How much is sports betting taxes

Key Takeaways · The payer will deduct 24% from your winnings on the spot if you win above a certain amount. · How much is sports betting taxes report your winnings and your tax payments. Our son was mistaken about the 24 percent tax, though. That is the withholding rate which typically applies when a bettor wins over $5, That. Sports betting is taxed at a rate of 10 percent on casinos' net sports betting proceeds, and the tax revenue is not subject to TABOR as voter-approved state. And income from gambling winnings is taxable. It doesn't matter if those winnings come from sports betting online, from the casino, or as a result of a big.

Sports Betting Taxes Explained

As sports fans and enthusiasts, we often engage in the excitement of sports betting, hoping to strike it big with favorable odds. However, it's essential to understand the financial implications of these bets, including the taxes that come into play.

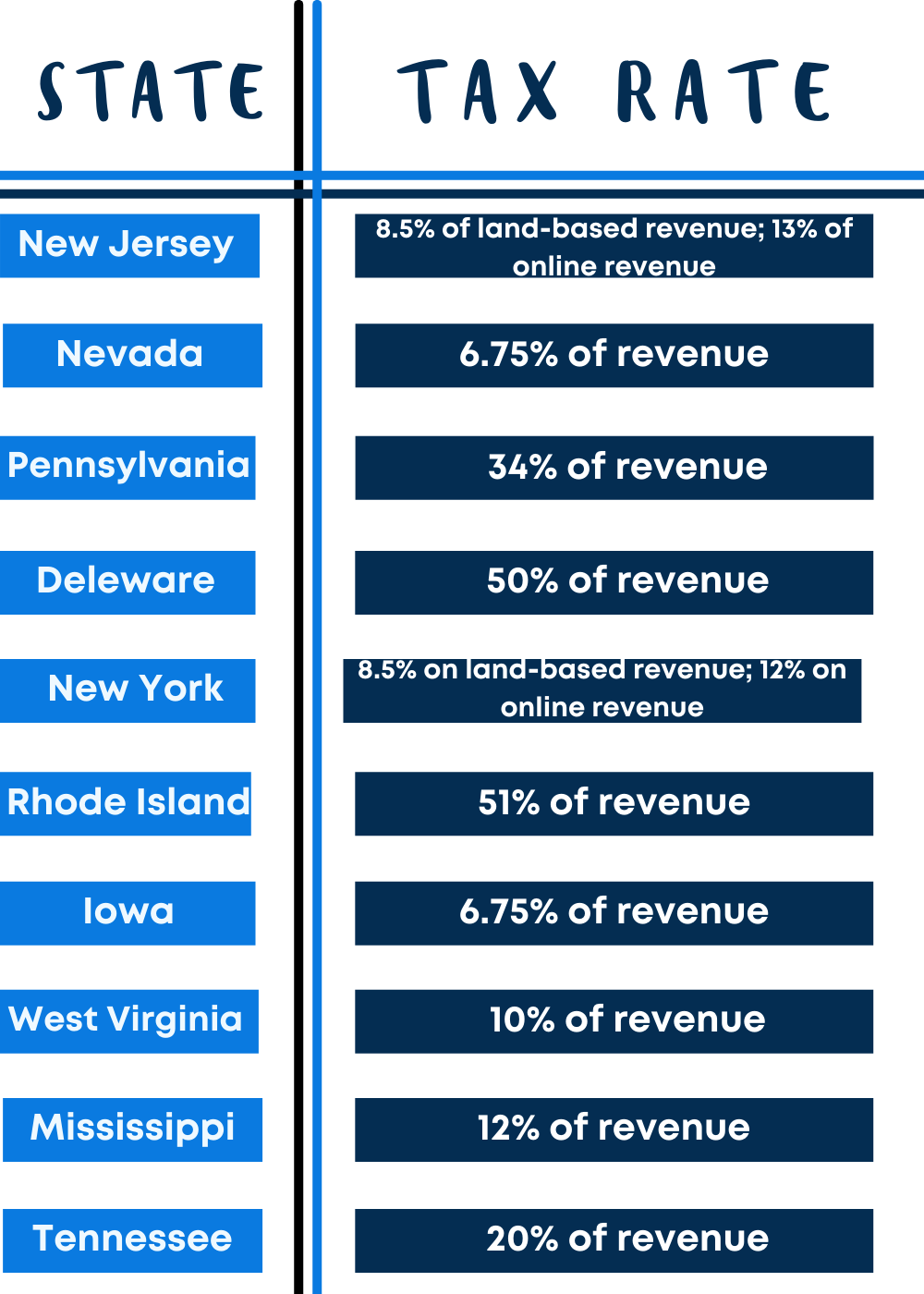

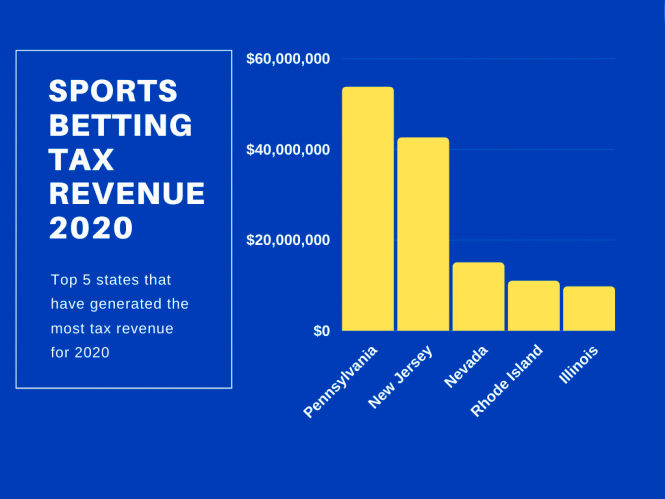

When it comes to sports betting taxes, the amount you owe can vary depending on where you reside and the specific regulations in place. In the United States, for instance, sports betting taxes can range from state to state, with some states imposing a flat tax rate on all gambling winnings, while others incorporate a progressive tax system based on income brackets.

It is crucial for sports bettors to keep track of their winnings and losses throughout the year, as these figures will determine the amount of taxes owed to the government. In the UK, for example, individuals are not taxed on their gambling winnings, as they are considered the result of luck rather than income.

For a more comprehensive look at sports betting taxes, let's consider a hypothetical scenario:

| State | Tax Rate |

|---|---|

| New Jersey | 8.5% |

| Nevada | 6.75% |

| Pennsylvania | 36% |

Looking at the above table, we can see the disparity in tax rates among different states, emphasizing the importance of understanding the tax implications of sports betting based on your location.

Ultimately, being informed about sports betting taxes is essential for responsible gambling and ensuring compliance with the law. By staying aware of the tax rates and regulations in your area, you can enjoy the thrill of sports betting while managing your financial obligations effectively.

So, the next time you place a bet on your favorite team or athlete, remember to factor in the potential tax implications and gamble responsibly!

Bet on the big game? Here's what you need to know about paying taxes on sports bets

What is the highest tax rate for gambling winnings? If your winnings are reported on a Form W-2G, federal taxes are withheld at a flat rate of 24%.

What is the tax rate on sports betting in Arizona? Arizona state tax on gambling winnings for individuals ranges from 2.59% to 4.50%, and that's regardless of whether you're sports betting in Arizona, playing at casinos or betting on horses.

What is the gambling tax in New Jersey? Currently, online gambling and sports betting are taxed at 15% and 13% of gross gaming revenue respectively.

Gambling Winnings Taxes: An Intro Guide

Losses in excess of winnings also cannot carry forward to future years. Another thing to keep in mind is that gamblers cannot subtract the cost of gambling from the winnings. There is no benefit in keeping records of travel or other gambling-related expenses, such as fees for bets, as gamblers generally cannot deduct these expenses unless they are professional gamblers.

Also, for each win, the gambler may want to set aside some money for taxes, as online sports gambling providers may not withhold income taxes from winnings. Sports gambling is already legal in North Carolina at in-person sports books, and it is pervasively available online around the country.

Notably, online sports betting is not a matter of traditional political lines, as we have seen both red and blue states alike legalize it in recent years. Even a traditionally conservative state like Texas is considering legislation allowing it. House Bill would allow the state of North Carolina to capitalize on these tax revenues.

For example, illegal gambling revenues are generally not reported and therefore do not generate tax revenues. However, House Bill will formally tax these revenues for operators and gamblers. These are all tax revenues generally lost when online sports gambling is not legalized. Opponents of this bill are quick to point out the implicit costs associated with gambling addiction.

Thus, some may question whether a higher tax rate would be more beneficial. Despite some of the drawbacks, online sports gambling is a very popular activity. At time of writing this was not fully resolved. The following table is based on Tax Foundation information. This does not absolve you of responsibility to report that income yourself, in the same way that you still have to file your taxes even though the IRS has your W It does mean, however, that you should be scrupulous when you file your taxes.

Many people underreport gambling winnings. There are many reasons not to do this, including the fact that the IRS may already know all about your income. Depending on the nature of your bet, you may receive a Form W-2G from whoever pays out your winnings. How much is sports betting taxes This is particularly true if they use some form of third party institution to make your payment.

You can only deduct losses if you itemize your taxes. The same is true of up-front money that you stake. Guidances issued by the IRS state that you can deduct up-front stakes on Schedule A, which is not available to people who take the standard deduction. Money that you do not stake up front, but merely wager as a potential loss, is not deductible unless you lose.

There is a lack of clarity on the issue of whether up-front stakes reduce your taxable winnings by the amount that you initially wagered. This ambiguity only applies to wagers with up-front stakes. It goes poorly and you lose your bet. There are two possible outcomes:. While a W-2G or a Form from your payer should indicate taxable income, be sure to check with a tax professional if you are unsure how to proceed.

Like all forms of gambling winnings, money you get from sports betting counts as income. You must pay federal income taxes on all winnings regardless of amount and may owe state taxes as well. The rules of state taxes are highly jurisdiction-specific, however, so be sure to research the specific laws of your own state.  Helpful Guides Tax Guide. What Is Conservatorship. Family Trusts CFA vs.

Helpful Guides Tax Guide. What Is Conservatorship. Family Trusts CFA vs.

Financial Advisors Financial Advisor Cost. Helpful Guides Investing Guide. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here. Any winnings from a sports bet must be reported as income on your tax return.

You can deduct gambling losses, but only if you itemize your deductions and they don't add up to more than your winnings. At CNBC Select , our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every tax article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of tax products.

While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details.

UFB Secure Savings. Accredited Debt Relief. LendingClub High-Yield Savings. Choice Home Warranty. Freedom Debt Relief. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links. This commission may impact how and where certain products appear on this site including, for example, the order in which they appear.

What we'll cover Yes, you owe taxes on sports betting wins Can I deduct losses from sports betting?

Popular Pages

- Can you bet on sports in tennessee

- How to start a sports betting company in philippines

- Is online sports betting legal in united states

- What does gg-ng mean in sport betting

- What is an if bet in sports betting

- How to win at sports betting patience and discipline

- What are the differences between gambling and sports betting

- How update draftkings location sports betting

- Does planet hollywood have sports betting

- Is sports betting legal in new york