How to report sports betting income on tax return

How to Report Gambling Winnings & Losses on Form for Expert Offers Tips on Filing Sports Betting Taxes How to File Income Tax. The responsibility for reporting gambling income is that of the individual. This is regardless of whether they received a tax document in the. Report all gambling winnings as taxable income on your tax return. · If you itemize deductions, you can offset your winnings by deducting gambling losses. Taxpayers should be reporting all types of wagering and gambling winnings how to report sports betting income on tax return their tax returns as “other income,” including winnings from your.

Unveiling the Financial Game: Reporting Sports Betting Income on Your Tax Return

Greetings, loyal readers and enthusiasts of the financial side of the sports world! Today, we delve into a crucial aspect that often goes unnoticed—reporting sports betting income on your tax return. Let's break it down step by step.

Understanding the Basics: When it comes to sports betting income, the IRS treats it like any other form of income, which means it must be reported on your tax return. Whether you engage in casual bets or you're a seasoned wagerer, all earnings are subject to taxation.

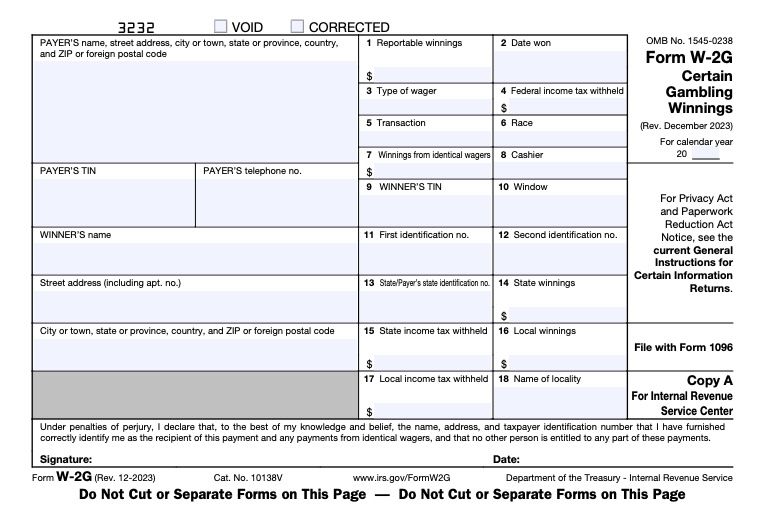

Forms and Documentation: Sportsbooks are required to issue IRS Form W-2G if your winnings exceed a certain threshold. However, even if you don't receive this form, you are still obligated to report your earnings. Keep meticulous records of your bets, wins, and losses to substantiate your income and deduction claims.

Filing Options: Sports betting income is typically reported on Form 1040 as "Other Income." If you have substantial earnings, consider filing as a professional gambler using Schedule C to deduct expenses related to your betting activities.

Tax Implications: Depending on the amount of your sports betting income, you may be subject to both federal and state taxes. Understanding the tax brackets and rates can help you prepare for tax season and avoid any surprises.

Seek Professional Assistance: If you're uncertain about how to report your sports betting income or want to maximize deductions, consider consulting with a tax professional. They can provide guidance tailored to your specific situation, ensuring compliance with tax laws and regulations.

Summing Up

Reporting sports betting income on your tax return may seem like a daunting task, but with proper documentation and understanding of tax requirements, you can navigate this financial terrain successfully. Remember, transparency and compliance are key when it comes to tax obligations, even in the world of sports betting.

Gambling Winnings Taxes: An Intro Guide

How do I report sports betting on my taxes? To complete your tax return, you'll report your winnings as “gambling income” on Form 1040, Schedule 1. If you have losses, you'll report them on Schedule A.

How do I claim my gambling winnings on my taxes? You must report all gambling winnings on Form 1040 or Form 1040-SR (use Schedule 1 (Form 1040)PDF), including winnings that aren't reported on a Form W-2GPDF.

Is it worth reporting gambling losses on taxes? The bottom line is that losing money at a casino or the race track does not by itself reduce your tax bill. You must first report all your winnings before a loss deduction is available as an itemized deduction. Therefore, at best, deducting your losses allows you to avoid paying tax on your winnings, but nothing more.

Topic no. 419, Gambling income and losses

Professional accounting software. Credit Karma credit score. More from Intuit. All rights reserved. Terms and conditions, features, support, pricing, and service options subject to change without notice. By accessing and using this page you agree to the Terms of Use. Click to expand. You are required to report your winnings The first rule is that the IRS requires you to report all winnings, whether the place that you gambled reports them to the IRS or not.

You have to itemize your deductions to claim your gambling losses as a tax deduction. Use your Intuit Account to sign in to TurboTax. Phone number, email or user ID. Remember me. Sign in. By selecting Sign in, you agree to our Terms and acknowledge our Privacy Statement. New to Intuit. Create an account. How to report sports betting income on tax return Max refund guarantee.

Start for free. Looking for more information. How Are Gambling Winnings Taxed. Tax Bracket Calculator Easily calculate your tax rate to make smart financial decisions Get started. W-4 Withholding Calculator Know how much to withhold from your paycheck to get a bigger refund Get started. Self-Employed Tax Calculator Estimate your self-employment tax and eliminate any surprises Get started.

Crypto Calculator Estimate capital gains, losses, and taxes for cryptocurrency sales Get started. Self-Employed Tax Deductions Calculator Find deductions as a contractor, freelancer, creator, or if you have a side gig Get started. Read why our customers love Intuit TurboTax Rated 4. Your security. Built into everything we do.  File faster and easier with the free TurboTax app.

File faster and easier with the free TurboTax app.

Excludes payment plans. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details. Audit Support Guarantee — Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax for the current tax year and for individual, non-business returns for the past two tax years , Audit support is informational only.

We will not represent you before the IRS or state tax authority or provide legal advice. Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

If you pay an IRS or state penalty or interest because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Limitations apply. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest.

You are responsible for paying any additional tax liability you may owe. If you receive an audit letter from the IRS or State Department of Revenue on your TurboTax business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited business returns filed with TurboTax for the current tax year.

For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to file or purchase add-on products or services. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice. Special discount offers may not be valid for mobile in-app purchases.

Strikethrough prices reflect anticipated final prices for tax year Offer may change or end at any time without notice. Must file between November 29, and March 31, to be eligible for the offer. Includes state s and one 1 federal tax filing. Intuit reserves the right to modify or terminate this TurboTax Live Assisted Basic Offer at any time for any reason in its sole and absolute discretion.

If you add services, your service fees will be adjusted accordingly. If you file after pm EST, March 31, , you will be charged the then-current list price for TurboTax Live Assisted Basic and state tax filing is an additional fee. See current prices here. Credit does not apply to state tax filing fees or other additional services.

Intuit reserves the right to modify or terminate this offer at any time for any reason in its sole discretion. Final price may vary based on your actual tax situation and forms used or included with your return. Price estimates are provided prior to a tax expert starting work on your taxes.

Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare your return, and forms or schedules included in your individual return. Prices are subject to change without notice and may impact your final price. If you decide to leave Full Service and work with an independent Intuit TurboTax Verified Pro, your Pro will provide information about their individual pricing and a separate estimate when you connect with them.

Pays for itself TurboTax Premium, formerly Self-Employed : Estimates based on deductible business expenses calculated at the self-employment tax income rate Actual results will vary based on your tax situation. Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary.

The IRS issues more than 9 out of 10 refunds in less than 21 days. Get your tax refund up to 5 days early: Individual taxes only. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan, you will not be eligible to receive your refund up to 5 days early.

Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic deposit and is dependent on and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early. Is sports betting allowed in california Maximum balance and transfer limits apply per account. Fees: Third-party fees may apply.

Casual gamblers report winnings as "Other Income. Depending on how much you win and the type of game, the gambling establishment may have withheld part of your winnings to cover federal income taxes. The amount already withheld for federal taxes is noted in Box 4 of Form W-2G. State and local tax withholdings are recorded in Boxes 15 and 17, respectively. There are two types of withholding for winnings from gambling: regular and backup.

This is known as regular withholding. Regular withholding applies to winnings from:. If not, the rate goes up to Backup withholding is made when any of the following occurs:. Depending on your federal income tax rate, the amount of the withholding may not be enough to cover your federal income tax liability. In addition to providing information about federal income tax withholding, the W-2G also contains information about any state and local taxes that were withheld.

That will be helpful when filing taxes in a state where gambling winnings are taxed. You cannot report your net winnings—that is, your winnings minus losses—on your tax form. However, you can list your gambling losses as an itemized deduction on Schedule A in order to reduce your tax liability. You may not, however, report losses in excess of your winnings. You cannot deduct other expenses you may have sustained in the process of gambling, such as transportation and hotel charges.

The IRS says: "Gambling winnings are fully taxable and you must report the income on your tax return. Cash and the cash value of any prizes you win must be reported. If you're a "casual" gambler rather than a professional, it is reported as "Other Income" on Form You can deduct losses up to the value of your winnings, but that requires itemizing your taxes and keeping paper records to prove your losses.

You may receive one or more W-2G forms from gambling establishments for taxable winnings, but the forms are required only if a certain amount is won on some but not all games. Generally, the forms are required for winners of games of chance like slot machines but not for winners of games of skill like blackjack. Note that the casino doesn't know how much you lost at its games.

If you plan to deduct your losses, you must keep careful records and itemize your taxes in order to claim the losses. Losses can be claimed up to the amount of your winnings. Check your state's guidelines to find out. How to report sports betting income on tax return If you had any gambling wins in , you should report the full winnings on your tax return in , claiming it as "gambling income" on line 8 of Form , Schedule 1.

Itemized deductions can be reported on Schedule A of Form The tax-filing season kicked off on Jan. TurboTax offers step-by-step guidance for filers and can access prior returns to get you started, even if they were filed with a different service. If you're going to write off your gambling losses, you should opt for TurboTax Deluxe — the basic edition is only available for simple returns with standard deductions.

TurboTax Free Edition. Click here for TurboTax offer details and disclosures. Terms apply. Users can also upload previous returns from other providers and they'll get an estimate of their tax refund in real time. Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here.

Any winnings from a sports bet must be reported as income on your tax return. You can deduct gambling losses, but only if you itemize your deductions and they don't add up to more than your winnings. At CNBC Select , our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every tax article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of tax products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Skip Navigation. Credit Cards.

Popular Pages

- What is su in sports betting

- Where can you sports bet in florida

- How to develop an online sports betting website

- Can you bet on sports online in virginia

- Is placing a sports bet online illegal

- Why are sports betting stocks down

- How to start sports betting business in florida

- What sports are bet on the most uk

- Is there sports betting in texas

- What is concensus means in sports betting