How to pay taxes on sports betting winnings

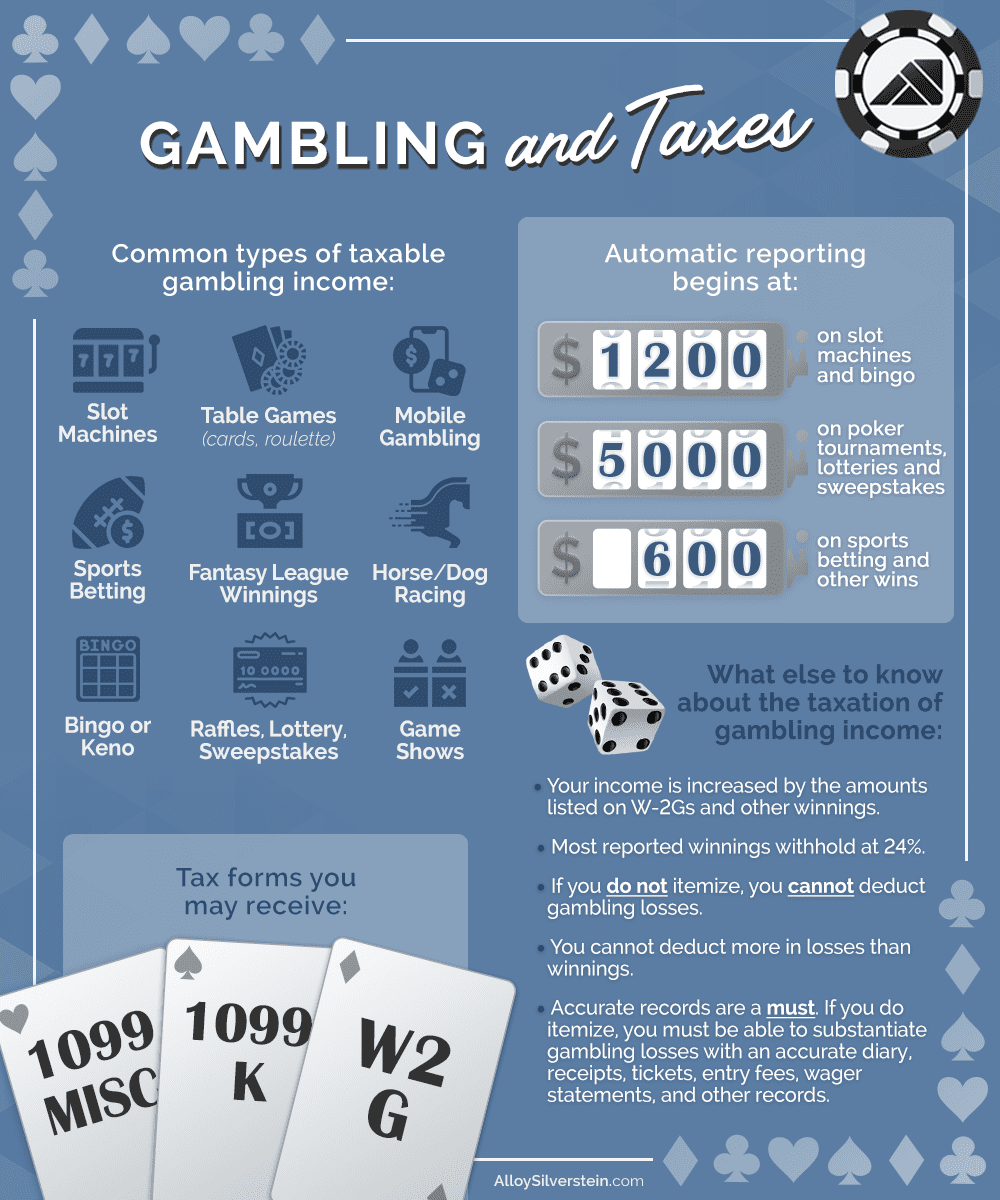

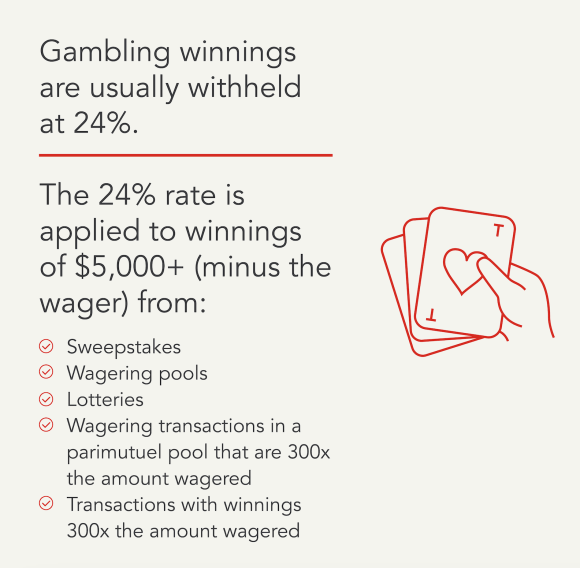

Like all forms of gambling winnings, money you get from how to pay taxes on sports betting winnings betting counts as income. You must pay federal income taxes on all winnings. According to the IRS, winnings from sports betting—or any form of gambling, including horse racing and lotteries—must be listed as “other income. However, gambling winnings from unlawful gambling activity must still be reported. An amended WV state return must be filed for tax years using the. The gamblers' net income from winnings will also be subject to the current individual state income tax rate of %. These are all tax revenues.

How to Handle Taxes on Sports Betting Winnings

In the world of sports betting, winning big is always a thrilling experience. However, amidst all the celebration, it's crucial to remember that with great winnings come great responsibilities. One such responsibility that every successful bettor must tackle is paying taxes on their winnings. Let's delve into the world of taxation on sports betting earnings.

The Basics of Taxation on Sports Betting Winnings

When it comes to taxes on sports betting winnings, it's essential to understand that such income is subject to taxation as it's considered a form of gambling income. The tax laws can vary depending on your country of residence, but generally, you are required to report and pay taxes on any net profit you make from sports betting activities.

Typically, the tax rate on sports betting winnings is a certain percentage of your profit. Be sure to keep accurate records of your bets, wins, and losses to facilitate the tax reporting process.

How to Report Your Winnings

When it's time to report your sports betting winnings to the tax authorities, honesty is always the best policy. Ensure you accurately report all your earnings from sports betting to avoid any potential legal troubles in the future.

Most tax authorities require you to declare your sports betting income on your annual tax return. Failure to do so can result in penalties and legal consequences, so it's crucial to comply with your country's tax laws.

Consulting a Tax Professional

If you find the tax implications of your sports betting winnings to be overwhelming or confusing, don't hesitate to seek help from a tax professional. A tax advisor can guide you through the process, help you understand your tax obligations, and ensure you are compliant with the law.

Remember, paying taxes on your sports betting winnings is not just a legal requirement but also a moral obligation. By fulfilling your tax responsibilities, you can enjoy your winnings with peace of mind, knowing that you are on the right side of the law.

The Taxation of Online Sports Betting in North Carolina

Do Americans pay tax on gambling wins? Yes, you owe taxes on sports betting wins

Do you have to pay tax on gambling winnings in USA? The following rules apply to casual gamblers who aren't in the trade or business of gambling. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos.

Yes, it's true. Generally, the U.S. federal government taxes prizes, awards, sweepstakes, raffle and lottery winnings, and other similar types of income as ordinary income, no matter the amount. This is true even if you did not make any effort to enter in to the running for the prize.Do Americans pay tax on winnings? Taxes on Winnings 101

Bet on the big game? Here's what you need to know about paying taxes on sports bets

To deduct your losses, you must keep an accurate diary or similar record of your gambling winnings and losses and be able to provide receipts, tickets, statements, or other records that show the amount of both your winnings and losses. Refer to Publication , Miscellaneous Deductions for more information. Home Help Tax Topics Topic no.

More In Help. Gambling winnings A payer is required to issue you a Form W-2G, Certain Gambling Winnings if you receive certain gambling winnings or have any gambling winnings subject to federal income tax withholding. Gambling losses You may deduct gambling losses only if you itemize your deductions on Schedule A Form and kept a record of your winnings and losses.

Recordkeeping To deduct your losses, you must keep an accurate diary or similar record of your gambling winnings and losses and be able to provide receipts, tickets, statements, or other records that show the amount of both your winnings and losses. Page Last Reviewed or Updated: Jan Start for free. Looking for more information?

How Are Gambling Winnings Taxed. Tax Bracket Calculator Easily calculate your tax rate to make smart financial decisions Get started. W-4 Withholding Calculator Know how much to withhold from your paycheck to get a bigger refund Get started. Self-Employed Tax Calculator Estimate your self-employment tax and eliminate any surprises Get started.

Crypto Calculator Estimate capital gains, losses, and taxes for cryptocurrency sales Get started. Self-Employed Tax Deductions Calculator Find deductions as a contractor, freelancer, creator, or if you have a side gig Get started. Read why our customers love Intuit TurboTax Rated 4. Your security. Built into everything we do. File faster and easier with the free TurboTax app.

Excludes payment plans. How to pay taxes on sports betting winnings This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

Audit Support Guarantee — Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax for the current tax year and for individual, non-business returns for the past two tax years , Audit support is informational only.

We will not represent you before the IRS or state tax authority or provide legal advice. Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

If you pay an IRS or state penalty or interest because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Limitations apply. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest.

You are responsible for paying any additional tax liability you may owe. If you receive an audit letter from the IRS or State Department of Revenue on your TurboTax business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited business returns filed with TurboTax for the current tax year.

For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to file or purchase add-on products or services. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice.  Special discount offers may not be valid for mobile in-app purchases.

Special discount offers may not be valid for mobile in-app purchases.

Strikethrough prices reflect anticipated final prices for tax year Offer may change or end at any time without notice. Must file between November 29, and March 31, to be eligible for the offer. Includes state s and one 1 federal tax filing. Intuit reserves the right to modify or terminate this TurboTax Live Assisted Basic Offer at any time for any reason in its sole and absolute discretion.

If you add services, your service fees will be adjusted accordingly. If you file after pm EST, March 31, , you will be charged the then-current list price for TurboTax Live Assisted Basic and state tax filing is an additional fee. See current prices here. Credit does not apply to state tax filing fees or other additional services. Intuit reserves the right to modify or terminate this offer at any time for any reason in its sole discretion.

Final price may vary based on your actual tax situation and forms used or included with your return. Price estimates are provided prior to a tax expert starting work on your taxes. Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare your return, and forms or schedules included in your individual return.

Prices are subject to change without notice and may impact your final price. If you decide to leave Full Service and work with an independent Intuit TurboTax Verified Pro, your Pro will provide information about their individual pricing and a separate estimate when you connect with them. Pays for itself TurboTax Premium, formerly Self-Employed : Estimates based on deductible business expenses calculated at the self-employment tax income rate Actual results will vary based on your tax situation.

Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. The IRS issues more than 9 out of 10 refunds in less than 21 days. Get your tax refund up to 5 days early: Individual taxes only. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan, you will not be eligible to receive your refund up to 5 days early.

Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic deposit and is dependent on and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early. Maximum balance and transfer limits apply per account.

Fees: Third-party fees may apply. Pay for TurboTax out of your federal refund or state refund if applicable : Individual taxes only. Subject to eligibility requirements. Additional terms apply. Prices are subject to change without notice. TurboTax specialists are available to provide general customer help and support using the TurboTax product.

Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. Limitations apply See Terms of Service for details. Intuit will assign you a tax expert based on availability. Tax expert and CPA availability may be limited.

For the TurboTax Live Assisted product, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return. For the TurboTax Live Full Service product: Handoff tax preparation by uploading your tax documents, getting matched with an expert, and meeting with an expert in real time.

The tax expert will sign your return as a preparer. Administrative services may be provided by assistants to the tax expert. Will rogers sports betting On-screen help is available on a desktop, laptop or the TurboTax mobile app. Unlimited access to TurboTax Live tax experts refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage.

Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. TurboTax Live Full Service — Qualification for Offer: Depending on your tax situation, you may be asked to answer additional questions to determine your qualification for the Full Service offer.

Because gambling facilities are required to withhold a flat percentage of your winnings if they're large enough, there may be a difference between the tax withheld and what you owe on your tax return. In addition, depending on where you live and where you gambled, you may also owe state and local taxes.

Check your state's guidelines to find out. If you had any gambling wins in , you should report the full winnings on your tax return in , claiming it as "gambling income" on line 8 of Form , Schedule 1. Itemized deductions can be reported on Schedule A of Form The tax-filing season kicked off on Jan. TurboTax offers step-by-step guidance for filers and can access prior returns to get you started, even if they were filed with a different service.

If you're going to write off your gambling losses, you should opt for TurboTax Deluxe — the basic edition is only available for simple returns with standard deductions. TurboTax Free Edition. Click here for TurboTax offer details and disclosures. Terms apply. Users can also upload previous returns from other providers and they'll get an estimate of their tax refund in real time.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here. Any winnings from a sports bet must be reported as income on your tax return. You can deduct gambling losses, but only if you itemize your deductions and they don't add up to more than your winnings.

At CNBC Select , our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every tax article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of tax products.

While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Popular Pages

- Which bank supports sports betting in canada

- How does a parlay work in sports betting

- Are sports bets taxed

- Does mexico regulate online sports betting

- Can sports betting be profitable

- How sports betting lines work

- How much money to start sports betting

- How do betting companies use advanced sports data

- How pro sports betting works

- When did sports betting become legal in indiana