Do sports betting winnings come out of tax returns

Michigan follows federal guidelines set by the IRS when taxing sports betting winnings. Those guidelines say winnings are taxable income that. When do you have to report gambling wins? Gambling winnings are considered do sports betting winnings come out of tax returns — technically, “other income” — on state and federal tax. A federal tax hit only comes into play if your gambling winnings reach $ or more. Also, the rate at which you're taxed varies based on how. Cash and the cash value of prizes are taxable. State and local taxes may be due on winnings. You can offset your tax liability by deducting your losses but only.

The Tax Implications of Sports Betting Winnings

As fervent fans of the sports world, many of us eagerly place bets on our favorite teams and athletes, hoping to strike gold with a winning wager. The thrill of victory and the potential for financial gain often overshadow the less glamorous aspect of taxation. The burning question remains: Do sports betting winnings come under the magnifying glass of tax returns?

Let's shed some light on this complex issue.

While the exhilaration of hitting a big win can be downright euphoric, it's essential to consider the tax implications of your newfound wealth. In most countries, including the US, sports betting winnings are subject to taxation. The specific rules and rates may vary depending on your jurisdiction.

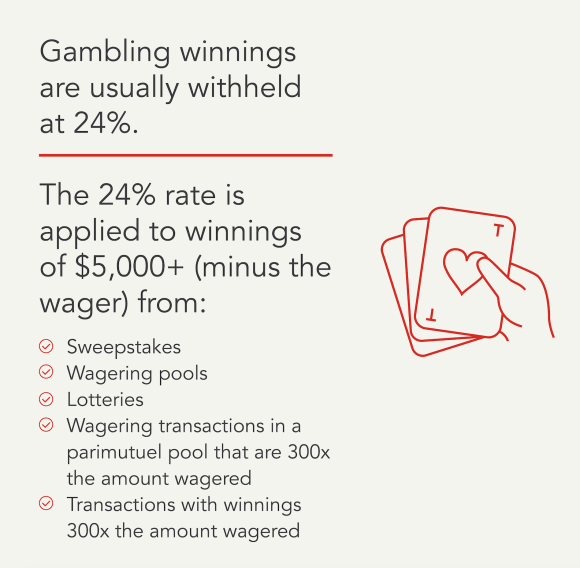

In the United States, the Internal Revenue Service (IRS) treats gambling winnings, including those from sports betting, as taxable income. The tax rate can range from 10% to 39.6%, depending on the amount won and other factors. It's crucial to keep track of your winnings and losses for accurate reporting on your tax return.

What about deductions? Sports bettors can offset their taxable winnings by deducting gambling losses, but there are certain limitations and requirements that must be met. Keeping detailed records of your bets, wins, and losses is vital to navigate the tax landscape successfully.

It's worth noting that the tax laws surrounding sports betting can be intricate and can vary from country to country. Consulting a tax professional or financial advisor is advisable to ensure compliance with regulations and optimize your tax situation.

In conclusion, while the allure of sports betting winnings is undeniable, understanding the tax implications is paramount. Being proactive in managing your tax obligations can help prevent headaches down the road and ensure a smooth sailing financial journey.

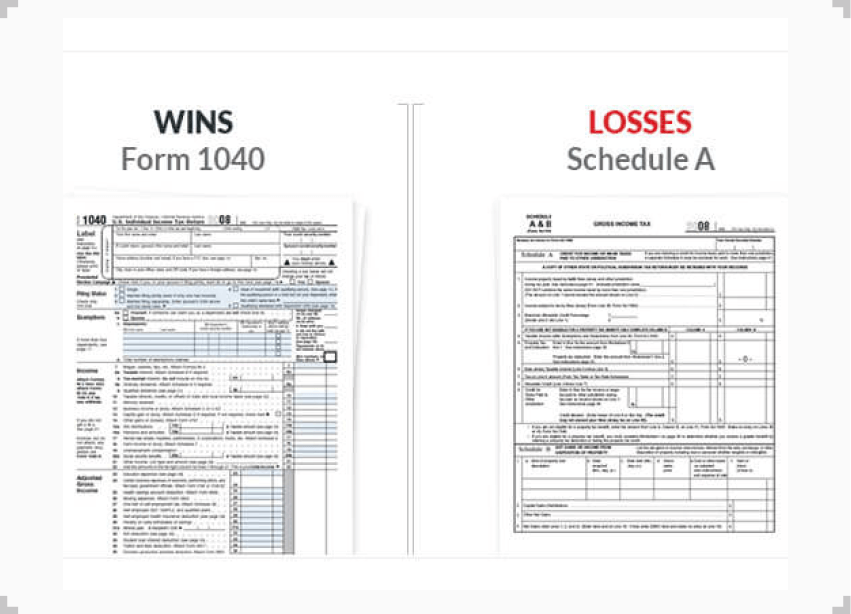

How to Pay Taxes on Gambling Winnings and Losses

Does DraftKings report all winnings to IRS? If you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings. This form will include all net earnings from the prior calendar year.

Does FanDuel withhold taxes? Yes, your winnings from Fanduel and other fantasy sports platforms, such as Draft Kings are taxable. Fanduel will issue a W-2G or 1099 for your winnings. Once your winnings reach $5,000 they will withhold 25% for you for federal tax purposes. Fanduel is not the only gambling platform whose winnings are taxable income.

If you win $600 or above, the gambling facility should ask for your social security number so they can report your winnings to the IRS, but remember, even if you don't receive a form reporting your income, you still have to claim your winnings on your taxes.How much do you have to win on DraftKings to file taxes? $600 or

Do you report gambling winnings on tax return? Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos. It includes cash winnings and the fair market value of prizes, such as cars and trips.

Gambling Winnings Taxes: An Intro Guide

While casual gamblers only need to report their winnings as part of their overall income on their tax forms, professional gamblers may file a Schedule C as self-employed individuals. They may be able to deduct their gambling-related expenses, such as travel or casino entry fees, to determine their net income. In regards to losses, deductions for gambling losses must be less than or equal to gambling winnings.

You can deduct losses from your gambling, but only if you itemize your deductions and keep an accurate record of your winnings and losses. The amount of losses you deduct cannot be more than the amount of gambling winnings you report on your tax return. Under tax reform, you can only deduct losses directly related to your wagers and not non-wagering expenses like travel-related expenses to gambling sites.

Gambling losses can be deducted up to the amount of gambling winnings. Whereas your winnings are reported by the payer on a Form W2-G, your losses may not be reported. You will have to produce other documentation to validate the deduction. This can include:. It may also be possible to establish your losses by keeping some type of detailed log.

This log should include information such as the:. No matter what moves you made last year, TurboTax will make them count on your taxes. More from TurboTaxBlogTeam. Hi Bob, Unfortunately you can only deduct losses up to your winnings and you have to be able to itemize your tax deductions. Table of Contents What types of gambling winnings are considered taxable income?

How are gambling winnings taxed. Do sportsbooks and casinos report gambling winnings to the IRS. Are gambling winnings taxed on both the federal and state level. Do sports betting winnings come out of tax returns How to report your gambling winnings on your taxes Are the rules different for professional gamblers?

Can you deduct gambling losses. Get started now. Best, Lisa Greene-Lewis Reply. Many people underreport gambling winnings. There are many reasons not to do this, including the fact that the IRS may already know all about your income. Depending on the nature of your bet, you may receive a Form W-2G from whoever pays out your winnings. This is particularly true if they use some form of third party institution to make your payment.

You can only deduct losses if you itemize your taxes. The same is true of up-front money that you stake. Guidances issued by the IRS state that you can deduct up-front stakes on Schedule A, which is not available to people who take the standard deduction. Money that you do not stake up front, but merely wager as a potential loss, is not deductible unless you lose.

There is a lack of clarity on the issue of whether up-front stakes reduce your taxable winnings by the amount that you initially wagered.  This ambiguity only applies to wagers with up-front stakes. It goes poorly and you lose your bet. There are two possible outcomes:.

This ambiguity only applies to wagers with up-front stakes. It goes poorly and you lose your bet. There are two possible outcomes:.

While a W-2G or a Form from your payer should indicate taxable income, be sure to check with a tax professional if you are unsure how to proceed. Like all forms of gambling winnings, money you get from sports betting counts as income. You must pay federal income taxes on all winnings regardless of amount and may owe state taxes as well. The rules of state taxes are highly jurisdiction-specific, however, so be sure to research the specific laws of your own state.

Helpful Guides Tax Guide. What Is Conservatorship. Family Trusts CFA vs. Financial Advisors Financial Advisor Cost. Helpful Guides Investing Guide. Compare Accounts Brokerage Accounts. Learn More What is a Fiduciary. Types of Investments Tax Free Investments. Helpful Guides Credit Cards Guide. Compare Quotes Life Insurance Quotes.

Helpful Guides Life Insurance Guide. Calculators Refinance Calculator. Compare Rates Compare Refinance Rates. Helpful Guides Refinance Guide. Calculators Personal Loan Calculator. Compare Rates Personal Loan Rates. Helpful Guides Personal Loan Guide. Calculators Student Loan Calculator. Helpful Guides Student Loan Guide. Helpful Guides Personal Loans Guide.

Helpful Guides Student Loans Guide. I'm an Advisor Find an Advisor.

Popular Pages

- How much is the booking fee for betting sports

- Is it actually ben johnson on sports betting ad

- Can you bet on sports in new york

- How to use algorithms for sports betting

- How to start a sports betting business in kenya

- What is illegal sports betting

- Has anyone gotten rich from sports betting

- How can i bet on sports in the us

- Does online sports betting send tax forms

- Who is the girl in the sports bet ad