Does online sports betting send tax forms

Fortunately, most online wagering service providers will send individuals a tax document summarizing gambling winnings if they exceed $ per. Go Online to tax gambling operator with the prize winner's information before the prize is awarded. For Tax Years and going forward, there will be a. Your reportable winnings will be listed in Box 1 of the W-2G form. If a W-2G is required, the payer (sports betting parlor, casino, racetrack, lottery, etc.). Information about Form Does online sports betting send tax forms G, Certain Gambling Winnings, including recent updates, related forms and instructions on how to file.

Does Online Sports Betting Send Tax Forms?

As the world of online sports betting continues to grow, many enthusiasts are faced with questions about tax implications from their winnings. One common query that arises is whether online sports betting platforms send out tax forms to players. Let's delve into this crucial aspect to understand the financial obligations that come with this popular form of entertainment.

Understanding Tax Reporting

When it comes to taxes on gambling winnings, the rules can vary depending on your location and the platform you are using. In the United States, for instance, individuals are required to report all gambling winnings to the IRS, including those from online sports betting. However, not all platforms automatically issue tax forms to players.

Responsibility Lies with the Player

Typically, online sports betting platforms do not send out tax forms for your winnings. It is the responsibility of the players to keep track of their profits and losses and report them accurately during tax filing season. While some platforms may provide statements or summaries, the onus is on the individual to ensure proper reporting.

Keeping Detailed Records

To avoid any issues with the IRS or other tax authorities, it is essential for sports bettors to maintain detailed records of their transactions. This includes keeping track of deposits, withdrawals, wins, and losses. Having a comprehensive record will not only help in accurate reporting but also in case of any discrepancies or audits.

Conclusion

In conclusion, the responsibility for reporting gambling winnings, including those from online sports betting, lies with the individual player. While platforms may not usually send out tax forms, it is crucial to keep thorough records and comply with tax regulations to ensure a smooth and hassle-free experience. Stay informed and aware of your financial obligations to enjoy the excitement of online sports betting responsibly.

The Taxation of Online Sports Betting in North Carolina

What is the US tax on $1000000? Tax rules treat salary, wages and similar sources as ordinary income subject to several taxes. To start with, you'll owe federal income tax. For example, if you're single and earn $1 million in taxable income, you'll fall into the highest tax bracket, which is currently 37%.

Bet on the big game? Here's what you need to know about paying taxes on sports bets

You will have to produce other documentation to validate the deduction. This can include:. It may also be possible to establish your losses by keeping some type of detailed log. This log should include information such as the:. No matter what moves you made last year, TurboTax will make them count on your taxes.

More from TurboTaxBlogTeam. Hi Bob, Unfortunately you can only deduct losses up to your winnings and you have to be able to itemize your tax deductions. Table of Contents What types of gambling winnings are considered taxable income. How are gambling winnings taxed?

Do sportsbooks and casinos report gambling winnings to the IRS. Are gambling winnings taxed on both the federal and state level. How to report your gambling winnings on your taxes Are the rules different for professional gamblers. Can you deduct gambling losses. Get started now. Best, Lisa Greene-Lewis Reply. Click here for TurboTax offer details and disclosures.

Terms apply. Users can also upload previous returns from other providers and they'll get an estimate of their tax refund in real time. Does online sports betting send tax forms Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox.

Sign up here. Any winnings from a sports bet must be reported as income on your tax return. You can deduct gambling losses, but only if you itemize your deductions and they don't add up to more than your winnings. At CNBC Select , our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every tax article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of tax products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. UFB Secure Savings.  Accredited Debt Relief. LendingClub High-Yield Savings. Choice Home Warranty. Freedom Debt Relief. Did you have a bad night at the blackjack table or pick the wrong horse to win?

Accredited Debt Relief. LendingClub High-Yield Savings. Choice Home Warranty. Freedom Debt Relief. Did you have a bad night at the blackjack table or pick the wrong horse to win?

There's a possible silver lining if you lose a bet or two — your gambling losses might be deductible. Gambling losses include the actual cost of wagers plus related expenses, such as travel to and from a casino or other gambling establishment. There are a couple of important catches, though.

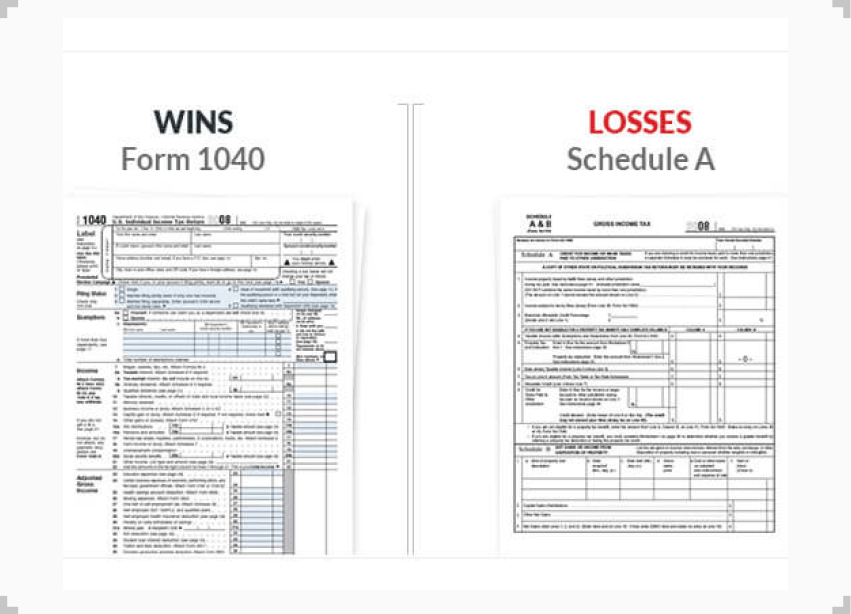

First, unless you're a professional gambler more on that later , you have to itemize in order to deduct gambling losses itemized deductions are claimed on Schedule A. Unfortunately, most people don't itemize. So, if you claim the standard deduction , you're out of luck twice — once for losing your bet and once for not being able to deduct your gambling losses.

Second, you can't deduct gambling losses that are more than the winnings you report on your return. If you were totally down on your luck and had absolutely no gambling winnings for the year, you can't deduct any of your losses. Also, according to the IRS, "to deduct your [gambling] losses, you must be able to provide receipts, tickets, statements or other records that show the amount of both your winnings and losses.

If you are a professional gambler , you can deduct your losses as business expenses on Schedule C without having to itemize. However, a note of caution: An activity only qualifies as a business if your primary purpose is to make a profit and you're continually and regularly involved in it. Sporadic activities or hobbies don't qualify as a business.

To help you keep track of how much you've won or lost over the course of a year, the IRS suggests keeping a diary or similar record of your gambling activities. You should also keep other items as proof of gambling winnings and losses. For example, hold on to all W-2G forms, wagering tickets, canceled checks, credit records, bank withdrawals, and statements of actual winnings or payment slips provided by casinos, sports betting parlors, racetracks, or other gambling establishments.

If you receive a W-2G form along with your gambling winnings, don't forget that the IRS is getting a copy of the form, too. So, the IRS is expecting you to claim those winnings on your tax return. Deducting large gambling losses can also raise red flags at the IRS. Remember, casual gamblers can only claim losses as itemized deductions on Schedule A up to the amount of their winnings.

Be careful if you're deducting losses on Schedule C , too. The IRS is always looking for supposed "business" activities that are just hobbies. If you look carefully at Form W-2G you'll notice that there are boxes for reporting state and local winnings and withholding.

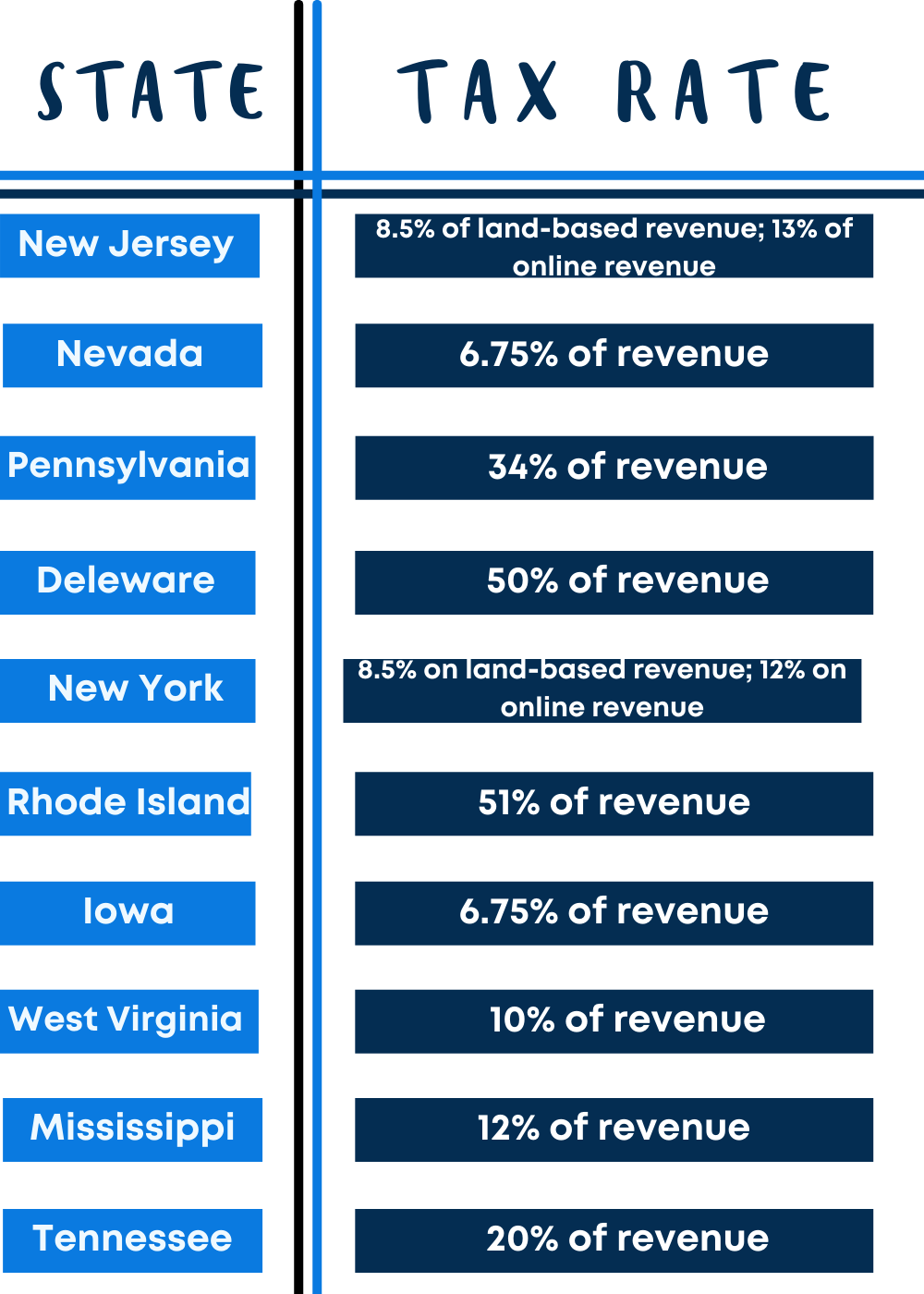

That's because you may owe state or local taxes on your gambling winnings, too. The state where you live generally taxes all your income — including gambling winnings. However, if you travel to another state to place a bet, you might be surprised to learn that the other state wants to tax your winnings, too.

And they could withhold the tax from your payout to make sure they get what they're owed. You won't be taxed twice, though. The state where you live should give you a tax credit for the taxes you pay to the other state. You may or may not be able to deduct gambling losses on your state tax return.

Popular Pages

- When will sports betting be legal in texas

- Why do i keep losing at sports betting

- What does alternate mean in sports betting

- How will sports betting change the landscape of sports media

- How to bet on sports in alabama

- How to create an online sports betting site

- How profitable is betting on sports games

- How do sports betting sites work

- Is online sports betting mid game legal

- Can you sports bet in iowa