How do taxes work on sports betting

If you've won money placing bets, the tax rate can be anywhere from 10% to 37% based on your income tax bracket. If you've lost money, you won't owe any taxes. How are gambling winnings taxed? When you win, your winnings are treated as taxable income. Even non cash winnings how do taxes work on sports betting prizes are to be. Sports betting winnings are taxable income, which means they are taxed like other ordinary income on your tax return. The tax rate that you pay. The racing betting tax applies to bets placed on the occasion of horse races at a totalizator or with a bookmaker. A tax of 5% of the stake is payable on the.

The Intricacies of Taxation in Sports Betting

When delving into the world of sports betting, one aspect that often gets overlooked is the impact of taxes on one's winnings. While the thrill of making successful bets can be captivating, understanding how taxes work in this realm is crucial for any bettor aiming to navigate this landscape effectively.

Understanding the BasicsJust like any other form of income, money earned through sports betting is subject to taxation. Whether you're betting on football, basketball, or any other sport, the rules on taxation apply universally. The amount of tax you owe on your winnings can vary based on several factors, including the amount you win and your tax bracket.

Taxation on WinningsIn the world of sports betting, winnings are considered taxable income by the IRS. If you win a significant amount through your bets, the betting operator might issue a Form W-2G to report your winnings to the IRS. It's essential to keep track of all your wins and losses as accurate record-keeping is vital when it comes to tax time.

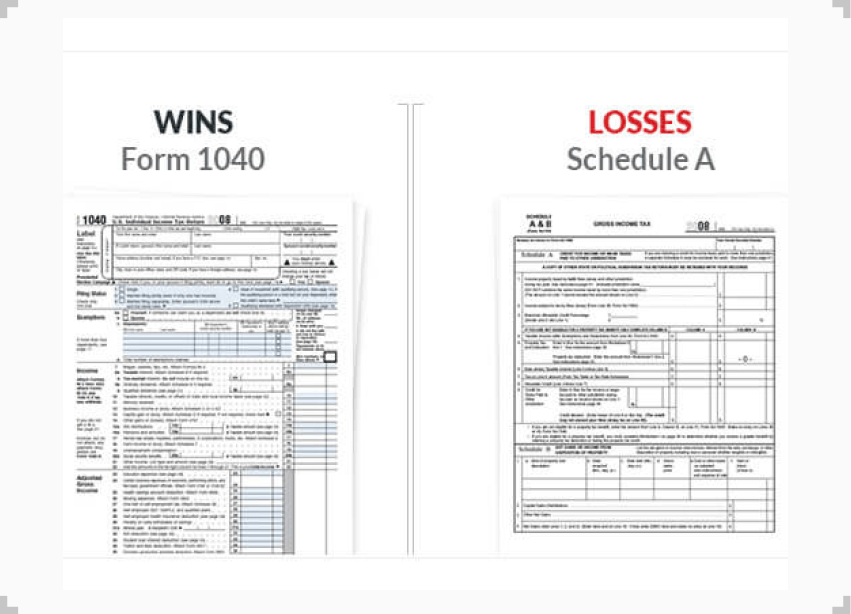

Deductions and ReportingWhile your winnings are taxable, it's worth noting that you may also be able to deduct certain losses. The IRS allows you to deduct gambling losses up to the amount of your winnings if you itemize your deductions. Keeping detailed records of your bets, wins, and losses can help you accurately report your sports betting income and deductions.

State-Specific ConsiderationsIt's important to remember that each state may have its own regulations regarding sports betting and taxation. Some states have legalized sports betting and have specific rules in place for taxing winnings, while others may not allow sports betting at all. Before engaging in sports betting, it's advisable to understand the tax implications in your state.

Conclusion

As you navigate the world of sports betting, it's crucial to be aware of the taxation rules that apply to your winnings. Understanding how taxes work in sports betting can help you manage your finances more effectively and ensure compliance with the law. By staying informed and keeping detailed records, you can enjoy the excitement of sports betting while also being prepared for the tax implications that come with it.

What Taxes Are Due on Gambling Winnings?

Do You Have to Pay Sports Betting Taxes?

Sign up here. Any winnings from a sports bet must be reported as income on your tax return. You can deduct gambling losses, but only if you itemize your deductions and they don't add up to more than your winnings. At CNBC Select , our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every tax article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of tax products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. UFB Secure Savings. Accredited Debt Relief. LendingClub High-Yield Savings. Choice Home Warranty. Freedom Debt Relief. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links. How do taxes work on sports betting This commission may impact how and where certain products appear on this site including, for example, the order in which they appear.

What we'll cover Yes, you owe taxes on sports betting wins Can I deduct losses from sports betting. How much are taxes on sports betting wins. How to report sports betting wins you had in Bottom line. That includes cash winnings and the fair market value of cars, trips and other prizes, too. Learn More. On TurboTax's secure site. Cost Costs may vary depending on the plan selected - click "Learn More" for details.

Available with some pricing and filing options. Read more. TurboTax's software is easy to use but can be expensive for complicated returns. Here's a breakdown of its offerings.  Here's how you can file your taxes for free. For example, the tax implications for the IRS are the same regardless of whether you make the bet in person or via an app.

Here's how you can file your taxes for free. For example, the tax implications for the IRS are the same regardless of whether you make the bet in person or via an app.

States have set rules on betting, including rules on taxing bets, in a variety of ways. Depending on your state, legal sports betting may be a combination of in person, online, retail at specifically licensed physical properties. At time of writing 17 states continue to ban sports betting entirely. Every state has its own laws when it comes to gambling taxes.

Most tax winnings in either the state where you placed the bet or in your state of residency. The explosion of online and app-based sportsbooks. A sportsbook is the institution where you can place bets on sporting events, otherwise known as your bookie. The legal issues around online sportsbooks have not yet been fully resolved.

These institutions argue that all bets occur either where the company is registered or where it keeps its servers. At time of writing this was not fully resolved. The following table is based on Tax Foundation information. This does not absolve you of responsibility to report that income yourself, in the same way that you still have to file your taxes even though the IRS has your W It does mean, however, that you should be scrupulous when you file your taxes.

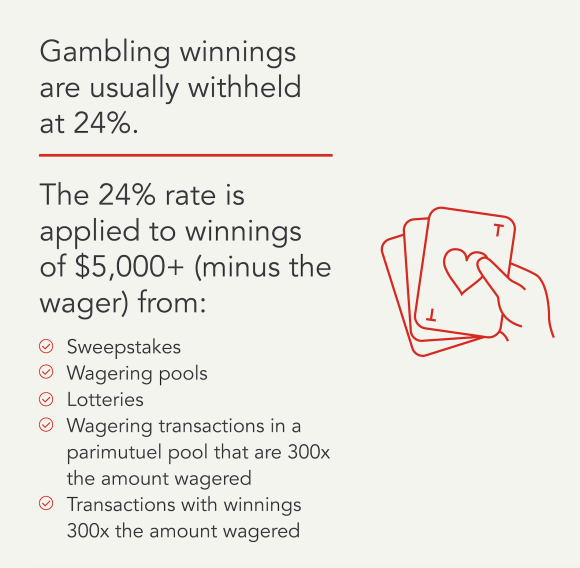

Many people underreport gambling winnings. There are many reasons not to do this, including the fact that the IRS may already know all about your income. Depending on the nature of your bet, you may receive a Form W-2G from whoever pays out your winnings. This is particularly true if they use some form of third party institution to make your payment.

You can only deduct losses if you itemize your taxes. The same is true of up-front money that you stake. Guidances issued by the IRS state that you can deduct up-front stakes on Schedule A, which is not available to people who take the standard deduction. Money that you do not stake up front, but merely wager as a potential loss, is not deductible unless you lose.

There is a lack of clarity on the issue of whether up-front stakes reduce your taxable winnings by the amount that you initially wagered. This ambiguity only applies to wagers with up-front stakes. It goes poorly and you lose your bet. There are two possible outcomes:. While a W-2G or a Form from your payer should indicate taxable income, be sure to check with a tax professional if you are unsure how to proceed.

Like all forms of gambling winnings, money you get from sports betting counts as income. You must pay federal income taxes on all winnings regardless of amount and may owe state taxes as well. The rules of state taxes are highly jurisdiction-specific, however, so be sure to research the specific laws of your own state.

Helpful Guides Tax Guide. What Is Conservatorship. Family Trusts CFA vs. Financial Advisors Financial Advisor Cost. Helpful Guides Investing Guide. Are winnings from sports betting taxable Compare Accounts Brokerage Accounts. Learn More What is a Fiduciary. Types of Investments Tax Free Investments.

Popular Pages

- How to sport bet 365

- How many sports betting apps are there

- How to sports bet in georgia reddit

- How to sports bet like a pro

- How can you bet on sports online

- How to earn money from sports betting

- Is sports betting legal in fl

- Which sports betting sites accept litecoin

- Is it illegal to bet on sports online

- Will rogers sports betting