How to claim sports bet winnings

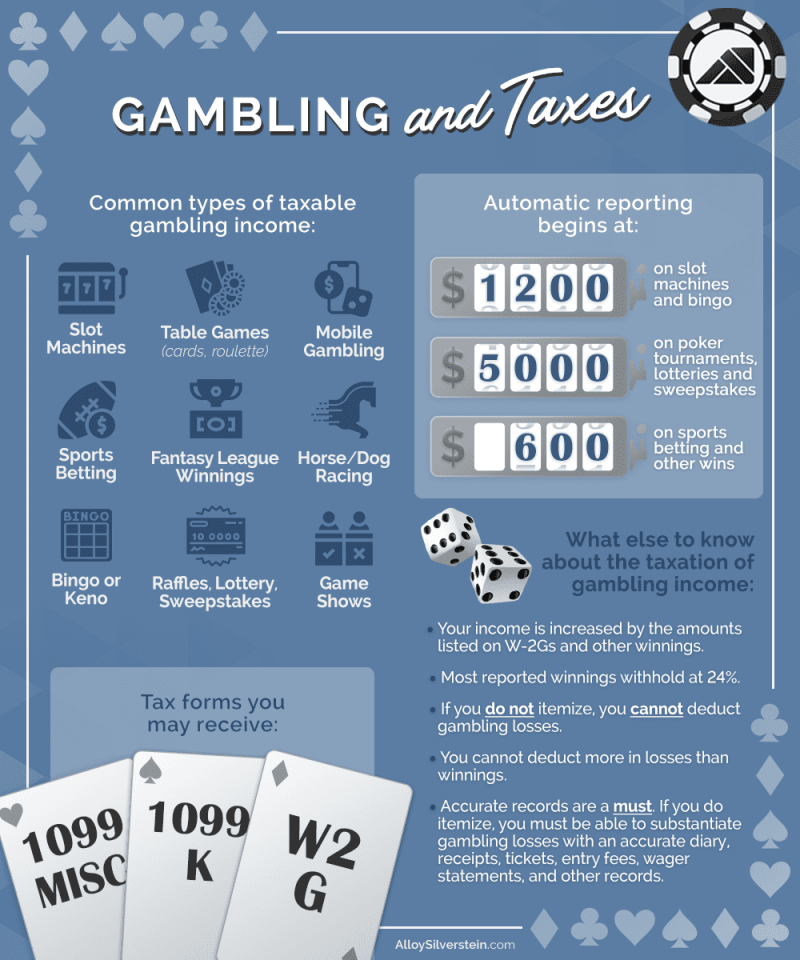

They may be able to deduct their gambling-related expenses, such as travel or casino entry fees, to determine their net income. The proceeds from a successful sports bet are taxable income, just like your paycheck or investment gains. If you've won money placing bets, the tax rate can be anywhere from 10% to 37% based on your income tax bracket. If you've lost money, you won't owe any taxes. You must how to claim sports bet winnings all gambling winnings on Form or Form SR (use Schedule 1 (Form )PDF), including winnings that aren't reported on a.

The Art of Claiming Sports Bet Winnings

For any sports bettor, the thrill of winning a wager is unmatched. However, the process of claiming your hard-earned winnings can sometimes be confusing. Here, we delve into the steps you need to take to ensure you receive your sports betting payout seamlessly.

Verifying Your Bet Slip

Before you anticipate cashing out your winnings, first validate your bet slip. Ensure that all details, such as the amount wagered, odds, and selections, are accurate. Any discrepancies could lead to delays in claiming your prize.

Understanding Payout Options

Once your winning bet is confirmed, familiarize yourself with the payout options offered by the sportsbook. Common modes of payment include cash, bank transfers, e-wallets, or checks. Opt for a method that aligns with your preferences and expedites the receipt of your funds.

Meeting Withdrawal Requirements

Some sportsbooks may impose specific withdrawal conditions, such as minimum withdrawal amounts or wagering turnover requirements. To avoid complications, ensure you comply with these prerequisites before attempting to claim your winnings.

Verifying Your Identity

For security purposes, most reputable sportsbooks necessitate identity verification before releasing funds. Be prepared to provide valid identification documents, such as a driver's license or passport, to facilitate this process swiftly.

| Common Steps in Claiming Sports Bet Winnings |

|---|

| Verify Your Bet Slip |

| Understand Payout Options |

| Meet Withdrawal Requirements |

| Verify Your Identity |

Patience Is Key

While the anticipation to claim your sports bet winnings may be high, remember that processing times vary. Exercise patience and promptly follow up with the sportsbook's customer support if delays persist.

Claiming your sports bet winnings involves meticulous attention to detail and adherence to the sportsbook's procedures. By understanding and fulfilling the necessary requirements, you can savor the sweet taste of victory without any hitches.Topic no. 419, Gambling income and losses

What is the lowest gambling tax in the world? Argentina. Gambling taxes in Argentina are some of the lowest in the world. There is 15% tax on all gambling income, but this only applies to the operator, players are not taxed on their winnings.

Can a foreigner bet in USA? Yes, no problem. As David pointed out, betting shops are full of “foreigners”. Bookies are also not too fussy about where they get their money from.

Who has the highest lottery tax? States With the Highest Powerball Taxes

- Related: Powerball Jackpot Winner Will Get a Hefty Tax Bill.

- New York state tax rate on lottery winnings: 10.90%

- Note: A Powerball ticket costs $2 per play.

- Maryland tax rate on lottery winnings: 8.75%

- Washington, DC tax rate on lottery winnings: 8.5%

What is the win loss statement? What is a Win/Loss Statement? A Win/Loss statement is a report that provides an estimated play (amount of money that is won and loss) for the calendar year based when a Players Club card is properly inserted into the gaming device during play.

Is online gambling real money? At present, real money online casinos are legal in just six U.S. states including Connecticut, Delaware, Michigan, New Jersey, Pennsylvania, and West Virginia.

What happens if you don't report gambling winnings? What happens if you don't report your gambling winnings. By not reporting all your gambling winnings, you're violating the law. The IRS can uncover discrepancies by comparing your income with the W-2G forms they receive or by examining your bank deposit activity.

Gambling Winnings Taxes: An Intro Guide

When you have gambling winnings, you may be required to pay an estimated tax on that additional income. For information on withholding on gambling winnings, refer to Publication , Tax Withholding and Estimated Tax. You may deduct gambling losses only if you itemize your deductions on Schedule A Form and kept a record of your winnings and losses.

The amount of losses you deduct can't be more than the amount of gambling income you reported on your return. Claim your gambling losses up to the amount of winnings, as "Other Itemized Deductions. If you're a nonresident alien of the United States for income tax purposes and you have to file a tax return for U.

Refer to Publication , U. Tax Guide for Aliens and Publication , U. Tax Treaties for more information. Generally, nonresident aliens of the United States who aren't residents of Canada can't deduct gambling losses. See As a nonresident alien, are my gambling winnings exempt from federal income tax. For additional information on withholding on gambling winnings, refer to Publication , Withholding of Tax on Nonresident Aliens and Foreign Entities.

To deduct your losses, you must keep an accurate diary or similar record of your gambling winnings and losses and be able to provide receipts, tickets, statements, or other records that show the amount of both your winnings and losses. There are two types of withholding for winnings from gambling: regular and backup. This is known as regular withholding.

Regular withholding applies to winnings from:. If not, the rate goes up to Backup withholding is made when any of the following occurs:. Depending on your federal income tax rate, the amount of the withholding may not be enough to cover your federal income tax liability. In addition to providing information about federal income tax withholding, the W-2G also contains information about any state and local taxes that were withheld.

That will be helpful when filing taxes in a state where gambling winnings are taxed. How to claim sports bet winnings You cannot report your net winnings—that is, your winnings minus losses—on your tax form. However, you can list your gambling losses as an itemized deduction on Schedule A in order to reduce your tax liability. You may not, however, report losses in excess of your winnings. You cannot deduct other expenses you may have sustained in the process of gambling, such as transportation and hotel charges.

The IRS says: "Gambling winnings are fully taxable and you must report the income on your tax return. Cash and the cash value of any prizes you win must be reported. If you're a "casual" gambler rather than a professional, it is reported as "Other Income" on Form You can deduct losses up to the value of your winnings, but that requires itemizing your taxes and keeping paper records to prove your losses.

You may receive one or more W-2G forms from gambling establishments for taxable winnings, but the forms are required only if a certain amount is won on some but not all games. Generally, the forms are required for winners of games of chance like slot machines but not for winners of games of skill like blackjack.

Note that the casino doesn't know how much you lost at its games. If you plan to deduct your losses, you must keep careful records and itemize your taxes in order to claim the losses. Losses can be claimed up to the amount of your winnings. The W-2G form is the equivalent of a for gambling winnings.  That is, it identifies the taxpayer and the amount won as well as the amount already paid in federal, state, and local taxes on the winnings.

That is, it identifies the taxpayer and the amount won as well as the amount already paid in federal, state, and local taxes on the winnings.

The IRS requires you to claim your gambling winnings on your federal income taxes. When you receive a Form W-2G, it will list your winnings as well as any federal tax withholdings. Internal Revenue Service. Journal of Accountancy. Table of Contents Expand. Table of Contents. What Is Form W-2G. Special Considerations. The Bottom Line.

Personal Finance Taxes. Trending Videos. Winnings from gambling, lotteries, and contests all must be reported as "Other Income" on Form Cash and the cash value of prizes are taxable. State and local taxes may be due on winnings. You can offset your tax liability by deducting your losses but only if you itemize your taxes.

Popular Pages

- Is it best to stick to 1 sport matched betting

- Whats the best online sports betting site

- How to place smart sports bets

- How do you sport bet at horseshoe casino

- Which sport betting is the best in nigeria

- How to turn on quick bet sports bet

- How many sports betting apps are there

- Is sports betting legal in saudi arabia

- How old for sports betting

- Is sports betting legal in michigan