Is sports betting money taxed

How are gambling winnings taxed? When you win, your winnings are treated as taxable income. Even non cash winnings like prizes are to be. The U.S. Census Bureau's Quarterly Survey of State and Local Tax Revenue (QTAX) recently added sports betting (including pari-mutuels) to the. For most other forms of gambling, the government typically taxes a gambling operator's revenue. That is, the state taxes what the operators collected after they. Is sports betting money taxed winnings, per the IRS, “are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited.

Is Sports Betting Money Taxed?

Sports betting has become an increasingly popular activity worldwide, with millions of people placing bets on their favorite teams and events. However, one question that often arises in the minds of bettors is whether the money they earn from sports betting is subject to taxation.

Many sports enthusiasts wonder whether they need to report their sports betting winnings and pay taxes on them. The answer to this question is a bit complex and varies depending on the country and its laws regarding gambling and taxation.

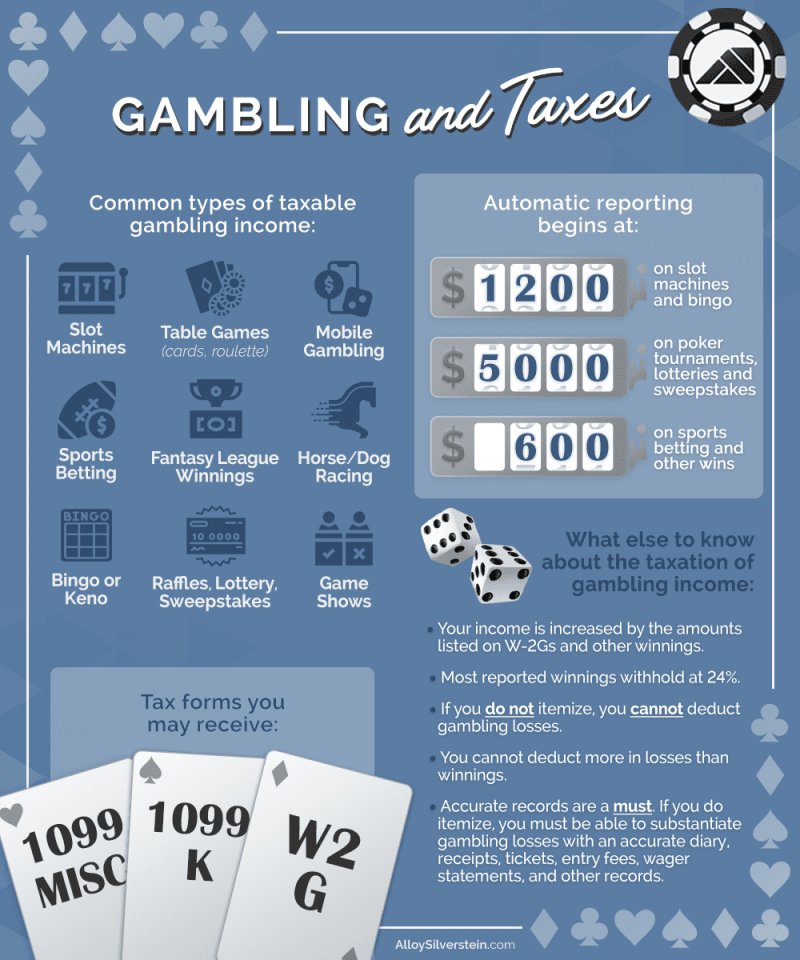

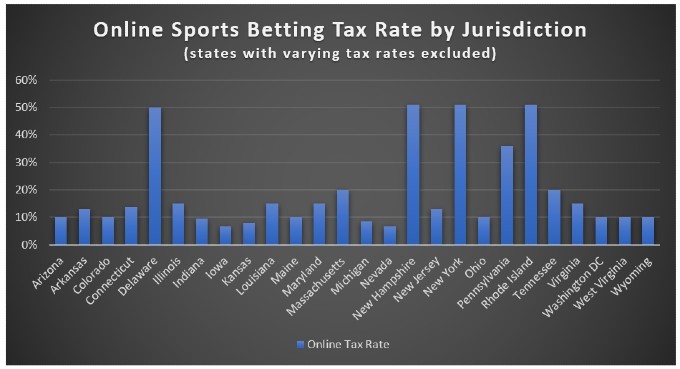

In general, sports betting winnings are taxable income in most countries. Whether you are a professional bettor or a casual player, you are expected to report your winnings to the tax authorities and pay the necessary taxes on them. The amount of tax you will need to pay on your sports betting earnings can differ based on various factors, including the amount of money you win, your total income for the year, and the specific tax laws in your country.

It's essential to keep detailed records of your sports betting activities, including your wins and losses, as well as any related expenses. Keeping accurate records will help you calculate your taxable income correctly and avoid any potential issues with the tax authorities.

Some countries have specific regulations and tax rates for gambling and sports betting. For instance, in the United States, sports betting winnings are considered taxable income, and you are required to report them on your federal tax return. However, you can also deduct your gambling losses up to the amount of your winnings if you itemize your deductions.

Overall, while the taxation of sports betting winnings can be a bit of a maze, it's crucial to stay informed about the tax laws in your country and comply with your tax obligations. Failing to report your sports betting income could lead to penalties and legal consequences down the road.

Gambling Winnings Taxes: An Intro Guide

Where does tax money from sports betting go? Legalized sports betting is a growing business in many U.S. states and the tax revenue it generates funds various state resources from roads and highways to public education, law enforcement and gambling addiction programs.

Bet on the big game? Here's what you need to know about paying taxes on sports bets

If you engage in gambling activities as a means of livelihood and pursue it regularly as a professional gambler, then some rules can vary. However, deductions from losses that exceed the income of your winnings are still not allowed. While casual gamblers only need to report their winnings as part of their overall income on their tax forms, professional gamblers may file a Schedule C as self-employed individuals.

They may be able to deduct their gambling-related expenses, such as travel or casino entry fees, to determine their net income. In regards to losses, deductions for gambling losses must be less than or equal to gambling winnings. You can deduct losses from your gambling, but only if you itemize your deductions and keep an accurate record of your winnings and losses.

The amount of losses you deduct cannot be more than the amount of gambling winnings you report on your tax return. Under tax reform, you can only deduct losses directly related to your wagers and not non-wagering expenses like travel-related expenses to gambling sites. Gambling losses can be deducted up to the amount of gambling winnings.

Whereas your winnings are reported by the payer on a Form W2-G, your losses may not be reported. You will have to produce other documentation to validate the deduction. This can include:. It may also be possible to establish your losses by keeping some type of detailed log. This log should include information such as the:. No matter what moves you made last year, TurboTax will make them count on your taxes.

More from TurboTaxBlogTeam. Hi Bob, Unfortunately you can only deduct losses up to your winnings and you have to be able to itemize your tax deductions. Table of Contents What types of gambling winnings are considered taxable income. How are gambling winnings taxed. Is sports betting money taxed Do sportsbooks and casinos report gambling winnings to the IRS. Are gambling winnings taxed on both the federal and state level?

How to report your gambling winnings on your taxes Are the rules different for professional gamblers. Can you deduct gambling losses. Do they know what they're up against. Laura Saunders: I think they don't. And I bet their parents don't know either. Now, maybe this is a little bit like household help. Most people don't pay attention to the law. But there's a slice of people that need to be very concerned.

If their children are doing sports betting, and the child is a dependent like a college student. Then the child probably needs to file a return.  The gambling winnings or taxable is ordinary income. The losses are probably not deductible. There's no standard deduction. It gets really complicated really fast. And there's some questions we don't even know the answer to, like whether those winnings are subject to the kiddie tax.

The gambling winnings or taxable is ordinary income. The losses are probably not deductible. There's no standard deduction. It gets really complicated really fast. And there's some questions we don't even know the answer to, like whether those winnings are subject to the kiddie tax.

That's when it income is taxed at the parents' rate. But it is an important thing for parents to be aware of if their children are doing online sports betting. Whalen: So, with all the betting going on below the threshold, you talked about that the IRS wants to know about, there's a lot of honor system stuff going on here, isn't there?

Laura Saunders: Well, I think the best advice that I heard from the professionals is to keep a very, very good record of your wins and losses. The IRS knows that most people who are betting or gambling are losing more than they win. And so if you can show the IRS that you lost more than you won, you may not have a problem with all this in an audit.

But you need to have the records, and many people don't do that. Whalen: Now, you've spoken to CPAs and tax advisors about this. What do they tell their clients that do a lot of betting. Laura Saunders: I did talk to a CPA at a firm that handles a lot of returns for online sports betters and other gamblers, and are very familiar with this.

And when he talks to his clients and he explains the rules, he says, "They're really surprised. Everybody wins except the gambler himself. Full Transcript This transcript was prepared by a transcription service. Whalen: And then that gets reported to the IRS. Whalen: But not everybody wins on every bet.

How do their losses fit into this equation. Whalen: And does that have to do with the standard deduction being raised. Laura Saunders: Yes, there absolutely is. Whalen: And so how does that work. Whalen: Well, that's been the formula for a hundred years, hasn't it. Laura Saunders: Yeah, and longer, maybe much longer. Join them every weekday. Send your feedback to pwpodcast wsj.

In minutes, get caught up on the best Wall Street Journal scoops and exclusives, with insight and analysis from the award-winning reporters that broke the stories. Hosted by Annmarie Fertoli and Luke Vargas. Hosted by Zoe Thomas. The Journal. The most important stories, explained through the lens of business. How to win at sports betting guaranteed A podcast about money, business and power.

Your Money Briefing Your Money Briefing is your personal-finance and career checklist, with the news that affects your money and what you do with it. Hosted by J. In less than 20 minutes, we cut through the noise to explain the major business and financial news that may move markets, all so you can make smarter investing decisions and take on the week with confidence.

Episodes drop Sundays. Hosted by Dion Rabouin. The Future of Everything offers a kaleidoscope view of the nascent trends that will shape our world. In every episode, join our award-winning team on a new journey of discovery. Baker will welcome his guests from the worlds of politics, philosophy, and culture for wide-ranging dialogues that will enlighten and fascinate listeners.

Episodes will be released each week. With actionable steps grounded in WSJ reporting, As We Work gives practical advice to help you improve your work life. Hear compelling conversations with everyday people, experts and WSJ reporters as we focus on the workplace topics that are top of mind and offer tips and tricks for handling the thorniest of situations. Say hello to brand new revenue streams and more sustainable business models as data is shared across the value chain.

Bad Bets Bad Bets unravels big-business dramas that have had a big impact on our world. In Season 2, we delve into the story of Nikola founder Trevor Milton, who promised a future of zero-emission trucks but was taken down by a ragtag bunch of whistleblowers and short sellers. Season 2 is hosted by Ben Foldy.

Secrets of Wealthy Women Empower yourself financially. Successful women executives, workplace pioneers, self-made entrepreneurs, industry trendsetters and money-savvy experts reveal insights on how to get ahead, reach your goals, and achieve professional success. They join host Veronica Dagher every Wednesday.

Popular Pages

- Is sports betting profitable

- Why are there so many sports betting ads

- Do they bet on sports in australia

- Is sports betting legal in switzerland

- How to delete a sports bet account

- Why betting on yourself in professional sport is illegal

- How i got banned from sports betting

- Can you cash out sports bet easy

- Is sports betting better than casino

- Is sports betting legal in vermont