Do you need to pay taxes winning in sports betting

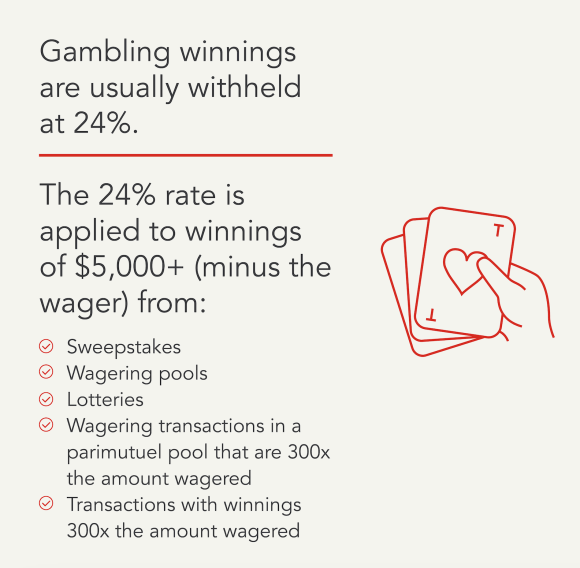

If your gambling winnings are over $5, or more than times your wager, the IRS requires that the casino/sportsbook withhold at least 24%. Winnings over $ are subject to a 24% withholding tax, which do you need to pay taxes winning in sports betting be applied at casinos or sports betting agencies, as well as when filing tax. When you win, your winnings are taxable income, subject to its own tax rules. TABLE OF CONTENTS. You are required to report your winnings; Form. Super Bowl gambling winnings. If you are one of the millions who placed a bet this year, you need to know that the IRS considers sports betting to be gambling.

Do You Need to Pay Taxes on Winnings in Sports Betting?

With the thrill of sports betting, come the questions about the taxation of your winnings. The sports betting arena is buzzing, but do you know how it can affect your tax obligations?

When you make money through sports betting, the taxman may come knocking at your door. Yes, you read that right. Just like any other source of income, your sports betting winnings are generally subject to taxation. So, if you've struck gold with your bets, you might need to set aside a portion for the tax authorities.

While the rules may vary depending on your location, it's crucial to understand the tax implications to avoid any surprises down the line. In some countries, there are specific thresholds below which winnings may be tax-free, but this isn't a universal rule.

Winning big in sports betting can lead to a significant tax bill—one that you don't want to ignore. To stay on the right side of the law, it's advisable to keep detailed records of your bets and winnings. This way, you can accurately report your earnings and comply with your tax obligations.

To navigate the murky waters of sports betting and taxation effectively, seek advice from a tax professional familiar with gambling laws in your area. They can provide tailored guidance and help you stay in the clear when it comes to taxes on your sports betting windfalls.

Gambling Winnings Taxes: An Intro Guide

Do You Have to Pay Sports Betting Taxes?

In any case, keep good records. If you itemize, you should be able to show the IRS the amounts of your gambling winnings, your losses, dates, places, and payers associated with that gambling. Remember that, like the federal government, most states tax income including gambling winnings , although some states don't allow deductions for gambling losses. If you're unsure how to report gambling winnings and losses from the state you reside in, or from a different state, check with a tax professional when it's time to file your taxes.

As the senior tax editor at Kiplinger. Taylor simplifies federal and state tax information, news, and developments to help empower readers. Kelley has over two decades of experience advising on and covering education, law, finance, and tax as a corporate attorney and business journalist. Here's what you need to know. By Joey Solitro Published 17 April EV Credits Claiming federal electric vehicle tax credits at the point of sale is a new and popular option in By Kelley R.

Taylor Published 17 April Fraud A new report sheds light on how older adult scam victims end up with big tax bills and lost retirement savings. Taylor Last updated 17 April Each wager must be reported separately and you can't deduct losses from your gambling income to lower how much you declare. Gambling losses can only be deducted if you itemize your return, which can be more of a headache than just taking the standard deduction.

If you think your gambling losses, plus other deductions combined, won't be more than the standard deduction for your tax bracket, it might not make sense to write off your gambling losses. If you do decide to itemize your deductions, your gambling losses can't be greater than the sum of your winnings. How much of your winnings you owe Uncle Sam depends on your tax bracket.

Because gambling facilities are required to withhold a flat percentage of your winnings if they're large enough, there may be a difference between the tax withheld and what you owe on your tax return. In addition, depending on where you live and where you gambled, you may also owe state and local taxes. Check your state's guidelines to find out. If you had any gambling wins in , you should report the full winnings on your tax return in , claiming it as "gambling income" on line 8 of Form , Schedule 1.

Itemized deductions can be reported on Schedule A of Form The tax-filing season kicked off on Jan. Do you need to pay taxes winning in sports betting TurboTax offers step-by-step guidance for filers and can access prior returns to get you started, even if they were filed with a different service. If you're going to write off your gambling losses, you should opt for TurboTax Deluxe — the basic edition is only available for simple returns with standard deductions.

TurboTax Free Edition. Click here for TurboTax offer details and disclosures. Terms apply. Users can also upload previous returns from other providers and they'll get an estimate of their tax refund in real time. Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox.

Sign up here. It includes cash winnings and the fair market value of prizes, such as cars and trips. You must report all gambling winnings to the IRS regardless of amount. This is incorrect.  The winner must report all winnings to the IRS on their income taxes. Taxpayers who itemize their taxes can deduct their losses on Schedule A.

The winner must report all winnings to the IRS on their income taxes. Taxpayers who itemize their taxes can deduct their losses on Schedule A.

However gambling losses can only offset gambling winnings. They cannot be used to reduce your taxable income from other sources. As with all deductions , you must keep records and receipts of all claimed losses. The manner in which you make the bet does not matter when paying federal income taxes.

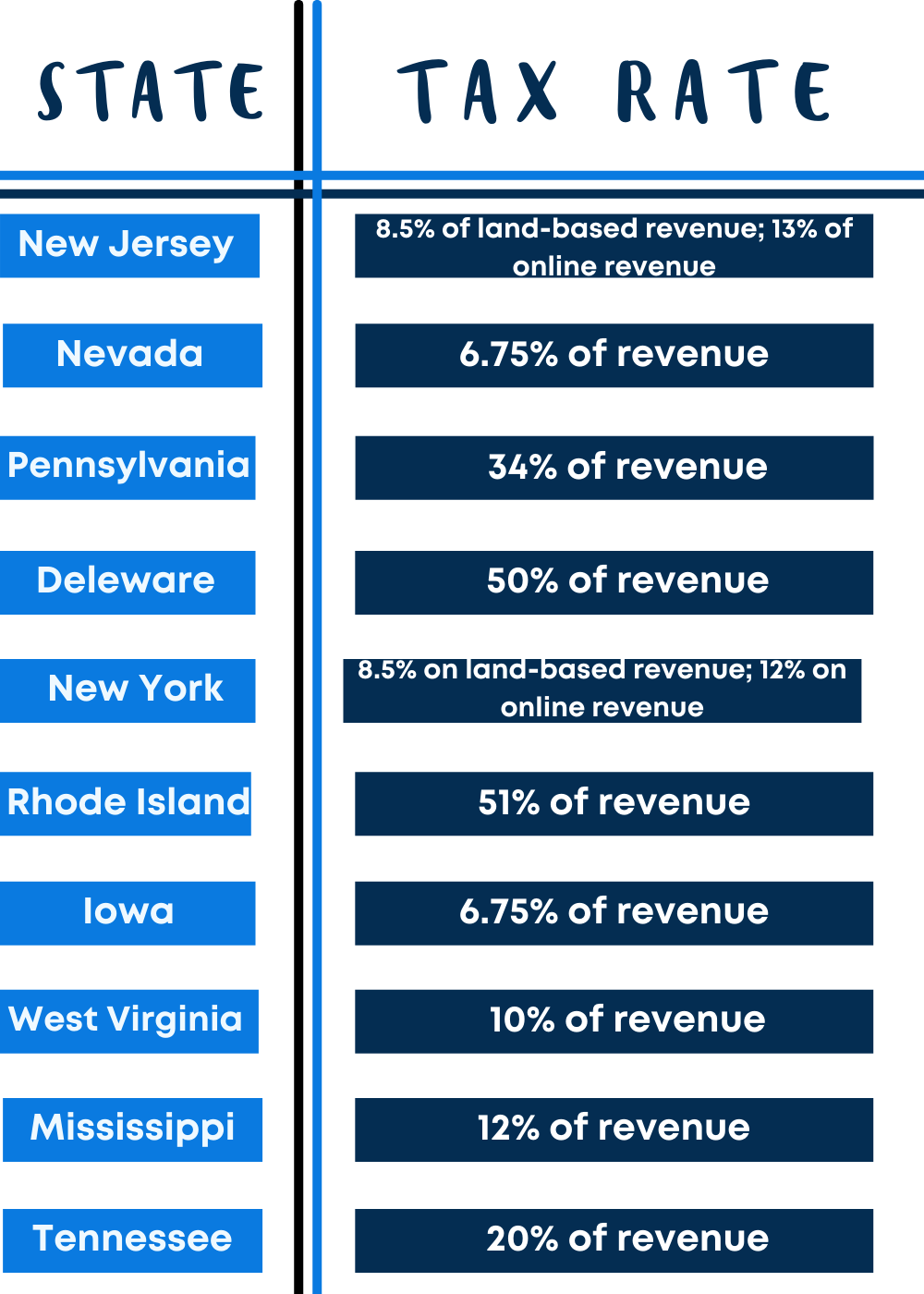

For example, the tax implications for the IRS are the same regardless of whether you make the bet in person or via an app. States have set rules on betting, including rules on taxing bets, in a variety of ways. Depending on your state, legal sports betting may be a combination of in person, online, retail at specifically licensed physical properties.

At time of writing 17 states continue to ban sports betting entirely. Every state has its own laws when it comes to gambling taxes. Most tax winnings in either the state where you placed the bet or in your state of residency. The explosion of online and app-based sportsbooks.

A sportsbook is the institution where you can place bets on sporting events, otherwise known as your bookie. The legal issues around online sportsbooks have not yet been fully resolved. These institutions argue that all bets occur either where the company is registered or where it keeps its servers. At time of writing this was not fully resolved.

The following table is based on Tax Foundation information. This does not absolve you of responsibility to report that income yourself, in the same way that you still have to file your taxes even though the IRS has your W It does mean, however, that you should be scrupulous when you file your taxes.

Many people underreport gambling winnings. There are many reasons not to do this, including the fact that the IRS may already know all about your income.

Popular Pages

- What do the plus minus mean in sports betting

- How does sports betting work point spread

- Is sports betting legal in alberta

- How to play bovada sports betting

- Is sports betting tax free

- How to make money of legalized sports betting

- What is illegal sports betting

- Do they bet on sports in australia

- What does void mean on sports bet

- When is mgm national harbor sports betting