Are online sports betting winnings taxable

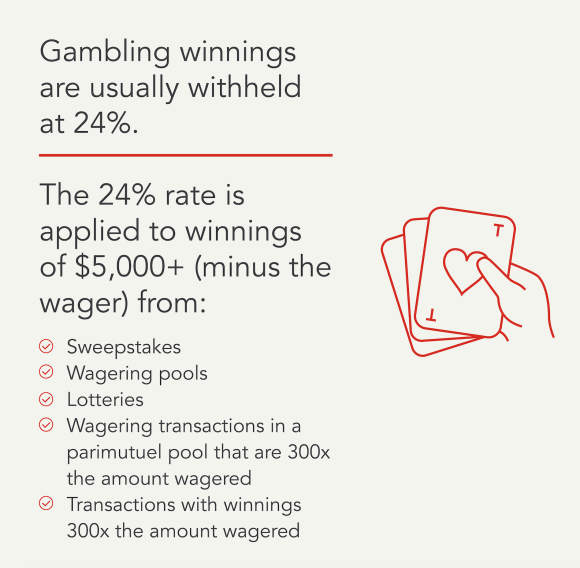

I don't believe winnings are taxable generally, unless you are doing it as a source of income (you are a "professional gambler"). However your. Unless you are a professional gambler, gambling income is included as income on your taxes and it's taxed at a rate of 24%. Casinos should withhold this portion. Gambling winnings are taxable at ordinary income rates, and they're reported on Line 8b of Schedule 1 of the form unless the filer. Are the winnings from sports betting taxed? Yes, and the winnings must be included on your tax return. The Are online sports betting winnings taxable indicates that you must pay taxes on all.

Are Online Sports Betting Winnings Taxable?

As the world of online sports betting continues to grow, one question that often arises is whether winnings from such activities are taxable. The answer to this question is crucial for both seasoned bettors and newcomers alike, as it directly impacts their potential earnings and financial planning.

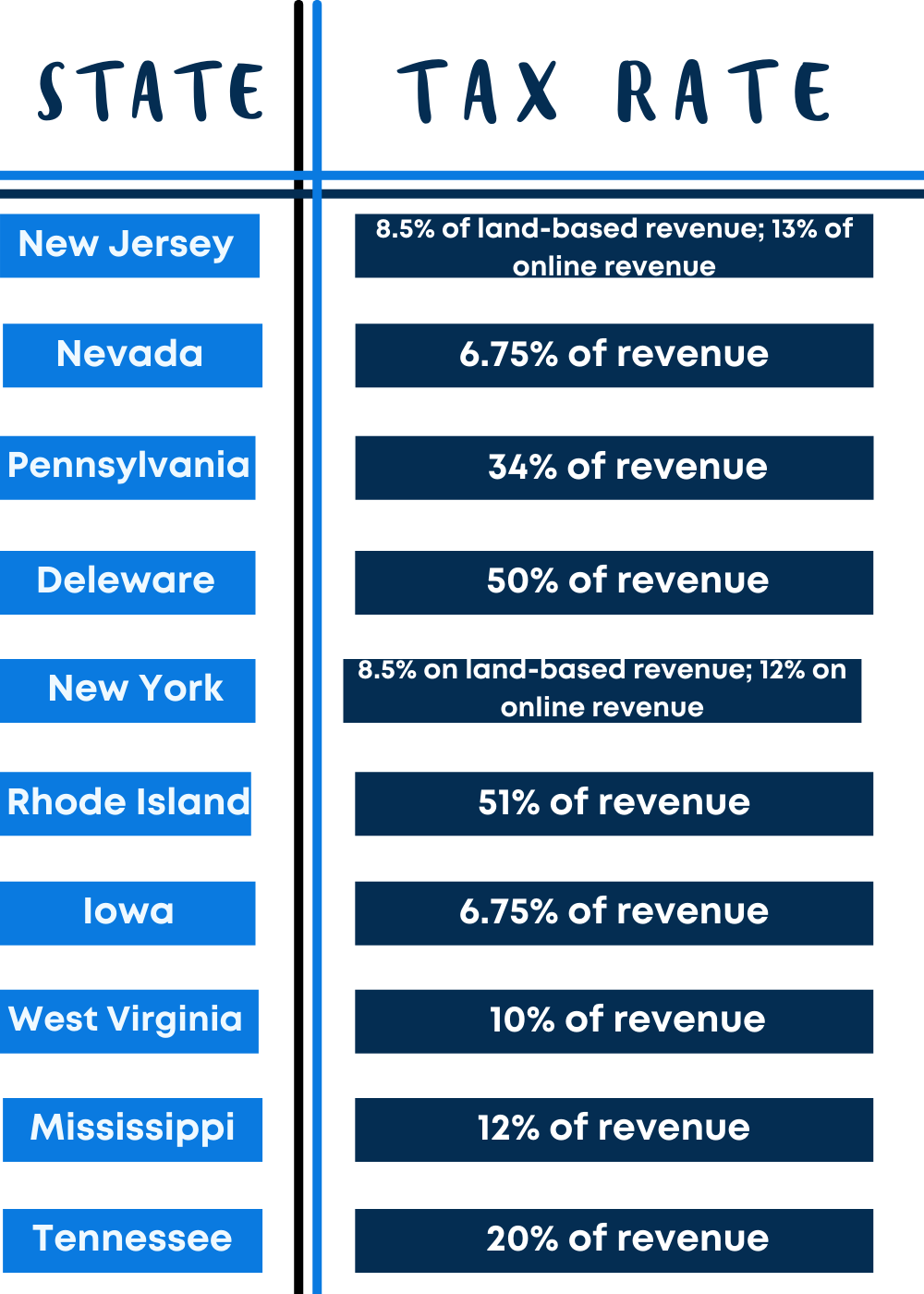

First and foremost, it's important to note that tax laws regarding online sports betting winnings can vary significantly from one jurisdiction to another. In some countries, such as the United States, any gambling winnings, including those from online sports betting, are generally considered taxable income.

However, the specifics of how these winnings are taxed can depend on several factors, including the amount won, the frequency of betting, and the individual's overall tax situation. For instance, in the US, winnings above a certain threshold are subject to federal income tax, while some states also impose their own gambling taxes.

On the other hand, in countries like the United Kingdom, gambling winnings, including those from online sports betting, are typically not subject to taxation. This can be a significant advantage for bettors in such regions, as they can keep their winnings in full without worrying about setting aside a portion for taxes.

For individuals who engage in online sports betting as a hobby rather than a source of income, the tax implications may be different. In some jurisdictions, occasional or casual bettors may not be required to report their winnings as taxable income, especially if the amounts are relatively small.

In summary, the taxation of online sports betting winnings is a complex issue that varies based on location and individual circumstances. It is essential for bettors to familiarize themselves with the tax laws applicable in their jurisdiction and seek guidance from a tax professional if needed to ensure compliance and avoid any potential legal issues.

Taxes on Gambling Winnings and Losses: 8 Tips to Remember

Will DraftKings send me a 1099? Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC.

How much do you have to make on DraftKings to report taxes? $600 If you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings. This form will include all net earnings from the prior calendar year.

Do online gambling sites report to IRS? Gambling establishments, including digital operations such as online sportsbooks, usually provide you and the IRS with a record of your taxable winnings. Internal Revenue Service.

Bet on the big game? Here's what you need to know about paying taxes on sports bets

Here's what you need to know about the tax implications of sports betting and gambling wins. The money you win from placing bets on your favorite sports team is considered income, no matter how little. The IRS considers all winnings from gambling fully taxable, whether from a website, app, state lottery, casino, raffle, bingo game, horse race, fantasy football league, poker tournament or just a friendly wager.

It might be issued on the spot or mailed later, depending on the venue and the amount. But regardless of what gambling platform you use, it's a good idea to always keep a record of the date and amount of your wins and losses, as well as hold onto any corresponding receipts and documentation. You're still on the hook even if you don't receive a tax form from the place you gambled.

Each wager must be reported separately and you can't deduct losses from your gambling income to lower how much you declare. Gambling losses can only be deducted if you itemize your return, which can be more of a headache than just taking the standard deduction.

If you think your gambling losses, plus other deductions combined, won't be more than the standard deduction for your tax bracket, it might not make sense to write off your gambling losses. If you do decide to itemize your deductions, your gambling losses can't be greater than the sum of your winnings.

How much of your winnings you owe Uncle Sam depends on your tax bracket. Because gambling facilities are required to withhold a flat percentage of your winnings if they're large enough, there may be a difference between the tax withheld and what you owe on your tax return. In addition, depending on where you live and where you gambled, you may also owe state and local taxes.

Check your state's guidelines to find out. If you had any gambling wins in , you should report the full winnings on your tax return in , claiming it as "gambling income" on line 8 of Form , Schedule 1. Itemized deductions can be reported on Schedule A of Form The tax-filing season kicked off on Jan.

TurboTax offers step-by-step guidance for filers and can access prior returns to get you started, even if they were filed with a different service. If you're going to write off your gambling losses, you should opt for TurboTax Deluxe — the basic edition is only available for simple returns with standard deductions.

TurboTax Free Edition. The benefits for the state could be substantial over the long term. Therefore many may be curious about how the funds will be apportioned. We summarize the projected allocation below as follows:. Are online sports betting winnings taxable This bill does not change how sports wagering is taxed for individuals. However, the law provides easier access to sports gambling, and therefore, more North Carolinians might be more likely to engage in sports wagering.

Sports enthusiasts and those interested in wagering will benefit from understanding how gambling will affect their tax bill. In North Carolina, gambling winnings are, and have always been, taxable both at the state and federal level. Therefore, individuals engaging in sports betting will need to keep track of their winnings.

Gamblers will also want to keep track of their losses because gambling losses can sometimes reduce taxes. Importantly, all gambling winnings are reported as taxable income. Even if the individual itemizes, gambling losses totaling more than gambling winnings are not deductible.

Losses in excess of winnings also cannot carry forward to future years. Another thing to keep in mind is that gamblers cannot subtract the cost of gambling from the winnings. There is no benefit in keeping records of travel or other gambling-related expenses, such as fees for bets, as gamblers generally cannot deduct these expenses unless they are professional gamblers.

In addition, depending on where you live and where you gambled, you may also owe state and local taxes. Check your state's guidelines to find out. If you had any gambling wins in , you should report the full winnings on your tax return in , claiming it as "gambling income" on line 8 of Form , Schedule 1.

Itemized deductions can be reported on Schedule A of Form The tax-filing season kicked off on Jan.  TurboTax offers step-by-step guidance for filers and can access prior returns to get you started, even if they were filed with a different service. If you're going to write off your gambling losses, you should opt for TurboTax Deluxe — the basic edition is only available for simple returns with standard deductions.

TurboTax offers step-by-step guidance for filers and can access prior returns to get you started, even if they were filed with a different service. If you're going to write off your gambling losses, you should opt for TurboTax Deluxe — the basic edition is only available for simple returns with standard deductions.

TurboTax Free Edition. Click here for TurboTax offer details and disclosures. Terms apply. Users can also upload previous returns from other providers and they'll get an estimate of their tax refund in real time. Money matters — so make the most of it.

Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here. Any winnings from a sports bet must be reported as income on your tax return. You can deduct gambling losses, but only if you itemize your deductions and they don't add up to more than your winnings.

At CNBC Select , our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every tax article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of tax products.

While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. Skip Navigation.

Popular Pages

- When was the ffa sport betting and match fixing impemented

- What are the best sports betting apps

- Why data mining doesnt work in sports betting

- Is sports betting allowed in florida

- What is action reverse sports betting

- Is sports betting legal in south africa

- Can you bet on sports in pa

- Is online sports betting legal in nc

- Can betting ocmpanies profit from sports corporations

- Does technical analysis for sports betting work