sports winnings and should be reported on the PA-40 Personal Income Tax Return. This includes non-cash prizes such as gift...

What type of income is exempt from Pennsylvania taxation as a result of federal tax law? Some types of income are exempt from Pennsylvania state income tax, including child support, alimony, unemployment payments, and some capital gains on the sale of a primary residence. Some deductions are allowed for contributions to educational savings accounts and medical or health savings accounts.

Does PA tax all income? Pennsylvania utilizes a “flat tax” system. This means that every taxpayer in the state, regardless of their level of income, pays the same percentage of their taxable income in state income taxes. That rate is 3.07%.

How much is FanDuel taxed in PA? Yes, Pennsylvania's 3.07 percent personal income tax applies to fantasy sports winnings and should be reported on the PA-40 Personal Income Tax Return.

Some goods are exempt from sales tax under Pennsylvania law. Examples include most non-prepared food items, items purchased with food stamps, prescription drugs, and most (but not all) wearing apparel.Do you pay taxes on Draftkings if you don't withdraw? Yes. Just like any other form of income, gambling winnings are taxable. This applies to all types of gambling, whether you placed your bet in person, on an app, or on your computer. One bright spot: You do have to win money in order to owe taxes on your gambling income.

How much winning is taxable? If you win the lottery, congrats! This income is still taxable, so you will owe taxes on Mega Millions, Powerball, and other lotteries and will take home your winnings after taxes. By default, the IRS will take 24-25% of your winnings and may even withhold some for state taxes if applicable.

What isn't taxed in PA? Tax-exempt goods

How much can you make gambling before you have to pay taxes? Do sportsbooks and casinos report gambling winnings to the IRS? If you win at a sportsbook or casino, they are legally obligated to report your winnings to the IRS and to you if you win up to a certain amount ($600 on sports, $1,200 on slots, and $5,000 on poker).

Over/Under: A Look at Sports Betting and Taxes

Sports Betting. As betting moves to legal U. Alyssa Keown — Imagn Content Services. Link Copied. What to Read. Front Office Sports Today. Featured Today. April 6, April 1, NCAA is still making avoidable mistakes three years after a complete overhaul. March 31, Careers Powered By. Under tax reform, you can only deduct losses directly related to your wagers and not non-wagering expenses like travel-related expenses to gambling sites.

Gambling losses can be deducted up to the amount of gambling winnings. Whereas your winnings are reported by the payer on a Form W2-G, your losses may not be reported. You will have to produce other documentation to validate the deduction. This can include:. It may also be possible to establish your losses by keeping some type of detailed log.

This log should include information such as the:. No matter what moves you made last year, TurboTax will make them count on your taxes. How much sports bet winning until taxed in pa More from TurboTaxBlogTeam. Hi Bob, Unfortunately you can only deduct losses up to your winnings and you have to be able to itemize your tax deductions. Table of Contents What types of gambling winnings are considered taxable income?

How are gambling winnings taxed. Do sportsbooks and casinos report gambling winnings to the IRS. Are gambling winnings taxed on both the federal and state level. How to report your gambling winnings on your taxes Are the rules different for professional gamblers. Gambling losses can only be deducted from federal tax, not state tax. You must enter itemized losses on Form , specifically on Line 28 or Schedule A.

For each loss, you must keep a record of:. Many new online casinos in PA , for example, automatically keep a record of your individual bets and results. However, no overhead costs, such as accommodation or fuel, can be deducted from gambling winnings.

Unlike in other US states, Pennsylvania does not have a special, and often higher, rate of tax for lottery winnings.  Any cash prize won from the State lottery, including the Powerball PA, is subject to a flat state tax of 3. To prove any applicable deductions on gambling taxes, you need to keep proper records of the data and time of each wager and its result and the name and location of each bet.

Any cash prize won from the State lottery, including the Powerball PA, is subject to a flat state tax of 3. To prove any applicable deductions on gambling taxes, you need to keep proper records of the data and time of each wager and its result and the name and location of each bet.

You must also keep copies of any wagering tickets, canceled checks, or bank card records. No, only direct gambling losses or specific participation costs buy-ins or wagers may be used to lower your taxes on gambling. You cannot claim other costs, such as fuel, accommodation, or entertainment. Yes, anyone over 65 years of age must still pay state and federal taxes as explained throughout this guide.

However, instead of filling in Form , senior citizens should use Form SR to benefit from specific deductions. Yes, no matter how much you win, you will be liable to pay at least a minimum amount of state tax. Fortunately, Pennsylvania has one of the lowest income tax rates in the country. Yes, gambling losses are tax deductible as long as they occur in the same year as winnings.

You cannot claim more losses than winnings and you cannot carry any losses forward into the next tax reporting year. Just as is the case for any type of income tax, you might be fined by state or federal authorities. After all, paying a gambling tax is a legal requirement. Moreover, the gambling operator that paid out your prize is legally required to inform the IRS if your prize surpasses a threshold.

Nobody enjoys paying taxes on gambling winnings, but by following these simple steps you might avoid any unnecessary hassle. Yes, a state tax of 3. The Commonwealth of Pennsylvania treats gambling winnings as another form of income.

Popular Pages

- Does bellagio allow sports betting after game started

- What are the basics of sports betting

- What does odds mean in sports betting yahoo answers

- Can you place sports bets online

- Where to place sports bets near me

- What could i do if my online sports betting

- Can i sports bet with aa vpn

- Does stake do sports betting

- How do taxes work on sports betting living in vegas

- Can you make money from sports betting