How long do have to claim a winning sports bet

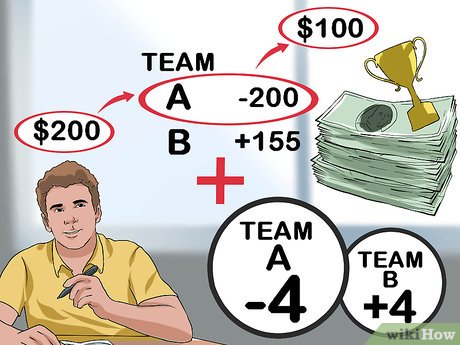

Businesses are required to send you Form W-2G by Jan. So if you won big betting on the Super Bowl this year, for example, you should receive. That is all you need to do to start winning big with westcoasteaglesfans.com.au! The number one priority we have as a sports entertainment and betting website is long as the. In some cases, you can cash out as soon as the game starts, but in other cases, you may need to wait how long do have to claim a winning sports bet bit before the option becomes available. sports betting sites, it's good to get familiar with some basic tips. This is what you should consider when wagering on online betting sites.

The Crucial Timing of Claiming a Winning Sports Bet

When it comes to the electrifying world of sports betting, one of the burning questions that often arises is how long one has to claim a winning bet. In the realm of pulsating sports action and unexpected outcomes, the management of timing can be the difference between ecstasy and agony for passionate punters.

Understanding the timeline for claiming your winnings is paramount to ensuring you don't miss out on the rewards of your successful wager.

Typically, most reputable sportsbooks provide a window of time within which punters can claim their winnings. While this timeframe varies from one platform to another, it is generally advised to promptly claim your winnings as soon as the outcome of the bet has been determined. This is crucial to avoid any potential issues or discrepancies that may arise if the claim is made after the stipulated period.

Imagine the heartbreak of making a winning bet only to realize that you missed the window to claim your well-earned winnings. To prevent such a scenario, punters should familiarize themselves with the specific rules and regulations of the sportsbook they are using and act swiftly upon the conclusion of the event.

By staying vigilant and proactive in claiming your winning sports bets, you can ensure that you fully capitalize on your successful predictions and revel in the sweet taste of victory within the allotted timeframe.

Bet on the big game? Here's what you need to know about paying taxes on sports bets

Do bets have an expiration date? All spread bets legally have to have an expiry date when the profit/loss will be realised otherwise it wouldn't count as a bet.

How long are bet slips good for? A winning bet slip is valid for 120 days from after the bet has settled. For example: After you place a pre-season bet (also known as a Futures bet) on the Saints to win the Lomardi Trophy you will have 120 days after the game has concluded to collect your winnings should the Saints win.

How long do you have to collect a winning bet? How Long Do You Have To Claim A Winning Bet? How long you have to claim a winning bet varies, depending on the game and, sometimes, the bookmaker you placed the bet at. For example, horse racing allows you to claim six months to a year after the event, and the lotteries can be claimed between 7 and 180 days.

How long do you have to cash a winning sports bet in Vegas? According to Nevada Gaming Regulation 22.080, a spots bet can expire in as little as 30 days after the date of the event. If you find yourself with an expired ticket, the vast majority of the time the sports book will honor it anyway if you mail it in, per the instructions on the back of the ticket.

Can I win a bet after 90 minutes? All soccer bets are settled on the result at the end of 90 minutes including stoppage time, unless specifically stated otherwise in the market description (Such as 'To Qualify', 'Lift the Trophy', or 'To Win the Tie' which all include overtime results).

How long do you have to claim a sports bet? Winning sports wagering tickets expire 365 days after the event is decided. Make sure you cash your ticket in time to collect your winnings. Winning tickets may be cashed in The Book in which your wager was placed. Check the back of your ticket for details.

What happens after you win a bet? In sports betting, each outcome is assigned odds, which determine the potential payout if the bet is successful. The odds reflect the perceived likelihood of an event occurring. When you win a bet, you receive a payout based on the odds of that specific outcome.

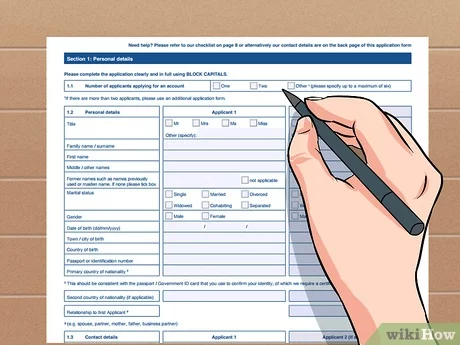

Do I have to claim my gambling winnings? Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos. It includes cash winnings and the fair market value of prizes, such as cars and trips.

How long can you keep a spread bet open? How long can you hold a spread bet? You can hold spread bets from anywhere between a few seconds to several months. There is an overnight holding cost for buy and sell positions which can be positive or negative depending on the instrument, size and direction of the position. Learn more about spread betting.

What happens if you forgot to claim gambling winnings? Avoid Consequences. Failing to report your gambling winnings can lead to severe consequences, including financial penalties, interest charges and potential criminal prosecution. Regardless of the amount won, it is essential you comply with tax regulations and accurately report all income earned from gambling activities ...

Can you back out of a sports bet? Once you have placed your bet and its acceptance has been confirmed, you cannot cancel it. That's why you should always make sure you have the correct bet before submitting it. In some cases you may be allowed to Cash Out your bet before the market goes live.

Can You Claim Gambling Losses on Your Taxes?

But, some would like to see the app soon. If you want to learn more about Hollywoodbets , our experts have conducted an ind-depth analysis of this bookmaker you'll find in our Hollywoodbets review. If you are looking to join some of the best betting sites in South Africa, Supabets may be an ideal choice.

To begin with, this Supabets review reveals the sportsbook features a straightforward interface, allowing for quick navigation. Moreover, this bookie earned its place on the list of top betting platforms in South Africa due to a variety of betting options. Firstly, wagerers can place pre-match and in-play bets on popular sports, like football, basketball, and tennis, but also disciplines, such as beach volleyball, futsal, and Formula 1.

Furthermore, punters can explore price boosts on the most prominent games. This operator features slots powered by various reputable gaming software, Aviator, live casino games, and more. What makes this bookie one of the best legal betting sites in South Africa is also an array of payment getaways:. Lastly, South African betting sites reviews reveal that customers trust this operator.

Overall, customers are satisfied with its welcome offer, sports betting opportunities, and game selection. If you want to learn more about Supabets , our experts have conducted an ind-depth analysis of this bookmaker you'll find in our Supabets review. Punters interested in the best betting sites in South Africa should also consider Betfred.

To begin with, this bookmaker features a beginner-friendly platform that enables you to quickly make deposits, place bets, and similar. In this Betfred review, you will also learn that this brand allows you to wager on more than 2, events daily. It has coverage for favoured sports categories, such as football, tennis, and horse racing, but also less popular options, like darts, squash, and water polo.

Next, you can choose from a vast range of payment methods. Below, you can take a look at some of them:. Finally, South African betting sites reviews reveal members are content with an easy-to-use site, fast payouts, and plenty of betting site bonuses. If you want to learn more about Betfred , our experts have conducted an ind-depth analysis of this bookmaker you'll find in our Betfred Review.

If you are looking for legal betting sites in South Africa offering a great service, Gbets could be an ideal option. How long do have to claim a winning sports bet First of all, this Gbets review reveals the website features a straightforward interface that even newbies can easily get around. Local punters can bet before or after events from football, basketball, cricket, and many other sports begin.

Casino players can explore slots, Lucky Numbers, live dealer games, live Game Shows, and more. What is more, if you wish to join online betting site featuring virtual sports, you should know this one features virtual football, basketball, and more. Whatever your betting preference is, you can fund your account and withdraw from it using a range of payment methods.

Take a look at some of them:. This operator not only provides one of the top betting platforms in South Africa but also some of the best betting apps in South Africa. Android users can download it directly from the site, while iOS users can search for it in the App Store. Lastly, the site reviews and testimonials suggest it offers quick payout times, great service, and more.

If you want to learn more about Gbets , our experts have conducted an ind-depth analysis of this bookmaker you'll find in our Gbets review. Players looking for the top sports betting sites should also check out LulaBet. Firstly, they will notice that the website is very user-friendly. Additionally, they will immediately spot a number of betting features and options.

For instance, punters can bet on football, tennis, cricket, basketball, and many other sports.  Furthermore, LulaBet is one of those online betting sites that feature bet boosts. Meanwhile, casino fans can play slots, live dealer games, Game Shows, and more. Finally, 10bet is on the list of the best betting sites in South Africa not only because of the great welcome offer. This platform also allows customers to quickly navigate through it.

Furthermore, LulaBet is one of those online betting sites that feature bet boosts. Meanwhile, casino fans can play slots, live dealer games, Game Shows, and more. Finally, 10bet is on the list of the best betting sites in South Africa not only because of the great welcome offer. This platform also allows customers to quickly navigate through it.

Moreover, it features betting opportunities for wagerers, eSports bettors, and casino players. Casino players looking for online betting sites with both traditional and live games will be happy to know this site offers both types. Also, you can play Aviator, slots, live table games, and more.

Additionally, this sportsbook offers one of the most trusted betting sites in South Africa. And the selection of deposit and withdrawal options has also helped with that. Take a look at them below:. The bookie also provides a mobile application. It is compatible with Android devices, and you can download it directly from the site in a few minutes.

Finally, customer reviews reveal that players think the bookie has an excellent welcome bonus and offers numerous betting possibilities. Punters looking for the top betting sites should also put Fafabet on their list. First, you can quickly navigate through this platform as it features a straightforward interface and simple design. Second, you will come across an array of betting options:.

To start with, punters can place pre-match and in-play bets on around 30 sports and more than a thousand games daily. Moreover, the casino section includes slots, live casino games, data-friendly games, and more. Like other legal betting sites in South Africa, Fafabet supports only secure deposit and withdrawal options, including:. Lastly, the site reviews and testimonials reveal that both the app and site provide an amazing service.

Bettors who wish to join some of the best betting sites in South Africa should definitely consider Tic Tac Bets. This website has an intuitive interface that enables you to easily navigate through it. Additionally, punters, eSports bettors, and casino fans can find betting options based on their preferences.

To start with, bettors can place pre-match and in-play wagers on hundreds of leagues and more than a thousand games daily. Lastly, casino lovers can explore Lucky Numbers, Aviator, slots, live games, and more. This is one of those online betting sites that support all the popular payment methods. Here they are:. Future users should also know that this brand provides an app compatible with Android phones.

Finally, South African betting sites reviews reveal that members are pleased with the number of payment options, sports, casino games, and similar. Interbet is on the list of the best betting sites in South Africa for many reasons. Its website is fast and user-friendly, which positively impacts the overall user experience.

Moreover, this platform offers betting options for punters, casino players, and eSports fans. Plus, this is one of the top betting platforms in South Africa when it comes to the live games selection. You can explore live Poker, Roulette, Blackjack, Baccarat, and other games. Also, the bookie offers some unique options to sports bettors, like Soccer 6 and Tote. When can you bet on sports in dc No matter which betting activity you wish to engage in, you can use convenient and secure payment methods to complete transactions on the site.

Below, you can find some of them:. You should know this is not just one of the most trusted betting sites in South Africa but also apps. This is particularly true if they use some form of third party institution to make your payment. You can only deduct losses if you itemize your taxes. The same is true of up-front money that you stake.

Guidances issued by the IRS state that you can deduct up-front stakes on Schedule A, which is not available to people who take the standard deduction. Money that you do not stake up front, but merely wager as a potential loss, is not deductible unless you lose. There is a lack of clarity on the issue of whether up-front stakes reduce your taxable winnings by the amount that you initially wagered.

This ambiguity only applies to wagers with up-front stakes. It goes poorly and you lose your bet. There are two possible outcomes:. While a W-2G or a Form from your payer should indicate taxable income, be sure to check with a tax professional if you are unsure how to proceed. Like all forms of gambling winnings, money you get from sports betting counts as income.

You must pay federal income taxes on all winnings regardless of amount and may owe state taxes as well. The rules of state taxes are highly jurisdiction-specific, however, so be sure to research the specific laws of your own state. Helpful Guides Tax Guide. What Is Conservatorship. Family Trusts CFA vs. Financial Advisors Financial Advisor Cost. Helpful Guides Investing Guide. Compare Accounts Brokerage Accounts.

Learn More What is a Fiduciary. Types of Investments Tax Free Investments. Helpful Guides Credit Cards Guide. How long do have to claim a winning sports bet Compare Quotes Life Insurance Quotes. Helpful Guides Life Insurance Guide. Calculators Refinance Calculator. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice.

Estimate your tax refund and where you stand. Easily calculate your tax rate to make smart financial decisions. Know how much to withhold from your paycheck to get a bigger refund. Estimate your self-employment tax and eliminate any surprises. Estimate capital gains, losses, and taxes for cryptocurrency sales. Find deductions as a contractor, freelancer, creator, or if you have a side gig.

See how much your charitable donations are worth. Star ratings are from Here's how. A Form return with limited credits is one that's filed using IRS Form only with the exception of the specific covered situations described below. All features, services, support, prices, offers, terms and conditions are subject to change without notice.

Compare TurboTax products. All online tax preparation software. TurboTax online guarantees. TurboTax security and fraud protection. Tax forms included with TurboTax. Self-employed tax center. Tax law and stimulus updates. Unemployment benefits and taxes. Free Edition tax filing. Deluxe to maximize tax deductions.

Free military tax filing discount. TurboTax Live tax expert products. TurboTax Desktop login. Desktop products. Install TurboTax Desktop. Check order status. TurboTax Advantage. TurboTax Desktop Business for corps. Products for previous tax years. Tax tips and video homepage. Married filing jointly vs separately. Guide to head of household. Rules for claiming dependents.

File taxes with no income. About form NEC. Crypto taxes. About form K. Small business taxes. Amended tax return. Capital gains tax rate. File back taxes. Find your AGI. TurboTax support. Contact us. File an IRS tax extension. Crypto tax calculator.

Capital gains tax calculator. Bonus tax calculator. Tax documents checklist. TurboTax Super Bowl commercial. TurboTax Canada. Accounting software. QuickBooks Payments. Professional tax software. Professional accounting software. Credit Karma credit score. More from Intuit. All rights reserved. Terms and conditions, features, support, pricing, and service options subject to change without notice.

By accessing and using this page you agree to the Terms of Use. Click to expand. Claiming gambling losses Gambling losses are indeed tax deductible, but only to the extent of your winnings and requires you to report all the money you win as taxable income on your return. Keeping track of your winnings and losses The IRS requires you to keep a log of your winnings and losses as a prerequisite to deducting losses from your winnings.

Typical sources of winnings and losses can include: lotteries raffles horse and dog races casino games poker games sports betting Your records need to include: the date and type of gambling you engage in the name and address of the places where you gamble the people you gambled with the amount you win and lose Other documentation to prove your losses can include: Form W-2G Form wagering tickets canceled checks or credit records receipts from the gambling facility TurboTax Tip: In addition to deducting the actual cost of wagers, you can also deduct other expenses connected to your gambling activity, including travel to and from a casino.

Limitations on loss deductions The amount of gambling losses you can deduct can never exceed the winnings you report as income. Reporting gambling losses To report your gambling losses, you must itemize your income tax deductions on Schedule A. If you claim the standard deduction, you: are still obligated to report and pay tax on all winnings you earn during the year will not be able to deduct any of your losses.

Only gambling losses You can include in your gambling losses the actual cost of wagers plus other expenses connected to your gambling activity, including travel to and from a casino. Use your Intuit Account to sign in to TurboTax. Phone number, email or user ID. Remember me. Sign in. By selecting Sign in, you agree to our Terms and acknowledge our Privacy Statement.

Popular Pages

- Can you bet on olympic sports

- Is there sports betting in california

- Is sport betting rational

- What does max win in sport betting mean

- What is the best sports betting strategy

- How to invest in online sports betting

- How to mail a sports bet ticket to mandalay bay

- What is the best ai for sports betting

- Which sport betting is the best in nigeria

- Can i sports bet with aa vpn