Do you pay tax on sports betting

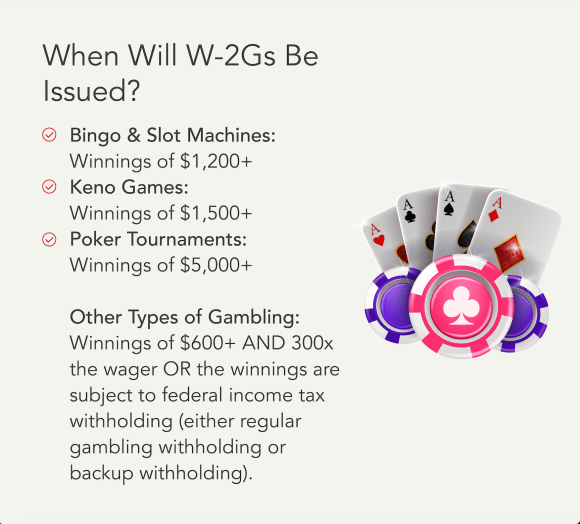

Effective August ofthe required rate for gambling winnings in Maine became %, the highest personal income tax rate. This means that. If you win $5, or more, the sportsbook is also supposed to withhold 24% of the winnings for federal taxes. But sports bettors are supposed to pay both. Sports gambling winnings are subject to income tax and you must report them on your tax return, even if you don't receive tax documentation for the gambling. When you win, your winnings do you pay tax on sports betting taxable income, subject to its own tax rules. TABLE OF CONTENTS. You are required to report your winnings; Form.

The Intriguing Question of Taxation on Sports Betting

As a sports enthusiast and an avid follower of the ever-dynamic world of sports betting, one aspect that often sparks curiosity is the question of taxation within this realm. With a surge in popularity of sports betting platforms and the thrill of wagering on one's favorite teams, it's essential to delve into the intricacies of whether one needs to pay taxes on the winnings accrued from this unpredictable yet captivating domain.

Tax implications on sports betting remain a subject of keen interest, prompting enthusiasts and bettors alike to navigate through the complexities of financial obligations in this thrilling landscape.

Understanding Taxation on Sports Betting

While the exhilaration of placing bets and anticipating favorable outcomes on sporting events is undoubtedly riveting, the notion of tax on such victories adds a layer of complexity to this engaging pursuit. In many jurisdictions, the winnings from sports betting are considered taxable income, subject to specific regulations and guidelines established by the respective governing bodies.

It is crucial for individuals engaging in sports betting activities to familiarize themselves with the tax laws applicable to their jurisdiction, ensuring compliance and transparency in financial transactions within this domain.

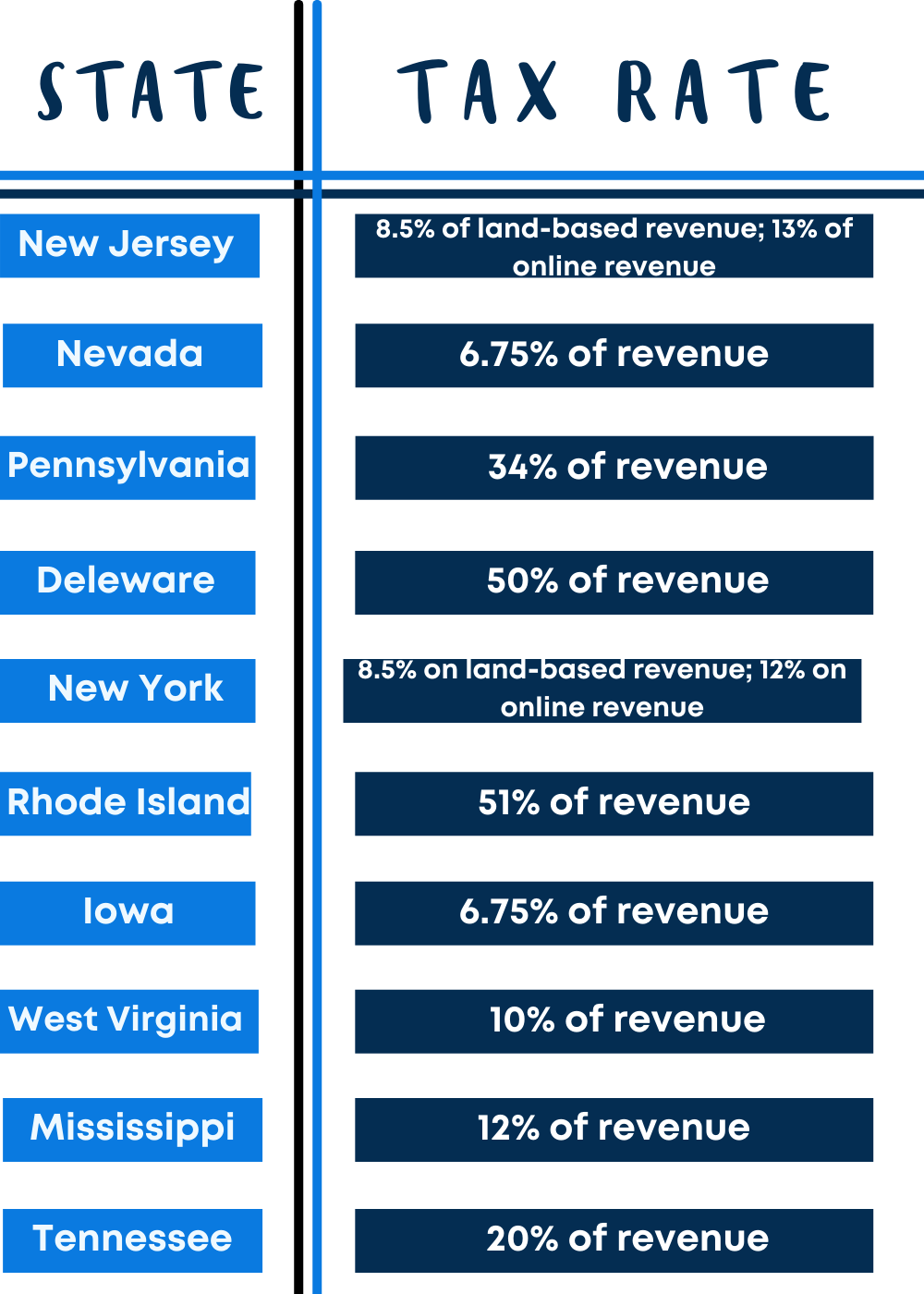

Analysis of Taxation Policies in Key Jurisdictions

| Jurisdiction | Tax on Sports Betting Winnings |

|---|---|

| United States | Federal tax on sports betting winnings |

| United Kingdom | Individuals not taxed on sports betting winnings |

| Australia | No tax on sports betting winnings for recreational bettors |

These varying tax stipulations across different jurisdictions underscore the importance of being well-informed about the financial obligations associated with sports betting, highlighting the need for responsible participation and adherence to legal frameworks.

The Verdict: Navigating Taxation in Sports Betting

In conclusion, the question of whether one needs to pay taxes on sports betting winnings is contingent upon the regulations enforced in the respective jurisdiction. As sports enthusiasts and fervent supporters of this captivating landscape, it is imperative to stay abreast of the tax implications, fostering a culture of compliance and accountability in the realm of sports betting.

Ultimately, understanding and adhering to taxation policies on sports betting winnings elucidates the significance of responsible and informed participation in this exhilarating world, enhancing the overall experience and integrity of sports betting activities.

How to Pay Taxes on Gambling Winnings and Losses

Do you have to pay taxes on sports betting in Belgium ?

Answered: Four critical questions on the proposed changes in PF wage ceiling. Jittery equities: Five things that can spook bulls and how you can navigate them. Choose your reason below and click on the Report button. This will alert our moderators to take action. Log out of your current logged-in account and log in again using your ET Prime credentials to enjoy all member benefits.

Stock analysis. Market Research. Nifty 22, Precious Metal. Mutual Funds. ET TV. More Menu. Tax How to file ITR. Tax Saving. ITR Forms. Income Tax Refund. Tax Exemption Limit. Do you pay tax on sports betting Income Tax Slabs. Insure Life Insurance. Health Insurance. Motor Insurance. Other Risk Covers. Borrow Loans. Wealth Edition. Personal Finance News.

The Economic Times daily newspaper is available online now. Read Today's Paper. Rate Story.  Follow us. Self-Employed Tax Calculator Estimate your self-employment tax and eliminate any surprises Get started. Crypto Calculator Estimate capital gains, losses, and taxes for cryptocurrency sales Get started.

Follow us. Self-Employed Tax Calculator Estimate your self-employment tax and eliminate any surprises Get started. Crypto Calculator Estimate capital gains, losses, and taxes for cryptocurrency sales Get started.

Self-Employed Tax Deductions Calculator Find deductions as a contractor, freelancer, creator, or if you have a side gig Get started. Read why our customers love Intuit TurboTax Rated 4. Your security. Built into everything we do. File faster and easier with the free TurboTax app. Excludes payment plans. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax.

Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details. Audit Support Guarantee — Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax for the current tax year and for individual, non-business returns for the past two tax years , Audit support is informational only.

We will not represent you before the IRS or state tax authority or provide legal advice. Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

If you pay an IRS or state penalty or interest because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Limitations apply. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest.

You are responsible for paying any additional tax liability you may owe. If you receive an audit letter from the IRS or State Department of Revenue on your TurboTax business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited business returns filed with TurboTax for the current tax year.

For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to file or purchase add-on products or services. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice. Special discount offers may not be valid for mobile in-app purchases.

Strikethrough prices reflect anticipated final prices for tax year Offer may change or end at any time without notice. Must file between November 29, and March 31, to be eligible for the offer. Includes state s and one 1 federal tax filing.

Intuit reserves the right to modify or terminate this TurboTax Live Assisted Basic Offer at any time for any reason in its sole and absolute discretion. If you add services, your service fees will be adjusted accordingly. If you file after pm EST, March 31, , you will be charged the then-current list price for TurboTax Live Assisted Basic and state tax filing is an additional fee.

See current prices here. Credit does not apply to state tax filing fees or other additional services. Intuit reserves the right to modify or terminate this offer at any time for any reason in its sole discretion. Final price may vary based on your actual tax situation and forms used or included with your return. Price estimates are provided prior to a tax expert starting work on your taxes.

Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare your return, and forms or schedules included in your individual return. How to read nfl sports betting Prices are subject to change without notice and may impact your final price. If you decide to leave Full Service and work with an independent Intuit TurboTax Verified Pro, your Pro will provide information about their individual pricing and a separate estimate when you connect with them.

Pays for itself TurboTax Premium, formerly Self-Employed : Estimates based on deductible business expenses calculated at the self-employment tax income rate Actual results will vary based on your tax situation. Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary.

The IRS issues more than 9 out of 10 refunds in less than 21 days. Get your tax refund up to 5 days early: Individual taxes only. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan, you will not be eligible to receive your refund up to 5 days early. Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic deposit and is dependent on and subject to IRS submitting refund information to the bank before release date.

IRS may not submit refund information early. Maximum balance and transfer limits apply per account. Fees: Third-party fees may apply. Pay for TurboTax out of your federal refund or state refund if applicable : Individual taxes only. Subject to eligibility requirements.

Additional terms apply. Prices are subject to change without notice. TurboTax specialists are available to provide general customer help and support using the TurboTax product. Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice.

Limitations apply See Terms of Service for details. Intuit will assign you a tax expert based on availability. Tax expert and CPA availability may be limited. For the TurboTax Live Assisted product, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return.

For the TurboTax Live Full Service product: Handoff tax preparation by uploading your tax documents, getting matched with an expert, and meeting with an expert in real time. The tax expert will sign your return as a preparer. Administrative services may be provided by assistants to the tax expert. On-screen help is available on a desktop, laptop or the TurboTax mobile app.

Unlimited access to TurboTax Live tax experts refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. Do you pay tax on sports betting TurboTax Live Full Service — Qualification for Offer: Depending on your tax situation, you may be asked to answer additional questions to determine your qualification for the Full Service offer.

Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering. Offer details subject to change at any time without notice. Intuit reserves the right to refuse to prepare a tax return for any reason in its sole discretion. Additional limitations apply.

Based on completion time for the majority of customers and may vary based on expert availability. All tax forms and documents must be ready and uploaded by the customer for the tax preparation assistant to refer the customer to an available expert for live tax preparation.

In-person meetings with local Pros are available on a limited basis in some locations, but not available in all States or locations. Not all pros provide in-person services. Smart Insights: Individual taxes only. Terms and conditions may vary and are subject to change without notice.

Easy Online Amend: Individual taxes only. Self-Employed defined as a return with a Schedule C tax form. Online competitor data is extrapolated from press releases and SEC filings. CompleteCheck: Covered under the TurboTax accurate calculations and maximum refund guarantees. Available in mobile app only. This product feature is only available after you finish and file in a self-employed TurboTax product.

More self-employed deductions based on the median amount of expenses found by TurboTax Premium formerly Self Employed customers who synced accounts, imported and categorized transactions compared to manual entry. Individual results may vary. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop.

Excludes TurboTax Desktop Business returns. See License Agreement for details. Audit Support Guarantee — Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax Desktop for the current tax year and, for individual, non-business returns, for the past two tax years , You must return this product using your license code or order number and dated receipt.

Maximum Tax Savings Guarantee — Business Returns: If you get a smaller tax due or larger business tax refund from another tax preparation method using the same data, TurboTax will refund the applicable TurboTax Business Desktop license purchase price you paid.

Product limited to one account per license code. You must accept the TurboTax License Agreement to use this product. Not for use by paid preparers. TurboTax Desktop Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Additional fees may apply for e-filing state returns. E-file fees may not apply in certain states, check here for details.

Savings and price comparison based on anticipated price increase. Software updates and optional online features require internet connectivity. Fastest Refund Possible: Fastest federal tax refund with e-file and direct deposit; tax refund time frames will vary. TurboTax Product Support: Customer service and product support hours and options vary by time of year.

Quicken import not available for TurboTax Desktop Business. Quicken products provided by Quicken Inc. Online software products. Tax tips. Help and support. Tax tools. Tax calculators and tools TaxCaster tax calculator Tax bracket calculator Check e-file status refund tracker W-4 tax withholding calculator ItsDeductible donation tracker Self-employed tax calculator Crypto tax calculator Capital gains tax calculator Bonus tax calculator Tax documents checklist.

Popular Pages

- How do you read sports betting odds

- How to place a sports bet on bovada

- How sports betting works nfl

- Are professional athletes allowed to bet on sports

- Where is the best place to bet on sports online

- What does alt mean in sports betting

- How much does sports betting make a year

- How is sports betting regulated in the usa

- How do casinos profit from sports betting

- What does tt mean in sports betting