Do sports bets get taxed

Fortunately, most online wagering service providers will send individuals a tax document summarizing gambling winnings if they exceed $ per. You can try to win big at the casino but make sure you understand tax laws before you do. Gambling winnings do sports bets get taxed taxable income but losses are deductible. You, however, are required to report any and all winnings on your personal tax return. You may be required to pay estimated tax payments if the agency did not. Super Bowl gambling winnings. If you are one of the millions who placed a bet this year, you need to know that the IRS considers sports betting to be gambling.

The Question of Taxation in Sports Betting

As the world of sports betting continues to grow in popularity, many enthusiasts and punters are left wondering whether the winnings from their bets are subject to taxation. This topic often sparks heated debates and confusion among bettors and authorities alike.

Breaking Down the Taxation Debate

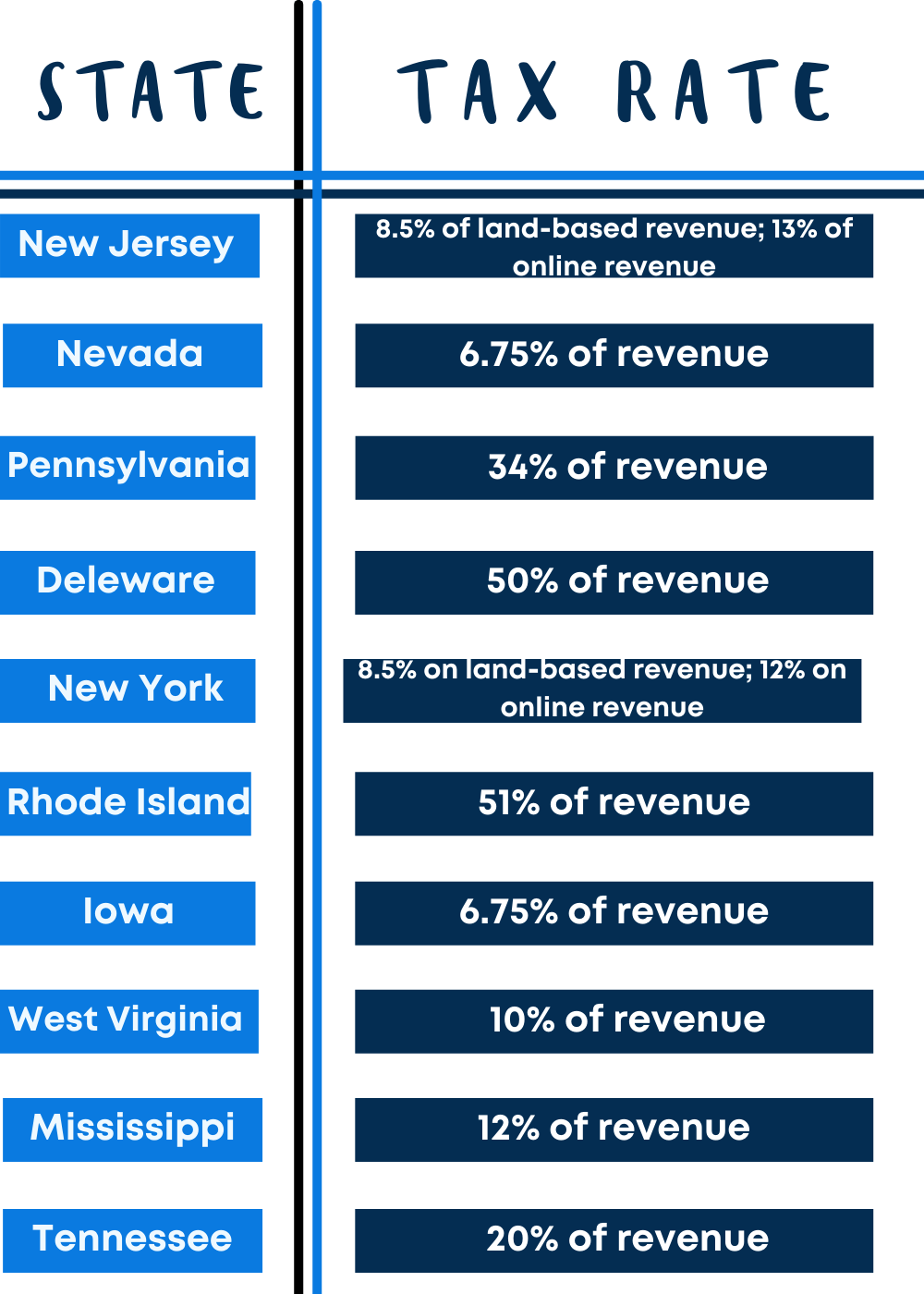

One of the key points to consider is that it ultimately depends on the country in which you reside. Tax laws vary significantly from one jurisdiction to another, so it's essential to understand the rules that apply to you. In some countries, such as the United States, sports betting winnings are typically considered taxable income, much like any other form of earnings. This means that punters may be required to report their winnings to the tax authorities and pay taxes on them.

On the other hand, in some European countries like the United Kingdom, sports betting winnings are generally not subject to taxation. This leniency has contributed to the rapid growth of the sports betting industry in these regions, attracting a large number of bettors.

The Intricacies of Taxation Policies

It's important to note that the rules and regulations surrounding the taxation of sports betting winnings can be complex and subject to change. For instance, in some cases, the type of bet placed or the amount won may influence whether taxation applies.

For bettors, staying informed about the taxation policies in their country is crucial to avoid any potential legal issues in the future. Seeking advice from tax professionals or financial advisors can offer clarity on how to handle sports betting winnings within the bounds of the law.

Conclusion

While the debate over whether sports bets should be taxed continues, it's evident that understanding the taxation policies in your specific jurisdiction is paramount. By being aware of the rules and regulations, bettors can navigate the world of sports betting responsibly and enjoy their winnings without any unforeseen tax implications.

Do You Have to Pay Sports Betting Taxes?

Bet on the big game? Here's what you need to know about paying taxes on sports bets

This includes non-cash winnings, such as vehicles or raffle prizes. The answer is: yes. If you do not report this income, you are subject to a penalty of 0. You are required by law to report all gambling winnings, no matter how much money you have won. This includes lottery tickets, slot machines, card games, sports betting, and even bingo games at the local senior center.

It also includes money you may have won outside the United States. Gaming facilities are required to provide you with a Form W-2G if your gambling winnings exceed any of these limits:. Ignore Marjorie Taylor Greene. Russia is not… Was O. His trial left me confused as a… Republicans must decide if they are anti-abortion… Republicans in the House keep failing. Is unity… More in Opinion.

EV drivers going on roadtrips will love this new… Third Disney cruise crew member arrested on child… American Airlines pilot union warns of safety… Barcelona increases its tourist tax to curb… More in Travel. Maritime incidents are on the rise. Here's how… Could tugboats have prevented Key bridge disaster… A giant ship. A towering bridge.

Kennedy family endorses President Biden in blow… Facing cash crunch, Trump funnels campaign money… How the Trump trial team is using social media to… Senate dismisses Mayorkas impeachment articles More in Politics.

Popular Pages

- Can i sports bet in georgia

- How to make a living through sports betting

- How to hedge sports bets

- Who is the sports bet actors

- How to sports bet in nebraska

- Should sport companies advertise betting

- How to make sports betting a career

- How sports betting ubiquitous

- Why you should stop sports betting

- Why is there a redemption date on sports bets