Do you have to pay income tax on sports betting

Note: For tax do you have to pay income tax on sports betting ending on or after December 31,you must pay Illinois Income Tax on Illinois gambling winnings, including sports wagering winnings. And because sports betting is considered income, its winnings are subject to federal and state taxes. According to Market Watch, winnings over. Do I Have to Pay State Taxes on Gambling Earnings? Most states levy a tax on all earnings made in that state, even if you don't live there. So, for example. You can choose to withhold federal and state taxes on gambling winnings. If your gambling winnings are over $5, or more than times your.

The Taxing Game: Income Tax Implications on Sports Betting Winnings

As enthusiasts and fans, we all relish the thrill of sports betting, the adrenaline-rush moments of watching our favored teams play. However, the question lingers—are we obligated to pay income tax on our sports betting winnings?

Delving into the realm of taxation, it's imperative to understand the legalities surrounding income derived from sports betting activities. In numerous countries, fiscal policies require individuals to report gambling winnings, including those obtained through sports betting, to the tax authorities.

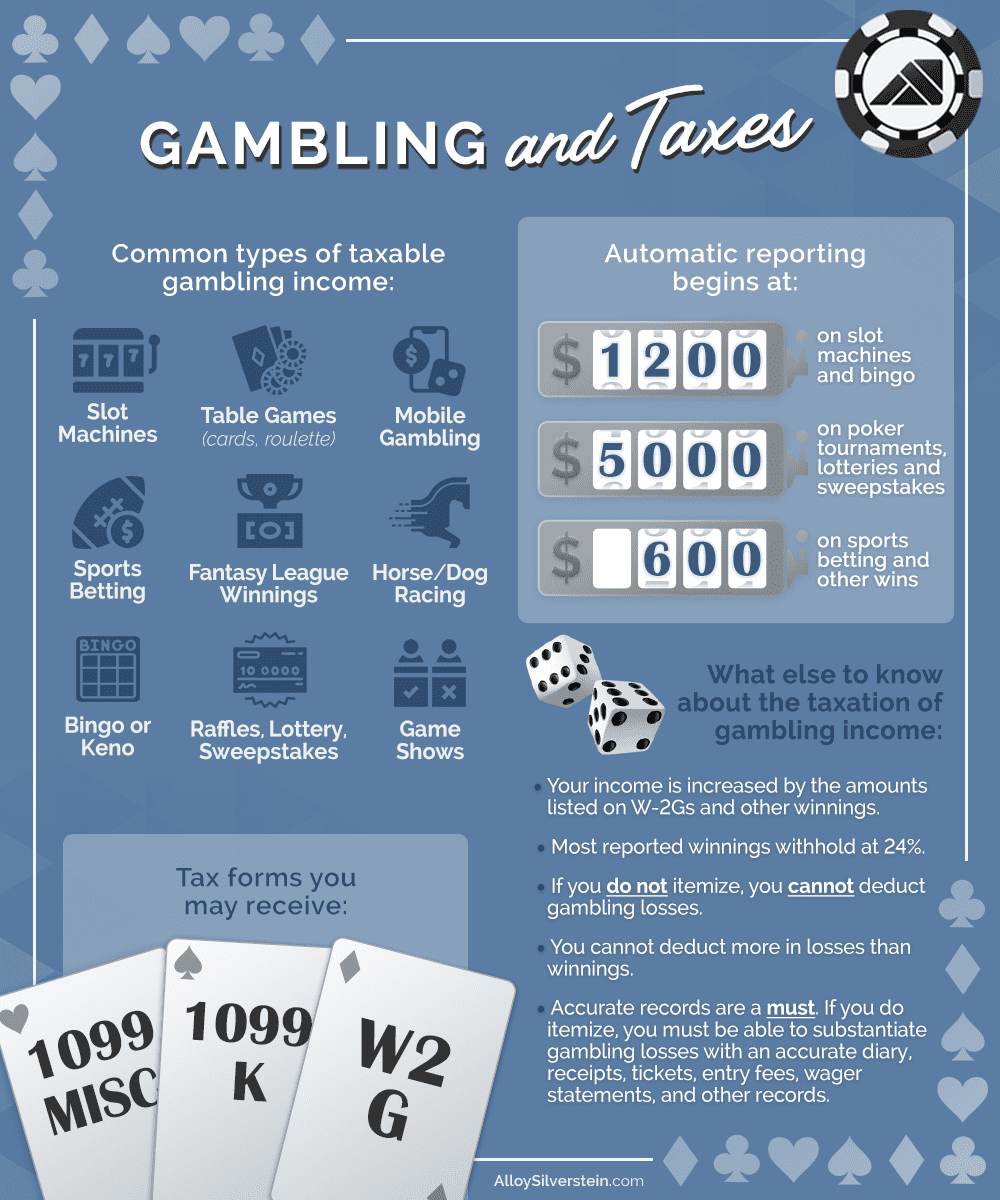

When it comes to the United States, the Internal Revenue Service (IRS) mandates that gambling winnings constitute taxable income, encompassing gains from sports betting. The tax rate applied on these earnings varies based on the amount won and your overall income bracket.

Many misconceptions exist regarding the tax obligations associated with sports betting, with some believing that smaller winnings may slip under the radar. Nonetheless, it's crucial to comprehend that failing to report these earnings can result in penalties or legal repercussions.

Complications may arise for professional sports bettors or those who engage in extensive gambling activities, where income from betting could potentially be categorized as a trade or business. In certain cases, this might lead to additional tax requirements or the need to account for losses against winnings.

While regulations differ across jurisdictions, it is advisable to maintain accurate records of all gambling activities, including sports bets, to facilitate tax compliance. Seeking guidance from tax professionals or financial advisors can offer valuable insights into managing sports betting winnings effectively.

In conclusion, the landscape of sports betting harbors implications in the realm of income taxation, emphasizing the importance of adhering to legal frameworks and fulfilling tax obligations in accordance with governing laws.

Do You Have to Pay Sports Betting Taxes?

Do I have to pay taxes on DraftKings winnings? Yes. Just like any other form of income, gambling winnings are taxable. This applies to all types of gambling, whether you placed your bet in person, on an app, or on your computer. One bright spot: You do have to win money in order to owe taxes on your gambling income.

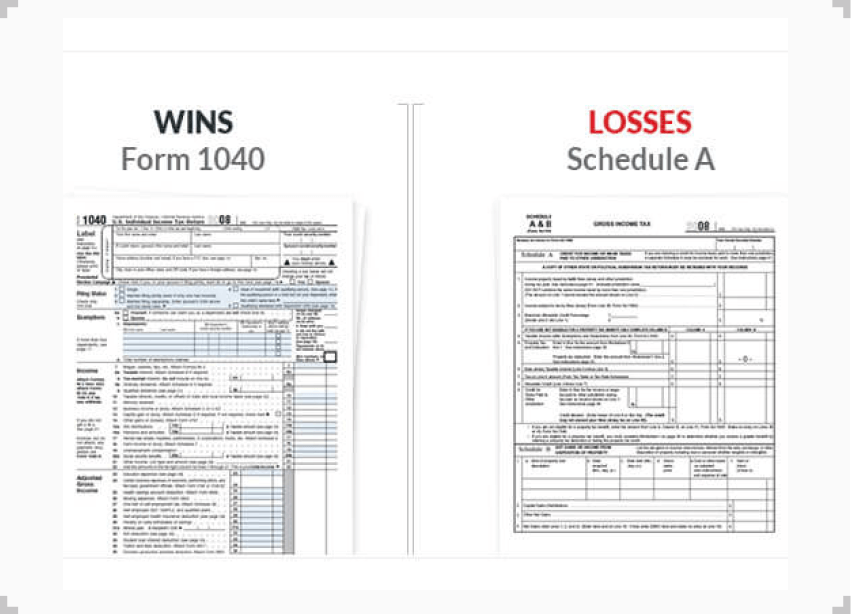

How much does the IRS tax on sports betting? If you've won money placing bets, the tax rate can be anywhere from 10% to 37% based on your income tax bracket. If you've lost money, you won't owe any taxes, but you may be able to deduct your losses if you itemize your deductions on your return. Take note: You can't deduct more than your winnings.

Gambling duties: detailed information

These institutions argue that all bets occur either where the company is registered or where it keeps its servers. At time of writing this was not fully resolved. The following table is based on Tax Foundation information. This does not absolve you of responsibility to report that income yourself, in the same way that you still have to file your taxes even though the IRS has your W It does mean, however, that you should be scrupulous when you file your taxes.

Many people underreport gambling winnings. There are many reasons not to do this, including the fact that the IRS may already know all about your income. Depending on the nature of your bet, you may receive a Form W-2G from whoever pays out your winnings. This is particularly true if they use some form of third party institution to make your payment. You can only deduct losses if you itemize your taxes.

The same is true of up-front money that you stake. Guidances issued by the IRS state that you can deduct up-front stakes on Schedule A, which is not available to people who take the standard deduction. Money that you do not stake up front, but merely wager as a potential loss, is not deductible unless you lose.

There is a lack of clarity on the issue of whether up-front stakes reduce your taxable winnings by the amount that you initially wagered. This ambiguity only applies to wagers with up-front stakes. It goes poorly and you lose your bet. There are two possible outcomes:. While a W-2G or a Form from your payer should indicate taxable income, be sure to check with a tax professional if you are unsure how to proceed.

Like all forms of gambling winnings, money you get from sports betting counts as income. You must pay federal income taxes on all winnings regardless of amount and may owe state taxes as well. Do you have to pay income tax on sports betting The rules of state taxes are highly jurisdiction-specific, however, so be sure to research the specific laws of your own state. Helpful Guides Tax Guide.

What Is Conservatorship. Family Trusts CFA vs. Financial Advisors Financial Advisor Cost. Helpful Guides Investing Guide. Compare Accounts Brokerage Accounts. Learn More What is a Fiduciary. Types of Investments Tax Free Investments. Helpful Guides Credit Cards Guide. Compare Quotes Life Insurance Quotes.  Helpful Guides Life Insurance Guide.

Helpful Guides Life Insurance Guide.

Calculators Refinance Calculator. Compare Rates Compare Refinance Rates. Helpful Guides Refinance Guide. Calculators Personal Loan Calculator. Compare Rates Personal Loan Rates. Helpful Guides Personal Loan Guide. Unlike other countries such as the USA you will be free to keep whatever you win in Britain even if you are professional poker player. Is an on-line professional gambler still just operating a system by habit or are they trading?

The betting exchanges have produced a number of sophisticated pro-punters who approach their work on a scientific, well-researched basis. For tax purposes there is no distinction between recreational and non-recreational players. How does the pro-punter deal with the issues of tax compliance. The safe answer has to be to make HMRC aware of the position. This applies to all types of gambling—from bingo, to slots, to lotteries, and even horse racing.

For example:. Betting shows were first legalised with the Betting and Gaming Act, in which a tax was levied either on stakes or winnings in high street betting shops. It was abolished by Gordon Brown in his March budget of This was a pressing concern for Brown, who feared that the UK was losing revenue to offshore gambling sites. This changed in , when the Gambling Act of was amended.

Gambling operators in Gibraltar and the Isle of Man, for example, were now required to pay tax in order to obtain a gambling licence. This amendment effectively made it illegal to conduct business in the United Kingdom without a UK gambling licence. This had a huge impact in making UK-based bookies and betting shops more competitive—increasing the growth and success of the gambling industry in the UK.

For example, if people are paying taxes on their winnings just like businesses do, then it would potentially be possible to claim back losses on tax returns. As you can imagine, this would be a nightmare, especially considering the fact that most people lose when it comes to gambling. After all, we all know what the 10 stages of losing at bingo are like. There are a variety of different taxes and gambling duties:.

Before you start thinking about how tough it must be for gambling businesses, or how great it might be for you, bear in mind that they do pass these costs on to you in some way. For example, some online gambling sites have high wagering requirements or lower odds.

An example of this goes back as far as , in which a man named Alexander Graham was taxed by Inland Revenue. That is not to say that professional gamblers will never be taxed. It can become a little complicated. For example, if a professional gambler receives an appearance fee for participating in a particular tournament, this would be taxable income.

After all, other taxes may still be applicable. Inheritance tax is levied on property or cash acquired by a gift or inheritance. If you give more than this away and you die, it will be liable to this tax. If you live longer than the allotted 7 years, it will be exempt from the inheritance tax.

If you live in the UK, our tax laws mean that you can gamble tax-free, without a single worry. What are the basics of sports betting After all, if you tax the income or profit made from an activity, you have to make allowances for any losses made from the same activity. Please complete the form with your details or email us at [email protected]. Please provide as much detail as possible.

One of our qualified business advisers will get back to you to discuss further. Submit the contact form below to receive free initial consultation from our qualified tax advisers. We do Tax Planning. We do Accounting. We do Payroll. We do Management Reports.

We do Xero. We do Capital Gains Tax. We do Business Restructuring.

Popular Pages

- What is a sharp in sports betting

- Where to go for sports betting

- When do i have to pay taxes on sports betting

- Is sports betting legal in west virginia

- Is online sports betting legal in nj

- How i got banned from sports betting

- What happen to fox sports one betting show

- How to win big money on sports betting

- How old do you have to be to sports bet

- How to make a career out of sports betting