Is sports betting taxable income

Yes. I explained that gambling wins and losses are not like taxable investments (you can deduct up to $3, in those net losses from income or. Gambling income includes, but is not limited to, is sports betting taxable income from lotteries, raffles, horse and dog races and casinos, as well as the fair market value of prizes. Winnings derived from betting and gaming are not, however, subject to income tax. Betting tax is levied on bets on horse-races made with a bookmaker or by means. Importantly, all gambling winnings are reported as taxable income. For example, if a gambler has winnings totaling $10, and losing wagers.

The Taxing Question in Sports Betting: Is It Considered Taxable Income?

As the world of sports betting continues to grow rapidly, one pressing question on the minds of many enthusiasts is whether the winnings earned from sports betting should be subjected to taxation. It is crucial to discern the legal implications surrounding this topic to avoid any unforeseen future financial complications.

Considering the excitement and thrill that comes with winning a sports bet, being aware of the financial obligations that follow is equally important. The question of whether sports betting is taxable income ultimately depends on various factors, including the laws and regulations of the specific jurisdiction in which you reside.

Understanding the Tax Implications of Sports Betting Winnings

While sports betting revenue is indeed considered taxable income in many countries, the rules and regulations can vary significantly from one place to another. It is essential to familiarize oneself with the specific laws governing gambling and taxation in your region.

For instance, in the United States, any winnings derived from sports betting are generally subject to taxation. The Internal Revenue Service (IRS) mandates that individuals report all gambling income, including sports betting proceeds, on their tax returns. Failure to comply with these regulations can lead to potential legal repercussions.

On the contrary, some countries do not impose taxes on sports betting winnings, providing a more lenient environment for punters who indulge in this recreational activity. However, it is crucial to conduct thorough research and consult with a tax professional to ensure full compliance with the applicable laws.

Seeking Clarity: Consultation with Tax Experts

Given the complexities and nuances involved in determining the taxability of sports betting income, it is advisable to seek guidance from tax professionals who specialize in gambling-related matters. These experts can provide tailored advice based on your individual circumstances and help you navigate the legal landscape effectively.

In conclusion, the treatment of sports betting winnings as taxable income varies depending on the jurisdiction and the prevailing laws within that region. It is essential for individuals to understand their tax obligations and responsibilities when engaging in sports betting to avoid potential financial ramifications in the future.

Bet on the big game? Here's what you need to know about paying taxes on sports bets

Are gambling winnings taxed as ordinary income? Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos.

Sports Gambling and How Your Winnings are Taxed

When you go to file taxes, you will need to calculate the final tax owed based on your total income for the year, including losses and deductions and any winnings not reported on a Form W-2G. Use Schedule A to itemize any deductions. Keep in mind that if you choose to claim the standard deduction, you cannot deduct your losses on your tax return.

You can only deduct your gambling losses up to the amount of winnings you report. This will help you accurately itemize your deductions and provide a clear paper trail for the IRS if you are ever audited. Navigating your taxes can be tricky when you add other types of income—like gambling winnings—into the mix. Let the experts at ezTaxReturn help. The articles and content published on this blog are provided for informational purposes only.

The information presented is not intended to be, and should not be taken as, legal, financial, or professional advice. Readers are advised to seek appropriate professional guidance and conduct their own due diligence before making any decisions based on the information provided.

Any winnings from a sports bet must be reported as income on your tax return. You can deduct gambling losses, but only if you itemize your deductions and they don't add up to more than your winnings. At CNBC Select , our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every tax article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of tax products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. UFB Secure Savings. Is sports betting taxable income Accredited Debt Relief. LendingClub High-Yield Savings. Choice Home Warranty. Freedom Debt Relief. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links.

This commission may impact how and where certain products appear on this site including, for example, the order in which they appear. What we'll cover Yes, you owe taxes on sports betting wins Can I deduct losses from sports betting. How much are taxes on sports betting wins. How to report sports betting wins you had in Bottom line.

Governor Roy Cooper has already pledged to sign it into law if passed by the Senate. Many celebrate this successful vote, given that several neighboring states already allow these gambling activities, and online sports gambling is legalized in most parts of the country.  Currently, sports fans can only legally gamble at tribal casinos located in the western part of the state.

Currently, sports fans can only legally gamble at tribal casinos located in the western part of the state.

In recent years, online sports gambling has become increasingly popular. North Carolinians could download apps such as DraftKings and FanDuel Sportsbook, but location-tracking software within the apps disallow users to place bets while they are physically located in North Carolina.

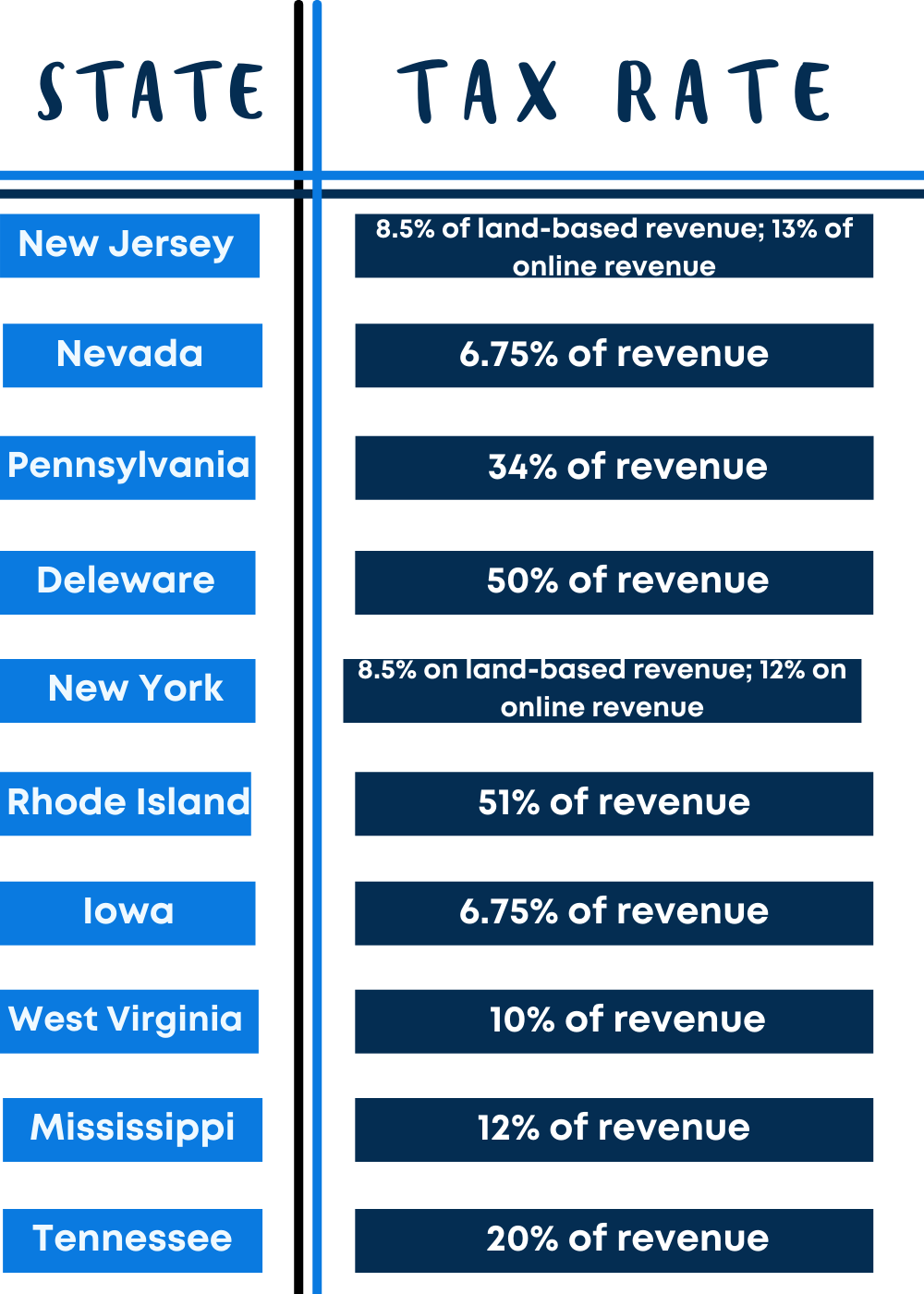

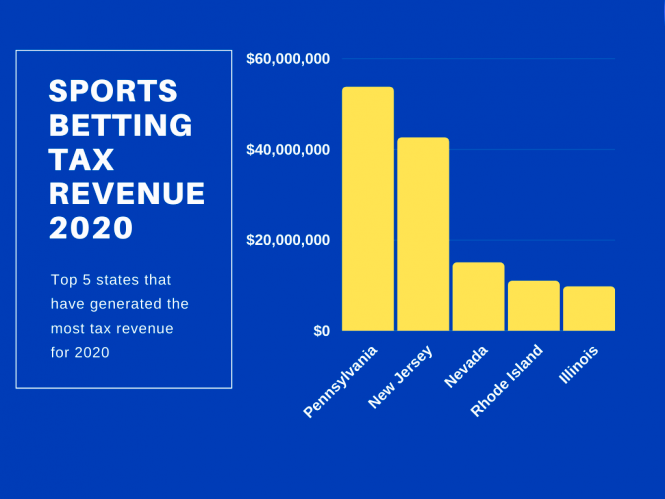

Poole College of Management accounting professors Nathan Goldman and Christina Lewellen help explain the tax outcomes and consequences of online gambling. How will sports books be taxed in North Carolina for online gambling service providers. As part of this legislation, online gambling service providers will be taxed by North Carolina.

However, as part of House Bill , the state allows unlimited deductions for the cash value of the bonus or promotional credits through , which are then phased out through We often hear about these promotional bets in advertisements. The benefits for the state could be substantial over the long term.

Therefore many may be curious about how the funds will be apportioned. We summarize the projected allocation below as follows:. This bill does not change how sports wagering is taxed for individuals.

Popular Pages

- Will iowa have online sports betting

- How to be the best at sports betting

- What sports betting apps are legal in georgia

- How to start a sports betting business in kenya

- How sports betting works in south africa

- How many people bet on sports a year

- Can you sports bet in iowa

- Can you become rich from sports betting

- How to find guaranteed profit sports bets

- Can i really make a living on sport betting