Will sports betting be legal in ohio

After a long wait and much fanfare, legal sports betting became effective in Ohio as of January 1, Ohio joined 36 other states and Washington. Sports betting, both retail and online, is legal and regulated in Ohio. Legal sports betting began in Will sports betting be legal in ohio on Jan. 1,following several. Yes, Ohio sports betting is legal and available for play in the state. Several online sportsbook apps and physical sports betting locations went live in January. As of January 1,sports betting is legal in Ohio for both retail and online sportsbooks. Now, anyone over the age of 21 and inside Ohio may place a.

The Future of Sports Betting Legalization in Ohio

Recent discussions surrounding the legalization of sports betting in Ohio have left both lawmakers and citizens curious about what the future holds for the state. With neighboring states embracing the industry, the question on everyone's mind is: will Ohio follow suit?

Current Status: As it stands, Ohio has yet to legalize sports betting, despite the growing popularity and revenue potential of this industry. However, there have been ongoing conversations and legislative proposals that suggest a shift may be on the horizon.

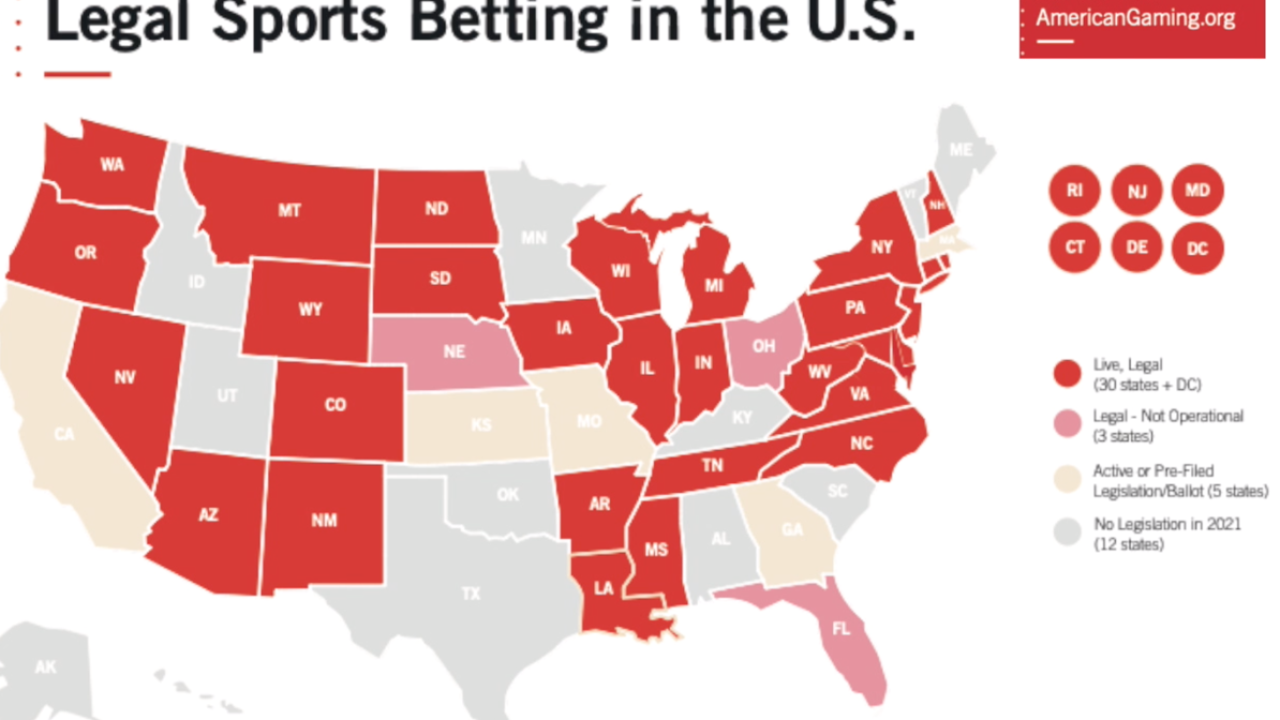

Neighboring States: Several states surrounding Ohio, including Pennsylvania, Indiana, and Michigan, have already legalized sports betting. This has generated significant revenue and provided a source of entertainment for residents.

Revenue Potential: Legalizing sports betting in Ohio could lead to a substantial increase in revenue for the state. By regulating the industry, the government could tap into a lucrative market while also promoting responsible gambling practices.

Support and Opposition: The topic of sports betting legalization in Ohio has garnered mixed reactions. Proponents argue that it could boost the economy and create jobs, while opponents raise concerns about potential social issues, such as gambling addiction.

Legislative Progress: Over the past year, there have been various bills introduced in the Ohio legislature to legalize sports betting. These proposals aim to establish a framework for regulating the industry and address key concerns regarding consumer protection and tax revenues.

Conclusion: While the future of sports betting legalization in Ohio remains uncertain, the ongoing discussions and legislative efforts suggest that it may be a matter of "when" rather than "if." With neighboring states reaping the benefits of a regulated sports betting market, Ohio may soon join the ranks and open up new opportunities for both residents and the state government.

Build a custom email digest by following topics, people, and firms published on JD Supra.

Can I gamble on FanDuel in Ohio? FanDuel Sportsbook is among the top legal Ohio betting sites. The sportsbook is allowed in Ohio, launching in Ohio cyberspace in January 2023. People 21 and over physically present within Ohio's borders can access FanDuel, which is available on mobile devices (iOS, Android) and through its website.

Did Ohio legalize casinos? There are several brick-and-mortar casinos in Ohio that you can visit as long as you are at least 21 years old. Some of these even have legal Ohio sportsbooks inside. Real-money online casinos might be legal across state lines in Michigan, but, they are not legal in Ohio.

Is Ohio going to legalize sports betting? Sports betting became legal in Ohio on Jan. 1, 2023, but experts are warning this will lead to a huge increase in problem gambling. Many Ohioans are passionate about sports and their local sports teams whether at the collegiate level or professional teams like the Cavaliers and the Guardians.

When can you gamble in Ohio? In Ohio, the legal age to play bingo is 16. You must be 18 to participate in Keno, the state lottery, and horse racing. The legal age play at casinos is 21. (Note: Children over 13 can go to a horse race track if accompanied by an adult.)

December 22nd, 2021: Governor Mike DeWine signed HB29 into law. January 1st, 2023: Ohio sports betting launched.Where can I bet sports in Ohio? Where Can I Bet at in Ohio? You can bet in Ohio at sportsbooks: DraftKings Ohio, FanDuel Ohio, Barstool Ohio, Caesars Ohio, BetMGM Ohio, PointsBet Ohio, bet365 Ohio, Tipico Ohio, BetRivers Ohio, Superbook Ohio, BetFred Ohio.

Can I gamble in Ohio? In Ohio, legal forms include charitable gaming such as instant bingo, bingo, raffles and games of chance. Other legal forms include betting at horse races, the state lottery, video lottery terminals (VLTs) at race tracks, Keno, casinos and skill-based amusement machines.

When can I bet in Ohio? January 1st, 2023

How is gambling legal in Ohio? Currently, state agencies regulate several gambling activities: The Attorney General's Office licenses bingo and instant bingo and has investigative and civil authority over charitable raffles and games of chance conducted at charitable festivals. Betting at horse races is regulated by the Ohio Racing Commission.

Ohio brings in hundreds of millions in first year of sports betting

The majority of taxes collected help fund K schooling with a small percentage used for a state-sponsored problem sports gaming fund. The legalization of sports betting in Ohio provides entrepreneurs the opportunity to attract sports fans to their business by providing a sportsbook or a kiosk to place bets.

A barrier of entry to entering the space is cost. This makes it especially difficult for smaller businesses that may have interest in establishing a brick-and-mortar sportsbook. A recent example of businesses coming together to provide a brick-and-mortar sportsbook is the teaming up of the Cleveland Browns, Bally Bet, and Harry Buffalo to create a new Bally Bet Sportsbook.

Furthermore, additional opportunities may become available in as 15 different licensed entities have not gone forth with their plans to offer sports betting in Ohio. The entities were recently granted additional time until June 30, , but could have their licenses revoked if they do not begin business in Larger businesses located in a county with a number of professional sports teams and casinos — or small to medium sized businesses that do not have the capital for a Type B license — can look to become a Type C Host.

Despite laying out a maximum of 20 Type C proprietors, HB 29 does not lay out a maximum number of hosts for a Type C license. Once licensed by the Ohio Casino Control Commission, Hosts can enter into an agreement with a Type C proprietor to offer a maximum of two kiosks at their location.

The big winner is the Ohio sports bettor with numerous options for retail sportsbooks and online betting apps available. See more ». Thomas Hunt , Scott Norcross. To embed, copy and paste the code into your website or blog:. Legalization of Sports Betting in Ohio On January 1, , sports betting became legal in the state of Ohio for those 21 years or older and physically present within the state.

The Ohio Lottery has a list of guidelines for the kiosks, but each provider can offer its own unique terminal equipment, prize payment capabilities and support. You will be able to bet spreads, over-unders, money lines and parlays with no more than four components at the terminals. There are multiple options, including: Being paid by the business hosting the kiosk; through the mail; from the Ohio Lottery central and regional offices; a credit voucher on the kiosk; or credit to a credit card, debit card or an electronic player account.

Kiosk hosts can also use the Ohio Lottery's mobile cashing application but are not required to do. If you want immediate payment, make sure to check the rules on the kiosk you're using before placing a bet. Yes, gambling winnings are taxed like any other income. The rate will vary depending on how much you earn in a year.

Note that online sportsbooks and other places that require an account track your wins. Will sports betting be legal in ohio But even if you don't receive forms, the IRS mandates you report gambling wins as income. On the flip side, for those who itemize their tax deductions, the IRS also allows people to deduct gambling losses.

You may deduct gambling losses only if you itemize your deductions on Schedule A Form and kept a record of your winnings and losses. The amount of losses you deduct can't be more than the amount of gambling income you reported on your return. Claim your gambling losses up to the amount of winnings, as "Other Itemized Deductions.

The National Council on Problem Gambling NCPG said that recent studies show gambling problems among sports bettors is at least twice as high as gamblers in general. The rate goes even higher for those making sports bets online. Sports gambling: What's the difference between a gambling enthusiast and an addict. Advice from an expert. Anyone can become addicted, but the NCPG said addicts are most often college-educated men under age 35 who have good-paying jobs.

Some gaming pros suggest setting a budget to limit yourself. Gamers can also set limits on sports gaming apps to control their spending. All bettors should know that gaming income is taxable and must be reported as income.  Gaming losses may be deducted by a taxpayer who itemizes deductions, but only to the extent of the gaming winnings reported and only if tracked accurately with sufficient documentation.

Gaming losses may be deducted by a taxpayer who itemizes deductions, but only to the extent of the gaming winnings reported and only if tracked accurately with sufficient documentation.

As always, one should consult a tax professional for advice on this subject. Though not a tax, bettors should also understand the fee that a proprietor charges simply to make a bet. Bettors have recourse if they dispute whether they won a wager. If a proprietor refuses payment of alleged winnings, the proprietor must inform the bettor that he or she may file a complaint.

For example, it is a felony to bet on a sporting event under age 21 or to help someone under age 21 do so. It is also a felony to place a bet with knowledge not available to the general public, offer anything of value to affect the outcome of a sporting event, or use counterfeit currency to place a bet. Proprietors must be licensed by the OCCC to accept bets. There are three types of sports gaming licenses.

Type B licenses authorize a proprietor to offer sports gaming at a location specified on the license. Ohio law allows gaming proprietors to manage their risk. Proprietors may reject or pool wagers, or lay off one or more wagers with another proprietor. Ohio bettors were busy on the opening weekend.

On January 1 and 2 alone, Ohio had over

Popular Pages

- How sports betting upended

- Is sports betting legal in mexico

- Is online sports betting legal in arkansas

- Can you sports bet in south dakota

- Does online sports betting send tax forms

- How long does sports bet results take

- Is internet sports betting illegal

- Can you bet on sports in pa

- Is online sports betting legal in illinois

- Is online sports betting legal in california