How much taxes on sports betting

Fortunately, most online wagering service providers will send individuals a tax document summarizing gambling winnings if they exceed $ per. Put your Kansas tax information in the state specific boxes on the W-2G. Where does my tax money go? InKansas' sports betting tax dollars. Our son was mistaken about the 24 percent tax, though. That is the withholding rate which typically applies when a bettor wins over $5, That. Winnings over $ are subject to a 24% withholding tax, which can be applied at casinos or sports betting agencies, how much taxes on sports betting well as when filing tax.

The Taxation Landscape of Sports Betting: A Deep Dive into Financial Realities

Sports betting, a realm where expectations meet realities on the field and financial stakes run high, is not devoid of the clutches of taxation. From seasoned high rollers to casual punters, the looming question remains: just how much of our winnings go back to the government's coffers?

Among the many facets of sports betting, one critical aspect is the taxation policies that vary across different regions and jurisdictions. Whether you are in the hustle and bustle of a bustling city or amidst the tranquility of a suburban neighborhood, taxation on sports betting is a subject that strikes a chord with all enthusiasts.

The Taxation Equation:

Understanding the specifics of taxation on sports betting can be a game-changer for both seasoned bettors and newcomers. The general consensus is that taxes on sports betting typically range between X% and Y%, depending on the country or state regulations in place. While some regions employ a fixed percentage tax system, others opt for a tiered approach based on the amount of winnings.

Importance of Transparent Taxation:

Transparency in taxation mechanisms is crucial in fostering trust between the betting community and regulatory bodies. A clear and well-defined taxation structure not only ensures compliance but also promotes a sense of accountability within the industry.

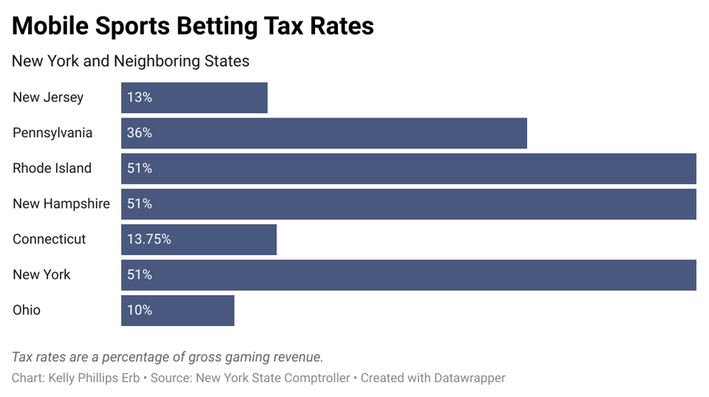

International Comparison of Taxation Rates:

| Country | Tax Rate (%) |

|---|---|

| United Kingdom | 15% |

| United States | Varies by State (e.g., Nevada at 6.75%) |

| Australia | Up to 10% |

Diving into the numbers, we observe a noticeable disparity in tax rates across the globe. While some countries opt for a more lenient approach to taxation, others enforce stringent policies that significantly impact the bottom line of bettors.

In Conclusion:

The landscape of taxation on sports betting is a multifaceted realm that demands attention and understanding from all stakeholders. As enthusiasts navigate the thrilling highs and crushing lows of the sports betting arena, being well-versed in the taxation dynamics can turn the tide in their favor.

Ultimately, transparency, fair taxation policies, and informed decision-making are pivotal to ensuring a harmonious relationship between sports bettors and the taxation authorities in the ever-evolving world of sports betting.

What Taxes Are Due on Gambling Winnings?

Yes, your winnings from Fanduel and other fantasy sports platforms, such as Draft Kings are taxable. Fanduel will issue a W-2G or 1099 for your winnings. Once your winnings reach $5,000 they will withhold 25% for you for federal tax purposes.How does the IRS know if you won money gambling? Having said that, in practice, the IRS doesn't expect you to report every time you win $5 from a scratch-off ticket, but it's important to note that you're officially required to report your winnings. And if you win more than a certain amount, the casino or gaming establishment is required to issue you a Form W-2G.

Are taxes automatically taken out of sports betting? Yes, you owe taxes on sports betting wins If you won at least $600 and 300 times the wager amount, casinos, gambling platforms and online sportsbooks should provide you with IRS Form W-2G (Certain Gambling Winnings). It might be issued on the spot or mailed later, depending on the venue and the amount.

How much gambling winnings is taxable? Your gambling winnings are generally subject to a flat 24% tax. However, for the following sources listed below, gambling winnings over $5,000 will be subject to income tax withholding: Any sweepstakes, lottery, or wagering pool (this can include payments made to the winner(s) of poker tournaments).

What percent of tax does DraftKings take? DraftKings's effective tax rate for fiscal years ending December 2019 to 2023 averaged 0.6%. DraftKings's operated at median effective tax rate of 0.0% from fiscal years ending December 2019 to 2023. Looking back at the last 5 years, DraftKings's effective tax rate peaked in December 2022 at 4.7%.

How much taxes do you pay on FanDuel winnings? 25%

What happens if you don't report sports betting taxes? In the United States, failing to report gambling winnings on your taxes can result in penalties and fines. The IRS considers all gambling winnings taxable income, and must be reported as such on your tax return.

Do You Have to Pay Sports Betting Taxes?

Goralka Published 16 April Fraud A new report sheds light on how older adult scam victims end up with big tax bills and lost retirement savings. By Kelley R. Taylor Last updated 16 April Tax Filing Tax Day means some people need to mail their federal income tax returns. Taylor Published 15 April By Katelyn Washington Last updated 14 April By Katelyn Washington Last updated 15 April Scams Tax season is a time to look out for email and text message scams.

Taylor Last updated 3 April Property Taxes High property tax bills make the places on this list the most expensive states for homeowners to live in. By Katelyn Washington Last updated 3 April Tax Deductions Do you qualify for the student loan interest deduction this year. By Katelyn Washington Last updated 29 March By Katelyn Washington Last updated 14 March Kiplinger is part of Future plc, an international media group and leading digital publisher.

Visit our corporate site. Newsletter sign up Newsletter. By Rocky Mengle. Image credit: Getty Images. Sponsored Content. Your gambling losses might be deductible Did you have a bad night at the blackjack table or pick the wrong horse to win. Report gambling winnings and losses separately on your tax return Gambling winnings and losses must be reported separately. Keep good records of your gambling winnings and losses To help you keep track of how much you've won or lost over the course of a year, the IRS suggests keeping a diary or similar record of your gambling activities.

Audit risks may be higher with gambling taxes If you receive a W-2G form along with your gambling winnings, don't forget that the IRS is getting a copy of the form, too. Gambling winnings: State and local taxes may apply If you look carefully at Form W-2G you'll notice that there are boxes for reporting state and local winnings and withholding. Rocky Mengle.

Social Links Navigation. How much taxes on sports betting How Did O. Retirees Face Significant Tax Bills Due to Fraud Fraud A new report sheds light on how older adult scam victims end up with big tax bills and lost retirement savings. It's not clear why the IRS has differentiated the requirements in this way but slot machines are considered to be games of chance.

Table games are seen as requiring a level of skill. The casino cannot determine with certainty how much money you started with when you cash in your chips from a table game but this doesn't absolve you of the obligation to report what you won to the IRS.

You'll include the amount of your winnings when you file your tax return for the year rather than at the casino when you claim them. Make sure to keep good records of your gambling activities, losses as well as gains. The Supreme Court gave U. It is legal in 37 states and the District of Columbia as of and legal but not yet operational in one other state.

It's still illegal in five states California, Utah, Idaho, Alabama, and Alaska and there is dead legislation in seven other states. You'll report the income and the taxes already paid on it under "Other Income" on your Form tax return when you prepare your taxes for the year in which you won a gambling payout. The real amount you owe or may be reimbursed depends on your total income for the year.

There are seven tax brackets as of Gambling proceeds are usually considered regular earned income and are taxed at a taxpayer's normal effective income tax rate if gambling is their actual profession. The income and expenses must therefore be recorded on Schedule C as a self-employed individual.

A professional gambler can deduct gambling losses as job expenses using Schedule C not Schedule A.  The IRS requires nonresidents of the U. Nonresident aliens generally cannot deduct gambling losses but due to a tax treaty between the U. You are allowed to deduct any money you lose from your gambling winnings for tax purposes but gambling losses in excess of what you win may not be claimed as a tax write-off.

The IRS requires nonresidents of the U. Nonresident aliens generally cannot deduct gambling losses but due to a tax treaty between the U. You are allowed to deduct any money you lose from your gambling winnings for tax purposes but gambling losses in excess of what you win may not be claimed as a tax write-off.

Some states require gambling winners to claim the gambling winnings in the state where they were won. Most states tax all income earned in their state, regardless of your residency. Your resident state will also require you to report the winnings but will offer a credit or deduction for taxes already paid to a non-resident state.

Yes, but certain thresholds must be eclipsed to trigger such reporting. Gambling winnings are fully taxable according to IRS regulations but gambling losses can be deductible up to the amount of your winnings if you choose to itemize deductions on your tax return. Be sure to maintain detailed records of your wins and losses to support your tax deduction claims.

If you or someone you know has a gambling problem, you can call the National Problem Gambling Helpline at or visit ncpgambling. American Gaming Association. Guidances issued by the IRS state that you can deduct up-front stakes on Schedule A, which is not available to people who take the standard deduction. Money that you do not stake up front, but merely wager as a potential loss, is not deductible unless you lose.

There is a lack of clarity on the issue of whether up-front stakes reduce your taxable winnings by the amount that you initially wagered. This ambiguity only applies to wagers with up-front stakes. It goes poorly and you lose your bet. There are two possible outcomes:. While a W-2G or a Form from your payer should indicate taxable income, be sure to check with a tax professional if you are unsure how to proceed.

Like all forms of gambling winnings, money you get from sports betting counts as income. You must pay federal income taxes on all winnings regardless of amount and may owe state taxes as well. The rules of state taxes are highly jurisdiction-specific, however, so be sure to research the specific laws of your own state. Helpful Guides Tax Guide. What Is Conservatorship?

Family Trusts CFA vs. Financial Advisors Financial Advisor Cost. Helpful Guides Investing Guide. Compare Accounts Brokerage Accounts. Learn More What is a Fiduciary. Types of Investments Tax Free Investments. Helpful Guides Credit Cards Guide. Compare Quotes Life Insurance Quotes. Helpful Guides Life Insurance Guide. Calculators Refinance Calculator. What is the best sports betting strategy Compare Rates Compare Refinance Rates.

Helpful Guides Refinance Guide. Calculators Personal Loan Calculator.

Popular Pages

- Is sports bet also horse racing

- Where can you bet on sports in indiana

- Where is sports betting legal in the us

- How to keep track of sports betting wins and losses

- Which sport is good to bet on

- How to make money off sports betting

- Is sports betting 50 50

- How to start a sports betting advice business

- What is the easiest sports bet to win

- What is concensus means in sports betting