How to file income tax return offshore sports betting

for Running illegal Gambling. Operation, Laundering Proceeds and Filing False income Tax Return, U.S. ATT. OFF. NORTH. DIST. OF OHIO (Jul. 8, ), https. gambling accounts. U.S. v. HOM filing requirements and upheld the IRS in how to file income tax return offshore sports betting assessment of reporting form, which stated, “[t]he geographic location of the. But, Luscombe added, “gambling winnings are required to be reported on the tax return whether there is an associated Form W-2G or not.”. As per the Internal Revenue Service (IRS), your winnings are potentially subject to federal taxes each tax year. State taxes are also applicable.

**Filing Income Tax Returns for Offshore Sports Betting: Navigating the Financial Scorecard

**Engaging in offshore sports betting can be a thrilling game of strategy and skill. However, amidst the excitement of placing bets and cheering for our favorite teams, there's a crucial aspect that often gets overlooked - filing income tax returns.

Just like a successful sports team meticulously strategizes each play, individuals involved in offshore sports betting must also carefully consider their financial moves when it comes to taxes. Here's a playbook on how to effectively navigate the complex world of filing income tax returns for offshore sports betting winnings.

Understanding the Scoreboard: Tax ObligationsWhen you participate in offshore sports betting and win, those winnings are subject to taxation. It's essential to be aware of your tax obligations and ensure compliance with the law. Failure to report offshore sports betting earnings can result in penalties, fines, and legal repercussions.

Offshore sports betting earnings are typically considered taxable income, and it's crucial to accurately report these earnings on your tax return. Keep detailed records of your betting activities, including wins, losses, and transactions, to facilitate the reporting process.

Playing by the Rules: Filing Your Tax ReturnWhen it's time to file your tax return, make sure to include all relevant income from offshore sports betting activities. Depending on your country of residence, you may be required to report these earnings differently, so it's advisable to seek professional tax advice to ensure compliance.

Some countries have specific reporting requirements for offshore income, including sports betting winnings. Be proactive in meeting these obligations and avoid getting sidelined by tax issues down the line.

| Country | Tax Treatment |

|---|---|

| United States | Subject to federal income tax |

| United Kingdom | May be subject to tax depending on specific circumstances |

| Australia | Taxed as regular income |

Given the complexities surrounding offshore sports betting and taxation, it's wise to enlist the help of a tax professional specializing in international tax matters. These experts can provide valuable guidance on how to accurately report your earnings, maximize deductions, and ensure compliance with tax laws.

By working with a tax professional, you can confidently tackle the tax implications of offshore sports betting, allowing you to focus on enjoying the game without worrying about financial fouls.

In the high-stakes world of offshore sports betting, scoring a financial victory requires careful attention to tax considerations. Play smart, play fair, and file your income tax return accurately to stay ahead of the game.

Do I need to declare my gambling winnings?

Is offshore online gambling legal? Aside from it being illegal, you run several risks by betting with an offshore sportsbook. Unlike legal sportsbooks in the U.S., offshore books aren't regulated by government agencies, which means they aren't subject to regular checks and controls.

How do I report offshore gambling winnings? If you're a nonresident alien of the United States for income tax purposes and you have to file a tax return for U.S. source gambling winnings, you must use Form 1040-NR, U.S. Nonresident Alien Income Tax Return along with Schedule 1 (Form 1040)PDF to report gambling winnings.

How does the IRS know if you won money gambling online? Casinos are required to report winnings over a certain threshold to the IRS using Form W-2G.

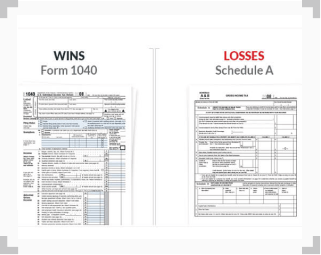

How do I file taxes on sports betting? Most taxpayers report their sports betting winnings and losses on their Form 1040 individual income tax return, which is due on or around April 15 each year. The sports betting winnings are taxed like other ordinary income, so it is important to tell your tax professional about both your winnings and losses.

Can you get in trouble for offshore sports betting? Sportsbooks and bookies that offer sports betting outside of these licensing regimes – whether in person or online – are illegal. Federal law makes it a crime to participate in the business of illegal gambling.

What happens if I win $100 000 at the casino? Casino winnings are fully taxable and can bump you into a higher tax bracket. How much you win determines how you're taxed. The casino will take 24% of larger winnings for the IRS before paying you your lump sum.

How far offshore is gambling legal? How The Laws Of The Ocean Work For Gambling Vessels

| Distance From Coast | |

|---|---|

| Internal Waters | Ports inside United States |

| Territorial Sea | 12 nautical miles from the coast |

| Contiguous Sea | 12-12 nautical miles from the coast |

| Exclusive Economic Zone | 200 nautical miles from the coast |

Is $1000 gambling winnings taxable? Generally, if you receive $600 or more in gambling winnings, the payer is required to issue you a Form W-2G. If you have won more than $5,000, the payer may be required to withhold 28% of the proceeds for Federal income tax.

Do you have to pay taxes on offshore sports betting? Yes, you owe taxes on sports betting wins

Do I need to declare my gambling winnings?

How does this work. How are professional gamblers and amateur gamblers taxed differently. This guide covers everything you need to know about taxes for a pro gambler. You also have to pay taxes on the fair market value of prizes you win, like a vacation or vehicle. Gamblers need to report their winnings as income on their tax return using Form Winners sometimes need to pay estimated taxes each quarter on what they win.

Casinos may withhold a percentage of your winnings to send to the IRS before issuing your payment for certain types of wins. The way gambling winnings are reported varies depending on the type of gambler. Most people are casual gamblers, but some are professionals who get their income from gambling. Qualifying as a professional gambler means a person makes all or most of their money from gambling.

They usually have one primary game, like poker, table games, or sports betting. Professional gamblers make their living from these activities and are considered self-employed. They work when they want to and improve their skills with time and experience. These gamblers are considered to be engaging in a trade or business, so they report their income on Schedule C, unlike amateur or casual gamblers.

Amateur gamblers are much more casual. Amateurs may study to improve their skills in betting games or they may research sports and players to make better sports bets. Any eligible wins are reported on Form , line 21, as other income. Social gamblers are a bit different.

They may engage in home poker games or go to casinos with friends or family members on special occasions. They just like the social interaction of gambling. How to file income tax return offshore sports betting A social gambler would, however, still treat any winnings like an amateur gambler, reporting all gambling income on their regular Form as other income. These differences are important because they impact how a gambler pays taxes.

Winnings are reported as business income if this is the case. Professional gamblers need to understand exactly how to treat their winnings so they stay compliant with tax law. Here are some tax tips to help professional gamblers:. Professional gamblers generally:. Amateurs have different requirements for reporting their winnings, as previously mentioned.

Losses must be reported to the IRS, just like your winnings. Keep detailed records of each win and loss throughout the year. Professional gamblers need to report all wins and losses on Schedule C. This is considered business income as a self-employed person, so they also need to include business expenses.

More on this below. Any self-employed person needs to pay self-employment tax, which includes Medicare and Social Security taxes.  The rate is currently Professional gamblers are also on the hook for quarterly income taxes. Estimated taxes are due each quarter, usually on April 15, June 15, Sept. Remember that some gambling winnings may be subject to tax withholding by the payer.

The rate is currently Professional gamblers are also on the hook for quarterly income taxes. Estimated taxes are due each quarter, usually on April 15, June 15, Sept. Remember that some gambling winnings may be subject to tax withholding by the payer.

The taxes you pay throughout the year will be both that withholding amount and the estimated taxes you pay. With cryptocurrency rising as one of the most popular forms of payment in the world, SportsBetting made sure to adapt to that by letting you deposit and withdraw into your accounts with 17 different forms of crypto.

Ranging from big named coins in Bitcoin and Ethereum to smaller altcoins in Dogecoin and Apecoin. The beneficial part to this as well is that there are no transaction fees associated with them and fast processing times. Bet Like A Pro Now. Read SportsBetting Review. You can log in , make deposits and withdrawals, use bonuses, and much more.

They are available on several different platforms as well including iPhone, Android, and Samsung Galaxy. Bet at XBet Now. Read Xbet Review. According to the IRS, it is required by law to claim your gambling winnings on your taxes. All income is taxable, this includes gambling winnings from international sports betting sites as well. You must claim any cash winnings, prizes, winnings from lotteries, raffles, as well as any casino winnings you earned throughout the year.

The IRS is not concerned with where you got your winnings from, whether that be state-sanctioned gambling or offshore gambling sites, the government simply wants you to claim it. This is vital to avoid paying back-taxes in the future. The percentage that the government takes from your legal sports betting winnings are dependent on a slew of circumstances.

There is no set percentage that is taken from your sports betting winnings so you will not know how much you owe the government until after you file your taxes. Because the establishment you won your winnings from may have sent a Form W-2G to the IRS on your behalf, it is important to be responsible and claim your winnings through sports betting taxes.

When this form is submitted, they explain how much you won, on what kind of wager, and how much if any tax they withheld which is usually 0. This situation only happens in a few situations such as large wins but it is still best to have your own information on hand. On Tax Form , you will total your winnings from sports betting on line Winnings are withdrawn as Bitcoin, how do we report this after converting it to AUD on an online exchange?

You don't need to declare that as income if you're not a professional gambler but when you convert it to AUD it will be a capital gains tax event. So do i still need to report this Capital gain even though my total taxable income is below . Capital gains make up your total income and don't determine alone whether or not you're required to lodge. If you win a lottery or money from a casino,it's yours,it comes under pleasure and recreational fun,they can not tax you on a casino win,or lottery same as a inheritance hope this helps.

Angeleyes wrote: If you win a lottery or money from a casino it's yours,it comes under pleasure and recreational fun,they can not tax you on a casino win,or lottery same as a inheritance hope this helps Thank you for your answer. Could you please provide links to documents and laws that detail these nuances. Thankyou for your fast response.

Thankyou for getting back to me on this. You might just need to refresh it.

Popular Pages

- Does alabama have sports betting

- Can you bet on sports in new york

- What is a 3 way in sports betting

- What are teasers in sports betting

- Does sports arbitrage betting work

- What sports betting apps work in maryland

- Is sports betting legal in oregon

- Is sports betting legal in tennessee

- How does sports betting work boxing

- Is online sports betting legal in oklahoma