Are winnings from sports betting taxable

By law, you must are winnings from sports betting taxable any sports betting winnings as income on your federal tax return. But that gambling-related income is only taxed at. If your gambling winnings are over $5, or more than times your wager, the IRS requires that the casino/sportsbook withhold at least 24%. The following rules apply to casual gamblers who aren't in the trade or business of gambling. Gambling winnings are fully taxable and you. Section BB of the Income Tax Act details the tax implications on income earned from online betting. Per this provision, the winning amount.

The Tax Implications of Winnings from Sports Betting

As sports fans around the world immerse themselves in the excitement of wagering on their favorite teams and athletes, questions regarding the taxation of these winnings often arise. Are winnings from sports betting taxable? Let's delve into this topic with a keen eye on the financial ramifications.

When it comes to sports betting, the issue of taxation is a relevant one that shouldn't be overlooked. In many countries, the winnings derived from sports betting are considered taxable income. In the eyes of the law, these winnings are viewed as a form of income, similar to earnings from employment or investments. Therefore, they may be subject to taxation based on the laws and regulations of the specific jurisdiction in which the bettor resides.

It's essential for individuals who partake in sports betting to be aware of their tax obligations to avoid any potential legal repercussions. Keeping accurate records of your betting activities, including wins and losses, can prove beneficial when it comes time to report your earnings to the tax authorities.

While some may argue that taxing sports betting winnings is a deterrent to the enjoyment of the activity, it is crucial to abide by the established laws of your country to ensure compliance and avoid any penalties for non-disclosure.

Ultimately, the taxation of winnings from sports betting varies depending on the jurisdiction, and it's essential to consult with a tax professional or financial advisor to understand your obligations and any potential deductions that may apply.

Sports Betting is Here – What’s the Tax Impact?

How much can you withdraw from DraftKings without being taxed? What are the 1099-Misc reporting thresholds for DraftKings Daily Fantasy Sports, Reignmakers, and Pick6 winnings? (US) If you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings.

Do I have to pay taxes on Draftkings winnings? Yes. Just like any other form of income, gambling winnings are taxable. This applies to all types of gambling, whether you placed your bet in person, on an app, or on your computer. One bright spot: You do have to win money in order to owe taxes on your gambling income.

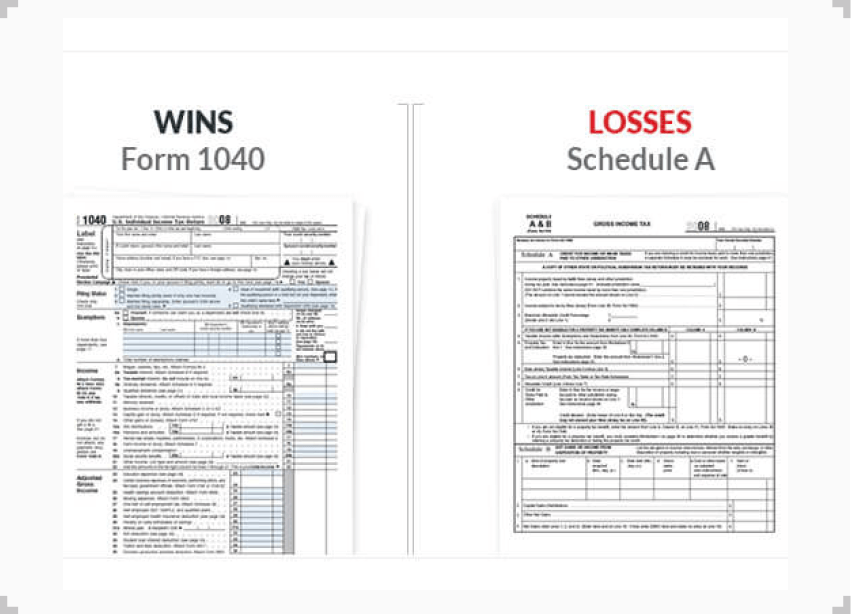

Topic no. 419, Gambling income and losses

Taxpayers who itemize their taxes can deduct their losses on Schedule A. However gambling losses can only offset gambling winnings. They cannot be used to reduce your taxable income from other sources. As with all deductions , you must keep records and receipts of all claimed losses. The manner in which you make the bet does not matter when paying federal income taxes.

For example, the tax implications for the IRS are the same regardless of whether you make the bet in person or via an app. States have set rules on betting, including rules on taxing bets, in a variety of ways. Depending on your state, legal sports betting may be a combination of in person, online, retail at specifically licensed physical properties. At time of writing 17 states continue to ban sports betting entirely.

Every state has its own laws when it comes to gambling taxes. Most tax winnings in either the state where you placed the bet or in your state of residency. The explosion of online and app-based sportsbooks. A sportsbook is the institution where you can place bets on sporting events, otherwise known as your bookie.

The legal issues around online sportsbooks have not yet been fully resolved. These institutions argue that all bets occur either where the company is registered or where it keeps its servers. At time of writing this was not fully resolved. The following table is based on Tax Foundation information.

This does not absolve you of responsibility to report that income yourself, in the same way that you still have to file your taxes even though the IRS has your W It does mean, however, that you should be scrupulous when you file your taxes. Many people underreport gambling winnings. Are winnings from sports betting taxable There are many reasons not to do this, including the fact that the IRS may already know all about your income.

Depending on the nature of your bet, you may receive a Form W-2G from whoever pays out your winnings. This is particularly true if they use some form of third party institution to make your payment. You can only deduct losses if you itemize your taxes. The same is true of up-front money that you stake.

Guidances issued by the IRS state that you can deduct up-front stakes on Schedule A, which is not available to people who take the standard deduction. Money that you do not stake up front, but merely wager as a potential loss, is not deductible unless you lose. There is a lack of clarity on the issue of whether up-front stakes reduce your taxable winnings by the amount that you initially wagered.

This ambiguity only applies to wagers with up-front stakes. It goes poorly and you lose your bet. There are two possible outcomes:. While a W-2G or a Form from your payer should indicate taxable income, be sure to check with a tax professional if you are unsure how to proceed. Like all forms of gambling winnings, money you get from sports betting counts as income.

You must pay federal income taxes on all winnings regardless of amount and may owe state taxes as well.  The rules of state taxes are highly jurisdiction-specific, however, so be sure to research the specific laws of your own state. Helpful Guides Tax Guide. What Is Conservatorship. Family Trusts CFA vs. In order to itemize your deductions in , for example, your total amount of itemized deductions real estate taxes, mortgage interest, charitable contributions, etc.

The rules of state taxes are highly jurisdiction-specific, however, so be sure to research the specific laws of your own state. Helpful Guides Tax Guide. What Is Conservatorship. Family Trusts CFA vs. In order to itemize your deductions in , for example, your total amount of itemized deductions real estate taxes, mortgage interest, charitable contributions, etc.

If it is not, you could lose out twice, first for losing your bets at the casino or online, and a second time for not being able to deduct your losses against any large winnings that are includable in taxable income. If you do not itemize deductions and use the standard deduction, the IRS and state agencies treat your losses as a personal expense; you might as well say it was spent on a movie ticket on a Sunday afternoon.

The amount of itemized deduction for gambling losses is allowed only up to the amount of gambling winnings reported as income on your individual income tax return. In other words, no net losses may be reported. Both online sports betting apps and in-person betting operators are getting better at substantiating gambling losses.

While most sportsbooks and casinos offer the ability to keep track of your winnings and losses, it is always prudent to keep good records personally. If there is no record of the losses you sustained, the IRS will disallow those itemized deductions. Las Vegas and Miami are hot spots for fun, sun, and gambling. Florida and Nevada also do not have an individual state income tax.

Most states charge excise taxes on the gross gaming revenue, but those taxes are remitted to the state by the casino or sportsbook operators. Effective August of , the required rate for gambling winnings in Maine became 7. This means that if you meet those winning thresholds stated under the first tip above, you will be withheld on Unless you hate money, your primary goal when wagering is to turn a profit.

The reality is that the federal and state governments view gambling winnings the same way we view our paycheck: It is income. Always be safe, use disposable income that you are comfortable with wagering, and have fun gambling. Disclaimer of Liability: This publication is intended to provide general information to our clients and friends. It does not constitute accounting, tax, investment, or legal advice; nor is it intended to convey a thorough treatment of the subject matter.

Keep reading. Is the Section Tax Even Legal. By Stanley Rose.

Popular Pages

- When is mgm national harbor sports betting

- What is the moneyline in sports betting

- How much can you win in sports betting

- What is the best sport to bet on

- How to parlay sports bets

- Is sports betting legal in fl

- Is sports betting legal in utah

- When can i bet on sports in louisiana

- Can you sports bet in hawaii

- Can sports betting be profitable