Do i have to pay taxes on sports betting winnings

It is important to note that all gambling winnings, like winning your Fantasy Football league, are subject to tax – even if the amount is less. Sports gambling winnings are do i have to pay taxes on sports betting winnings to income tax and you must report them on your tax return, even if you don't receive tax documentation for the gambling. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings. Sports betting winnings in Ohio are taxed as income and should be reported as such on tax forms. If you win more than $, the sportsbook is supposed to supply.

Understanding Tax Implications on Sports Betting Winnings

As a passionate sports fan and occasional bettor, one key element that often gets overlooked is the taxation aspect of sports betting winnings. It's crucial to grasp the legal responsibilities and potential financial implications that come with profiting from sports wagering.

Do I Have to Pay Taxes on Sports Betting Winnings?

Yes, you are required to pay taxes on sports betting winnings in most countries, including the United States. While the rules may vary depending on your location, the general consensus remains the same: sports betting winnings are considered taxable income and must be reported to the appropriate tax authorities.

Understanding Tax Reporting Requirements

When it comes to documenting your sports betting earnings, accuracy and transparency are key. Many jurisdictions require individuals to report their gambling winnings on their annual tax returns. The specifics can differ based on whether you're a casual bettor or a professional gambler.

Internal Revenue Service (IRS) Guidelines

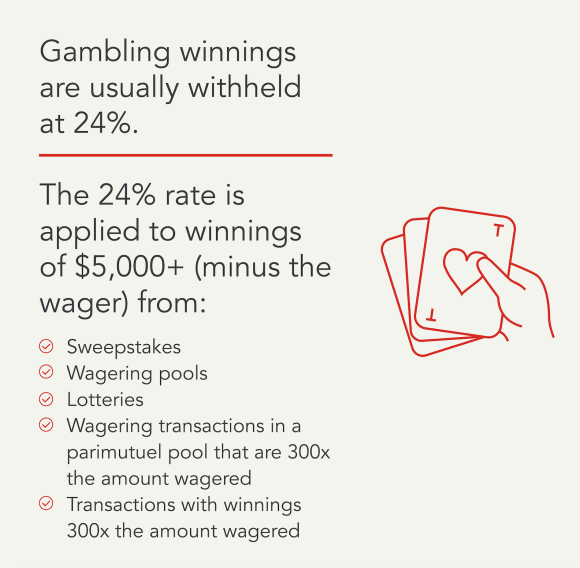

In the United States, the IRS mandates that all gambling winnings, including those from sports betting, are subject to federal income tax. This includes winnings from casinos, lotteries, and other forms of betting. The tax rate can vary and depends on the amount won and your overall income bracket.

Keeping Track of Your Winnings and Losses

To accurately report your sports betting income, it's essential to maintain detailed records of your wins and losses. This documentation will not only help you stay compliant with tax laws but also provide a clear picture of your financial standing.

Consulting with a Tax Professional

If you're unsure about how to navigate the tax implications of your sports betting activities, seeking guidance from a tax professional is highly recommended. They can offer personalized advice based on your situation and ensure that you fulfill your tax obligations correctly.

In Conclusion

While the prospect of winning big on sports bets is undoubtedly thrilling, it's crucial to remember that taxation is an integral part of the equation. By staying informed about the tax laws that govern sports betting winnings and fulfilling your reporting requirements, you can enjoy your earnings responsibly and avoid any potential legal complications.

What Taxes Are Due on Gambling Winnings?

Do people actually report gambling winnings? When you win, your winnings are taxable income, subject to its own tax rules. You are required to report all gambling winnings—including the fair market value of noncash prizes you win—as “other income” on your tax return. You can't subtract the cost of a wager from your winnings.

Do You Have to Pay Sports Betting Taxes?

You will need to file an Illinois return to get any withholding refunded to you. Question Question Do I have to pay income tax on gambling winnings if I already paid the tax in the state where I won the money. Answer Answer Page Content If you were an Illinois resident when the gambling winnings were earned, you must pay Illinois Income Tax on the gambling winnings.

Answers others found helpful. What other income is NOT allowed as a subtraction on my individual income tax return. Who is required to withhold Illinois Income Tax. I donated money on my original tax form, can I change these amounts on my ILX. Footer Back to top. The first rule is that the IRS requires you to report all winnings, whether the place that you gambled reports them to the IRS or not.

For example, if you hit the trifecta on Derby Day, you are required to report the winnings as income. You are not permitted to "net" your winnings and losses. Cash is not the only kind of winnings you need to report. If you win a new laptop in a raffle, this counts as income, too. If you score big, you might even receive a Form W-2G reporting your winnings. The tax code requires institutions that offer gambling to issue Forms W-2G if you win:.

Table games in a casino, such as blackjack, roulette, baccarat, or craps are exempt from the W-2G rule. This allows you to deduct costs associated with your gambling activity, including meals and travel expenses. Yes and no. Do i have to pay taxes on sports betting winnings Deductions from losses that exceed your winnings still are not allowed.

The U. Supreme Court ruled in in the case of Commissioner vs. Groetzinger that deductions for losses cannot exceed the income from winnings. This is an important distinction, because you can deduct your other costs of doing business on Schedule C, ultimately reducing your taxable income.

For example, you can deduct the costs of:. Your expert will uncover industry-specific deductions for more tax breaks and file your taxes for you. Backed by our Full Service Guarantee. You can also file taxes on your own with TurboTax Premium. Get unlimited advice, an expert final review and your maximum refund, guaranteed.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Estimate your tax refund and where you stand. Easily calculate your tax rate to make smart financial decisions.  Know how much to withhold from your paycheck to get a bigger refund.

Know how much to withhold from your paycheck to get a bigger refund.

Estimate your self-employment tax and eliminate any surprises. Estimate capital gains, losses, and taxes for cryptocurrency sales. Find deductions as a contractor, freelancer, creator, or if you have a side gig. See how much your charitable donations are worth. Star ratings are from Here's how. A Form return with limited credits is one that's filed using IRS Form only with the exception of the specific covered situations described below.

All features, services, support, prices, offers, terms and conditions are subject to change without notice. Compare TurboTax products. All online tax preparation software. TurboTax online guarantees. TurboTax security and fraud protection. Tax forms included with TurboTax. Self-employed tax center.

Tax law and stimulus updates. Unemployment benefits and taxes. Free Edition tax filing. Deluxe to maximize tax deductions. Free military tax filing discount. TurboTax Live tax expert products. TurboTax Desktop login. Desktop products. Install TurboTax Desktop. Check order status. TurboTax Advantage. TurboTax Desktop Business for corps.

Products for previous tax years. Tax tips and video homepage. Married filing jointly vs separately. Guide to head of household. Rules for claiming dependents. Can you mystery bet on sports bet File taxes with no income. About form NEC. Crypto taxes. About form K. Small business taxes. Amended tax return. Capital gains tax rate. File back taxes. Find your AGI. TurboTax support.

Contact us. File an IRS tax extension. Crypto tax calculator. Capital gains tax calculator. Bonus tax calculator. Tax documents checklist. TurboTax Super Bowl commercial. TurboTax Canada. Accounting software. QuickBooks Payments. Professional tax software. Do i have to pay taxes on sports betting winnings Professional accounting software. Credit Karma credit score.

More from Intuit. All rights reserved. Terms and conditions, features, support, pricing, and service options subject to change without notice. By accessing and using this page you agree to the Terms of Use. Click to expand. You are required to report your winnings The first rule is that the IRS requires you to report all winnings, whether the place that you gambled reports them to the IRS or not.

You have to itemize your deductions to claim your gambling losses as a tax deduction. Use your Intuit Account to sign in to TurboTax. Phone number, email or user ID. Remember me. Sign in. By selecting Sign in, you agree to our Terms and acknowledge our Privacy Statement. New to Intuit. Create an account.

Max refund guarantee. Start for free. Looking for more information. How Are Gambling Winnings Taxed. Tax Bracket Calculator Easily calculate your tax rate to make smart financial decisions Get started. W-4 Withholding Calculator Know how much to withhold from your paycheck to get a bigger refund Get started.

Self-Employed Tax Calculator Estimate your self-employment tax and eliminate any surprises Get started. Crypto Calculator Estimate capital gains, losses, and taxes for cryptocurrency sales Get started. Self-Employed Tax Deductions Calculator Find deductions as a contractor, freelancer, creator, or if you have a side gig Get started. Read why our customers love Intuit TurboTax Rated 4.

Your security. Built into everything we do. File faster and easier with the free TurboTax app. Excludes payment plans. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns.

Popular Pages

- Can you actually make cash of sports bet

- Is thw sports bet app legit on android

- Has kansas legalized sports betting

- How to bet on sports in nyc in person

- Is betting on sports with a bookie illegal

- When will online sports betting be legal in maryland

- When can i bet on sports in illinois

- How many states in the us have legalized sports betting

- Can you make more money sports trading vs matched betting

- Are sports betting apps legal in california