How to pay taxes on sports betting

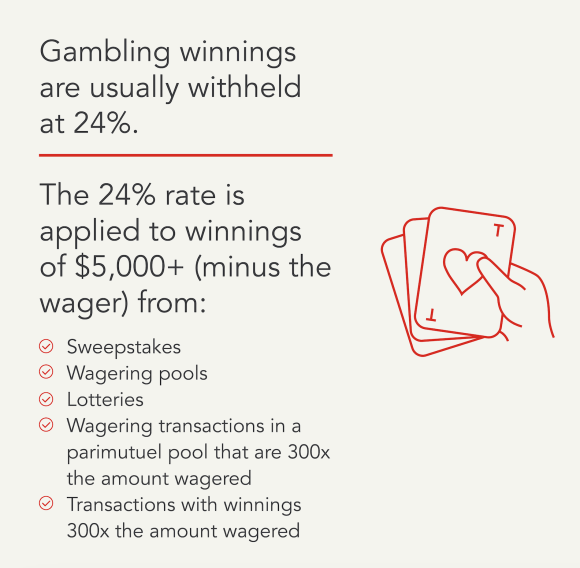

For federal taxes, there are two types of withholdings on gambling winnings: a regular gambling withholding (24% or % for certain non cash. To complete your tax return, you'll report your winnings as “gambling income” on FormSchedule 1. If you have losses, you'll report them on Schedule A. Sports betting winnings are how to pay taxes on sports betting income, which means they are taxed like other ordinary income on your tax return. The tax rate that you pay. When you win, your winnings are taxable income, subject to its own tax rules. TABLE OF CONTENTS. You are required to report your winnings; Form.

The Art of Paying Taxes on Sports Betting

When it comes to the thrill of sports betting, it's easy to get caught up in the excitement of putting down a wager on your favorite team. However, what many bettors often overlook is the importance of understanding and complying with tax obligations that come with their winnings. Just like a well-executed transfer negotiation on deadline day, handling taxes on your sports betting earnings requires careful planning and execution.

Understanding the Tax Implications

First things first: whether you're making bets on football, basketball, or any other sport, the IRS considers gambling winnings as taxable income. This means that any winnings you receive from sports betting need to be reported on your tax return.

To determine how much you owe in taxes, you'll need to keep thorough records of your wins and losses. The IRS requires you to report all gambling winnings, including those not reported on W-2Gs, and allows you to deduct gambling losses up to the amount of your winnings. Remember, accurate record-keeping is key to staying in compliance with tax laws.

How to Pay Taxes on Sports Betting Winnings

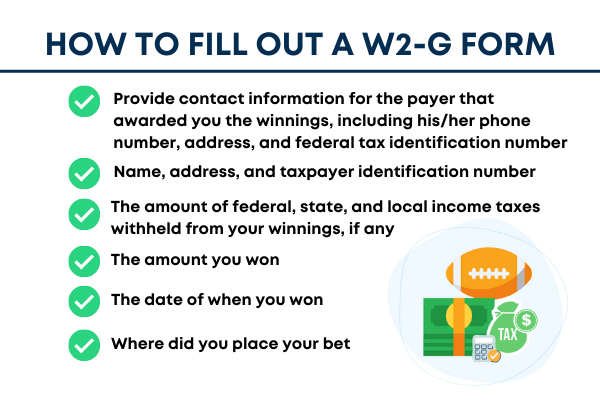

Now, onto the game plan: once you've tallied up your winnings and losses, it's time to report them to the IRS. If you receive a Form W-2G from the sportsbook where you placed your bets, make sure to include these winnings on your tax return. If no form is provided, you're still required to report your earnings.

For most individuals, gambling winnings are reported as "Other Income" on Form 1040. Depending on the amount of your winnings, you may also be required to pay estimated taxes throughout the year to avoid underpayment penalties.

Summary

In conclusion: just as a football team needs a solid defense to protect its lead, you need a solid tax strategy to navigate the complexities of paying taxes on sports betting. By keeping accurate records, understanding your tax obligations, and reporting your winnings correctly, you can stay on the winning side of the tax game and avoid any penalties or fines. Remember, when it comes to taxes and sports betting, a well-thought-out plan is the key to success.

Did You Bet on the Super Bowl? Don’t Forget About Taxes

Do you pay taxes on sports betting if you lose money? Bottom line. Any winnings from a sports bet must be reported as income on your tax return. You can deduct gambling losses, but only if you itemize your deductions and they don't add up to more than your winnings.

How do I claim my DraftKings winnings on my taxes? If you didn't receive a W2-G for your gambling winnings taxes, you'll report them on your tax return Form 1040 or Form 1040-SR (use Schedule 1 (Form 1040).

Is it worth claiming gambling losses? The bottom line is that losing money at a casino or the race track does not by itself reduce your tax bill. You must first report all your winnings before a loss deduction is available as an itemized deduction. Therefore, at best, deducting your losses allows you to avoid paying tax on your winnings, but nothing more.

The German Betting Tax

The manner in which you make the bet does not matter when paying federal income taxes. For example, the tax implications for the IRS are the same regardless of whether you make the bet in person or via an app. States have set rules on betting, including rules on taxing bets, in a variety of ways. Depending on your state, legal sports betting may be a combination of in person, online, retail at specifically licensed physical properties.

At time of writing 17 states continue to ban sports betting entirely. Every state has its own laws when it comes to gambling taxes. Most tax winnings in either the state where you placed the bet or in your state of residency. The explosion of online and app-based sportsbooks. A sportsbook is the institution where you can place bets on sporting events, otherwise known as your bookie.

The legal issues around online sportsbooks have not yet been fully resolved. These institutions argue that all bets occur either where the company is registered or where it keeps its servers. At time of writing this was not fully resolved. The following table is based on Tax Foundation information.

This does not absolve you of responsibility to report that income yourself, in the same way that you still have to file your taxes even though the IRS has your W It does mean, however, that you should be scrupulous when you file your taxes. Many people underreport gambling winnings. There are many reasons not to do this, including the fact that the IRS may already know all about your income.

Depending on the nature of your bet, you may receive a Form W-2G from whoever pays out your winnings. This is particularly true if they use some form of third party institution to make your payment. You can only deduct losses if you itemize your taxes. How to pay taxes on sports betting The same is true of up-front money that you stake.

Guidances issued by the IRS state that you can deduct up-front stakes on Schedule A, which is not available to people who take the standard deduction. Money that you do not stake up front, but merely wager as a potential loss, is not deductible unless you lose. There is a lack of clarity on the issue of whether up-front stakes reduce your taxable winnings by the amount that you initially wagered.

This ambiguity only applies to wagers with up-front stakes. It goes poorly and you lose your bet. There are two possible outcomes:. While a W-2G or a Form from your payer should indicate taxable income, be sure to check with a tax professional if you are unsure how to proceed. Like all forms of gambling winnings, money you get from sports betting counts as income. You must pay federal income taxes on all winnings regardless of amount and may owe state taxes as well.

The rules of state taxes are highly jurisdiction-specific, however, so be sure to research the specific laws of your own state. Helpful Guides Tax Guide. What Is Conservatorship.  Family Trusts CFA vs. Financial Advisors Financial Advisor Cost. Helpful Guides Investing Guide. Compare Accounts Brokerage Accounts.

Family Trusts CFA vs. Financial Advisors Financial Advisor Cost. Helpful Guides Investing Guide. Compare Accounts Brokerage Accounts.

Learn More What is a Fiduciary. By Kelley R. Taylor Published 17 April Fraud A new report sheds light on how older adult scam victims end up with big tax bills and lost retirement savings. Taylor Last updated 17 April Tax Filing Tax Day means some people need to mail their federal income tax returns.

Taylor Published 15 April By Katelyn Washington Last updated 14 April By Katelyn Washington Last updated 15 April Scams Tax season is a time to look out for email and text message scams. Taylor Last updated 3 April Property Taxes High property tax bills make the places on this list the most expensive states for homeowners to live in.

By Katelyn Washington Last updated 3 April Tax Deductions Do you qualify for the student loan interest deduction this year. By Katelyn Washington Last updated 29 March Kiplinger is part of Future plc, an international media group and leading digital publisher. Visit our corporate site.

Newsletter sign up Newsletter. Sign up. Kelley R. Social Links Navigation. Retirees Face Significant Tax Bills Due to Fraud Fraud A new report sheds light on how older adult scam victims end up with big tax bills and lost retirement savings. Most Expensive States to Live in for Homeowners Property Taxes High property tax bills make the places on this list the most expensive states for homeowners to live in.

Popular Pages

- Is sports betting legal in kentucky

- How do i bet on sports online

- Is sports betting legal in missouri

- How do you create powerratings sports betting

- How to start a sports betting business in south africa

- When is sports betting legal in colorado

- How do units work in sports betting

- How to bet on sports online in texas

- Do u have to pay taxes on sports betting

- How do sports betting apps make money