Are sports betting losses tax deductible

Gambling losses are indeed tax deductible, but only to the extent of your winnings and requires you to report all the money you win as. However, you can claim your gambling losses as a tax deduction if you itemize your deductions. • Your deductions for gambling losses can't. Gambling losses are indeed tax deductible, but only to the extent of your winnings and requires you to report all the money you win as taxable. You can deduct gambling losses if you itemize your are sports betting losses tax deductible on your tax return, but you cannot deduct more than the gambling income you received. You'll need.

Exploring the Tax Implications of Sports Betting Losses

When it comes to the exhilarating world of sports betting, punters often find themselves engrossed in the highs and lows of the unpredictable outcomes. As someone who appreciates the thrill and strategic nuances of sports wagering, I pondered upon a complex question that has been circulating among enthusiasts: Are sports betting losses tax-deductible?

Delving into this intricacy reveals a mix of considerations that intertwine the realms of gambling, taxation, and fiscal clarity. First and foremost, it's vital to comprehend that tax laws vary across different jurisdictions, adding layers of complexity to this subject.

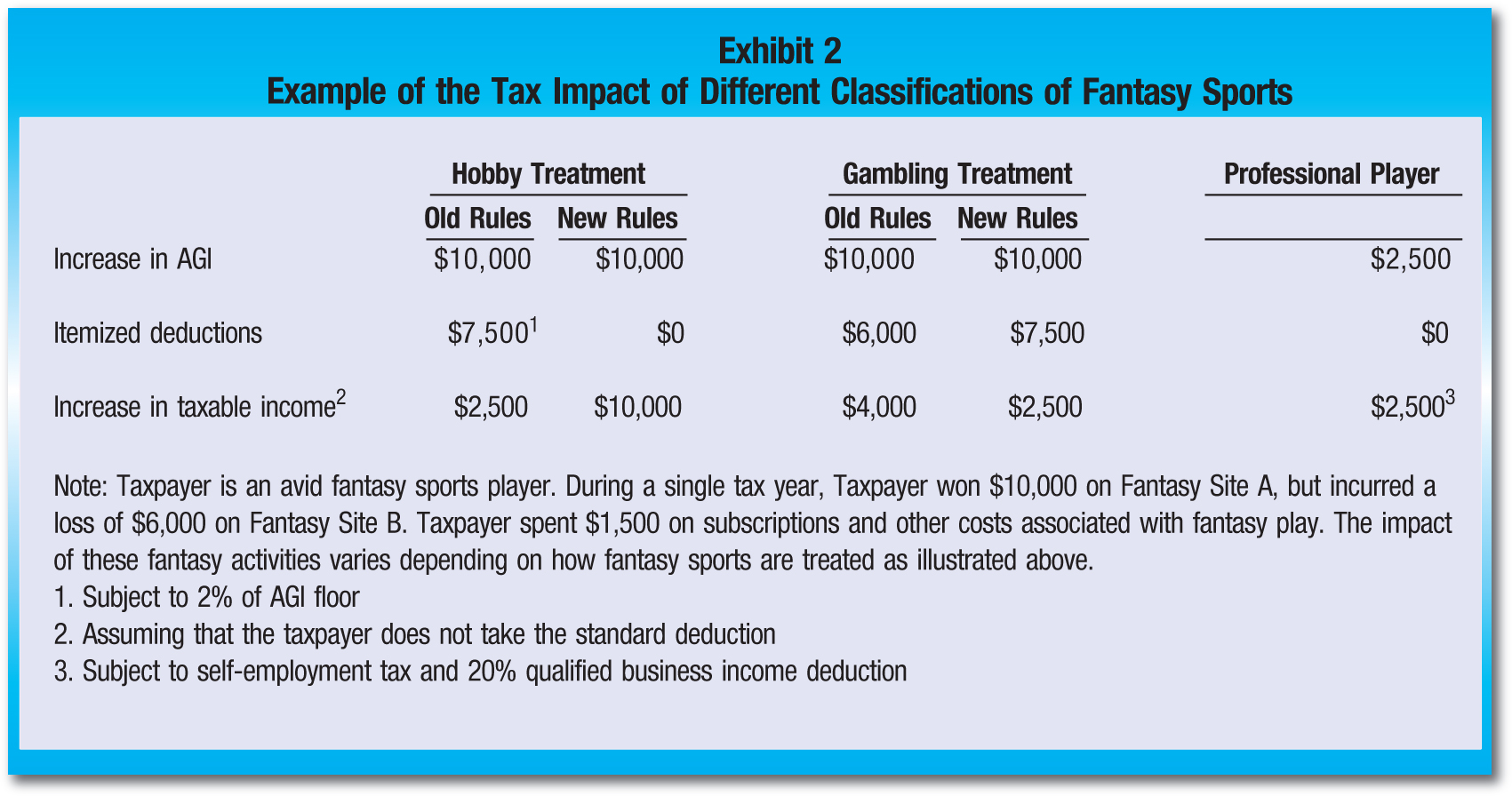

Within certain regions, sports betting losses may be tax-deductible, but this deduction is typically limited to the extent of one's gambling winnings, acting as a mitigating factor rather than a complete deduction. Governments often view gambling losses as part of the larger framework of gambling income, thereby regulating the deductibility aspect to prevent potential abuse of the system.

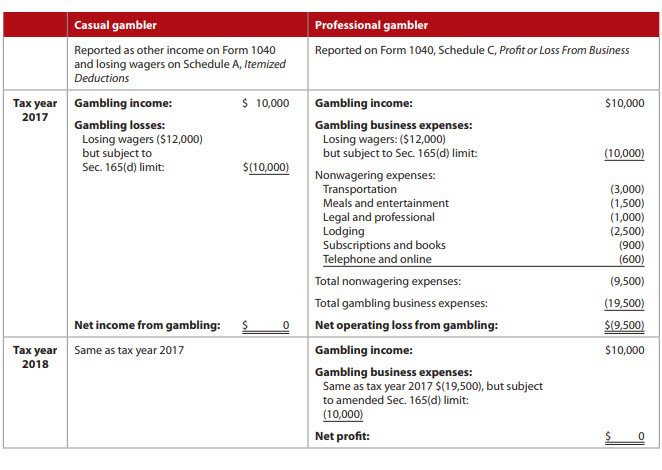

For instance, in the United States, the Internal Revenue Service (IRS) stipulates that gambling losses are deductible, provided the individual itemizes deductions on their tax return. These losses can only be offset against gambling winnings and cannot exceed the amount of total winnings reported. The process demands meticulous record-keeping to substantiate claims in case of an audit.

The Intricacies of Tax Deduction Limitations

While the prospect of deducting sports betting losses may seem appealing, the stringent limitations imposed by tax authorities curb the magnitude of potential deductions. Across various countries, tax codes are designed to strike a balance between fostering responsible gambling practices and ensuring compliance with fiscal obligations.

This nuanced balance underscores the significance of approaching sports betting and associated tax implications with prudence and awareness.

Furthermore, for individuals engaging in sports betting as a professional endeavor, the tax landscape shifts, necessitating a distinct approach to income reporting, deductions, and regulatory compliance.

Conclusion

In essence, the question of whether sports betting losses are tax-deductible underscores the duality of this recreational pursuit as both a source of entertainment and a financial transaction subject to regulatory frameworks. While the prospect of deductibility exists in certain jurisdictions, it is crucial for punters to navigate this terrain with a clear understanding of the rules and limitations imposed by tax laws.

Ultimately, the interplay between sports betting, taxation, and financial responsibility underscores the multifaceted nature of this pastime, elevating the importance of informed decision-making and compliance within the regulatory landscape.

How Gambling Income and Losses are Treated for Tax Purposes

Where do I write off gambling losses? The full amount of your gambling winnings for the year must be reported on line 21, Form 1040. If you itemize deductions, you can deduct your gambling losses for the year on line 27, Schedule A (Form 1040). Your gambling loss deduction cannot be more than the amount of gambling winnings.

Has anyone been audited for gambling losses? If you choose to deduct your gambling losses, then they must be to the same extent as your winnings. The IRS may perform an audit if they notice you've deducted a high amount in gambling losses but low gambling winnings. This is considered suspicious behavior by the IRS.

Are gambling losses 100% deductible? The amount of losses you deduct can't be more than the amount of gambling income you reported on your return. Claim your gambling losses up to the amount of winnings, as "Other Itemized Deductions."

Can I write off all my gambling winnings? You are required to report all gambling winnings—including the fair market value of noncash prizes you win—as “other income” on your tax return. You can't subtract the cost of a wager from your winnings. However, you can claim your gambling losses as a tax deduction if you itemize your deductions.

Does the IRS audit gambling losses? Audit risks may be higher with gambling taxes

How does IRS verify gambling losses? To deduct your losses, you must keep an accurate diary or similar record of your gambling winnings and losses and be able to provide receipts, tickets, statements, or other records that show the amount of both your winnings and losses.

Report your full amount of gambling winnings on U.S. Individual Income Tax Return (IRS Form 1040) . Report your losses on Itemized Deductions, Schedule A (IRS Form 1040) .How do I claim gambling wins and losses on my taxes? Federal return

Does the IRS ask for proof of gambling losses? To deduct your losses, you must keep an accurate diary or similar record of your gambling winnings and losses and be able to provide receipts, tickets, statements, or other records that show the amount of both your winnings and losses. Refer to Publication 529, Miscellaneous Deductions for more information.

Are bank statements proof of gambling losses? Regarding your gambling losses, you can deduct these on your tax return to the extent of your gambling winnings for the year. As you have bank transactions as proof of your losses, ensure these records detail the dates, locations, and amounts of both your losses and winnings.

Is a win loss statement good enough for taxes? Taxpayers who win a certain amount when gambling at a casino will be provided with a win/loss statement, known as IRS Form W-2G, Certain Gambling Winnings, which can be used to report their gambling wins and losses on their tax returns.

How much gambling loss can you write off? The amount of gambling losses you can deduct can never exceed the winnings you report as income. To report your gambling losses, you must itemize your income tax deductions on Schedule A. If you claim the Standard Deduction, then you can't reduce your tax by your gambling losses.

Can I offset gambling winnings with losses? However, like any other income, regardless of whether or not documentation was provided at the time it was earned (or won), all income must be reported on your federal tax return. Fortunately, you can offset your gambling winnings with any losses that you may have incurred up to the amount of your winnings.

If you receive a W-2G form along with your gambling winnings, don't forget that the IRS is getting a copy of the form, too. So, the IRS is expecting you to claim those winnings on your tax return. Deducting large gambling losses can also raise red flags at the IRS.Do you have to pay taxes on sports betting if you lose? Bottom line. Any winnings from a sports bet must be reported as income on your tax return. You can deduct gambling losses, but only if you itemize your deductions and they don't add up to more than your winnings.

Taxes on Gambling Winnings and Losses: 8 Tips to Remember

Get unlimited advice, an expert final review and your maximum refund, guaranteed. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice.

Estimate your tax refund and where you stand. Easily calculate your tax rate to make smart financial decisions. Know how much to withhold from your paycheck to get a bigger refund. Estimate your self-employment tax and eliminate any surprises. Estimate capital gains, losses, and taxes for cryptocurrency sales.

Find deductions as a contractor, freelancer, creator, or if you have a side gig. See how much your charitable donations are worth. Star ratings are from Here's how. A Form return with limited credits is one that's filed using IRS Form only with the exception of the specific covered situations described below.

All features, services, support, prices, offers, terms and conditions are subject to change without notice. Compare TurboTax products. All online tax preparation software. TurboTax online guarantees. TurboTax security and fraud protection. Tax forms included with TurboTax. Self-employed tax center. Are sports betting losses tax deductible Tax law and stimulus updates. Unemployment benefits and taxes.

Free Edition tax filing. Deluxe to maximize tax deductions. Free military tax filing discount. TurboTax Live tax expert products. TurboTax Desktop login. Desktop products. Install TurboTax Desktop. Check order status. TurboTax Advantage.  TurboTax Desktop Business for corps. Products for previous tax years. Tax tips and video homepage.

TurboTax Desktop Business for corps. Products for previous tax years. Tax tips and video homepage.

Married filing jointly vs separately. Guide to head of household. Rules for claiming dependents. File taxes with no income. About form NEC. Crypto taxes. About form K. Small business taxes. Amended tax return. Capital gains tax rate. File back taxes.

Find your AGI. TurboTax support. Contact us. File an IRS tax extension. Crypto tax calculator. Capital gains tax calculator. Bonus tax calculator. Tax documents checklist. TurboTax Super Bowl commercial. TurboTax Canada. Accounting software. QuickBooks Payments. Professional tax software. Professional accounting software.

Credit Karma credit score. More from Intuit. How much do i win betting on sports All rights reserved. Terms and conditions, features, support, pricing, and service options subject to change without notice. By accessing and using this page you agree to the Terms of Use. Click to expand. Claiming gambling losses Gambling losses are indeed tax deductible, but only to the extent of your winnings and requires you to report all the money you win as taxable income on your return.

Keeping track of your winnings and losses The IRS requires you to keep a log of your winnings and losses as a prerequisite to deducting losses from your winnings. Typical sources of winnings and losses can include: lotteries raffles horse and dog races casino games poker games sports betting Your records need to include: the date and type of gambling you engage in the name and address of the places where you gamble the people you gambled with the amount you win and lose Other documentation to prove your losses can include: Form W-2G Form wagering tickets canceled checks or credit records receipts from the gambling facility TurboTax Tip: In addition to deducting the actual cost of wagers, you can also deduct other expenses connected to your gambling activity, including travel to and from a casino.

Limitations on loss deductions The amount of gambling losses you can deduct can never exceed the winnings you report as income. Reporting gambling losses To report your gambling losses, you must itemize your income tax deductions on Schedule A. If you claim the standard deduction, you: are still obligated to report and pay tax on all winnings you earn during the year will not be able to deduct any of your losses.

Only gambling losses You can include in your gambling losses the actual cost of wagers plus other expenses connected to your gambling activity, including travel to and from a casino. Use your Intuit Account to sign in to TurboTax. Phone number, email or user ID. Remember me. Sign in. By selecting Sign in, you agree to our Terms and acknowledge our Privacy Statement.

New to Intuit. Create an account. Max refund guarantee. Start for free. Looking for more information. Tax Bracket Calculator Easily calculate your tax rate to make smart financial decisions Get started. W-4 Withholding Calculator Know how much to withhold from your paycheck to get a bigger refund Get started.

Self-Employed Tax Calculator Estimate your self-employment tax and eliminate any surprises Get started. Crypto Calculator Estimate capital gains, losses, and taxes for cryptocurrency sales Get started. Are sports betting losses tax deductible Self-Employed Tax Deductions Calculator Find deductions as a contractor, freelancer, creator, or if you have a side gig Get started. Read why our customers love Intuit TurboTax Rated 4.

Your security. Built into everything we do. File faster and easier with the free TurboTax app. Excludes payment plans. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns.

Additional terms and limitations apply. See Terms of Service for details. Audit Support Guarantee — Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax for the current tax year and for individual, non-business returns for the past two tax years , Audit support is informational only.

We will not represent you before the IRS or state tax authority or provide legal advice. Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

If you pay an IRS or state penalty or interest because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Limitations apply. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest.

You are responsible for paying any additional tax liability you may owe. If you receive an audit letter from the IRS or State Department of Revenue on your TurboTax business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited business returns filed with TurboTax for the current tax year.

For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to file or purchase add-on products or services. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice.

Special discount offers may not be valid for mobile in-app purchases. Strikethrough prices reflect anticipated final prices for tax year Offer may change or end at any time without notice. Must file between November 29, and March 31, to be eligible for the offer. Includes state s and one 1 federal tax filing. Intuit reserves the right to modify or terminate this TurboTax Live Assisted Basic Offer at any time for any reason in its sole and absolute discretion.

Self-Employed Tax Calculator Estimate your self-employment tax and eliminate any surprises Get started. Crypto Calculator Estimate capital gains, losses, and taxes for cryptocurrency sales Get started. Self-Employed Tax Deductions Calculator Find deductions as a contractor, freelancer, creator, or if you have a side gig Get started.

Read why our customers love Intuit TurboTax Rated 4. Your security. Built into everything we do. File faster and easier with the free TurboTax app. Excludes payment plans. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax.

Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details. Audit Support Guarantee — Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax for the current tax year and for individual, non-business returns for the past two tax years , Audit support is informational only.

We will not represent you before the IRS or state tax authority or provide legal advice. Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

If you pay an IRS or state penalty or interest because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Limitations apply. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. You are responsible for paying any additional tax liability you may owe.

If you receive an audit letter from the IRS or State Department of Revenue on your TurboTax business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited business returns filed with TurboTax for the current tax year.

For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to file or purchase add-on products or services. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice.

Special discount offers may not be valid for mobile in-app purchases. Strikethrough prices reflect anticipated final prices for tax year Offer may change or end at any time without notice. Must file between November 29, and March 31, to be eligible for the offer.

Includes state s and one 1 federal tax filing. Intuit reserves the right to modify or terminate this TurboTax Live Assisted Basic Offer at any time for any reason in its sole and absolute discretion. If you add services, your service fees will be adjusted accordingly.

If you file after pm EST, March 31, , you will be charged the then-current list price for TurboTax Live Assisted Basic and state tax filing is an additional fee. See current prices here. Credit does not apply to state tax filing fees or other additional services.

Intuit reserves the right to modify or terminate this offer at any time for any reason in its sole discretion. Final price may vary based on your actual tax situation and forms used or included with your return. Price estimates are provided prior to a tax expert starting work on your taxes. Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare your return, and forms or schedules included in your individual return.

Prices are subject to change without notice and may impact your final price. If you decide to leave Full Service and work with an independent Intuit TurboTax Verified Pro, your Pro will provide information about their individual pricing and a separate estimate when you connect with them. Pays for itself TurboTax Premium, formerly Self-Employed : Estimates based on deductible business expenses calculated at the self-employment tax income rate Actual results will vary based on your tax situation.

Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. The IRS issues more than 9 out of 10 refunds in less than 21 days. Get your tax refund up to 5 days early: Individual taxes only. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan, you will not be eligible to receive your refund up to 5 days early.

Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic deposit and is dependent on and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early. Maximum balance and transfer limits apply per account. Fees: Third-party fees may apply.

Pay for TurboTax out of your federal refund or state refund if applicable : Individual taxes only. Subject to eligibility requirements. Additional terms apply. Prices are subject to change without notice. TurboTax specialists are available to provide general customer help and support using the TurboTax product. Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice.

Limitations apply See Terms of Service for details. Intuit will assign you a tax expert based on availability. Tax expert and CPA availability may be limited. For the TurboTax Live Assisted product, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return.

For the TurboTax Live Full Service product: Handoff tax preparation by uploading your tax documents, getting matched with an expert, and meeting with an expert in real time. The tax expert will sign your return as a preparer. Administrative services may be provided by assistants to the tax expert. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Unlimited access to TurboTax Live tax experts refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage.

Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. TurboTax Live Full Service — Qualification for Offer: Depending on your tax situation, you may be asked to answer additional questions to determine your qualification for the Full Service offer. Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering.

Offer details subject to change at any time without notice. Intuit reserves the right to refuse to prepare a tax return for any reason in its sole discretion. Additional limitations apply. Based on completion time for the majority of customers and may vary based on expert availability.

All tax forms and documents must be ready and uploaded by the customer for the tax preparation assistant to refer the customer to an available expert for live tax preparation. In-person meetings with local Pros are available on a limited basis in some locations, but not available in all States or locations.

Not all pros provide in-person services. Smart Insights: Individual taxes only. Terms and conditions may vary and are subject to change without notice. Easy Online Amend: Individual taxes only. Self-Employed defined as a return with a Schedule C tax form. Online competitor data is extrapolated from press releases and SEC filings.

CompleteCheck: Covered under the TurboTax accurate calculations and maximum refund guarantees. Available in mobile app only. This product feature is only available after you finish and file in a self-employed TurboTax product. More self-employed deductions based on the median amount of expenses found by TurboTax Premium formerly Self Employed customers who synced accounts, imported and categorized transactions compared to manual entry.

Individual results may vary. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. See License Agreement for details.

Audit Support Guarantee — Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax Desktop for the current tax year and, for individual, non-business returns, for the past two tax years , You must return this product using your license code or order number and dated receipt.

Maximum Tax Savings Guarantee — Business Returns: If you get a smaller tax due or larger business tax refund from another tax preparation method using the same data, TurboTax will refund the applicable TurboTax Business Desktop license purchase price you paid. Product limited to one account per license code. You must accept the TurboTax License Agreement to use this product.

Not for use by paid preparers. TurboTax Desktop Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Additional fees may apply for e-filing state returns. E-file fees may not apply in certain states, check here for details.

Savings and price comparison based on anticipated price increase. Software updates and optional online features require internet connectivity. Fastest Refund Possible: Fastest federal tax refund with e-file and direct deposit; tax refund time frames will vary. TurboTax Product Support: Customer service and product support hours and options vary by time of year.

Quicken import not available for TurboTax Desktop Business. Quicken products provided by Quicken Inc. Online software products. Tax tips. Help and support. Tax tools. Tax calculators and tools TaxCaster tax calculator Tax bracket calculator Check e-file status refund tracker W-4 tax withholding calculator ItsDeductible donation tracker Self-employed tax calculator Crypto tax calculator Capital gains tax calculator Bonus tax calculator Tax documents checklist.

Popular Pages

- What is clv in sports betting

- Can you bet on sports in kansas

- Is sports betting legal in tennessee

- Is sports betting 50-50

- How do i bet on sports

- How much money sports betting

- How do you bet on sports games

- When is mgm national harbor sports betting

- Does arizona allow sports betting

- When will sports betting be legal in iowa