Do u have to pay taxes on sports betting

All you need to do is actually complete a Federal tax return to immediately see that gambling wins are treated differently. Do u have to pay taxes on sports betting not netted. Gambling income is any money that you make from games of chance or wagers on events with uncertain outcomes. Gambling income is fully taxable and must be. But even the winners can be losers if they don't pay their taxes! Any money you win while gambling or wagering is considered taxable income by the IRS as is the. When you have gambling winnings, you may be required to pay an estimated tax on that additional income. For information on withholding on.

The Tax Implications of Sports Betting

As sports enthusiasts, we are often caught up in the excitement of placing bets on our favorite teams and players. However, it is crucial to understand the tax implications that come with sports betting. The question that looms large is: do you have to pay taxes on your sports betting winnings?

The straightforward answer is yes. In most jurisdictions, any income earned from sports betting is considered taxable. Whether you are betting on football, basketball, or any other sport, the profits you make are subject to taxation.

When it comes to taxes on sports betting, the rules can vary depending on where you reside. In some countries, such as the United States, winnings from sports betting are treated as taxable income and must be reported to the relevant authorities. Failure to do so can result in penalties and legal consequences.

It is essential to keep detailed records of your sports betting activities, including wins and losses. By maintaining accurate records, you can ensure compliance with tax laws and avoid potential issues in the future.

Some sports bettors may be able to deduct losses from their winnings, reducing the overall tax liability. However, the specific rules regarding deductions can differ based on the tax laws in your jurisdiction.

Overall, while the thrill of sports betting is undeniable, it is essential to be aware of the tax implications and fulfill your obligations as a responsible bettor. Remember, paying taxes on your sports betting winnings is not just a legal requirement—it is also a way to contribute to society and support the integrity of the sports industry.

What Taxes Are Due on Gambling Winnings?

Does DraftKings report all winnings to IRS? Winnings that meet certain state or federal thresholds must be reported by DraftKings to the IRS for tax purposes. There may be tax withheld from your winnings, depending on how much you've won, and what game you were playing.

What happens if you win more than 600 on FanDuel? If you've won in your fantasy football league, $600 or above must be reported. For poker tournaments, it's anything over $5,000. Bingo or slot machines are $1,200, and Keno is $1,500. Gambling winnings are considered taxable income.

Does Fanduel take taxes out? Yes, your winnings from Fanduel and other fantasy sports platforms, such as Draft Kings are taxable. Fanduel will issue a W-2G or 1099 for your winnings. Once your winnings reach $5,000 they will withhold 25% for you for federal tax purposes. Fanduel is not the only gambling platform whose winnings are taxable income.

How much can you win sports betting without paying taxes? Do sportsbooks and casinos report gambling winnings to the IRS? If you win at a sportsbook or casino, they are legally obligated to report your winnings to the IRS and to you if you win up to a certain amount ($600 on sports, $1,200 on slots, and $5,000 on poker).

What happens if you don't pay gambling taxes? The IRS considers all gambling winnings taxable income, and must be reported as such on your tax return. If you are caught underreporting your winnings or failing to report them altogether, you may face fines, interest charges, and even criminal charges in some cases.

Do You Have to Pay Sports Betting Taxes?

You then must report all gambling winnings on your tax return. When you win, your winnings are treated as taxable income. Even non cash winnings like prizes are to be included on your tax return at their fair market value. If you win, understanding when each type of gambling category is required to issue to report your winnings is important for you when gathering your tax documents accurately and with confidence.

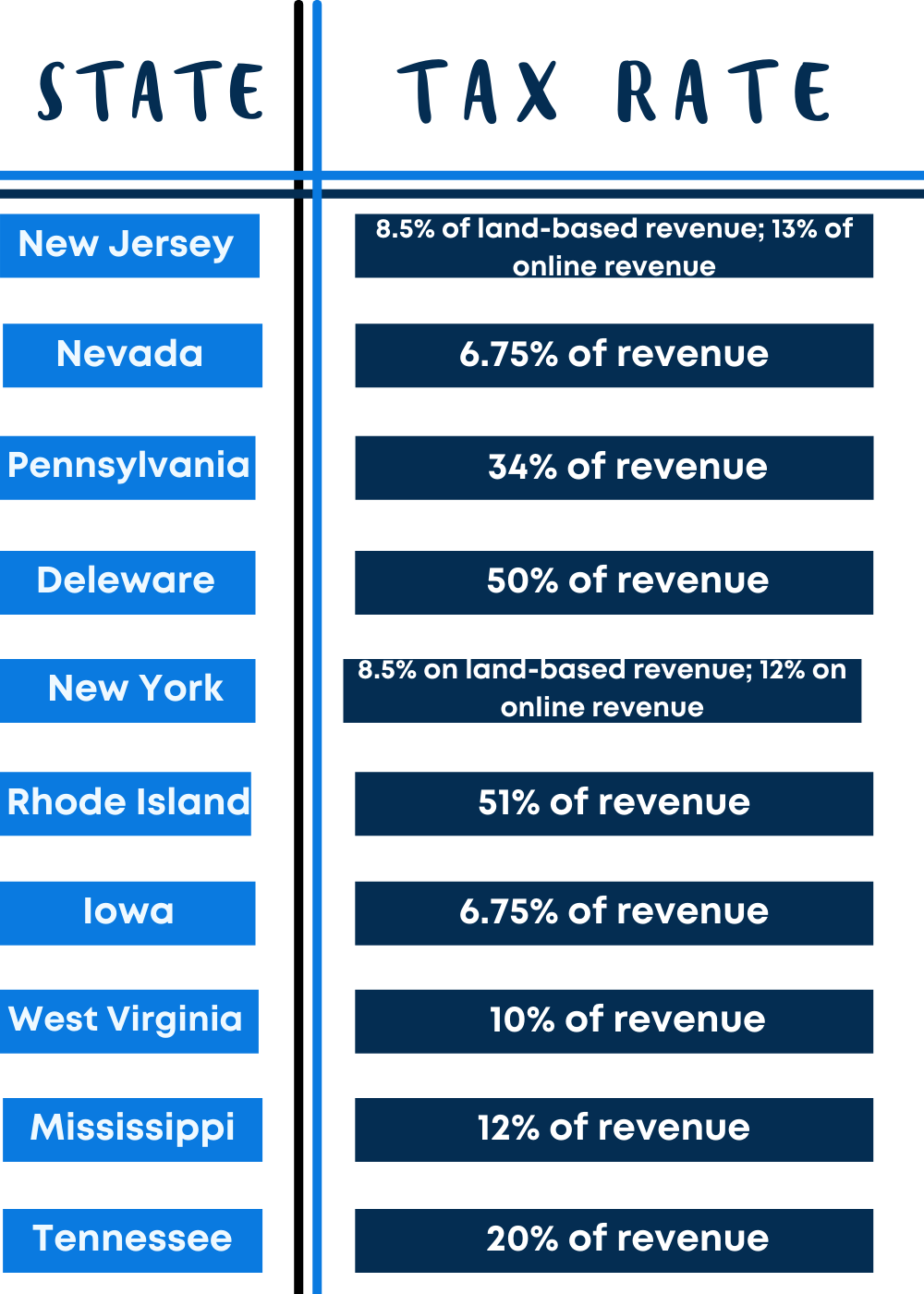

However, you still must report your winnings on your IRS tax return even if the winnings did not result in a tax form, so keep accurate records of all your buy-ins and winnings at casinos. Keep accurate records of your wager or buy-in amounts, as this can be used to offset your reported winnings. The tax rate on gambling winnings will typically vary from state to state.

The majority of states have income taxes, which means that gambling winnings are likely subject to both federal and state taxation. The rules and rates of your gambling wins and taxes can vary significantly depending on your state. Some states take your gambling winnings tax at a flat rate, while other states tie it to your overall income tax rate. Form W-2G details your gambling winnings and any taxes withheld.

Even if your gambling winnings are not substantial and you were not issued Form W-2G, you are still required to report your winnings as part of your total income. Whether you won the lottery or a sweepstakes or simply enjoyed a bit of friendly competition, keeping track and reporting your gambling income is important to stay on the right side of tax regulations.

If you engage in gambling activities as a means of livelihood and pursue it regularly as a professional gambler, then some rules can vary. However, deductions from losses that exceed the income of your winnings are still not allowed. While casual gamblers only need to report their winnings as part of their overall income on their tax forms, professional gamblers may file a Schedule C as self-employed individuals.

They may be able to deduct their gambling-related expenses, such as travel or casino entry fees, to determine their net income. In regards to losses, deductions for gambling losses must be less than or equal to gambling winnings. You can deduct losses from your gambling, but only if you itemize your deductions and keep an accurate record of your winnings and losses.

The amount of losses you deduct cannot be more than the amount of gambling winnings you report on your tax return. Under tax reform, you can only deduct losses directly related to your wagers and not non-wagering expenses like travel-related expenses to gambling sites. Do u have to pay taxes on sports betting Gambling losses can be deducted up to the amount of gambling winnings. Whereas your winnings are reported by the payer on a Form W2-G, your losses may not be reported.

If you gain wealth of any kind, you must pay taxes on it. This includes physical property, money and debt forgiveness. Likewise, winning a bet counts as gaining wealth, which means you must report it to the taxing authorities. In a Supreme Court ruling struck down federal legislation that banned the practice nationwide. Today the legality of sports betting is both a federal and a state matter.

This has allowed states to set their own rules. A financial advisor can help you manage and invest your monetary assets. The IRS taxes winnings differently whether you are a casual bettor or in the trade and business of gambling. This article will address gambling winnings when you are paying individual taxes.

Business taxes are beyond the scope of this article and are claimed as Schedule C revenue over costs. It includes cash winnings and the fair market value of prizes, such as cars and trips.  You must report all gambling winnings to the IRS regardless of amount. This is incorrect.

You must report all gambling winnings to the IRS regardless of amount. This is incorrect.

The winner must report all winnings to the IRS on their income taxes. Taxpayers who itemize their taxes can deduct their losses on Schedule A. However gambling losses can only offset gambling winnings. They cannot be used to reduce your taxable income from other sources. As with all deductions , you must keep records and receipts of all claimed losses.

The manner in which you make the bet does not matter when paying federal income taxes. For example, the tax implications for the IRS are the same regardless of whether you make the bet in person or via an app. States have set rules on betting, including rules on taxing bets, in a variety of ways. Depending on your state, legal sports betting may be a combination of in person, online, retail at specifically licensed physical properties.

At time of writing 17 states continue to ban sports betting entirely. Every state has its own laws when it comes to gambling taxes. Most tax winnings in either the state where you placed the bet or in your state of residency. The explosion of online and app-based sportsbooks.

A sportsbook is the institution where you can place bets on sporting events, otherwise known as your bookie. The legal issues around online sportsbooks have not yet been fully resolved. These institutions argue that all bets occur either where the company is registered or where it keeps its servers. At time of writing this was not fully resolved.

The following table is based on Tax Foundation information. This does not absolve you of responsibility to report that income yourself, in the same way that you still have to file your taxes even though the IRS has your W It does mean, however, that you should be scrupulous when you file your taxes. Many people underreport gambling winnings. There are many reasons not to do this, including the fact that the IRS may already know all about your income.

Depending on the nature of your bet, you may receive a Form W-2G from whoever pays out your winnings. This is particularly true if they use some form of third party institution to make your payment. You can only deduct losses if you itemize your taxes.

Popular Pages

- When did online sports betting become mainstream

- How much money to start sports betting

- What is mobile sports betting

- How long does sports bet results take

- What are the odds of winning betting sports

- Can you bet on sports at mgm national harbor

- How to cash out bet on 888 sport

- What are props in sports betting

- How do i betting sports online at hard rock ac

- How many states in the us have legalised sports betting