Is there tax on sports betting

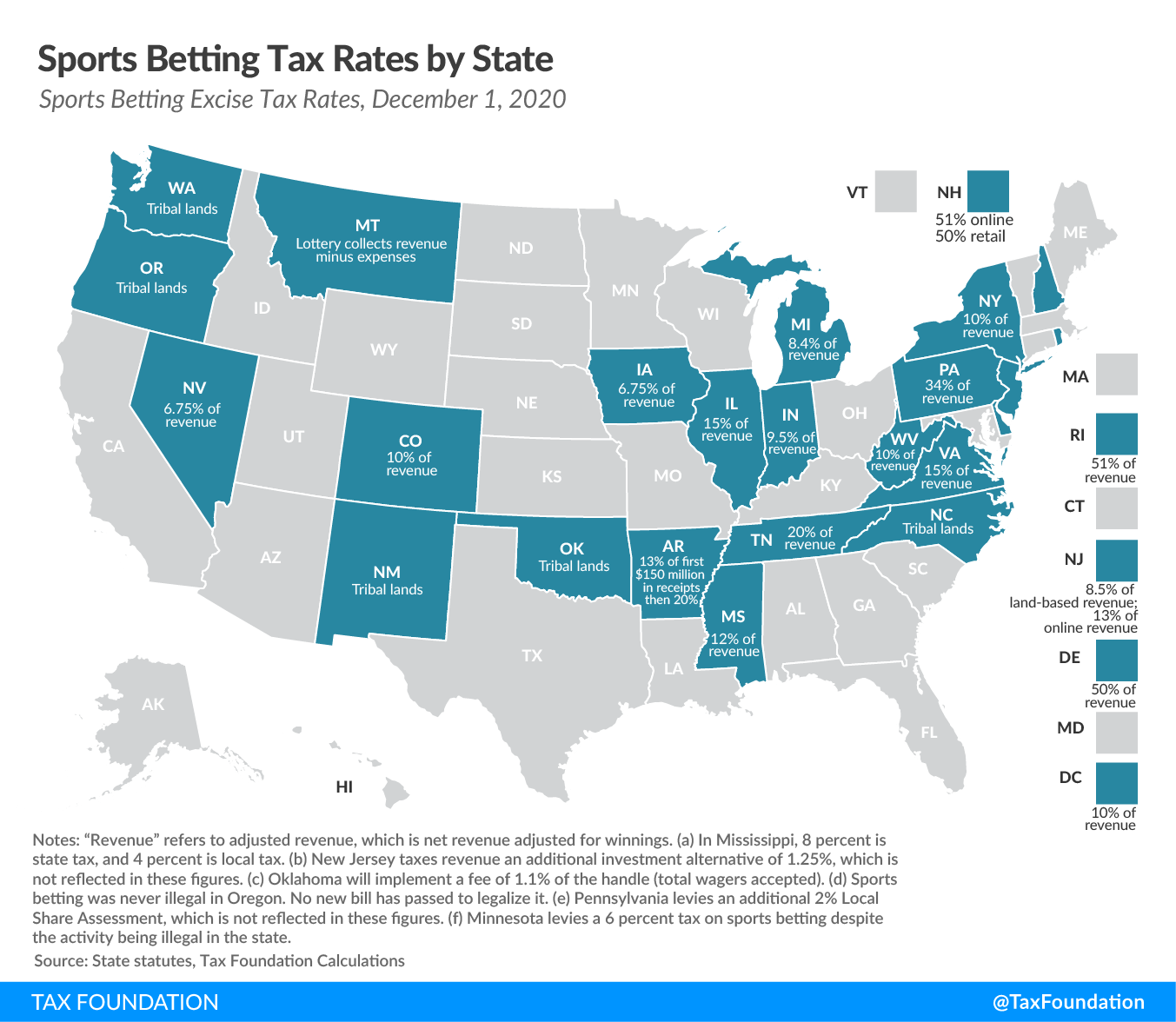

Gambling taxes are common because the American gaming industry is booming. From new casinos to lotteries and online sports betting, there are plenty is there tax on sports betting. That's why Michigan betting operators pay an percent tax on adjusted gross sports betting receipts (“bets minus winnings paid to bettors”). A federal tax hit only comes into play if your gambling winnings reach $ or more. Also, the rate at which you're taxed varies based on how. Fee impacts are not included in the revenue estimate. A tax is imposed on sports betting net revenue equal to 20% on wagers placed online.

The Impact of Taxes on Sports Betting

As sports fans, we are always eager to place bets on our favorite teams and players. However, one aspect that often goes unnoticed is the taxation involved in sports betting. While the thrill of wagering on sports outcomes remains captivating, understanding the tax implications is crucial for all enthusiasts.

Taxation on sports betting varies depending on the country and region. In some places, betting winnings are considered taxable income, while in others, such as the United Kingdom, there are no taxes on gambling winnings. This disparity in taxation policies adds complexity to the betting landscape, impacting both casual bettors and professional gamblers.

Understanding the tax regulations in your jurisdiction is essential to avoid any unexpected liabilities. It is recommended to consult with a financial advisor or tax professional to clarify the rules specific to your location.

For further insight into the taxation on sports betting, take a look at the following hypothetical data table showcasing different tax scenarios in select countries:

| Country | Tax on Betting Winnings |

|---|---|

| United States | Varies by state; potential federal taxes |

| United Kingdom | No taxes on gambling winnings |

| Australia | Taxed at the operator level |

It is important to keep in mind that tax laws can change over time, so staying informed about the latest developments is key to responsibly navigating the world of sports betting.

In conclusion, while the excitement of sports betting remains undiminished, awareness of the tax implications is vital for all participants. By staying informed and seeking professional advice when needed, sports bettors can ensure they comply with relevant tax laws and make the most of their wagering experiences.

Gambling Winnings Taxes: An Intro Guide

How does IRS know about gambling winnings? Generally, if you receive $600 or more in gambling winnings, the payer is required to issue you a Form W-2G.

Do I pay taxes on Draftkings? Yes. Just like any other form of income, gambling winnings are taxable. This applies to all types of gambling, whether you placed your bet in person, on an app, or on your computer. One bright spot: You do have to win money in order to owe taxes on your gambling income.

Does sport betting get taxed? The IRS has clear-cut rules on gambling income that predate the recent explosion of the sports betting industry. In short, the proceeds from a successful sports wager are taxable income, just like your paycheck or capital gains from investment income.

The Taxation of Online Sports Betting in North Carolina

UFB Secure Savings. Accredited Debt Relief. LendingClub High-Yield Savings. Choice Home Warranty. Freedom Debt Relief. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links. This commission may impact how and where certain products appear on this site including, for example, the order in which they appear.

What we'll cover Yes, you owe taxes on sports betting wins Can I deduct losses from sports betting. How much are taxes on sports betting wins. How to report sports betting wins you had in Bottom line. That includes cash winnings and the fair market value of cars, trips and other prizes, too. Learn More. On TurboTax's secure site. Cost Costs may vary depending on the plan selected - click "Learn More" for details.

Available with some pricing and filing options. Read more. Is there tax on sports betting TurboTax's software is easy to use but can be expensive for complicated returns. Here's a breakdown of its offerings. Here's how you can file your taxes for free. This log should include information such as the:.

No matter what moves you made last year, TurboTax will make them count on your taxes. More from TurboTaxBlogTeam. Hi Bob, Unfortunately you can only deduct losses up to your winnings and you have to be able to itemize your tax deductions. Table of Contents What types of gambling winnings are considered taxable income. How are gambling winnings taxed?

Do sportsbooks and casinos report gambling winnings to the IRS. Are gambling winnings taxed on both the federal and state level. How to report your gambling winnings on your taxes Are the rules different for professional gamblers.  Can you deduct gambling losses?

Can you deduct gambling losses?

Get started now. Best, Lisa Greene-Lewis Reply. Leave a Reply Cancel reply. Browse Related Articles. Life Lottery Calculator. Advisors like Withum are here to help sports betting and gambling companies understand and navigate these tax implications. The fast-paced field of technology changes more than just its industry; it changes the world around it.

Tech companies know they need to do more than just manage current trends, […]. As the world of sports evolves, so does the technology used to enhance various aspects of the industry, like sports betting, daily fantasy sports, sports performance, training, management, and the […]. Being in the public eye has its own set of unique challenges.

Whether you are playing on the field, building fitness equipment, or playing competitive Esports, navigating complex tax regulations, […]. The complexity and persistent changes in state and local tax SALT laws and regulations can make it difficult for businesses to meet their objectives. At Withum, our consultants are relentless […].

Alex Rockoff.

Popular Pages

- Which sports books in mississippi have horse race betting

- How to become rich with sport betting

- How does sports betting work football

- Does colorado have sports betting

- Can you bet sports online in mi

- How sports betting upended

- How pro sports betting works

- Does pokerstars have sports betting

- How to bet on sports in memphis

- How to bet just sling sports