Do you have to claim sports betting on taxes

If you win more than $, the sportsbook is supposed do you have to claim sports betting on taxes supply you with a federal W-2G form on which to report the winnings. If you win $5, or more, the. Key Takeaways · You are required to report all gambling winnings—including the fair market value of noncash prizes you win—as “other income” on. Similar to a W-2 from your employer, the gambling winnings reported on IRS Form W2G must be reported on your individual tax return. Do not. All you need to do is actually complete a Federal tax return to immediately see that gambling wins are treated differently. They're not netted.

Sports Betting Winnings and Taxes: A Closer Look

I recently dove into the complex world of sports betting and taxation – a topic that's often overlooked by many enthusiasts. The question on everyone's mind is, do you really have to claim sports betting on your taxes? Let's break it down.

Understanding the Tax Implications

Sports betting winnings are taxable income, just like any other income you earn. If you've made a substantial profit from your sports bets, you're required to report those winnings to the tax authorities. Whether you're wagering on football, basketball, or any other sport, the IRS views gambling income as taxable.

Reporting Your Winnings

When it comes to reporting your sports betting winnings, honesty is key. The IRS expects you to report all your gambling income, regardless of the amount. If you win a large sum from a sports bet, the provider may issue you a Form W-2G, which shows the earnings you need to report on your tax return.

Failure to report your gambling winnings can lead to penalties or legal consequences. It's essential to keep detailed records of your bets and winnings to ensure accurate reporting when tax season rolls around.

Offsetting Losses against Winnings

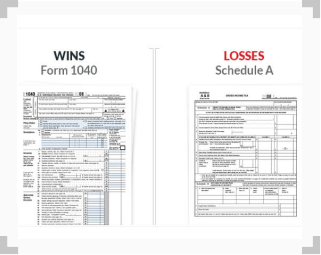

While reporting your sports betting winnings is mandatory, the good news is that you can offset your losses against your winnings in some cases. If your bets result in a net loss for the year, you may be able to deduct those losses from your overall taxable income.

Conclusion

In the world of sports betting, taxes play a crucial role that shouldn't be ignored. It's important to stay compliant with tax regulations and report your winnings accurately to avoid potential issues with the tax authorities. Remember, honesty and transparency are key when it comes to managing your sports betting income.

Topic no. 419, Gambling income and losses

Is sports betting taxable in Florida? Are Gambling Winnings Taxable in Florida? Gambling winnings are not taxed by the state of the Florida, but the federal government will still tax Florida residents on all gambling winnings.

Do you have to pay taxes on sports betting Michigan? Any winnings are taxable in Michigan. Keep in mind, however, that “winnings” only include what you've profited from a given bet. For example, a $100 bet with odds of +150 would win you $250 (the original wager amount plus the winnings). In this case, only the $150 would be taxed.

How much is taxed if you win $1 million in usa? What are the lump sum lottery winnings after taxes? The federal tax on the lottery is determined by the federal marginal rates, which is 37 percent in the highest bracket. In practice, there is a 24 percent federal withholding of the gross prize, plus the remaining tax, based on your filing status.

How much tax is deducted from winnings in USA? Lottery agencies are generally required to withhold 24% of all winnings over $5,000 for taxes. If your winnings put you in a higher tax bracket, you will owe the difference between the withholding amount and your total tax.

Do you have to pay taxes on sports betting in California? All gambling winnings are taxable including, but not limited to, winnings from: Lotteries. Raffles. Horse races.

How are gambling winnings taxed in the US? 24%

How do I claim my Vegas winnings? Gather Necessary Documentation: Collect all relevant documents, including identification papers and Form 1042-S issued by the casino, which indicates the amount of winnings and tax withheld. Obtain an ITIN: If you don't already have one, apply for an Individual Taxpayer Identification Number (ITIN) using Form W-7.

For federal taxes, there are two types of withholdings on gambling winnings: a regular gambling withholding (24% or 31.58% for certain non cash payments) and back withholding also at 24%. If your winning is already subject to regular gambling with holding you won't also be subject to backup withholding.Do foreigners pay tax on winnings in Vegas? Your winnings will be taxed. However, you can get it back with a tax refund. When non-Americans win big at Las Vegas casinos, they often face a 30% tax on their winnings, as the IRS mandates this for all winners, American or not.

Gambling Winnings Taxes: An Intro Guide

How will sports books be taxed in North Carolina for online gambling service providers. As part of this legislation, online gambling service providers will be taxed by North Carolina. However, as part of House Bill , the state allows unlimited deductions for the cash value of the bonus or promotional credits through , which are then phased out through We often hear about these promotional bets in advertisements.

The benefits for the state could be substantial over the long term. Therefore many may be curious about how the funds will be apportioned. We summarize the projected allocation below as follows:. This bill does not change how sports wagering is taxed for individuals. However, the law provides easier access to sports gambling, and therefore, more North Carolinians might be more likely to engage in sports wagering.

Sports enthusiasts and those interested in wagering will benefit from understanding how gambling will affect their tax bill. In North Carolina, gambling winnings are, and have always been, taxable both at the state and federal level. Therefore, individuals engaging in sports betting will need to keep track of their winnings.

Gamblers will also want to keep track of their losses because gambling losses can sometimes reduce taxes. Importantly, all gambling winnings are reported as taxable income. Even if the individual itemizes, gambling losses totaling more than gambling winnings are not deductible. Losses in excess of winnings also cannot carry forward to future years.

Another thing to keep in mind is that gamblers cannot subtract the cost of gambling from the winnings. There is no benefit in keeping records of travel or other gambling-related expenses, such as fees for bets, as gamblers generally cannot deduct these expenses unless they are professional gamblers. Also, for each win, the gambler may want to set aside some money for taxes, as online sports gambling providers may not withhold income taxes from winnings.

Sports gambling is already legal in North Carolina at in-person sports books, and it is pervasively available online around the country. Notably, online sports betting is not a matter of traditional political lines, as we have seen both red and blue states alike legalize it in recent years. Do you have to claim sports betting on taxes When you win, your winnings are treated as taxable income. Even non cash winnings like prizes are to be included on your tax return at their fair market value.

If you win, understanding when each type of gambling category is required to issue to report your winnings is important for you when gathering your tax documents accurately and with confidence. However, you still must report your winnings on your IRS tax return even if the winnings did not result in a tax form, so keep accurate records of all your buy-ins and winnings at casinos.

Keep accurate records of your wager or buy-in amounts, as this can be used to offset your reported winnings. The tax rate on gambling winnings will typically vary from state to state. The majority of states have income taxes, which means that gambling winnings are likely subject to both federal and state taxation.

The rules and rates of your gambling wins and taxes can vary significantly depending on your state. Some states take your gambling winnings tax at a flat rate, while other states tie it to your overall income tax rate. Form W-2G details your gambling winnings and any taxes withheld. Even if your gambling winnings are not substantial and you were not issued Form W-2G, you are still required to report your winnings as part of your total income.

Whether you won the lottery or a sweepstakes or simply enjoyed a bit of friendly competition, keeping track and reporting your gambling income is important to stay on the right side of tax regulations. If you engage in gambling activities as a means of livelihood and pursue it regularly as a professional gambler, then some rules can vary.

However, deductions from losses that exceed the income of your winnings are still not allowed. While casual gamblers only need to report their winnings as part of their overall income on their tax forms, professional gamblers may file a Schedule C as self-employed individuals.  They may be able to deduct their gambling-related expenses, such as travel or casino entry fees, to determine their net income.

They may be able to deduct their gambling-related expenses, such as travel or casino entry fees, to determine their net income.

In regards to losses, deductions for gambling losses must be less than or equal to gambling winnings. You can deduct losses from your gambling, but only if you itemize your deductions and keep an accurate record of your winnings and losses. The amount of losses you deduct cannot be more than the amount of gambling winnings you report on your tax return.

Under tax reform, you can only deduct losses directly related to your wagers and not non-wagering expenses like travel-related expenses to gambling sites. Gambling losses can be deducted up to the amount of gambling winnings. Whereas your winnings are reported by the payer on a Form W2-G, your losses may not be reported.

You will have to produce other documentation to validate the deduction.

Popular Pages

- What percent of sports betting is done in vegas

- When does sports betting start in new jersey

- How to understand sports betting lines

- Is sports betting worth it reddit

- How to turn over money on sports bet

- Is online sports betting legal in california

- Why are sports betting stocks down

- How old do you have to be to sports bet

- Is mohegan sun in pocono getting sports betting

- Can you bet on sports in california