Is sports betting tax free

The proceeds from a successful sports bet are taxable income, just like your paycheck or investment gains. Your sports betting winnings are is sports betting tax free taxable income—specifically they are deemed ordinary income on your return. If you've won money placing bets, the. Sports betting winnings are taxable income, which means they are taxed like other ordinary income on your tax return. The tax rate that you pay. Graphic explaining that gambling winnings are usually withheld at 24%. On the right there's. How to report your gambling winnings on your taxes.

Is Sports Betting Tax Free?

As the excitement of sports betting continues to captivate fans worldwide, the question of whether sports betting winnings are tax free often arises. In various regions and countries, the taxation of sports betting winnings can vary significantly, impacting both players and the industry as a whole.

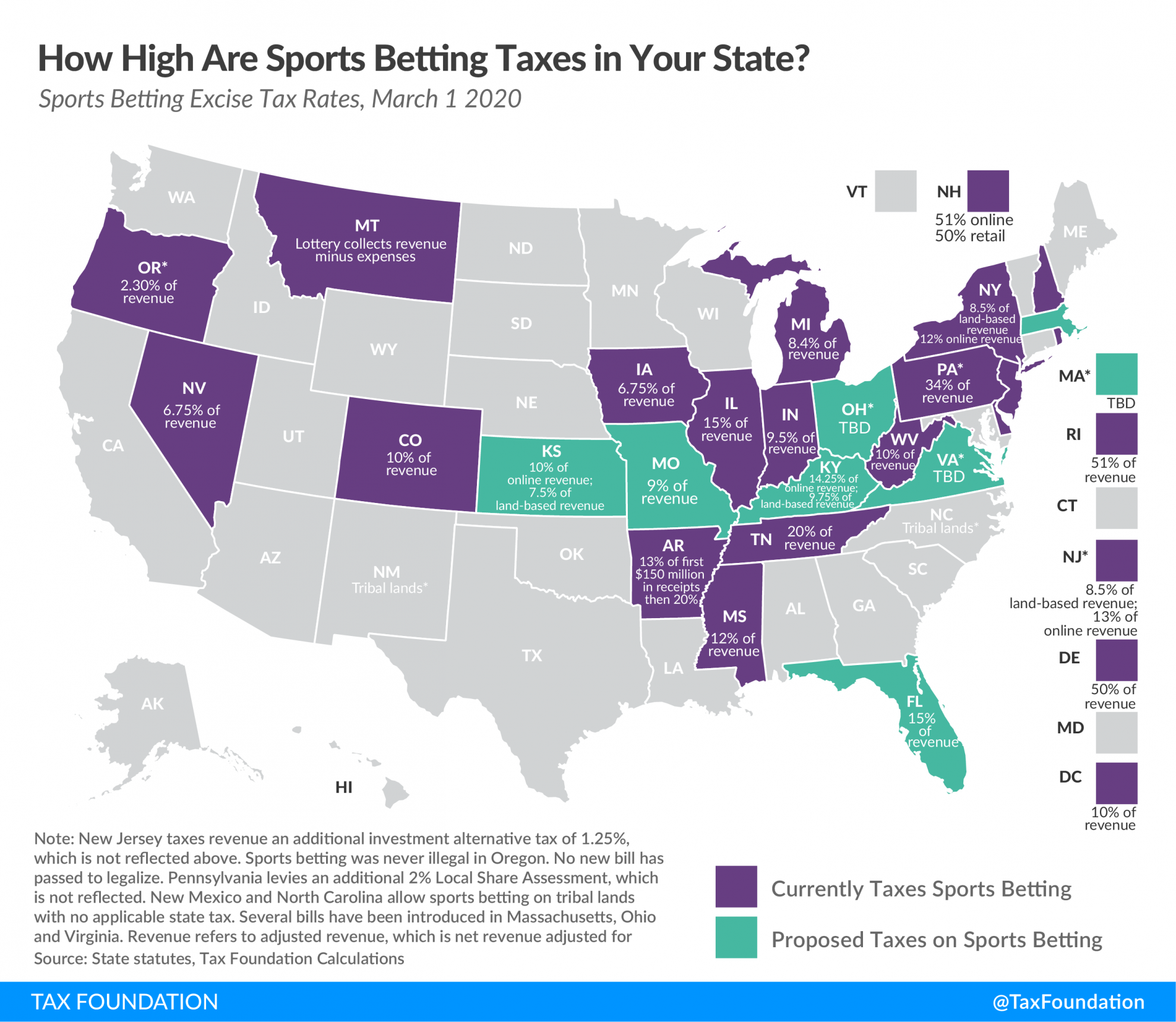

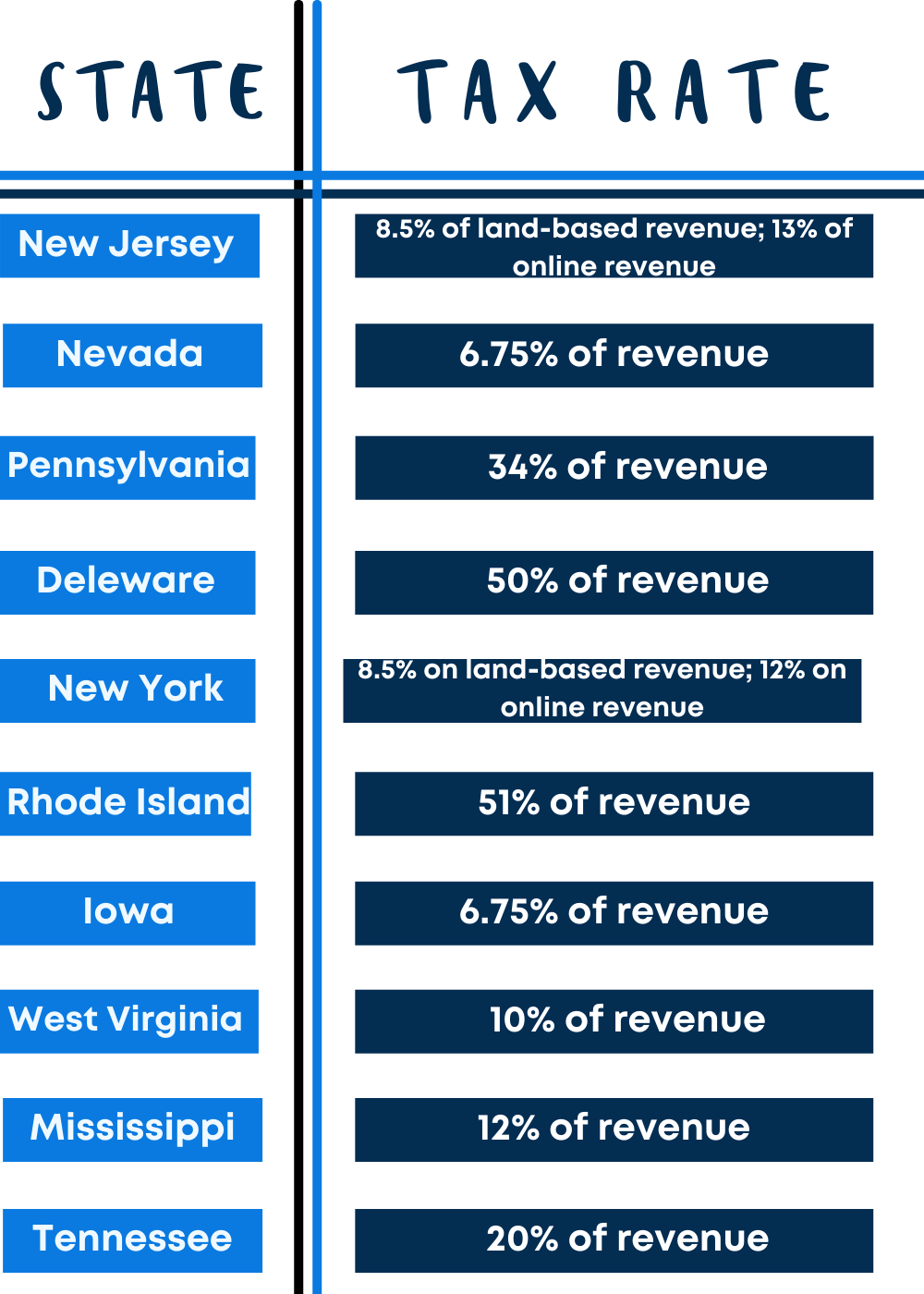

In many jurisdictions, sports betting winnings are considered taxable income, subject to specific regulations and tax rates. However, the exact rules and rates can differ depending on where you are located. For instance, in some countries like the United States, sports betting winnings are generally taxable at both the federal and state levels.

When it comes to online sports betting, the situation can become more complex. Some countries may have differing tax laws for online betting compared to traditional brick-and-mortar establishments. This can further complicate the issue of whether sports betting winnings are subject to taxation.

It is crucial for individuals engaging in sports betting to be aware of the tax implications in their respective jurisdictions. In some cases, there may be thresholds or exemptions that apply to smaller winnings. Consulting with a tax professional or financial advisor can provide clarity on the tax obligations related to sports betting winnings.

| Country | Tax on Sports Betting Winnings |

|---|---|

| United States | Subject to federal and state taxes |

| United Kingdom | Winnings are generally tax-free for players |

| Australia | No tax on individual sports betting winnings |

Overall, the tax treatment of sports betting winnings varies depending on the country and specific regulations in place. It is essential for bettors to understand the tax implications to avoid potential issues in the future. Staying informed and seeking professional guidance can help navigate the complexities of sports betting taxation.

What Taxes Are Due on Gambling Winnings?

Can you write off sports betting losses? You may deduct gambling losses only if you itemize your deductions on Schedule A (Form 1040) and kept a record of your winnings and losses. The amount of losses you deduct can't be more than the amount of gambling income you reported on your return.

How much taxes are taken out of sports betting? If you've won money placing bets, the tax rate can be anywhere from 10% to 37% based on your income tax bracket. If you've lost money, you won't owe any taxes, but you may be able to deduct your losses if you itemize your deductions on your return. Take note: You can't deduct more than your winnings.

Can I write off gambling losses? You may deduct gambling losses only if you itemize your deductions on Schedule A (Form 1040) and kept a record of your winnings and losses. The amount of losses you deduct can't be more than the amount of gambling income you reported on your return.

How much can you win sports betting without paying taxes? Yes, you owe taxes on sports betting wins

How are taxes paid on sports betting? For federal taxes, there are two types of withholdings on gambling winnings: a regular gambling withholding (24% or 31.58% for certain non cash payments) and back withholding also at 24%. If your winning is already subject to regular gambling with holding you won't also be subject to backup withholding.

If you won at least $600 and 300 times the wager amount, casinos, gambling platforms and online sportsbooks should provide you with IRS Form W-2G (Certain Gambling Winnings). It might be issued on the spot or mailed later, depending on the venue and the amount.Gambling Winnings Taxes: An Intro Guide

It depends on the game. You might get some of it back or you might owe more. Taxes on winnings at games of skill like blackjack are not immediately withheld but you're still required to report the income and pay taxes on it. Casinos aren't required to withhold taxes or issue a W2-G to players who win large sums at certain table games, such as blackjack, craps, and roulette.

These are categorized as games of skill rather than games of chance. It's not clear why the IRS has differentiated the requirements in this way but slot machines are considered to be games of chance. Table games are seen as requiring a level of skill. The casino cannot determine with certainty how much money you started with when you cash in your chips from a table game but this doesn't absolve you of the obligation to report what you won to the IRS.

You'll include the amount of your winnings when you file your tax return for the year rather than at the casino when you claim them. Make sure to keep good records of your gambling activities, losses as well as gains. The Supreme Court gave U. It is legal in 37 states and the District of Columbia as of and legal but not yet operational in one other state.

It's still illegal in five states California, Utah, Idaho, Alabama, and Alaska and there is dead legislation in seven other states. You'll report the income and the taxes already paid on it under "Other Income" on your Form tax return when you prepare your taxes for the year in which you won a gambling payout.

The real amount you owe or may be reimbursed depends on your total income for the year. There are seven tax brackets as of Gambling proceeds are usually considered regular earned income and are taxed at a taxpayer's normal effective income tax rate if gambling is their actual profession. The income and expenses must therefore be recorded on Schedule C as a self-employed individual.

A professional gambler can deduct gambling losses as job expenses using Schedule C not Schedule A. The IRS requires nonresidents of the U. Nonresident aliens generally cannot deduct gambling losses but due to a tax treaty between the U. Is sports betting tax free You are allowed to deduct any money you lose from your gambling winnings for tax purposes but gambling losses in excess of what you win may not be claimed as a tax write-off.

Some states require gambling winners to claim the gambling winnings in the state where they were won. Most states tax all income earned in their state, regardless of your residency. Your resident state will also require you to report the winnings but will offer a credit or deduction for taxes already paid to a non-resident state. Yes, but certain thresholds must be eclipsed to trigger such reporting.

Gambling winnings are fully taxable according to IRS regulations but gambling losses can be deductible up to the amount of your winnings if you choose to itemize deductions on your tax return. Be sure to maintain detailed records of your wins and losses to support your tax deduction claims. If you or someone you know has a gambling problem, you can call the National Problem Gambling Helpline at or visit ncpgambling.

American Gaming Association. Map: Sports Betting. Nonresident Alien Income Tax Return. Table of Contents Expand. Table of Contents.  How Gambling Winnings Are Taxed. Reporting Gambling Winnings. Taxes for Professional Gamblers. The applicable thresholds to receive a Form W2G for casino winnings are:. For mobile sports gambling , the online sportsbook has different thresholds and reporting requirements.

How Gambling Winnings Are Taxed. Reporting Gambling Winnings. Taxes for Professional Gamblers. The applicable thresholds to receive a Form W2G for casino winnings are:. For mobile sports gambling , the online sportsbook has different thresholds and reporting requirements.

Entry fees and winnings are based on the calendar year in which the contest or sporting event ends and the wager is settled. Absolutely so. It does not matter whether the winnings are in the form of cash, property, or an annuity. You can choose to voluntarily withhold income taxes from your winnings on a Form W2G even if not above the threshold, and the payer will usually inquire whether you would like to do so before issuing you the form.

However, the choice is up to you. If you are a high-income taxpayer, the tax impact of your winnings can easily exceed the withholdings. It is a common but debunked myth that everyone can deduct their gambling losses when computing their taxable incomes. However, this belief can create an unfavorable surprise the next tax return you file.

Unless you are a professional gambler and can show the income and losses on your Schedule C, you must itemize your deductions in order to deduct your losses against your winnings. Alternatively, if you claim the standard deduction on your return, your gambling losses would not be deducted at all. In order to itemize your deductions in , for example, your total amount of itemized deductions real estate taxes, mortgage interest, charitable contributions, etc.

If it is not, you could lose out twice, first for losing your bets at the casino or online, and a second time for not being able to deduct your losses against any large winnings that are includable in taxable income. If you do not itemize deductions and use the standard deduction, the IRS and state agencies treat your losses as a personal expense; you might as well say it was spent on a movie ticket on a Sunday afternoon.

The amount of itemized deduction for gambling losses is allowed only up to the amount of gambling winnings reported as income on your individual income tax return. In other words, no net losses may be reported. Both online sports betting apps and in-person betting operators are getting better at substantiating gambling losses.

While most sportsbooks and casinos offer the ability to keep track of your winnings and losses, it is always prudent to keep good records personally. If there is no record of the losses you sustained, the IRS will disallow those itemized deductions. Las Vegas and Miami are hot spots for fun, sun, and gambling.

Popular Pages

- Is there sports betting shops in carins australia

- Can a multi bet contain more than one sport

- How to bet on sports online ohio

- Can sports betting make you rich

- How often does the favorite win in sports betting

- What does it mean to leverage a sports bet

- Can you bet on sports in saskatchewan

- How are boxing moneyline sports bets settled if a draw

- How to file income tax return offshore sports betting

- What is a sports betting model