Do i have to report sports betting on taxes

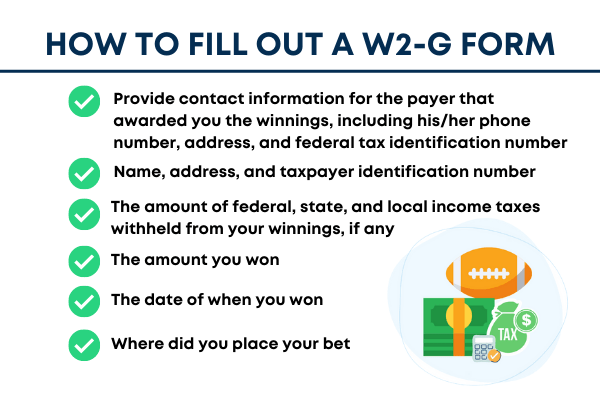

If you win more than $, the sportsbook is supposed to supply you with a federal W-2G form on which to report the winnings. If you win $5, or more, do i have to report sports betting on taxes. You'll report your winnings and your tax payments when you file your annual tax return. You may then have to pay more in taxes or you may get a refund. Taxpayers should be reporting all types of wagering and gambling winnings on their tax returns as “other income,” including winnings from. Sports gambling winnings are subject to income tax and you must report them on your tax return, even if you don't receive tax documentation for the gambling.

Do I Have to Report Sports Betting on Taxes?

As a sports enthusiast and occasional bettor, a common question that often comes to mind is whether I need to report my sports betting activities on my taxes. In the world of gambling and sports wagering, the intricacies of tax implications can be as complex as a last-minute transfer deal in football. Let's dive into the details to get a better understanding.

The Legal Aspect

The main thesis: In most countries, including the United States, any income earned from sports betting is considered taxable.

When it comes to reporting sports betting on taxes, one must understand the legal requirements governing gambling activities. The regulations differ from country to country, but in general, any winnings from sports betting are subject to taxation. In the U.S., for instance, the IRS expects individuals to report all gambling winnings, including those obtained from sports betting, on their tax returns.

Keeping Records

The main thesis: Maintaining detailed records of your sports betting activities is crucial for tax purposes.

To ensure compliance with tax laws and regulations, it is essential to keep thorough records of your sports betting endeavors. This includes documenting the dates, amounts wagered, winnings, and losses. By maintaining accurate records, you can not only facilitate the tax reporting process but also safeguard yourself in case of an audit or scrutiny by tax authorities.

Tax Deductions and Offsetting Losses

The main thesis: In some jurisdictions, losses incurred from sports betting may be deductible to offset taxable winnings.

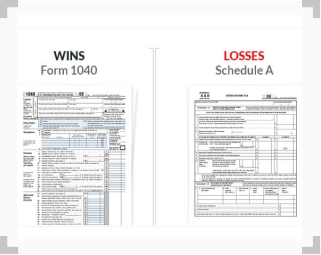

While reporting sports betting winnings is imperative for tax purposes, it is also crucial to consider the deductibility of gambling losses. In certain jurisdictions, individuals can deduct gambling losses up to the amount of their reported winnings. This provision allows bettors to offset taxable winnings with documented losses, thereby potentially reducing their overall tax liability.

Conclusion

When it comes to the taxing nature of sports betting, one must tread carefully to ensure compliance with the law. By understanding the legal requirements, maintaining meticulous records, and exploring potential deductions, individuals can navigate the intricate landscape of sports betting and taxation with greater ease. Remember, just like a transfer saga in the football world, the stakes are high when it comes to reporting sports betting on taxes.

Sports Betting Taxes: Do You have to pay taxes on bets?

Topic no. 419, Gambling income and losses

At CNBC Select , our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every tax article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of tax products.

While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. Skip Navigation.

Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. UFB Secure Savings. Accredited Debt Relief. LendingClub High-Yield Savings. Choice Home Warranty. Freedom Debt Relief. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links. This commission may impact how and where certain products appear on this site including, for example, the order in which they appear.

What we'll cover Yes, you owe taxes on sports betting wins Can I deduct losses from sports betting. How much are taxes on sports betting wins. How to report sports betting wins you had in Bottom line. Do i have to report sports betting on taxes That includes cash winnings and the fair market value of cars, trips and other prizes, too. Learn More. On TurboTax's secure site.

Cost Costs may vary depending on the plan selected - click "Learn More" for details. Available with some pricing and filing options. Read more. TurboTax's software is easy to use but can be expensive for complicated returns. Here's a breakdown of its offerings. Here's how you can file your taxes for free.

Living in these 9 states means you don't pay income tax, but here's what to watch out for. Find the right savings account for you. Latest This is the best budgeting app to help investors track their money Jasmin Suknanan 5 best credit cards with pre-approval or pre-qualification Jason Stauffer American Express Blue Business Cash review: Keep it simple with this cash-back card Jason Stauffer.

Sports enthusiasts and those interested in wagering will benefit from understanding how gambling will affect their tax bill.  In North Carolina, gambling winnings are, and have always been, taxable both at the state and federal level. Therefore, individuals engaging in sports betting will need to keep track of their winnings.

In North Carolina, gambling winnings are, and have always been, taxable both at the state and federal level. Therefore, individuals engaging in sports betting will need to keep track of their winnings.

Gamblers will also want to keep track of their losses because gambling losses can sometimes reduce taxes. Importantly, all gambling winnings are reported as taxable income. Even if the individual itemizes, gambling losses totaling more than gambling winnings are not deductible. Losses in excess of winnings also cannot carry forward to future years.

Another thing to keep in mind is that gamblers cannot subtract the cost of gambling from the winnings. There is no benefit in keeping records of travel or other gambling-related expenses, such as fees for bets, as gamblers generally cannot deduct these expenses unless they are professional gamblers.

Also, for each win, the gambler may want to set aside some money for taxes, as online sports gambling providers may not withhold income taxes from winnings. Sports gambling is already legal in North Carolina at in-person sports books, and it is pervasively available online around the country.

Notably, online sports betting is not a matter of traditional political lines, as we have seen both red and blue states alike legalize it in recent years. Even a traditionally conservative state like Texas is considering legislation allowing it. House Bill would allow the state of North Carolina to capitalize on these tax revenues.

For example, illegal gambling revenues are generally not reported and therefore do not generate tax revenues. However, House Bill will formally tax these revenues for operators and gamblers. These are all tax revenues generally lost when online sports gambling is not legalized.

Opponents of this bill are quick to point out the implicit costs associated with gambling addiction. Thus, some may question whether a higher tax rate would be more beneficial. Despite some of the drawbacks, online sports gambling is a very popular activity. Given the legalization of other gambling activities like the lottery, the widespread legalization of online sports gambling in many states across the country, and the inherent benefits that greater tax revenues will afford, this move by North Carolina legislators appears warranted.

Popular Pages

- Does nathan brown own sports bet

- Can you sports bet in vegas

- How old for sports betting

- Can you bet on sports in alabama

- What cards can i use on sports bet

- Why is silver ferns nz suspended on sports bet

- What wesbite can you make sports bets on

- Which sports books in mississippi have horse race betting

- Who will win the australian federal election 2019 sports bet

- When will sports betting be legal in dc