Do you pay taxes on sports bet winnings

Are winnings reportable on your tax return even if you did not receive a Form W2G or Form MISC? Absolutely so. Taxpayers should be reporting. All online gambling winnings, whether placed online or in person at casinos, are taxable. That includes winnings from sports betting, slot. Taxes on gambling winnings: You might get a Form W-2G Generally, you'll receive an IRS Do you pay taxes on sports bet winnings W-2G if your gambling winnings are at least $ and the payout is. When you win, your winnings are taxable income, subject to its own tax rules. TABLE OF CONTENTS. You are required to report your winnings; Form.

The Tax Game: What Happens When Sports Betting Pays Off?

Dear football enthusiasts, today we delve into a different kind of game win. The exhilarating world of sports betting serves as an adrenaline-filled pastime with its share of thrills—anticipating your favored team’s victory can be almost as exciting as the win itself. But what's the score on taxation when luck finally smiles your way?

Victory celebrations can sometimes be dampened by the imposing presence of tax regulations. Yes, the taxman lurks even in the realm of sports betting wins.

So, do you pay taxes on those hard-earned sports bet winnings that light up your day? The answer, much like a VAR decision, can be somewhat complex.

Tax liability on sports betting winnings largely depends on your country’s stance on gambling earnings. In some regions, these earnings are seen as a form of income and are taxed accordingly. On the flip side, some countries exempt casual bettors from taxing their winnings.

For example, in the United States, sports betting winnings are considered taxable income. The burden of reporting these earnings falls squarely on the individual. Casinos and sportsbooks may even withhold a portion of larger wins to comply with tax laws.

Let’s consider an illustrative scenario with and without taxation implications in the United States:

| Scenario | Winning Amount | Tax Rate | Net Winnings After Tax |

|---|---|---|---|

| With Taxation | $1,000 | 25% | $750 |

| Without Taxation | $1,000 | N/A | $1,000 |

So before you start counting your winnings, be sure to know the rules of the tax game. Ignoring tax obligations can lead to penalties that can turn a joyous win into a financial headache. Remember, transparency and compliance are key when celebrating victories within the betting arena.

As sports enthusiasts bidding for success, let’s not forget that in the world of tax, scoring big also demands sharing the spoils with the tax authorities. Play smart, win big, and remember to stand by your financial playbook to avoid any surprises down the line.

Until next time, keep betting wisely and may the odds be ever in your favor!

Gambling Income: What It Is, How It Works, and Advantages

How much can I win in Vegas without paying taxes? Do sportsbooks and casinos report gambling winnings to the IRS? If you win at a sportsbook or casino, they are legally obligated to report your winnings to the IRS and to you if you win up to a certain amount ($600 on sports, $1,200 on slots, and $5,000 on poker).

Can tourists play Toto Singapore? I would do try to play the lottery when I am there. Am i eligible ? Yes, there are no restrictions on non-residents on buying the lottery or claiming of prize winnings.

Is gambling legal in Kuala Lumpur? Gambling is criminalised in Malaysia, unless its betting on licensed sweepstakes, horse racing in the three turf clubs or at a certain highland resort casino.

Is it illegal to gamble in Malaysia? Gambling, both legal and illegal forms, is very popular in Malaysia. Some forms of gambling, such as lotteries, casino games and horse racing, are legal in Malaysia, whereas all forms of sports betting (at bookmakers) and online gambling are illegal.

Do Americans pay tax on casino wins? In the United States, gambling wins are taxable. The Internal Revenue Code contains a specific provision regulating income-tax deductions of gambling losses. Under Section 165(d) of the Internal Revenue Code, losses from “wagering transactions” may be deducted to the extent of gains from gambling activities.

Are casino winnings taxable in Singapore? Winnings received are not taxable as they are windfalls and not considered as an income. You do not need to declare the winnings in your Income Tax Return.

Does Nevada tax gambling winnings? You can choose to have taxes withheld if you win less than $5,000 and a W2-G is issued. The gambling establishment is required to withhold taxes if you win $5,000 or more and it triggers a W2-G. The standard withholding amount is 24% from gambling winnings.

Is gambling taxable in Malaysia? Taxation of Online Casino Winnings

How much are gambling winnings taxed in Singapore? Do you have to declare your winnings and are they taxable? Well, good news: according to the Inland Revenue Authority of Singapore (IRAS), "winnings received are not taxable as they are windfalls and not considered as an income". Hence, you do not need to declare the winnings in your income tax return.

The income from online gambling is taxable under the Income Tax Act 1967. Per the IRBM, any form of gambling winnings, whether from land-based casinos or online platforms, is deemed income and should be declared for tax purposes.What Taxes Are Due on Gambling Winnings?

Some states have legalized sports betting while others have not. Some states have pending legislation to make sports betting legal. In Florida, Vermont, and Maine, sports betting is legal but not operational as of Oct. Casinos should withhold this portion of your winnings and report them to the IRS after you win a certain amount, depending on the game and how much you wagered.

Consider consulting a tax professional if you need assistance. Internal Revenue Service. American Psychiatric Association. American Gaming Association. Table of Contents Expand. Table of Contents. What Is Gambling Income. How It Works. Gambling Income vs. Gambling Losses.

Advantages of Gambling Income. Special Considerations. The Bottom Line. Do you pay taxes on sports bet winnings Investing Investing Basics. Trending Videos. Key Takeaways Gambling income is any money that you earn from games of chance or wagers on events with uncertain outcomes. Gambling always involves a negative expected return with the house having the advantage. The tax paid on gains is not progressive: U.

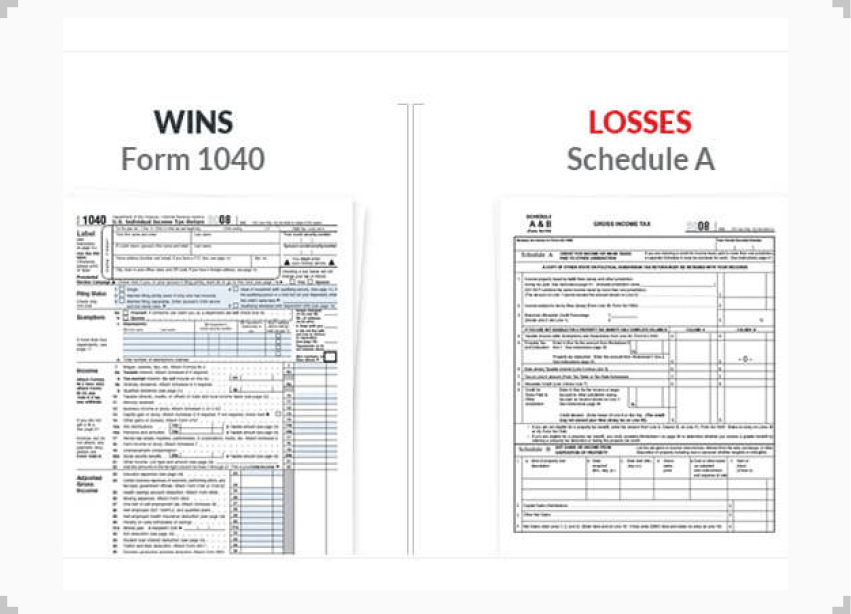

Taxpayers who itemize their taxes can deduct their losses on Schedule A. However gambling losses can only offset gambling winnings. They cannot be used to reduce your taxable income from other sources. As with all deductions , you must keep records and receipts of all claimed losses. The manner in which you make the bet does not matter when paying federal income taxes.

For example, the tax implications for the IRS are the same regardless of whether you make the bet in person or via an app. States have set rules on betting, including rules on taxing bets, in a variety of ways.  Depending on your state, legal sports betting may be a combination of in person, online, retail at specifically licensed physical properties.

Depending on your state, legal sports betting may be a combination of in person, online, retail at specifically licensed physical properties.

At time of writing 17 states continue to ban sports betting entirely. Every state has its own laws when it comes to gambling taxes. Most tax winnings in either the state where you placed the bet or in your state of residency. The explosion of online and app-based sportsbooks.

A sportsbook is the institution where you can place bets on sporting events, otherwise known as your bookie. The legal issues around online sportsbooks have not yet been fully resolved. These institutions argue that all bets occur either where the company is registered or where it keeps its servers.

At time of writing this was not fully resolved. The following table is based on Tax Foundation information. This does not absolve you of responsibility to report that income yourself, in the same way that you still have to file your taxes even though the IRS has your W It does mean, however, that you should be scrupulous when you file your taxes.

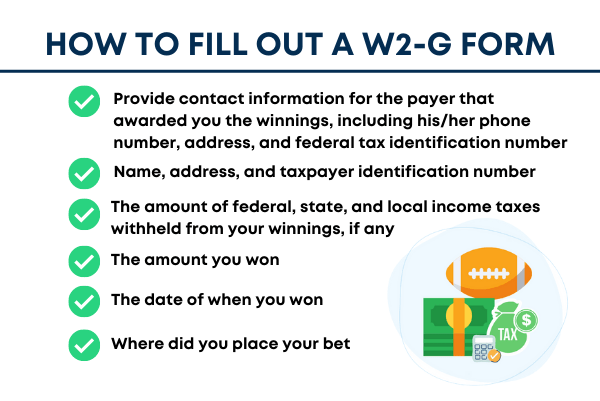

Many people underreport gambling winnings. There are many reasons not to do this, including the fact that the IRS may already know all about your income. Depending on the nature of your bet, you may receive a Form W-2G from whoever pays out your winnings. This is particularly true if they use some form of third party institution to make your payment. You can only deduct losses if you itemize your taxes.

The same is true of up-front money that you stake. Get started. When comparing taxable vs. If you win money from lotteries, raffles, horse races, or casinos — that money is subject to income tax. When you win, the entity paying you will issue you a Form W2-G, Certain Gambling Winnings, if the win is large enough.

You then must report all gambling winnings on your tax return. When you win, your winnings are treated as taxable income. Even non cash winnings like prizes are to be included on your tax return at their fair market value. If you win, understanding when each type of gambling category is required to issue to report your winnings is important for you when gathering your tax documents accurately and with confidence.

However, you still must report your winnings on your IRS tax return even if the winnings did not result in a tax form, so keep accurate records of all your buy-ins and winnings at casinos. Keep accurate records of your wager or buy-in amounts, as this can be used to offset your reported winnings.

The tax rate on gambling winnings will typically vary from state to state. The majority of states have income taxes, which means that gambling winnings are likely subject to both federal and state taxation. The rules and rates of your gambling wins and taxes can vary significantly depending on your state.

Some states take your gambling winnings tax at a flat rate, while other states tie it to your overall income tax rate. Form W-2G details your gambling winnings and any taxes withheld.

Popular Pages

- How does sports betting work nitrogen sports

- How to build a sports betting model in excel

- How to bet on sports in vegas from another state

- Can i cash out on 32red sports bets

- How big is the us sports betting marketing

- How to sport spread bet

- How is sports betting good for the economy

- How to read sports bet form guide

- How to mail in vegas sports bet

- How to win sports betting by betting on both sides