Do i have to pay taxes on sports betting

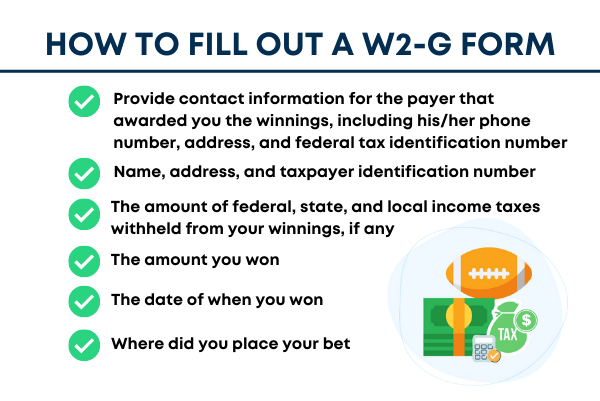

Effective August ofthe required rate for gambling winnings in Maine became %, the highest personal income tax rate. This means that. Sports gambling winnings are subject to income tax and you must report them on your tax return, even do i have to pay taxes on sports betting you don't receive tax documentation for the gambling. All you need to do is actually complete a Federal tax return to immediately see that gambling wins are treated differently. They're not netted. When you win, your winnings are taxable income, subject to its own tax rules. TABLE OF CONTENTS. You are required to report your winnings; Form.

The Tax Game: Understanding Taxes on Sports Betting Winnings

It's no secret that sports betting has become a popular pastime for many sports fans around the world. The thrill of placing a bet and potentially winning big adds an extra layer of excitement to watching games unfold. However, as with any form of gambling, the question of taxes on sports betting winnings often arises. So, do you have to pay taxes on your sports betting profits? Let's break it down.

Understanding the Tax Rules

The general rule of thumb is that you must pay taxes on any gambling winnings, including those from sports betting. In most countries, gambling winnings are considered taxable income and should be reported to the appropriate tax authorities. The specific rules and rates may vary depending on where you live, so it's essential to familiarize yourself with the tax laws in your jurisdiction.

Keeping Track of Your Winnings

One crucial aspect of dealing with taxes on sports betting winnings is keeping accurate records of your bets and winnings. Maintaining a detailed log of your bets, including dates, amounts wagered, and winnings, will help you when it comes time to report your income to the tax authorities. This documentation is essential for ensuring compliance with tax laws and accurately calculating any taxes owed.

Tax Implications on Different Types of Bets

It's important to note that the tax treatment of sports betting winnings can vary depending on the type of bet placed. For example, in some jurisdictions, winnings from casual bets among friends may not be subject to taxation. However, for larger wins from online sportsbooks or professional gambling activities, taxes are more likely to apply.

Consulting a Tax Professional

If you're unsure about how sports betting winnings are taxed in your area or need assistance with reporting your gambling income, it's advisable to seek guidance from a tax professional. They can provide you with personalized advice based on your individual circumstances and ensure that you comply with all relevant tax laws.

In conclusion, while the thrill of winning big on sports bets can be exhilarating, it's essential to understand the tax implications of your gambling activities. Remember, it's better to be prepared and informed about taxes on sports betting winnings to avoid any unexpected surprises come tax season. Stay vigilant, keep track of your bets, and when in doubt, seek professional advice to ensure you stay on the right side of the tax game.

Gambling Winnings Taxes: An Intro Guide

Is spread betting tax free in USA? Key Takeaways. Spread betting allows traders to bet on the direction of a financial market without actually owning the underlying security. Spread betting is sometimes promoted as a tax-free, commission-free activity that allows investors to speculate in both bull and bear markets, but this remains banned in the U.S.

Can you bet at 18 in Ohio? The legal age for betting is 21, and you must be physically present in the state to gamble. You don't need to be a resident. Many of the leading online sportsbooks have platforms in Ohio. They all have similar betting markets, odds and lines, promotions, features and deposit/withdrawal methods.

How much are taxes in Buffalo New York? The minimum combined 2024 sales tax rate for Buffalo, New York is 8.75%. This is the total of state, county and city sales tax rates. The New York sales tax rate is currently 4%. The County sales tax rate is 4.75%.

Do you have to pay taxes on sports betting in Ohio? Do I have to pay taxes on gambling winnings in Ohio? Yes. In Ohio, the tax rate for the operators is 10% of the gross revenue. For the bettors, gambling winnings are taxable income like any other.

How is gambling taxed in the US? For federal taxes, there are two types of withholdings on gambling winnings: a regular gambling withholding (24% or 31.58% for certain non cash payments) and back withholding also at 24%. If your winning is already subject to regular gambling with holding you won't also be subject to backup withholding.

Do I have to pay local taxes on gambling winnings? The state where you live generally taxes all your income — including gambling winnings. However, if you travel to another state to place a bet, you might be surprised to learn that the other state wants to tax your winnings, too. And they could withhold the tax from your payout to make sure they get what they're owed.

How much will a casino payout in cash? Casinos typically pay winnings of less than $25,000 by cash or check. They may disburse larger winnings either as a lump sum or as an annuity. Some casinos won't allow you to choose how to receive winnings.

Bet on the big game? Here's what you need to know about paying taxes on sports bets

Even if the individual itemizes, gambling losses totaling more than gambling winnings are not deductible. Losses in excess of winnings also cannot carry forward to future years. Another thing to keep in mind is that gamblers cannot subtract the cost of gambling from the winnings.

There is no benefit in keeping records of travel or other gambling-related expenses, such as fees for bets, as gamblers generally cannot deduct these expenses unless they are professional gamblers. Also, for each win, the gambler may want to set aside some money for taxes, as online sports gambling providers may not withhold income taxes from winnings.

Sports gambling is already legal in North Carolina at in-person sports books, and it is pervasively available online around the country. Notably, online sports betting is not a matter of traditional political lines, as we have seen both red and blue states alike legalize it in recent years.

Even a traditionally conservative state like Texas is considering legislation allowing it. House Bill would allow the state of North Carolina to capitalize on these tax revenues. For example, illegal gambling revenues are generally not reported and therefore do not generate tax revenues. However, House Bill will formally tax these revenues for operators and gamblers.

These are all tax revenues generally lost when online sports gambling is not legalized. Opponents of this bill are quick to point out the implicit costs associated with gambling addiction. Thus, some may question whether a higher tax rate would be more beneficial. But regardless of what gambling platform you use, it's a good idea to always keep a record of the date and amount of your wins and losses, as well as hold onto any corresponding receipts and documentation.

You're still on the hook even if you don't receive a tax form from the place you gambled. Each wager must be reported separately and you can't deduct losses from your gambling income to lower how much you declare. Gambling losses can only be deducted if you itemize your return, which can be more of a headache than just taking the standard deduction.

If you think your gambling losses, plus other deductions combined, won't be more than the standard deduction for your tax bracket, it might not make sense to write off your gambling losses. If you do decide to itemize your deductions, your gambling losses can't be greater than the sum of your winnings. How much of your winnings you owe Uncle Sam depends on your tax bracket.

Because gambling facilities are required to withhold a flat percentage of your winnings if they're large enough, there may be a difference between the tax withheld and what you owe on your tax return. Do i have to pay taxes on sports betting In addition, depending on where you live and where you gambled, you may also owe state and local taxes.

Check your state's guidelines to find out. If you had any gambling wins in , you should report the full winnings on your tax return in , claiming it as "gambling income" on line 8 of Form , Schedule 1. Itemized deductions can be reported on Schedule A of Form The tax-filing season kicked off on Jan. TurboTax offers step-by-step guidance for filers and can access prior returns to get you started, even if they were filed with a different service.

If you're going to write off your gambling losses, you should opt for TurboTax Deluxe — the basic edition is only available for simple returns with standard deductions. TurboTax Free Edition. Click here for TurboTax offer details and disclosures. Terms apply. Users can also upload previous returns from other providers and they'll get an estimate of their tax refund in real time.

Money matters — so make the most of it. Gambling always involves a negative expected return with the house having the advantage. The tax paid on gains is not progressive: U.  Is Sports Betting Legal. Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Is Sports Betting Legal. Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Part Of. Related Terms. Gambling Loss: What It Means and How It Works A gambling loss is a loss resulting from risking money or other stakes on games of chance or wagering events with uncertain outcomes.

Sin Tax Definition and How It Works A sin tax is a tax on goods and services deemed harmful to society, such as tobacco, alcohol, and gambling. Read how much states make from sin taxes. Here's why you need a W-2 and how it is used. Taxable Income: What It Is, What Counts, and How to Calculate Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year.

Related Articles. Partner Links. Investopedia is part of the Dotdash Meredith publishing family.

Popular Pages

- What is the best bitcoin casino sports betting

- Can you mystery bet on sports bet

- When will i get my free bet on sport nation

- What are dead heat rules in sports betting

- Is mobile sports betting legal in florida

- How to bet on betfair sport bonus

- What is ml in sports betting

- Does sports arbitrage betting work

- How does plus minus work in sports betting

- What does plus or minus mean in sports betting