Do you get tax slips for sports betting

If you are in the 25% tax bracket, then you will pay 25% on your winnings; $ x 25% = $ Keep in mind that you may also be subject to state. When you have gambling winnings, you may be required to pay an estimated tax on that additional income. For information on withholding on. According to Market Watch, winnings over $ will cause sports do you get tax slips for sports betting companies to send you a MIS form, as they are subject to federal. Yes. I explained that gambling wins and losses are not like taxable investments (you can deduct up to $3, in those net losses from income or.

Are Tax Slips Issued for Sports Betting Winnings?

During a recent investigation into the regulations surrounding sports betting, there has been a pressing question on the minds of many individuals engaging in this widespread activity. Do sports bettors receive tax slips for their winnings? The answer to this query is of vital importance for those involved in this thriving industry and for tax authorities keen on regulating the field of gambling.

Understanding the intricate maze of tax laws is crucial for punters looking to comply with legal requirements. In many jurisdictions, any income generated from sports betting falls under taxable income, akin to other forms of earnings. This means that winnings from wagers could potentially be subject to taxation, depending on the country's specific laws and regulations involved.

Keeping track of these regulations is paramount, as failure to report taxable income from sports betting could result in legal consequences down the line. While the process of receiving tax slips varies across different regions, it is essential for individuals to be aware of their obligations and responsibilities when it comes to declaring their winnings.

One significant aspect to consider is whether the betting platform automatically issues tax slips or if bettors are required to report their winnings independently. Some entities may provide detailed statements outlining the earnings and losses incurred through betting activities, simplifying the tax reporting process for customers.

However, in certain instances, bettors may need to maintain meticulous records of their transactions and calculate the taxable portion themselves, in accordance with applicable tax laws. Failure to accurately report these earnings could lead to complications during tax audits and may result in penalties or fines.

To ensure compliance and avoid any potential legal issues, individuals engaged in sports betting should proactively seek information on their tax obligations. Consulting with tax professionals or seeking guidance from relevant authorities can offer clarity on the proper procedures to follow when it comes to reporting sports betting winnings and navigating the associated tax implications.

Do You Have to Pay Sports Betting Taxes?

Will FanDuel send me a tax form? Yes, your winnings from Fanduel and other fantasy sports platforms, such as Draft Kings are taxable. Fanduel will issue a W-2G or 1099 for your winnings. Once your winnings reach $5,000 they will withhold 25% for you for federal tax purposes. Fanduel is not the only gambling platform whose winnings are taxable income.

Will I get a tax document from DraftKings? If you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings. This form will include all net earnings from the prior calendar year.

Do I have to claim DraftKings on my taxes? Yes. Just like any other form of income, gambling winnings are taxable. This applies to all types of gambling, whether you placed your bet in person, on an app, or on your computer. One bright spot: You do have to win money in order to owe taxes on your gambling income.

Do you get taxes back from sports betting? Bottom line. Any winnings from a sports bet must be reported as income on your tax return. You can deduct gambling losses, but only if you itemize your deductions and they don't add up to more than your winnings.

Do you receive a 1099 for gambling winnings? Generally, if you receive $600 or more in gambling winnings, the payer is required to issue you a Form W-2G. If you have won more than $5,000, the payer may be required to withhold 28% of the proceeds for Federal income tax.

Do I have to report DraftKings winnings on taxes? Spoiler alert: all your winnings, big or small, cash or noncash must be reported to the IRS. Whether you're a seasoned or professional gambler or someone who simply got lucky at the bingo hall or in a fantasy league showdown, understanding the ins and outs of the gambling winnings tax is crucial.

Bet on the big game? Here's what you need to know about paying taxes on sports bets

With the legislation passed last year, Maine became one of the most recent states to begin operations with legal sports betting. It is paramount for a quick refresher on how gambling can impact you from a tax perspective. Here are five prevalent facts to keep in mind when sports betting, or gambling in the general sense:.

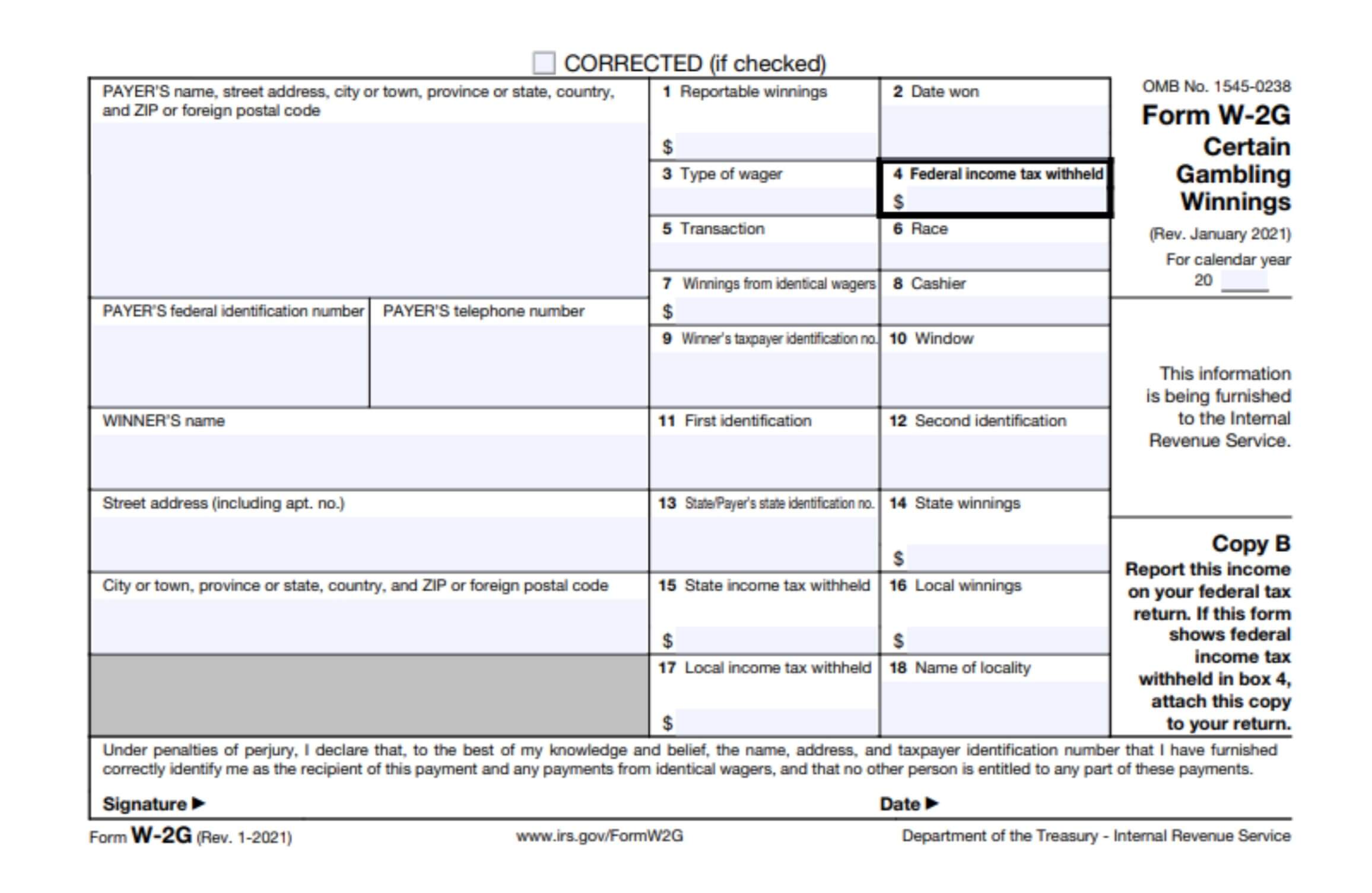

The applicable thresholds to receive a Form W2G for casino winnings are:. For mobile sports gambling , the online sportsbook has different thresholds and reporting requirements. Entry fees and winnings are based on the calendar year in which the contest or sporting event ends and the wager is settled. Absolutely so. It does not matter whether the winnings are in the form of cash, property, or an annuity.

You can choose to voluntarily withhold income taxes from your winnings on a Form W2G even if not above the threshold, and the payer will usually inquire whether you would like to do so before issuing you the form. However, the choice is up to you. If you are a high-income taxpayer, the tax impact of your winnings can easily exceed the withholdings.

It is a common but debunked myth that everyone can deduct their gambling losses when computing their taxable incomes. However, this belief can create an unfavorable surprise the next tax return you file. Unless you are a professional gambler and can show the income and losses on your Schedule C, you must itemize your deductions in order to deduct your losses against your winnings.

From new casinos to lotteries and online sports betting, there are plenty of opportunities if you enjoy gambling. And data from the Pew Research Center show that you wouldn't be alone. However, if you're lucky enough to win from a bet or smart gamble, don't forget that the federal government wants its cut through gambling taxes.

So, here are 8 things to know about how gambling winnings are taxed. If you win a non-cash prize, such as a car or a trip, report its fair market value as income. And be sure you report all your gambling winnings. Do you get tax slips for sports betting The IRS isn't typically hunting down small-time winners, but you should file an accurate income tax return.

The payout doesn't have to be times the wager for these types of winnings. Your reportable winnings will be listed in Box 1 of the W-2G form. If a W-2G is required, the payer sports betting parlor, casino, racetrack, lottery, etc. In some cases, you'll get the W-2G on the spot. Otherwise, for winnings, the payer must send the form to you by Jan.

In any event, if your bet was with a casino, we're fairly certain you'll get the W-2G. But if your bet was just a friendly wager with a friend or you won an office pool … well, don't count on it. Special withholding rules apply for winnings from bingo, keno, slot machines and poker tournaments. The amount withheld will be listed in Box 4 of the W-2G form you'll receive.

You will also have to sign the W-2G stating under penalty of perjury, that the information listed on the form is correct. When you file your for the tax year, include the amount withheld by the payer, as federal income tax withheld. It will be subtracted from the tax you owe.  You'll also have to attach the W-2G form to your return. Again, this is what to expect when you place a bet at a casino, racetrack, sports betting parlor, or with some other legally operated gaming business.

You'll also have to attach the W-2G form to your return. Again, this is what to expect when you place a bet at a casino, racetrack, sports betting parlor, or with some other legally operated gaming business.

Don't expect your friend who is running an office pool, for example, to withhold taxes although, technically, they should. Did you have a bad night at the blackjack table or pick the wrong horse to win. There's a possible silver lining if you lose a bet or two — your gambling losses might be deductible. Gambling losses include the actual cost of wagers plus related expenses, such as travel to and from a casino or other gambling establishment.

There are a couple of important catches, though. First, unless you're a professional gambler more on that later , you have to itemize in order to deduct gambling losses itemized deductions are claimed on Schedule A. Unfortunately, most people don't itemize. So, if you claim the standard deduction , you're out of luck twice — once for losing your bet and once for not being able to deduct your gambling losses.

Second, you can't deduct gambling losses that are more than the winnings you report on your return. As explained by Mike you only pay tax on your winnings based on your tax bracket. Keep in mind that you may also be subject to state income tax, unless you live in a state that does not have state income tax.

You have clicked a link to a site outside of the TurboTax Community. By clicking "Continue", you will leave the Community and be taken to that site instead. Expert does your taxes An expert does your return, start to finish. Full Service for personal taxes Full Service for business taxes.

Do it yourself We'll guide you step-by-step. Resources Explore tax tools, get tips, and read reviews. File your own taxes with expert help. File your own taxes. Support Find answers and manage your return. Sign up Sign in. Sign in to TurboTax. Turn on suggestions. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for.

Popular Pages

- How to be the best at sports betting

- What banks allow sports betting

- How to start sports betting business in florida

- Can you bet on sports at mgm detroit

- How to make a living from sports betting

- What do plus and minus mean in sports betting

- Is there tax on sports betting

- Is sports betting legal in nevada

- Can i bet on sports

- How to get around sports bet ban